Richard Beddard: a cataclysm at this budget airline?

20th August 2021 11:08

by Richard Beddard from interactive investor

Our columnist examines the books of AIM-listed budget airline Jet2 in the wake of the pandemic.

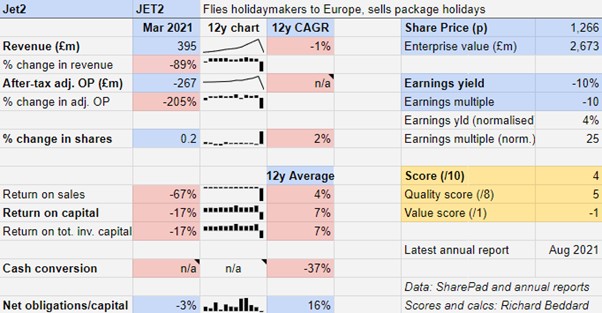

Judging by the numbers, something cataclysmic happened to Jet2 (LSE:JET2) during the year to March 2021.

Something cataclysmic did happen. Jet2’s financial year spans the first year of the pandemic and the leisure airline was largely prevented from flying due to travel restrictions.

The good news is, its competitors were restricted too. The bad news is keeping an airline and package tour operator solvent when it is not flying is expensive.

Jet2 broke my spreadsheet

The numbers are by far the most alarming that I have ever put into my Decision Engine.

In 2020, the company flew nearly 15 million passenger legs, but in 2021 it only flew 1.3 million, often on emptier planes. Revenue at £395 million was 89% lower than the previous year and the company made a huge loss.

Perhaps the most horrible figure of them all is negative cash conversion over the last 12 years.

Jet2, which for most of the period was a strong cash generator, refunded customers, settled derivative contracts that fixed the jet fuel price for flights that never took off, and kept itself operational in 2021 at great cost, while at the same time receiving less cash from new bookings.

More cash flowed out of the company due to its operations than had flowed in during the preceding eleven years.

The company did not go under because just about everybody apart from its customers bailed Jet2 out, which generated an almost equal but opposite inflow.

Furlough reduced the operating outflows as did 546 redundancies and a company-wide pay cut, the company borrowed an additional £286 million and raised £580 million from investors. Since the year end Jet2 has borrowed an additional £150 million, and raised £287 million through the issue of convertible bonds.

- Read more of our content on UK shares here

- Check out our award-winning stocks and shares ISA

- How our 10 Dogs of the Footsie are faring

Jet2 also renegotiated leases, cut investment to a level sufficient to maintain the fleet, and received proceeds from the sale of Fowler-Welch last May.

The company’s road distribution business had long-since become a footnote in its annual reports, but Fowler-Welch’s last contribution was to help prop the mothership up in its time of crisis.

Because of these measures Jet2 believes it has raised enough cash to last until at least July 2022 even under a downside “no-fly” scenario lasting until April 2022 followed by a return to a full flying programme next summer.

However, even if flights to European hotspots are unrestricted by then, fewer people might choose to fly and the company’s projections assume it will not fly as many flights in 2022 and 2023 as it did in 2020, the last pre-pandemic year.

Why hold?

With the numbers looking so bad, the future still uncertain, and the share price surprisingly buoyant you might well ask why hold the shares?

Source: SharePad. Chart shows share price since Jan 2009, and the date and share price of additions and disposals in the Share Sleuth portfolio

A case can be made...

Part of the reason the cash losses this year look so large compared to the gains of previous years is that the company has grown very fast. That has had two effects. Cash flow in recent years has been suppressed by investment in new planes, and the company has a much bigger fleet to support now.

It has achieved this growth entirely under its own steam, through vertical integration, largely owning and operating its own planes and airport slots, at a time when the industry has moved in the opposite direction.

Vertical integration gives it control over the product, which Jet2 has focused on the needs of its customers who are, by and large, families going on holiday to the Mediterranean - often package holidays created by Jet2.

As a relatively new airline and package tour operator, from the outset in the early 2000s it sold most of its tickets directly over the ‘phone and through its website, distinguishing it from competitors like TUI (LSE:TUI) and Thomas Cook, now defunct, who ran costly travel agents.

