Fund picks for ISA season

Five experts tell us which funds they're buying, holding and selling ahead of the tax year-end.

15th March 2019 14:00

by Marina Gerner from interactive investor

Five experts tell us which funds they're buying, holding and selling ahead of the tax year-end.

The final quarter of 2018 was a painful one for global markets. It saw the end of strong US outperformance and the low-volatility environment investors had enjoyed during previous years. As we move through 2019, elevated volatility is likely to continue.

Concerns are mounting about a slowdown in global growth. The US Federal Reserve's chair Jay Powell has said he will be "patient" with further US rate hikes, citing slowing global growth and the waning effect of tax cuts.

Meanwhile, many central banks continue to rewind their bond-buying programmes, which takes liquidity out of global markets and adds to a volatile environment.

Emerging markets have underperformed over the past year, and some of our experts now believe they offer attractive value. Some are shunning commodity-focused funds, as China has shown renewed signs of slowing down in recent months. Others have turned away from funds with a eurozone mandate, as weakness has spread across European markets. Germany's manufacturing output and growth have slowed down, and Italy is now in a technical recession.

Our fund managers are therefore turning to Japan, and also consider the UK to be an undervalued opportunity.

These experts invest largely in funds and trusts, rather than building their portfolios out of individual companies' stocks or bonds. That's why they're very well-positioned to identify strong themes and winning fund managers. Here they tell us their fund and trust buys, holds and sells.

Peter Hewitt

F&C Investments

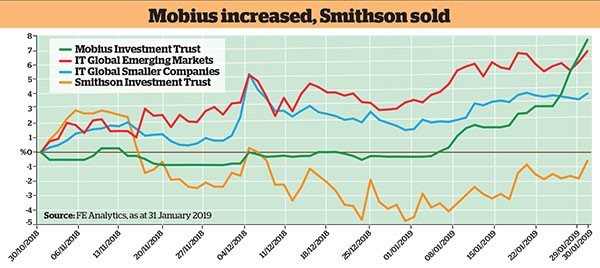

NEW BUY A new purchase made by Hewitt was Mobius Investment Trust (LSE:MMIT), which launched in November last year. The trust has a high-conviction portfolio of 20-30 small and mid-cap holdings invested in emerging and frontier markets. It's run by Carlos Hardenberg and Greg Konieczny, both of whom have over 20 years' experience.

"They were both instrumental in turning around the performance of Templeton Emerging Markets investment trust (LSE:TEM) from 2015," says Hewitt. The managers put in £20 million of the £100 million raised at IPO. "When experienced and successful fund managers leave to set up their own company and put a lot of their own money behind the trust, this is a good sign," he adds.

INCREASED Following a recent meeting with the management, Hewitt increased his position in Capital Gearing trust (LSE:CGT). The trust has the dual objective of preserving shareholders' wealth and achieving absolute returns. "Manager Peter Spiller has an outstanding long-term record of delivering on these objectives, and has only experienced one down year since launch in 1982," he says. The trust is defensively positioned, with only 12% in direct equities and 35% in index-linked government bonds (mainly in the US). It trades at around asset value.

SOLD Hewitt recently disposed of the BlackRock Commodities Income trust (LSE:BRCI), because "2019 has become more challenged". The portfolio is invested approximately half in basic materials and materials and mining companies and half in energy and oil companies. "The recent sharp reversal of the oil price creates a major headwind for large integrated oil companies," he says. Meanwhile, concerns over growth in the Chinese economy could put pressure on demand and prices of key minerals and commodities. Despite offering a 5% dividend yield, prospects for the trust's overall total return this year are "less certain".

David Hambidge

Premier Asset Management

NEW BUY In terms of new holdings, Hambidge has added an emerging market equity fund to a number of his multi-asset funds. The Pacific North of South Emerging Markets All-Cap Equity fund is run by an "experienced team with an impressive track record," he says. Their approach is valuation-driven, so they seek good companies at attractive prices. "They believe that emerging markets offer plenty of opportunities currently for patient long-term investors, and we agree with them."

INCREASED Having taken some money off the table in early January 2018, Hambidge has been topping up equity positions more recently. He argues that the UK looks "cheap on a number of measures" now, but remains out of favour with investors as a result of the Brexit gridlock. One position he has topped up is Montanaro UK Income, which has a bias to higher-yielding mid and small caps.

SOLD At the start of last year the world was enjoying strong and synchronised economic growth, but subsequently the US soared ahead and the dollar strengthened. Now, the US economy is facing headwinds, and just before the end of last year, Hambidge sold his Vanguard USD Treasury Bond ETF. It had performed well since he bought it last February, mainly as a result of a strong US dollar.

