International Women’s Day 2022: debunking myths about female investors

2nd March 2022 15:13

by Jemma Jackson from interactive investor

On the eve of International Women’s Day on 8 March, interactive investor explores how investors feel about some of the common assumptions made about female investors.

- Slightly more women than men self-define as ‘Adventurous’ investors (12% versus 9%)

- 35% of women and 33% of men say they have a balanced/medium risk approach

- More men say they are ‘moderately adventurous’ (50% versus 36% for women)

- 34% of female respondents from an iiflash poll believe investment marketing aimed at women is patronising

Ahead of International Women’s Day on 8 March, ii wanted to explore how investors really feel about some of the common assumptions made about female investors, particularly within the realm of investment marketing.

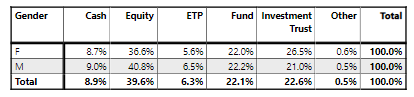

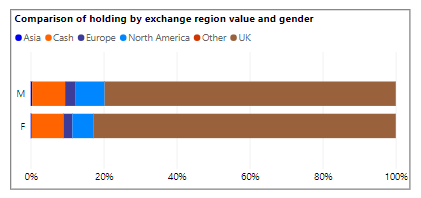

interactive investor, the UK’s second-largest investment platform, now has 120,000 female customers – that’s bigger than some entire platforms. The differences in investment approaches between the genders appear to be subtle when looking at average ii accounts (see tables below). Performance is similar too.

That said, data published this week by ii shows that average SIPP values in customer accounts suggests that a gender pension gap appears when women are between ages 25 and 34 - around the time those who become mothers typically have their first child (age 29). Becky O’Connor, ii Head of Pensions and Savings, describes this as a ‘mothers pension gap’.

How do women feel they are represented when it comes to financial services investment marketing?

In a flash poll* conducted on the ii website from the 25th-28th February, 34% of female respondents said they find investment marketing aimed at women patronising compared to just 16% of men.

Within this, over 20% of female respondents felt that this is because the financial services industry makes the assumption that women do not know what they are doing, or need more handholding. 6% of respondents felt particularly patronised by the use of pink in advertising, and just over 8% pointed to the generalisation that women are risk averse.

Are you adventurous?

Interestingly, the same ii poll did ask female and male investors to self-define their investment risk approach, and while ii customer data suggests very little difference in the way female and male customers invest, the website poll showed some nuances.

Women were more likely to self-define as ‘adventurous’ (12% versus 9% for men). Some 33% of men and 35% of women define their investment risk as balanced/ medium risk.

But fewer women defined as ‘moderately adventurous’ (36% versus 50% of men). While 15% of female respondents described themselves as ‘cautious’, only 6% of men defined their risk approach in the same way.

Becky O’Connor, Head of Pensions & Savings, interactive investor, said:“The results of this poll suggest we need to scrap hackneyed assumptions that women are fundamentally more risk averse and stop babying women, implying that they need more help in understanding investment.

“It is true that there is a gender pension gap and an investment gap, but the reasons are less to do with fundamental differences between men and women and more to do with investing not featuring on women’s radar.

“These reasons may be social, cultural or economic. They might be a result of investment marketing historically being aimed at men and therefore women not seeing it as something for them. But it’s not because of capability or even necessarily approach.”

Question | % of male respondents | % of female respondents |

Q - Do you ever find investment marketing aimed at women patronising? | ||

Yes – especially the use of pink in advertising | 3.63% | 5.80% |

Yes – especially the generalisation that women are risk averse | 4.42% | 8.19% |

Yes – the suggestion that women don’t know what they are doing/need more handholding | 7.56% | 20.14% |

Yes - other | 0.00% | 0.00% |

No – I haven’t noticed this | 76.45% | 59.95% |

No – I’ve noticed this, but I don’t have a problem with it | 7.95% | 10.92% |

Q - Which of the following best describes your risk preferences when it comes to investing? | ||

Adventurous | 9.21% | 11.74% |

Moderately adventurous | 49.76% | 36.24% |

Balanced/ medium risk | 33.40% | 35.23% |

Cautious | 5.88% | 15.44% |

Don`t know | 1.76% | 1.34% |

Q - What would you say is one of the main barriers you face when investing? | ||

Worrying about making the wrong decision | 29.33% | 32.17% |

Difficulty finding information | 8.97% | 8.74% |

Lack of time | 7.86% | 12.59% |

Lack of cash to invest | 15.63% | 16.78% |

Other | 0.00% | 0.00% |

I do not face many barriers when it comes to my investments | 38.21% | 29.72% |

How have active buyers been navigating turbulent markets?

