Four investment trust turnaround stories the pros are backing

16th August 2022 09:00

by Sam Benstead from interactive investor

Fund analysts reveal their top investment trusts trading at undeservedly high discounts.

Choppy stock markets are a big test for investors – but they also bring opportunities. Those who can stick with a regular investing plan (such as monthly) buy shares at cheaper prices, while more adventurous investors can attempt to time their entry to avoid market crashes and buy cheap shares via a lump sum to bolster their returns.

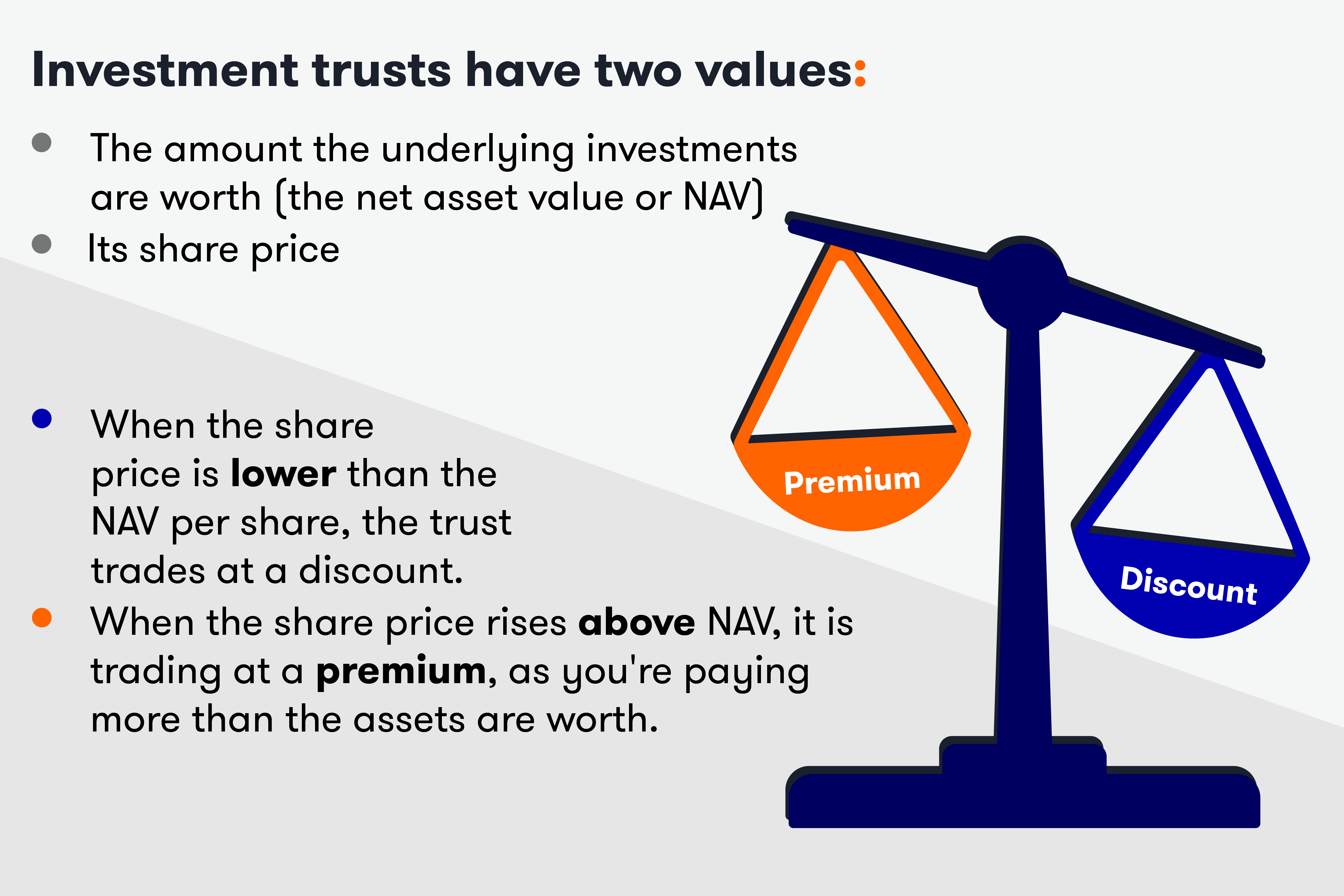

At such times, investment trusts offers rich opportunities. Because share prices can diverge from the underlying net asset value (NAV) of a trust, investors can get an extra bargain by picking up under-pressure shares at even greater discounts.

Investment trust discounts have widened this year in response to market falls, spurred by rising interest rates, inflation, and economic growth fears. Winterflood, the investment trust researcher, calculated that the average discount had widened from 2.2% at the start of the year to 9.5% at the end of June.

Look for unusual discounts

Ewan Lovett-Turner, head of investment trust research at broker Numis, highlights two bargain trusts that could see their fortunes turn.

The first is HgCapital Trust, the listed vehicle for private equity giant Hg that owns a concentrated portfolio of “boring” but essential workplace software firms, such as accounting and human resources programmes.

