How to play and profit from the commodities boom

We explain how investors can gain exposure to the asset class.

19th May 2021 12:40

by David Craik from interactive investor

A new super-cycle for commodities has been predicted. We explain why and name the various ways investors can gain exposure to the asset class.

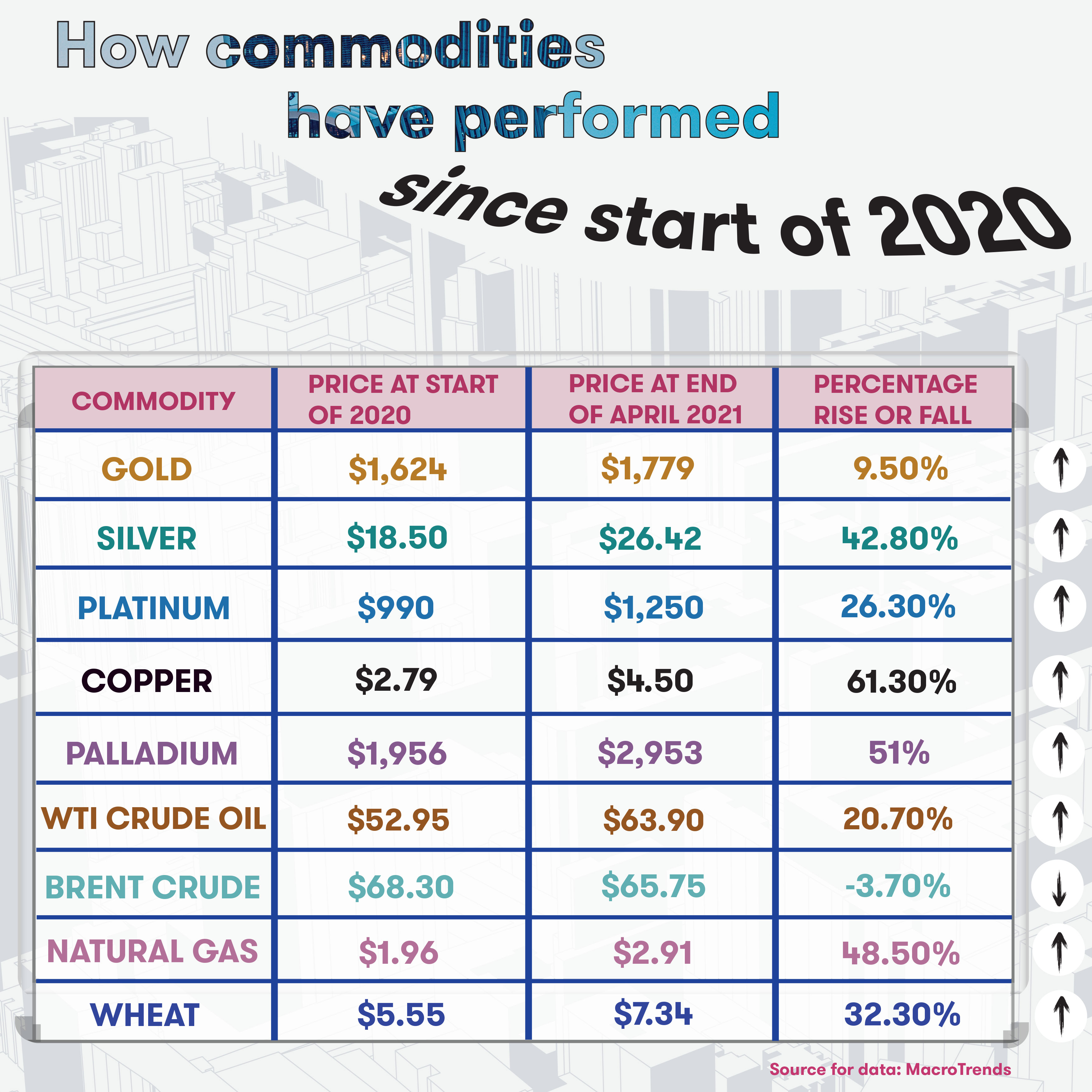

Commodities shone during the pandemic, despite disruption to industry, transport and consumer spending.

Investment bank Goldman Sachs believes it marks the start of a commodities super-cycle – a multi-year bull market. “Looking at the 2020s, we believe that similar structural forces to those which drove commodities in the 2000s could be at play,” the bank said in its 2021 Commodities Outlook last November.

That super-cycle was largely driven by emerging markets, particularly China, Brazil, India and Russia. It came to an end as the global financial crisis hit and emerging market growth began to cool. The S&P Goldman Sachs Commodity Index fell by around 60% between 2010 and 2020.

Saxo Bank also believes that a super-cycle is back. The firm said earlier this year that “in the past 227 years, the world has witnessed a mere six commodity bull markets. We expect 2021 to mark the beginning of the seventh.”

“We are seeing developments across energy, metals and agriculture suggesting that prices have further to run,” says Ole Hansen, head of commodity strategy at Saxo Bank.

Increasing use of ‘green metals’ to drive super-cycle

Both banks agree that the new super-cycle will be driven by the global green revolution, as major economies strive to decarbonise. This will lead to increased use of ‘green’ metals such as lithium and copper to power car batteries and wind turbines.

Governments looking to bridge the inequality gap in society post-pandemic will also help drive deeper demand for property and consumer products.

