Ian Cowie: sticking with 10 winning trusts

There are remarkable links between manager longevity and outperformance. These trusts are true stars.

25th June 2020 09:11

by Ian Cowie from interactive investor

There are remarkable links between manager longevity and outperformance. These trusts are true stars.

New research from interactive investor shows that eight out of the top 10 investment trusts by total returns over the last decade have fund managers who have been in post for more than a decade. You can argue about cause and correlation - or which is which - but 80% can’t be just a coincidence.

Who’s in charge of the rattling train? That’s the question the press baron Lord Beaverbrook used to pose when his newspapers lacked leadership or seemed to lose their way. Here and now, investors should not only ask who is running our money but also how long he or she has been in charge.

Industry veteran Ben Yearsley, a director of Shore Financial Planning who was formerly head of investment research at Charles Stanley, pointed out the remarkable links between manager longevity and long-term outperformance.

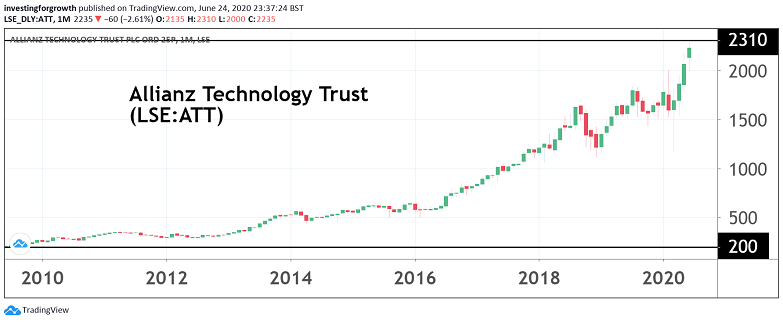

Allianz Technology Trust (LSE:ATT) leads the pack over the last decade, beating more than 300 other investment trusts by delivering total returns of 683%, according to independent statisticians Morningstar. This £861 million star of the Association of Investment Companies (AIC) Technology & Media sector has produced more than quadruple the average AIC member’s total returns of 160% over the last decade. ATT has been managed by Walter Price since April 2007.

Source: TradingView. Share price performance only. Past performance is not a guide to future performance.

Biotech Growth (LSE:BIOG) stands second overall with total returns of 673%. Geoffrey Hsu has been at the helm of this £545 million long-term leader of the AIC Biotechnology and Healthcare sector since May 2005.

Scottish Mortgage (LSE:SMT) ranks third with total returns of 663%. James Anderson and Tom Slater have managed this £12.4 billion giant of the AIC Global sector - and the only investment trust to currently qualify for a place in the FTSE 100 index - since April 2000.

Baillie Gifford Shin Nippon (LSE:BGS), the Japanese Smaller Companies sector star with total assets of £607 million, discussed in this space last week, is fourth overall with a total return of 588%. BGS is also exceptional because Praveen Kumar has only been at the helm since December 2015.

Lindsell Train (LSE:LTI), the £221 million Global sector trust, finds itself fifth with a total return of 585% and has been managed by Nick Train since January 2001. Polar Capital Technology (LSE:PCT), a £2.8 billion giant of the Technology and Media sector, stands sixth overall with total returns of 577%. Ben Rogoff has been lead fund manager since April 2006.

- What investors should do when a long-serving fund manager leaves

- Be first to watch our upcoming Fundsmith Emerging Equities Trust interview by clicking here

- Five most-held dividend stocks among the biggest income funds

Worldwide Healthcare (LSE:WWH), another giant with total assets of £2.1 billion in the Biotechnology & Healthcare sector, is seventh with total returns of 528%. Sven Borho has been manager since April 1995.

International Biotechnology (LSE:IBT), in the same sector with assets of £302 million, is eighth with total returns of 521%. Katie Bingham and Carl Harald Janson have been managers since November 2000.

Rights & Issues (LSE:RIII) a relative tiddler, appropriately enough in the UK Smaller Companies sector, with total assets of £141 million, is ninth with total returns of 445%. Simon Knott has steered a path to profits since 1984.

Edinburgh Worldwide (LSE:EWI), with £873 million assets in the Global Smaller Companies sector, ranks tenth with total returns of 430%. It’s also the second exception to the ‘manager longevity and long-term outperformance’ rule because Douglas Brodie and Svetlana Viteva became managers in January 2014.

Venture capital trusts (VCTs), very small funds and non-AIC members were excluded from the analysis, but many investors may find it provides a new criterion to consider when seeking sustained superior returns. Annabel Brodie-Smith, a director of the AIC, pointed out: “It’s been a tough year for investors as markets plunged during the coronavirus sell-off and then bounced back to a partial recovery.

“Amidst all this market uncertainty, it’s reassuring to know that nearly half of investment company managers have had the same manager for 10 years and 18 managers have steered their companies through at least 20 years of market ups and downs.”

Yearsley told me: “One of the benefits of investment trusts is the independent board and I think that ties in with why investment trusts and longevity go together, hand in hand.

“An independent board has no management fees to defend and therefore can always put the interests of investors first - is that always true in open-ended funds?

“In the investment trust world there should be no excuse for a manager at the helm for a decade or more having poor performance.”

- UK income investors at risk of owning the same shares

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Long-suffering investors elsewhere have seen their money being used to reward failure far too often. More positively, this shareholder is delighted to find that five of the long-term winners identified above also feature in my ‘forever fund’.

Ian Cowie holds shares in Baillie Gifford Shin Nippon, Polar Capital Technology, Worldwide Healthcare, International Biotechnology and Rights & Issues investment trusts.

Ian Cowie is a freelance contributor and not a direct employee of interactive investor.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.