The future of emerging markets and investment trust tips

Kepler answers five questions on emerging markets, including on growth drivers over the next 10 years.

13th October 2023 13:03

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Pithy phrases are popular in the investment world. Like traditional health remedies, it doesn’t matter much if the rationale seems shaky, they provide opportunities to appear profound. For example, it is hard to see how “the most dangerous words in investing are ‘this time is different’”, can be made to reconcile with regulatory warnings that past performance doesn’t guarantee future results.

In our view, the second phrase is more valuable to keep in mind, or to put it in a pithy phrase or two: “stuff happens”, and “life comes at you fast”. Maybe our readers follow rugby more closely than we do, but for the casual fans we are, the number of rule changes there have been over the years makes the game almost unrecognisable from the good old days (when did they get rid of rucking?!).

- Invest with ii: Buy Investment Trusts | Top UK Shares | Open a Trading Account

The lesson perhaps is not to assume the knowledge you have built up in the past is still relevant to the future. Nowhere is this more relevant than in emerging markets, where the rate of change is remarkable and the game is completely different these days. Here we provide a catch-up for the casual investor who hasn’t paid much attention to the sector for a while.

Is China finished?

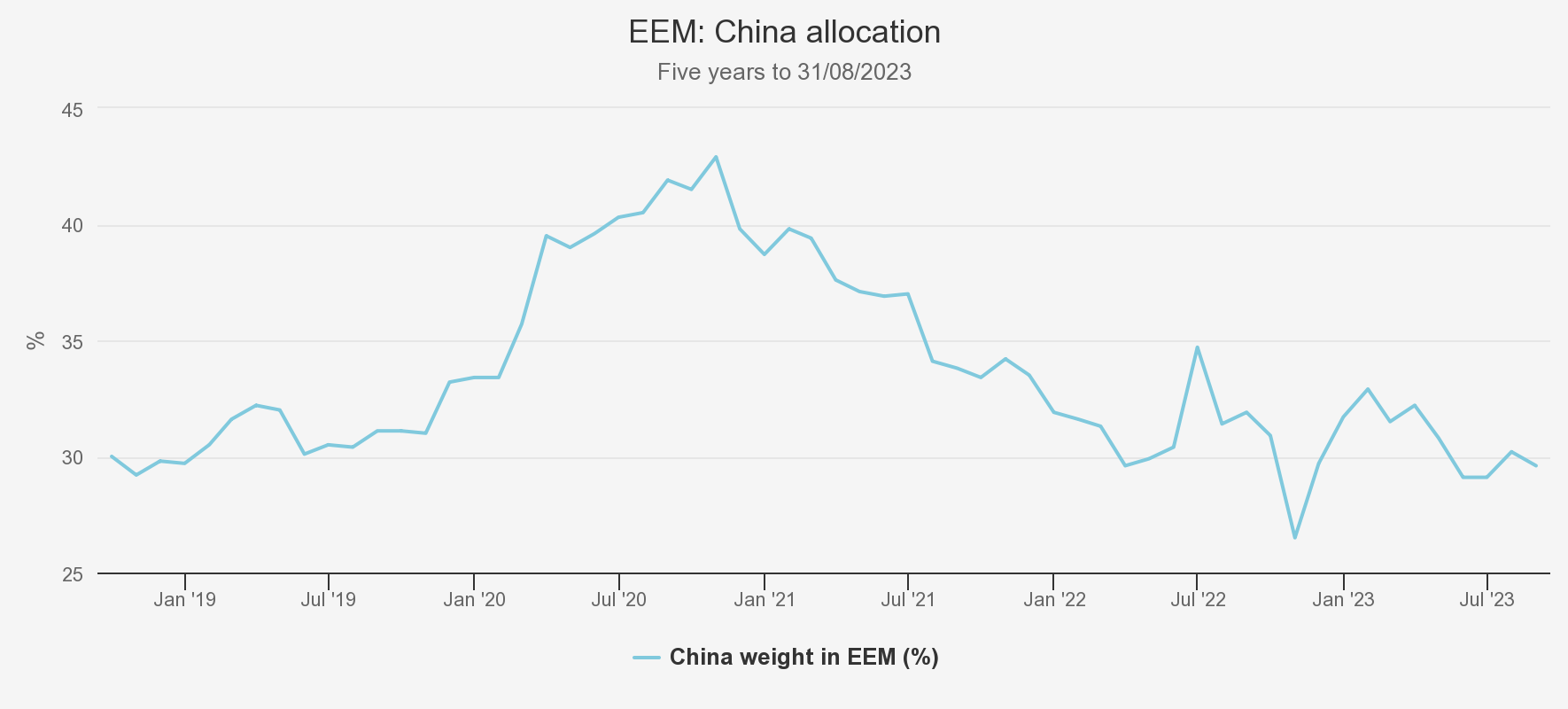

China has been the key success story in the emerging markets universe of the last generation. Its high economic growth has had huge social and political consequences while attracting investors to equities that offer the potential to benefit from it. It was only five years ago that onshore China-listed stocks were included in the MSCI universe, expanding China’s weight in the index and bringing a flood of overseas capital into Chinese companies. In late 2018, following the inclusion, China was 30% of the emerging markets index.

Strong returns and the intention of MSCI to increase the weight accorded to the shares meant that at the end of 2020, the weight had risen to 45% and analysts (including Kepler analysts) were speculating that investors would soon be managing their China allocation separately rather than through regional funds, as they typically do with the US concerning global funds. Our crystal ball clearly failed us, and the situation has completely reversed since, as the below chart shows. We show data from iShares for their ETF investing in the index, and the weight of China has fallen back to 30%.

CHINA WEIGHT IN ISHARES ETF

Source: Morningstar

