FTSE reshuffle candidates plus today’s big winners

As the FTSE 100 hits a three-month high, we look at major movers and what it means for tracker funds.

3rd June 2020 13:33

by Graeme Evans from interactive investor

As the FTSE 100 hits a three-month high, we look at major movers and what it means for tracker funds.

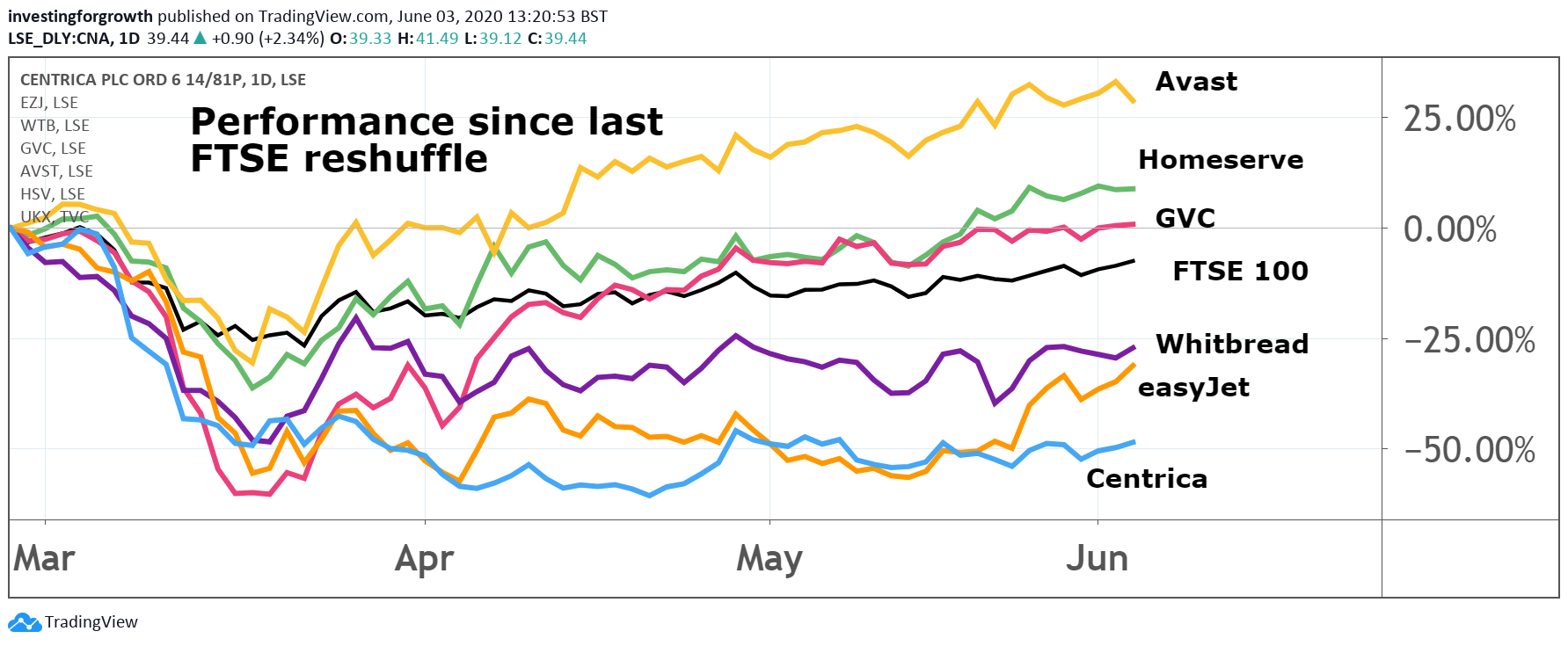

Hunger for stocks hit hardest in the pandemic powered the FTSE 100 index again today, although the resurgence still won't save the top-flight status of Centrica (LSE:CNA) and easyJet (LSE:EZJ).

Tonight's closing prices will confirm the pair's demotion to the FTSE 250 index later this month, alongside Meggitt (LSE:MGGT) and possibly Premier Inn owner Whitbread (LSE:WTB). Those in the frame for promotion include cyber security company Avast (LSE:AVST), Ladbrokes owner GVC Holdings (LSE:GVC) and Homeserve (LSE:HSV).

British Gas owner Centrica jumped 7% to 41.2p and easyJet was 5% higher at 763.6p in a session when the FTSE 100 index jumped another 1.4% to above 6,300 for the first time since 6 March, which was during the peak of the Covid-19 market sell-off.

Source: TradingView. Past performance is not a guide to future performance.

It means the top-flight is now just 15% lower than at the start of the turmoil in mid-February, having been down by more than a third at below 4,900 briefly on 16 March. It was still below 5,000 a week later.

The easing of lockdown measures and the ongoing support of central banks has driven the recovery, with the switch into heavily-sold stocks given added momentum today by figures from China showing services sector activity at the highest level since 2010.