- Global funds switch focus from tech to value shares to play recovery

- The ETFs Show: investing in oil, gold and other commodities

- Our five Model Portfolios are maintaining momentum

Dzmitry Lipski, head of funds research at interactive investor, adds that other drivers could be investors looking to gold and silver as an inflation hedge and a structural recovery as governments fill infrastructure gaps.

Hansen adds that Chinese demand for raw materials will remain robust, which is another reason to be bullish on commodities. He adds that the US and Europe will also step up their infrastructure focusing on bridge and airport upgrades. “This includes green build such as the electricity grid and EV infrastructure. The last cycle was China, but this time it will be a global phenomenon,” says Hansen.

Rising tide may not lift all boats

However, he adds that it may not be wholly universal. Hansen says that despite crude oil’s ‘strong vaccine-led’ rally to around $65, questions remain around demand from business and holiday travel trends post-pandemic.

“Oil will probably go higher in the next couple of years, but it is not where we will see the biggest growth,” he says.

Anthony Speight, potatoes, cereals and oilseeds analyst at the Agriculture & Horticulture Development Board, also has some uncertainty over crops.

He says global cereals prices have been driven recently by Chinese hunger for grains both for its population and pig herd recovering from African Swine Flu, dry weather in South America affecting crop quality, and Russia introducing an export tax on wheat, maize and barley to help fight domestic food price inflation.

“New crop values are very dependent on the development of winter cereals and planting progression for spring crops,” he says. “It is really a wait and see how US plantings go and if its maize market will keep climbing. If China drastically slows purchasing next season, this could also have an impact.”

Why a super-cycle may not play out

Other wobbles can be seen in the gold price, which had, over a six-month period from mid-October to mid-April, fallen from $1,900 to $1,745. Factors driving the dip included a strengthening US dollar and rising Treasury yields. But since then, the gold price has been moving upwards, and is currently around $1,860.

There could also be a potentially slower than forecast roll-out of electric vehicles, and a moderation in Chinese growth after its rapid Covid recovery.

“It’s very difficult to predict the future of commodity prices when you have got huge numbers of factors impacting supply and demand,” says Ben Mackie, fund manager at Hawksmoor Fund Managers.

Mark Smith, fund manager of the TB Amati Strategic Metals fund, believes the talk around a super-cycle is just ‘headline-grabbing’. “The definition is above normal growth over a sustained period. All we’ve seen in the last 12 months is a response to unprecedented fiscal stimulus,” he says. “China is the largest consumer of base metals and they are actively trying to reduce their commodity price inflation by limiting exports and encouraging domestic scrap recycling. The Chinese sit on over two million tonnes of copper inventories and could easily return that to the market to put a lid on the boiling pan of water.”

Timothy Harvey, chief executive of funds distributor NTree, believes it may be a specific rather than a broad commodity super-cycle.

“I see commodities like the whack-a-mole game,” he says. “If certain metals become too expensive, then others will be used instead, so aluminium as a transmitter of electricity instead of copper. There is an element of substitution in commodities. Also, if we all do go green then our dependency on oil will reduce. So not every commodity is going to keep rising in price.”

How to profit from a potential new super-cycle

So, how can investors best play the commodity sector given this mixture of bullishness and uncertainty?

One way to take advantage is via investment trusts. Richard Curling, manager of the Jupiter Fund of Investment Trusts, holds Baker Steel Resources (LSE:BSRT), which invests in early stage miners. It is up 32.4% so far this year – to 17 May 2021. Curling also invests in BlackRock World Mining Trust (LSE:BRWM), which has returned 30% over the same time frame.

“BlackRock has a big exposure to copper. It’s not unreasonable to expect a very big increase in its price given renewables demand,” says Curling. “The background for both trusts is extraordinarily favourable and that is from someone who is usually very cynical of mining companies and their cost and production schedules. But they are much better now in terms of capital discipline, lower debts and returning money to shareholders in dividends and share-buybacks rather than asking for it.”

Hawksmoor Global Opportunities fund also contains Baker Steel Resources, as well as Jupiter Gold & Silver Fund and investment company Geiger Counter (LSE:GCL). The latter is focused on uranium sector holdings.

“Gold is a portfolio diversifier and with all the money printing that is going on, you can’t rule out a protracted debasement of fiat currencies. In that environment, gold as a store of value looks quite attractive,” says Mackie. “Gold miners are trading quite cheaply and offer value. With uranium, we see nuclear power as cheaper and cleaner than fossil fuels and vital given the intermittency of wind and solar.”

ETF options for commodity exposure

The Rogers International Commodity Index UCITS ETF has achieved a return of 52.4% in the last 12 months. It tracks a basket of commodities in energy, metals, livestock and agriculture.

Danny Dolan, director of China Post Global owned Market Access ETFs, says: “It’s broader and more diversified than most other commodity ETFs. We don’t miss out on areas such as rice, which a lot of the world eats, or rubber,” he states. “There are multiple reasons to be strongly positive on commodities going forward, such as a weaker US dollar and more infrastructure spending. A passive allocation to a diversified basket is the right approach. Commodities can be volatile. If you take a view on a single commodity, there are many variables and unexpected events such as weather affecting crops and geopolitics hitting oil.”

- Fund spotlight: WisdomTree Enhanced Commodity ETF

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Lipski is a fan of the smart-beta WisdomTree Enhanced Commodity ETF (LSE:WCOB), which gives a broad and diversified commodity exposure to energy, agriculture, industrial and precious metals. Earlier this month, the ETF was added to interactive investor’s Super 60 list.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.