There is a lot of talk about China’s GDP growth being lower in future, but we don’t think that should be a major worry for investors in Chinese equities. The stock market is not the economy, and there are clear examples of sectors and stocks in China with huge earnings growth potential even in a weak economy, such as green energy technology or the rush to develop a homegrown semiconductor ecosystem. Moreover, China remains a huge consumer market, and companies selling innovative products or strong brands into that market will have huge growth potential before they get to the size where growth in the economy is correlated to their earnings growth.

Politics is a more relevant fear, and the growing tensions between China and the US have certainly weighed on Chinese equity markets. Investors have to respond to tariffs and sanctions against doing business in certain sectors, and some investors are no doubt worried about those tariffs and sanctions being expanded further. As we will come to later, this is as much a source of opportunity as anything, although the opportunity is largely outside China. Another dimension of political risk is internal, and there has been growing concern about regulatory interference after the decision in 2021 to nationalise the private education sector and the heavy-handed interference in the e-commerce space. It is hard to provide much insight or analysis on political risks, by their nature they are unquantifiable. However, we would note that on the latter point, Alibaba is back at prices it last traded at in 2016, which is no doubt a contributory factor behind its place in the top ten positions of Fidelity Emerging Markets (LSE:FEML) and Templeton Emerging Markets (TEM), in the latter case at a very high overweight. In our view, politics doesn’t make China uninvestable but it does mean investors have to be keenly aware of political risks on a case-by-case basis.

SHARE PRICE PERFORMANCE

Source: Morningstar. Past performance is not a reliable indicator of future results

We think the most worrying factor weighing on Chinese equity markets at the moment is in the real estate sector. This is something of a slow-motion train wreck, with the latest stage being the narrow avoidance of default by Country Garden, one of the largest property developers (and listed in Hong Kong). The danger in this sector is the impact on the banks, which have lent to the property developers, and the knock-on impact on their ability to take risks elsewhere. In addition, falling property prices are bad news for highly leveraged consumers, and given the expectation for further residential price falls, homebuyers have been waiting rather than buying, thereby foregoing all the expenditure connected to buying a home as well as the transaction itself. This should have an impact on business lending, and retail spending across the economy, which could lead to widespread earnings declines for corporates – this dynamic is similar to that experienced after the 2007-08 financial crisis, softened by QE, and to that Japan experienced in the 1990s. Serious government intervention is likely to be needed to avert such a dynamic.