Victoria Scholar, Head of Investment, interactive investor, explains: “The market environment since the start of the year has been incredibly brittle – this began with inflationary pressures at the start of the year, and has continued as the devastating impact of the humanitarian crisis in the Ukraine unfolds.

“These anxious markets are not often kind to investors in the short term. If investment marketing assumptions about women taking a more cautious approach is true, you might expect this to be reflected in our recent buying data. We can’t make generalisations about our wider customer base when looking at the top buys, but active male and female traders continue to invest along similar lines.”

Top 10 most bought on ii: 1st February to 1st March 2022

Female investors Male investors

1 | ||

2 | ||

3 | ||

4 | ||

5 | ||

6 | ||

7 | ||

8 | ||

9 | ||

10 |

Victoria Scholar, Head of Investment, interactive investor, adds: “You only need to glance at our February best buys to see that there is very little difference in the way our male and female customers’ have been behaving. Divided-paying FTSE 100 blue-chips like Lloyds and BP both feature, in the same ranking, for men and women – and those more contrarian choices have more similarities than differences too.”

Private performance index - gender breakdown

ii’s Private Investor Performance Index, published earlier this year to end December 2021, also paints quite a different picture from these common assumptions made about female investor behaviour.

With data now going back two years, the index charts interactive investor’s customer performance data, in median average terms*, since the first coronavirus cases emerged in the UK.

Despite the market turbulence that the pandemic caused, the data showed very little difference between male and female DIY investor performance. Portfolios were broadly similar too, with women slightly more inclined to favour investment trusts, and slightly less inclined towards direct equities. But the differences are minimal.

However, if we dig deeper, recent ii data suggests there are nuances. The average female account has five percentage points more in FTSE 100 stocks than men, with men four percentage points more in AIM stocks.

Performance to end December 2021

SEGMENT | Two years | 18 months | 12 months | 9 months | 6 months | 3 months |

Female | 14.3% | 10.8% | 13.9% | 10.6% | 4.5% | 2.7% |

Male | 14.2% | 11.2% | 13.7% | 9.7% | 4.1% | 2.4% |

ii ISA millionaire data – gender breakdown

We can see a similar pattern when we assess ii’s recent ISA millionaire data.

The data showed that female ISA millionaires have more in investment trusts then men (49% versus 44%), and less in direct equities (33.5% versus 42% for men). But again, the differences are minimal.

Becky O’Connor, Head of Pensions and Savings: “As ever, it is fantastic to see large numbers of very savvy female investors at ii who were able to grow their ISA pots to £1 million. 33% of our ISA millionaires are women – which is broadly in line with our wider customer base*, however we would love to see that percentage continue to rise – year on year. The key takeaway is – our female investors are not taking wildly different approaches to their ISAs, compared to men.”

Average ii ISA millionaire asset split (female)

Asset | ISA Millionaires |

Cash | 5.0% |

Equities | 33.5% |

Funds | 8.8% |

ETP | 3.6% |

Investment trusts | 48.6% |

Other | 0.5% |

Assessing the barriers to investing, for men and women

Another key area ii wanted to look at was around barriers to investing. Are women truly facing greater challenges than men when it comes to confidence in making the right decision or finding the most useful information for them? Our poll data suggests not.

When asked: ‘What would you say is one of the main barriers you face when investing? Just under 9% of male respondents, and just under 9% of female respondents both answered ‘difficulty finding information.’ This helps debunk the idea that women need greater hold-handing or help making the right decision, compared to men.

In fact, when asked the same question – 29% of men said ‘worrying about making the wrong decision’ was one of the main barriers they face, when it comes to their investments.

If female stereotypes used in investment marketing are to be believed, you’d expect a much higher percentage of female respondents saying the same thing. But only 2% more, so 32%, of women said they worry about making the wrong decision in their investments.

Becky O’Connor, Head of Pensions and Savings, said:“We’d like investment marketing targeted at women to sit up and take notice of these findings. It is clear there is an issue here – every investor should feel empowered that they can find investment products that meet their investment objectives – how can this be done if the investment industry is allowing products to be marketed based on inaccurate, and patronising, stereotypes?”

Notes to Editors

*Flash poll was conducted on interactive investor’s website from 25th-28th February – 1,66 total respondents. Of these, 70% of respondents were male, and the remaining 20% were female – which is in line with ii’s wider customer base.

**Private Investor Performance Index: ii customer performances quoted are median values to avoid the influence of outlier performance skewing the data.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.