The optimism meant Lloyds Banking Group (LSE:LLOY) added another 5% to extend this week's improvement in fortunes, from below 30p on Friday to almost 34p today. Airlines and those companies impacted by the grounding of aircraft were also in demand, as European holiday destinations looked to lift travel restrictions in time to welcome tourists this summer.

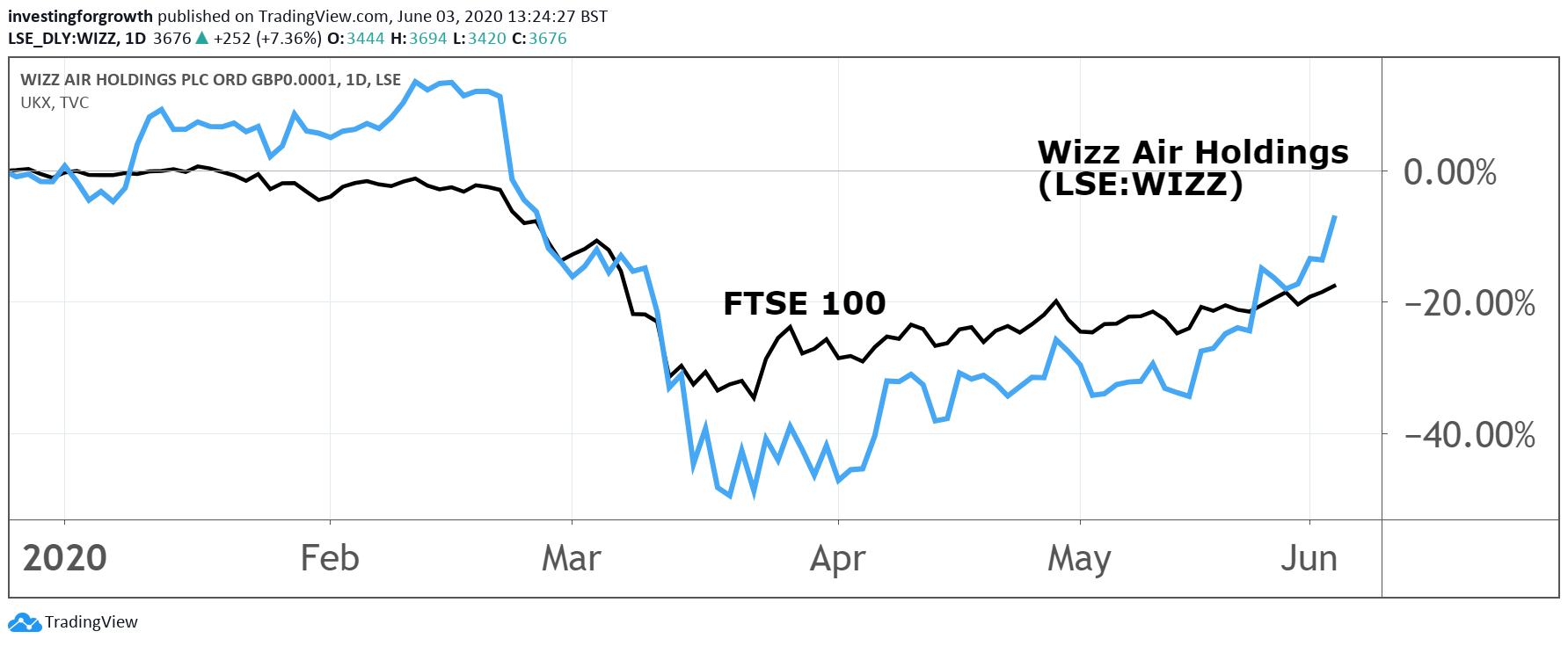

British Airways owner International Consolidated Airlines Group (LSE:IAG) was the top riser in the FTSE 100 after adding another 9% to 273.7p, with Rolls-Royce (LSE:RR.) not far behind with a 7% gain. The mood was helped by full-year results from low-cost carrier Wizz Air Holdings (LSE:WIZZ), which reassured investors when it disclosed an end of financial year cash position of 1.5 billion euros (£1.35 billion).

It said cash burn was coming down quickly, with a monthly figure of €90 million (£80 million) in the event of a full grounding of its fleet due to fall to €70 million (£62.3 million) from October onwards.

Source: TradingView. Past performance is not a guide to future performance.

The low-cost airline, which flew 40 million passengers from 155 airports in its last financial year, is braced for strong demand when restrictions lift, given that the average age of its customer base is 36 and around two-thirds use the airline to visit friends and relatives.

The company expects to operate at about 60% of capacity this summer, although with so much uncertainty about the market recovery it has declined to give guidance on net profit for the new financial year. The figure for the year to 31 March jumped 30% to 344.8 million euros (£307 million).