Which countries are performing well?

All these issues have weighed on Chinese equity markets this year, and as of the end of August, the MSCI China All Shares Index was down 5.6% (in dollar terms). Over the same period, the MSCI Emerging Markets Index was up 4.9%. Given the high weighting of China to the index, this illustrates that some countries have been performing very well indeed.

India has delivered decent gains of 5.3% over the same period. Having fallen less than the market in 2022, and made 25% in 2021 as the index fell, it has been one of the major beneficiaries of China’s derating in the index weightings, its weight in the index almost doubling to 15% over the past five years. India looks set to see continual investment at the expense of China, given its better political ties with the developed world. We covered its outlook relative to China in more detail in a recent strategy note.

Latin America is a much smaller part of the emerging markets universe, but it has delivered some of the best returns, up 15.6% in dollar terms. Latin America has been benefiting from a few dynamics. First, while China’s weakness is weighing on demand for commodities, demand remains strong thanks to the commitments of governments to net zero technology which relies on vast amounts of metals and minerals. Second, central banks were early to raise rates decisively and inflation has come down swiftly, leaving central banks in the position to consider cutting rates – in fact, Brazil has already embarked on a cutting cycle. Third, Latin America is one of a number of emerging market regions which are benefiting from the freezing of trading relations between the US and China. Countries in the region are able to maintain close trading relationships with both countries and are benefitting from a diversion of trade patterns and manufacturing bases (of which more later).

Another standout market has been the very different story of South Korea, which is up around 13% and has contributed to TEM’s above-average returns this year thanks to the trust’s big overweight to the country. Korean stocks have benefitted from the rush to AI, with Samsung Electronics Co Ltd DR (LSE:SMSN) circa 30% of the index and SK Hynix, the semiconductor stock, the second-largest weighting. They are also benefiting from an increased focus on corporate governance by the regulators, which are intended to increase access by foreigners and close the valuation discount the market suffers from. It is worth noting that this is a very different set of factors to those pushing Latin American equities higher, and neither is chiefly dependent on the health of the Chinese economy.

Is deglobalisation bad for emerging markets?

Lots of funny ideas came out of the pandemic period, but now some time has passed we can see that we will not all be walking around wearing bell jars on our heads in perpetuity, people will still want to go to the gym and show off rather than ride a bike in their living room, and the world is not going through a period of deglobalisation. We may or may not have better plans for getting access to scrubs and medicine in the next pandemic (one suspects that has been forgotten) but we have not seen a wholesale relocation of industry and manufacturing back to the West. What we are seeing is as much friend-shoring as reshoring and a realignment of supply chains. The main aim of this is to reduce reliance on China, in the light of the increasing hostility of the US towards that country and increasing distrust by investors of both parties and the regulatory restrictions they may enact. As a result, we are seeing a huge boost for countries which can replace China’s role in manufacturing, as well as those which can help, shall we say, ‘finesse’ the routes goods take between the world’s second and first economies.

In the first category sits India. Modi has implemented deep reforms which have reduced red tape and simplified the tax system, and has also funded investment in infrastructure. The Make in India campaign has been pushing on an open door thanks to the need of Western corporates to decouple from China, and major multinationals have expanded their manufacturing activities in the country, shifting up the value chain to make more complex electrical components in India. For example, Indians will be able to buy the new iPhone, the 15, actually made in India on day one of the release for the first time.