Ayesha Akbar

Fidelity Investments

NEW BUY Given heightened volatility, Akbar believes it's increasingly important to be "defensive without being entirely risk-off "; one fund that gives her exposure to the generally defensive Japanese market is the Aberdeen Japan Equity fund. Fidelity's team of analysts and portfolio managers "aim to help investors get exposure to capital growth in the Japanese market by focusing on quality companies with strong balance sheets," she says.

INCREASED Given the winding down of quantitative easing globally, Akbar argues that an allocation to inflation-linked bonds may be wise. She has topped up a holding in Standard Life's SLI Global Index Linked Bond fund. "Adam Skerry's team is highly experienced, and governments often ask the firm to advise them on their inflation programmes," she notes. The team believes that this expertise gives them an "incisive edge" over less experienced fund managers.

HOLD "With a great deal of focus on Brexit, some investors are overlooking the rather bleak picture on the continent," says Akbar. While the Italian budget issue appears temporarily resolved, longer-term issues remain, and Germany's poor economic performance is an even bigger headwind, she believes. The Threadneedle European Select fund offers investors exposure to a concentrated portfolio of under-researched companies, but while it's attractive in the long term, Akbar says she would wait to add further to Europe as an equity region until the picture becomes clearer.

Jordan Sriharan

Thomas Miller Investments

NEW BUY Sriharan has been wary of extended valuations in US equities since the end of the third quarter 2018, so he is "intent on rotating into a more defensive active manager from the rump of the passive allocation we have left". He says he had previously identified Vontobel US Equity run by Matthew Benkendorf as a "high-conviction play" in this space, and made an initial investment in the fund in the final quarter of 2018. The fund has a "quality growth" approach that is focused on the preservation of capital.

NO POSITION INCREASED Sriharan has been positioning his portfolios towards a more defensive stance over the past 18 months, by rotating out of passive equity funds into active managers. He believes that the active managers he has chosen should perform well in the latter part of the economic cycle. But while the active fund managers he chose helped to protect his portfolio at the end of last year, he says they "did not offer the same value, thereby negating the opportunity to increase our holdings in the quarter."

TRIMMED "We had begun to express concerns over the Kames Investment Grade Bond fund well before co-manager Steven Snowden resigned," he says. Sriharan felt the portfolio's positioning appeared less driven by credit selection ideas and more by sector positioning and macro views. As a result, "volatility in returns picked up". The manager's departure and broader staff movements at Kames were enough for the team to review its conviction in the fund, "which resulted in the eventual trimming in holdings".

Peter Walls

Unicorn Mastertrust

NEW BUY Among the recent spate of trust IPOs, Walls decided to support the launch of the AVI Japan Opportunity trust (LSE:AJOT). "The managers believe there are extraordinary undervaluations in a range of cash-rich, overcapitalised Japanese small companies," he says. The AVI team anticipates that reformed corporate governance codes and shareholder activism will unlock more value.

INCREASED Last summer, Baillie Gifford were appointed managers of the now renamed Baillie Gifford UK Growth trust (LSE:BGUK). The portfolio was realigned to represent the management team's best ideas, and it has an active share of 87% relative to the FTSE All-Share index. "A recent placing of shares held by the previous manager's savings scheme provided the opportunity to increase my holding at an attractive discount to net asset value," says Walls.

SOLD Smithson Investment Trust (LSE:SSON) raised £823 million and started trading in October 2018. The investment strategy is exactly the same as the hugely successful open-ended Fundsmith Equity fund, save that investments are made in small and mid-cap companies with comparable characteristics. "I have little doubt the trust will be a rewarding long-term investment," says Walls. But he sees the trust's continuing premium as unsustainable, and therefore sold.

Multi-manager biographies

Jordan Sriharan

Sriharan is head of the collectives research team and a senior portfolio manager at Thomas Miller Investments. Prior to working at the firm, he worked at Mercer, Fidelity Investments and the Wellcome Trust.

Peter Walls

Walls manages Unicorn Mastertrust, an open-ended fund of investment trusts. Before he joined the Unicorn investment house in 2001, he was an investment trust analyst and commentator for nearly 20 years.

David Hambidge

Hambidge is head of multi-asset investment at Premier Asset Management. He helped set up Premier's fund-of-funds operation in 1995 and is regarded as one of the UK's most experienced multi-managers.

Ayesha Akbar

Akbar is a portfolio manager in Fidelity's multi-manager team. Prior to joining Fidelity, she worked at Barclays Wealth, where she was instrumental in helping establish the -firm's multi-manager business.

Peter Hewitt

Hewitt is a director and investment manager with the F&C global equities team, and fund manager of the F&C Managed Portfolio Trust, where he specialises in investment trusts. He joined the ¬firm in 1983.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.