Shares, which had been trading at a record high near to 4,500p in February, were up 4% at 3,568p following today's results. Its performance was one of a number of high points for mid-cap investors as the FTSE 250 index surged almost 2% to 17,752.

- Top 10 funds, trusts and shares in May 2020

- An investor’s guide to buying motor stocks in a crisis

- Prospects for UK bank shares

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

There were 5% gains for both Marks & Spencer (LSE:MKS) and Royal Mail (LSE:RMG), while shopping centre owner Hammerson (LSE:HMSO) continued its recent turnaround with a further jump of 21% to 134.1p.

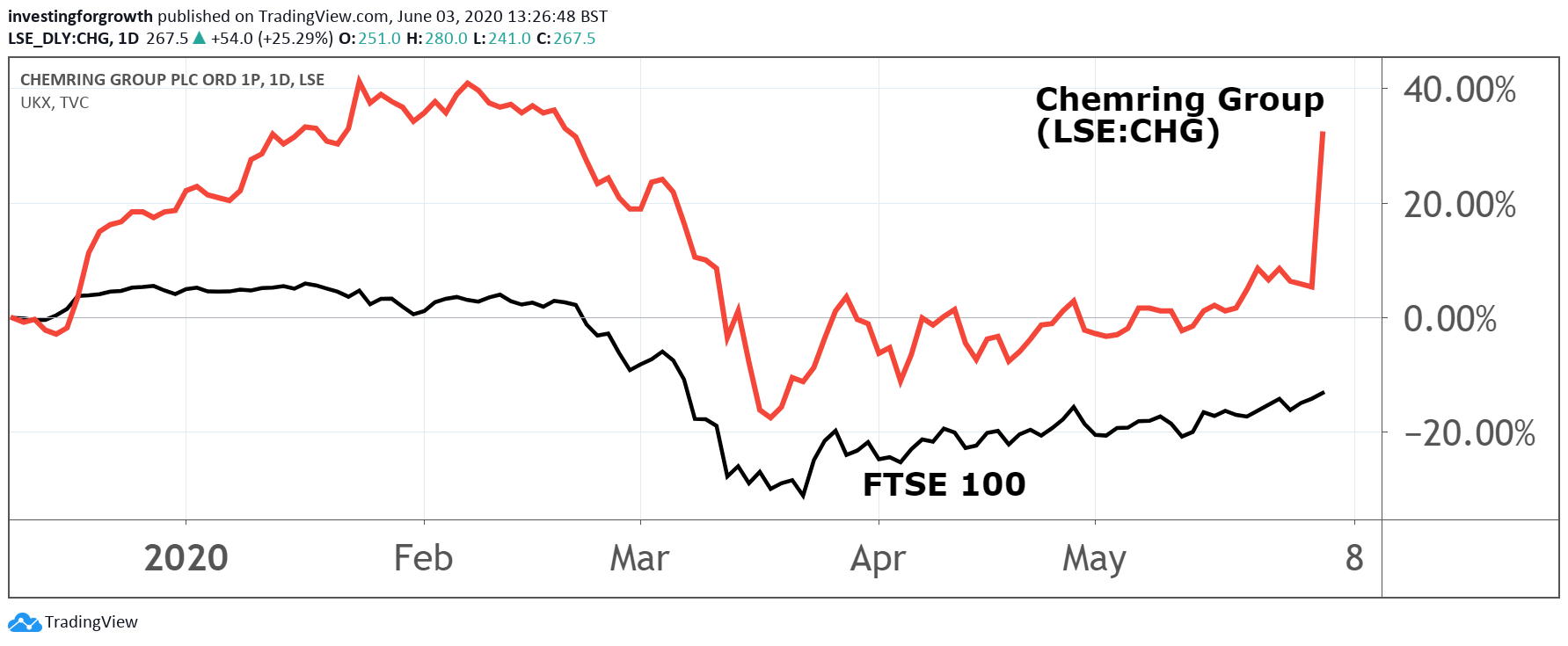

That was bettered at the top of the FTSE 250 risers board by the 25% improvement for Chemring Group (LSE:CHG), with the defence contractor reporting better-than-expected half-year results and bucking the recent trend on dividends by increasing its pay-out by 8%.

Source: TradingView. Past performance is not a guide to future performance.

About 95% of its expected second-half revenues have already been delivered or are in the order book, reflecting strong demand from the United States. The stock jumped 25% to 267p, which is close to where it was prior to the market sell-off.

Among smaller cap stocks, medical devices company Creo Medical (LSE:CREO) surged 11% to 171p after NHS health economics data appeared to support the adoption of the first of its suite of advanced energy devices designed for use in flexible endoscopy.

CEO Craig Gulliford said the roll-out of the company's technology throughout the NHS would empower endoscopists and surgeons to change the way they operate.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.