Other countries in this category include Vietnam. Vietnam benefits from a much cheaper workforce, which means it is one attraction for those leaving China. Its proximity to its northern neighbour means it is relatively easy for it to manufacture parts and send them on for further assembly, or vice-versa. However, it has a strong dependency on exports to China, which means weakness in the latter’s economy is a risk factor. Nonetheless, it is a popular frontier market to which several emerging market managers are keen to have exposure. Alongside BlackRock Frontiers Ord (LSE:BRFI), this includes Utilico Emerging Markets (LSE:UEM) and Fidelity Emerging Markets (LSE:FEML). Indonesia is another country to be benefiting, its rich natural resources being highly valuable to the electric vehicle industries of both China and the US, which is one of the major focusses of tariffs. BRFI has almost 15% in the country, and FEML, JPMorgan Emerging Markets (LSE:JMG), and JPMorgan Global Emerg Mkts Inc (LSE:JEMI)are between 4 and 5%. This compares to a weight of around 2% in the ETF.

In the second category sits predominantly Mexico. The country has become a popular place for Chinese companies to make goods for export to the US, avoiding tariffs or the potential for future restrictions. Trade data can vary from source to source, so all numbers have to be taken with a pinch of salt. However, there is a clear picture of skyrocketing imports from China and exports to the US between 2021 and 2022 of around 15-17% in each case (using figures from the UN Comtrade database). This has helped boost the Mexican currency, which is up 16% over the past 12 months. The Dollar Index is down around 4.4% over the period, so the peso has outperformed. A Mexican overweight entering the year was helpful for the managers of BlackRock Latin American (LSE:BRLA), although they have actually trimmed their positions into strength, preferring the domestic growth story in Brazil. We will be publishing an updated note on BRLA in the coming weeks - click here to be notified of its release.

What are the growth drivers going to be over 10 years?

More experienced colleagues are prone to be sceptical about a lot of things. One thing we have been asked on a number of occasions is where the growth is going to come from now China is slowing. That country’s huge demographic boom coincided with the liberalisation of its economy, and both factors combined to create an explosion of demand for commodities, basic consumer goods, and then latterly more sophisticated goods. China’s demand was supplied by fossil fuels and commodities from other emerging markets, while China’s growing capital was reinvested overseas, often in other emerging or frontier markets. That boom is clearly over, China has matured and is facing the task of escaping the “middle-income trap” in the long run, and a debt crisis in the property sector in the short run. So is the emerging markets growth story over?

The first thing to recognise is that there are plenty of countries following China down a rapid path of development. India is the most prominent in the index, but there are others to consider such as Indonesia, as well as frontier markets such as Vietnam. To benefit from this, investors need to be active, however, as the MSCI Emerging Markets Index is dominated by North Asian countries China, Taiwan, and South Korea, which together make up over 50% of the index and are being driven by very different themes. There are specialist trusts investing in India and Vietnam, of which in the latter case Vietnam Enterprise (LSE:VEIL)is the largest. BRFI has the most significant weight to Indonesia in the investment trust universe, as well as numerous other countries pursuing rapid economic catch-up.

One of the themes with huge growth potential driving North Asia is technology. Over the past decade, Asian equities have become absolutely central to the investment opportunity in technological development. Taiwanese TSMC has circa 55% of market share in the global semiconductor market and Samsung another 16%. Of the top 10 manufacturers, eight are Asian and have between them circa 87% market share. As highlighted above, Samsung dominates the Korean equity market in terms of market capitalisation. While semiconductor demand moves in cycles, linked to corporate capex, we think this is clearly a long-term secular trend in which earnings growth should exceed growth in the global economy, and as such represents an investment opportunity at the right valuation.

Investors shouldn’t overestimate the need for a rampant China on commodities either, in our view. A weaker Chinese economy has traditionally been seen as bearish for hard commodity demand. While this is true, and while there are no guarantees, there are two key developments which may mean it is less important than in the previous cycle. The first is the transition to green technology in pursuit of net zero. This creates huge demand – perhaps insatiable demand – for copper, lithium, rare earths, and other materials. This creates a secular tailwind behind not only the corporate producers of those materials, but the countries supplying them. Indonesia and Chile are likely to be amongst the beneficiaries. The second development is the friend-shoring or reshoring of supply chains. In both cases, heavy investment in plant and machinery is needed to physically relocate manufacturing and assembly, which is bullish for commodities.

