An outstanding fund in difficult markets

14th November 2022 12:30

by Douglas Chadwick from interactive investor

Saltydog Investor’s latest report that hunts for consistent funds reveals a top healthcare pick.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

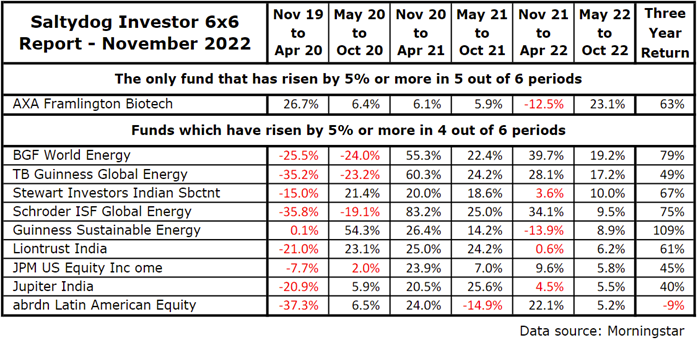

In our latest “6 x 6” analysis, there is only one fund, AXA Framlington Biotech, that has beaten our 5% target in five out of the last six six-month periods.

This fund was launched in 2001 and its investment policy is to “invest in shares of listed companies, principally in the biotechnology, genomic and medical research industry, which the fund manager believes will provide above-average returns. The fund invests in companies of any size which can be based anywhere in the world, albeit the fund tends to be biased towards the US as this is where the majority of biotechnology companies are based”.

Its largest holdings are Regeneron Pharmaceuticals, Biogen, Vertex Pharmaceuticals, Alnylam Pharmaceuticals and Gilead Sciences, all of which are in the US.

We know that the fund can be volatile, but over the years it has often been towards the top end of our tables and was our best performing fund of the year in 2013.

There are another 23 funds that have increased in value four out of six times, but only nine of them also rose in the last six months.

Three years ago, we started providing our Saltydog members with our “6 x 6 Report”. It was a new piece of analysis highlighting the funds that had done consistently well over a three-year period. This is a much longer timescale than we usually consider.

As trend investors we normally focus on the short term. Each week we issue new reports showing how a wide range of funds have performed over the past few weeks and months. We believe that the overall performance of the Investment Association sectors reflects what is happening around the world, and that different sectors will emerge at the top of our tables as the economic conditions change.

It is then relatively straight-forward to identify the leading funds in these sectors. This information is designed to help make sure our members can always be invested in the best-performing funds from the best-performing sectors.

- Saltydog: The top 10 best-performing funds in October

- Saltydog: finding a safe home for our idle cash

- Saltydog: the best and worst performing funds in Q3 2022

Although this system works well for investors who enjoy reviewing their portfolios on a weekly basis, we appreciate that there are a considerable number of people who do not believe that they have the time to take this approach.

That is why we developed this report, where we identify funds which have performed at a consistently high level in each of the six-month periods over the last three years. Ideally, they will have achieved a return of at least 5% in all six periods. We update the report every three months.

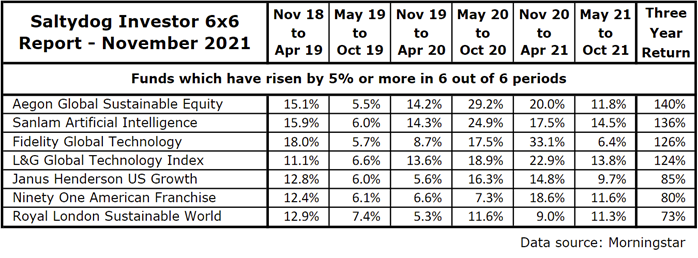

When we ran the report for the first time there were six funds that achieved the target in each of the six periods, but we soon realised it was not as easy as it may have initially appeared. In fact, it was a whole year later when we next found a fund that had achieved the elusive six out of six, the Smith & Williamson (now Sanlam) Global Artificial Intelligence fund.

It seems hard to believe now, but this time last year there were seven funds in this category.

They had all benefited from the rise in the American stock markets and large technology stocks in particular. However, that bubble was about to burst.

Over the last year most funds have decreased in value and so it is probably not surprising that it is hard to find funds that have gone up by 5% every six months. In our last three reports, there have not been any funds that have achieved the target in all six periods, and when we ran the report three months ago there was not even a single fund that had managed to do it five times.

This report is certainly more encouraging than the last, and hopefully another sign that markets may have stopped falling and that a recovery could be around the corner.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.