Its share price has more than doubled over the past five years, but fallen 7% so far in 2022 and now trades on an 10% discount. The trust has traded at a 1.2% premium on average over the past year.

Given that the portfolio is all in unquoted stocks, which are valued behind closed doors and whose valuation often lags that of public markets, the market is sceptical that HgCapital’s portfolio is overvalued.

However, Lovett-Turner does not think it is, which is why he views it as a great buying opportunity. He said: “It has been trading at a rare discount but its focus on profitable, ‘dull’ tech, and the fact that close to 30% of the portfolio has had positive valuation uplifts when they have listed or been bought since March this year, means I expect the next NAV to be a lot more resilient than the market appears to be pricing in.”

- Bargain Hunter: 13 eye-catching investment trust discounts

- Discount Delver: the 10 cheapest trusts on 5 August 2022

- Funds Fan: Scottish Mortgage, bonds are back, and China's a buy

Investors do not have long to wait, as the next biannual NAV, for the six months to 30 September, is not too far away.

He adds: “HgCapital Trust is our core recommendation within the listed private equity sector. It has built an exceptional track record through a disciplined approach focused on deep sector specialisation in software-as-a-service and tech-enabled service companies.

“Technology is a broad church and Hg targets companies with proven software that automates dull tasks, freeing up people to focus on more complex decision-making. Portfolio companies provide a business-critical product or service, have highly predictable earnings from contracted or recurring revenues, and a diversified loyal customer base. This has fuelled consistent double-digit earnings/revenue growth from the portfolio which has driven value generation and NAV growth.”

Private equity is also a favourite sector for Markuz Jaffe, investment companies research analyst at Peel Hunt.

He said HarbourVest Global Private Equity was due a turnaround after a 19% share price drop this year.

“It has suffered a sharp de-rating year-to-date, caused by the various volatility drivers that have rocked public equity markets this year, and further amplified by the general caution that investors have taken with regard to pricing expected movements in private equity valuations,” Jaffe said.

Private equity investment companies are trading on some of the widest discounts across the universe, he says, with HarbourVest’s at 41%.

He says: “Should updated private equity valuations not reflect the pessimism incorporated into the share price, there could be substantial re-rating potential for the trust, especially if wider market and/or economic conditions improve.”

Think smaller companies

Another trust Lovett-Turner backs for a turnaround is Henderson Smaller Companies. The UK investment trust’s shares have dropped around 30% this year and trade at a 13% discount. The trust, which recently reported only its third year of underperformance in 19 years, is a member of interactive investor’s Super 60. For the whole of that time the portfolio has been managed by Neil Hermon.

He said: “It has been a difficult time for small-caps, particularly growth-biased companies, which have underperformed large caps in 2022. Macro uncertainty continues to dominate sentiment with soaring inflation, rising interest rates and the threat of recession.

“However, valuations are now below long-term averages and merger and acquisition activity has been picking up, indicating value in the market with potential acquirers having significant ‘dry powder’. Often the best time to invest in a strategy or manager is after a period of underperformance and it may be an interesting time to have a look at the fund.”

- Rare year of underperformance for UK smaller company trust

- Don't be shy, ask ii...why do some trusts always trade on a discount?

- What should I do when a fund or trust falls out for form?

Lovett-Turner adds that he rates the investment team highly. He pointed out that fund manager Hermon has an exceptional long-term track record, through a disciplined approach with experience through economic cycles.

He said: “We believe that there has been a wholesale sell-off in the assets class, and growth companies in particular, but that over time the market is likely to become more discerning and this may create an attractive environment for an active manager to outperform through picking the companies that can deliver operationally. We believe that the 13% discount may prove an attractive entry point.”

Jaffe also backs BlackRock Smaller Companies for a turnaround. He said: “Investing in domestically oriented UK equities, particularly smaller companies, continue to offer compelling value.”

Year-to-date performance for the trust has been tough, with NAV total returns of around 24%, slightly worse than the peer group weighted average of about 21%.

Nonetheless, Jaffe notes that this is ahead of its stablemate BlackRock Throgmorton Trust, which has lost around 33% on a NAV basis, yet BlackRock Smaller Companies sits on a wider discount, at 14% versus 4% for Throgmorton.

Jaffe said: “This puts BlackRock Smaller Companies' discount [at] wider than the weighted average discount versus average UK smaller companies trust (13%), and offers a compelling re-rating opportunity, and additional upside to any recovery in UK smaller companies that could take place if market conditions turn.”

Compare public and private valuations

Joe Bauernfreund, manager of the AVI Global Trust, which buys undervalued assets, including investment trusts, says the biggest opportunities are in some of the best-performing trusts of the past decade, such as those in private equity, technology and venture capital.

“The biggest question mark is around the true valuations of private assets. Listed stocks have had a sharp sell-off, but we haven't seen similar write-downs in private markets yet. All private equity trusts have been hit by the same selling, but some NAVs may be more resilient,” he said.

Bauernfreund says the key is to look at mature businesses and compare valuations in private and public market. However, for venture capital trusts this is a more difficult task.

He said: “For venture capital trust Chrysalis Investments , it is hard to figure out the true valuation of its stocks, such as buy-now pay-later firm Klarna, as there are no profits yet.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.