Where are the opportunities in the investment trust sector?

The beauty of the investment trust sector is how active the managers typically are. Competition for permanent capital is fierce, and within the confines of the closed-ended structure, talented fund managers have come up with numerous differentiated strategies and portfolios which are tilted away from the index and towards exciting growth themes. In the interests of brevity, we will save the discussion of the country specialists for another day and focus on the AIC Emerging Markets sector.

The outstanding performer year-to-date has been BlackRock Frontiers (BRFI). The trust invests in emerging and frontier markets outside the largest eight countries, which means it is highly differentiated from the North Asia-heavy index. Positions in Saudi Arabia and Indonesia have helped performance this year. Utilico Emerging Markets (UEM) has been another strong performer and is highly differentiated, investing in infrastructure and utilities. A few years ago this seemed quite old hat, but the energy transition and digitalisation of economies both create demand for new and more sophisticated infrastructure, while the reorganisation of global trade also creates demand for transportation assets. UEM has little exposure to China, but a huge overweight in Latin America which has been helpful this year. India and Vietnam are also well-represented in the portfolio. The third-best performer has been Mobius Investment Trust (LSE:MMIT). This is very different from both BRFI and UEM, with a heavy focus on technology (61% of the portfolio) – and a small-cap focus. As much as 24% is in Taiwan and 18% in India. We heard from manager Carlos Hardenberg at our summer conference, and you can rewatch his presentation here. MMIT is very focused on company-specific drivers of performance rather than macroeconomics, which makes the overweight to India particularly interesting – clearly, there is more than macroeconomics favouring India.

SECTOR PERFORMANCE

| YTD | THREE YEARS | ||||||

|---|---|---|---|---|---|---|---|

| DISCOUNT | RETURN (CUM.) | CORRELATION | STD DEV (ANN.) | RETURN (ANN.) | CORRELATION | STD DEV (ANN.) | |

| BRFI | -8.7 | 16.9 | 0.86 | 10.1 | 20.4 | 0.78 | 14.8 |

| UEM | -16.2 | 9.0 | 0.94 | 10.3 | 11.1 | 0.73 | 12.3 |

| MMIT | -5.3 | 7.6 | 0.89 | 16.1 | 11.5 | 0.82 | 16.3 |

| TEM | -13.4 | 3.7 | 0.98 | 16.7 | -0.8 | 0.96 | 15.9 |

| JEMI | -10.6 | 1.0 | 0.96 | 14.8 | 7.2 | 0.95 | 15.0 |

| BEMO | -20.2 | -1.7 | 0.80 | 12.0 | -3.1 | 0.64 | 20.8 |

| JMG | -6.9 | -3.5 | 0.97 | 12.1 | -0.1 | 0.96 | 14.3 |

| FEML | -12.5 | -4.9 | 0.94 | 7.3 | -6.3 | 0.92 | 13.7 |

Calculation benchmark = MSCI EM NR USD

Source: Morningstar, data to last month’s end except discount as of 14/09/2023. Past performance is not a reliable indicator of future results.

The trusts that have lagged this year include Barings Emerging EMEA Opportunities (LSE:BEMO), which has suffered from weakness in South Africa, one of two major country positions in its portfolio alongside Saudi Arabia. JPMorgan Emerging Markets (JMG) and Fidelity Emerging Markets (FEML) have also underperformed the MSCI Emerging Markets Index year-to-date. At an index level, value has outperformed growth this year, which has been negative for both trusts. Given they are more large-cap and benchmarked to the MSCI Emerging Markets Index, this style effect has been more important to relative returns than for the trusts that have outperformed. There has also been some weakness in large-cap positions in which the managers have strong convictions over the long run, an example being HDFC Bank in India. Stylistically, these trusts have been out of favour and they haven’t benefited from large positions in the smaller emerging markets.

However, as discussed above, we still think there are a number of economic growth drivers which should be able to deliver attractive returns from leading companies in China, India, and the other largest markets, although we would argue taking an active approach is essential given the obvious risks.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.