Jet2’s much bigger rivals were also much less focused. They offered long-haul holidays and cruises as well.

Although Jet2 flies from East Midlands, Stansted and Bristol, its southern bases are late stages in a roll out that originated at Leeds Bradford Airport and radiated outwards offering convenient holidays to underserved northerners.

This allowed Jet2 to grow and develop its unique brand of “Real Package Holidays*” in a less competitive market, almost as though it were in stealth mode.

Vertical integration gives Jet2 the ability to specify numerous parameters like family friendly flight times, large baggage allowances and the ability to check in at the resort and spend less time in airports. This marks it out from online “dynamic packagers” like On The Beach Group (LSE:OTB) and Expedia.

Dynamic packagers usually marry scheduled flights to accommodation sold by wholesalers, so-called bed banks.

What does not kill you makes you stronger

Jet2 entered the pandemic with momentum. It was already the country’s leading package tour operator to the Mediterranean and one of its biggest airlines, yet it had only recently established itself in the south of England.

Its behaviour during the pandemic encourages me to believe it will emerge with its reputation enhanced and, ultimately, with its market share enlarged.

Jet2 moved rapidly to ensure its own solvency, and from a position of financial strength to treat customers well by refunding cancelled flights promptly, stepping up communications, and making it easier for customers to book holidays despite the circumstances, for example by incorporating cancellation and medical cover for Covid-19 in its insurance policies.

Source: Jet2.com. Jet2’s marketing during the pandemic focused on safety and flexibility

- Richard Beddard: can this firm keep delivering magic for investors?

- Read more Richard Beddard articles here

- Shares for future: this small-cap is top of my latest rankings

Jet2 created automated systems to refund customers within 14 days of a flight’s cancellation, and was the only British airline to be recognised by the Civil Aviation Authority for refunding customers promptly. If customers are forced to self isolate, they can reschedule their flight free of charge.

The company launches a new sustainability strategy in September, and I have high hopes that it will embrace perhaps an even bigger challenge, climate change, with the same vigour.

Flying to the Mediterranean not only contributes to global warming, but it is also impacted by severe weather events and environmental damage (like loss of beaches) to the warm coastal regions it flies too.

Scoring Jet2

My Decision Engine was not designed to cope with loss-making companies hemorrhaging cash for the simple reason that I do not expect any of the companies I plug into it to be in this position.

The Decision Engine is a means of comparing profitable, sustainable businesses.

Yet, on one hand we have horrendous numbers and the fact that even as the pandemic recedes, for many people the idea of overseas travel remains a distant prospect.

Even Jet2 can only do so much to mitigate the uncertainty caused both by the development of the disease and governments’ responses to it.

On the other hand and pandemic aside, we have a business I can barely find fault with, one of a handful like Games Workshop (LSE:GAW), Howden Joinery (LSE:HWDN), Next (LSE:NXT) and XP Power (LSE:XPP).

In addition, it is still managed by the directors that had the vision to get it this far.

Does the business make good money? [0]

- Average return on capital is low

- Negative cash flows

+ Highly profitable under ‘normal’ circumstances

What could stop it growing profitably? [1]

- The pandemic has stopped Jet2 operating

? Strong finances should see it through

+ Competitors are less integrated and less focused

How does its strategy address the risks? [2]

+ Vertical integration enables a superior product

+ Innovation makes travel more convenient, fun and safe

+ Service culture drives repeat business

Will we all benefit? [2]

+ Puts customers first

+ Extremely experienced board headed by founder Philip Meeson

+ Takes care of staff

Is the share price low relative to profit? [-1]

- Jet2 made a loss in 2021. If it had earned its average return on capital this year, its enterprise value would be 25 times profit.

A score of 4 out of 9 suggests Jet2 may not be a good long-term investment.

This score puts my holdings in Jet2 in jeopardy. I should consider removing it from the model Share Sleuth portfolio, and shortly thereafter from my own.

However, when I make this decision, I may well play a joker and override the scoring system.

My instinct is to put more emphasis on Jet2’s strategy and culture than the uncertainty affecting all airlines and holiday companies.

~

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

*Real Package Holidays is a registered trademark of Jet2

Richard owns shares in Jet2

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.