Richard Beddard: I like this share that’s near a 10-year low

6th April 2023 14:01

by Richard Beddard from interactive investor

Despite having his confidence rattled a little, our columnist still thinks this company is probably a good but somewhat speculative long-term investment.

Farming is a risky business. In the past, Anpario (LSE:ANP), which supplies animal feed additives, has prospered even when some farmers have not, because of its geographically diverse customers.

The year to December 2022 though was a year in which everything happened almost everywhere all at once, due mostly to the Russian invasion of Ukraine, which led to dramatically higher energy and feed costs.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Farmers cut production rather than lose money, some went out of business, resulting in lower demand for additives. The fixed costs of Anpario’s factory in Worksop and dramatically higher raw material and shipping costs ate into Anpario’s profitability too.

The good news is Anpario got through 2022 profitably, and some of the challenges have receded. Shipping costs are back to where they were before and raw material costs are falling again, although suppliers are only reluctantly and slowly reducing costs.

The bad news is the war is not over, and we now know that geographical diversification helps Anpario, but it is not a panacea.

Alternative to antibiotics

Anpario manufactures natural animal feed additives for poultry, fish, shrimp, livestock and pigeons. Farmers mix them with feed to make farm animals healthier because healthy animals produce more meat.

Their key selling point is they are not antibiotics, which serve a similar purpose but are banned or discouraged as growth promoters in many food producing regions.

Some Anpario additives have natural antibiotic properties. They contain plant extracts like oregano oil, an essential oil.

Anpario’s Acid Based Eubiotics (ABEs) alter the chemistry inside the animal gut to kill off germs like salmonella, and mycotoxin binders bind with poisons produced by moulds growing in feed to prevent them from being digested.

- Share Sleuth: adding to my No 1 ranked share

- 10 dividend growth stocks to boost investment returns

- Stockwatch: could this AIM share be a massive winner?

Natural supplements are also an alternative to nasties like zinc oxide, which is fed to piglets but was recently banned in the EU, often the first territory to bring in new regulations.

The company reports that Orego-Stim, an oregano oil supplement and the company’s best-selling product, improves feed efficiency in chicken meat production by 7%. Studies show hens fed with Orego-Stim lay 2.2% more eggs.

By producing more with less, natural animal feed additives can lower feed costs and the carbon footprints of farms, which are under the spotlight because meat production is one of the biggest contributors to climate change.

The company says cattle fed with Optomega Plus, an omega-3 supplement, produce 7% less methane, a greenhouse gas.

Worst year on record

By some margin, 2022 was Anpario’s worst year since it came into being in its current form after a series of acquisitions culminating in 2012.

The company sold 11% less animal feed by volume, although it recouped most of the revenue through price increases. Those price increases were not sufficient to maintain adjusted profit, which fell 30% due to higher costs and operational inefficiencies due to lower volumes.

Revenue increased in most territories but fell sharply in Europe, which contributed 23% of total revenue compared to 29% in 2021.

The only territory not to suffer lower profit margins was Asia, Anpario’s biggest market, which contributed 38% of revenue. It might have contributed more were it not for Covid lockdowns in China.

In the Americas (28% of revenue), where energy and agricultural commodity prices have been less volatile, Anpario’s profit margin dipped only modestly.

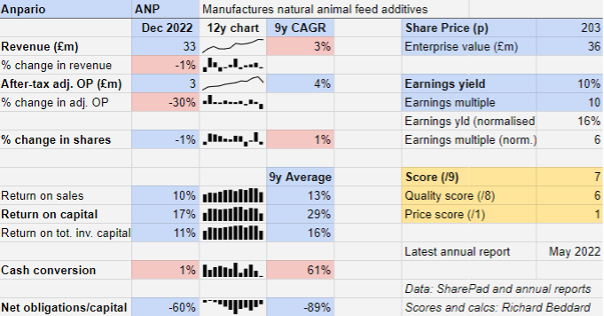

I have chosen a nine-year period to measure Anpario’s growth and average profitability because that takes us back to 2013, the year after its last significant acquisition, Meriden.

Since then, Anpario has largely grown under its own steam, but it does not have much growth to show for it. Profit has grown at a compound annual growth rate (CAGR) of 4%, although the underlying rate of growth is probably higher. Last year the long-term CAGR was 10%.

The results still bear hallmarks of a high-quality business. Return on capital was well below its eight-year average in 2022, but still a healthy 17%, and although cash conversion was just 1%, due to better results in the past Anpario has an extremely strong balance sheet.

Cash conversion deteriorated because the company had more cash tied up in working capital. It stocked up on raw materials to get ahead of price rises and mitigate supply shortages, and payables reduced as the company paid for a solar panel installation and last year’s higher bonuses.

Shortages and shipping delays are easing, which means Anpario expects inventory levels to shrink in 2023.

Capricious industry

Farm profits can easily be turned into losses by the cost of inputs like energy and animal feed, which generally translates into lower demand for feed additives.

Profit is also susceptible to disease outbreaks. The company says culls due to the spread of African Swine Fever in China have all but wiped out small and medium sized farmers, requiring it to re-focus on large integrators.

Culls at poultry farms around the world due to widespread avian influenza will “inevitably affect feed volumes”, the company says. It earns about 60% of revenue from egg and chicken production.

Longer term, changing attitudes due to climate change need to be watched. One of the easiest steps we can take to reduce global warming is to eat less meat, and, with the exception of chicken and eggs, that is happening in Europe. Global meat consumption, though, is expected to increase as wealthier developing countries consume more.

I am not convinced we can rely on these trends. Economic development is threatened by climate change, and there may be a risk that taxes on meat production and consumer choice may one day reduce demand for meat protein, and consequently food additives.

Hard sell

Anpario’s strategy is to develop a diverse range of natural and sustainably sourced additives to promote animal growth, help reduce the carbon footprint of farmers, and make the company less reliant on particular animals and regions.

Orego-Stim Forte, a new feed additive for fish and shrimp farms and the development of Orego-Stim for ruminants may help the company diversify.

Apart from the existential problems of agribusiness, the biggest challenge facing Anpario is being heard. Its additives are sometimes an order of magnitude more expensive than less sophisticated alternatives and antibiotics, which are still widely available, especially in Asia and Africa.

Sometimes Anpario is competing with its own raw materials, like formic acid supplied by BASF, which can be sprayed on feed or, as in Anpario’s ABEs, blended with other ingredients and incorporated in a carrier matrix to ensure the ingredients are released along the full length of the gut.

- Shares for the future: this company’s days in my list might be numbered

- Four AIM shares up over 1,000% since Covid crash

There are also rivals with similar additives, some of them owned by large agribusinesses. Anpario’s product may be better value, but farmers must be sold the science, which is established in trials conducted in collaboration with customers and universities.

Distributors have not always been effective, so over the last decade or so Anpario has opened 10 wholly owned subsidiaries, the biggest of which are in China, where it has 12 sales people, the US, where it has six, and Brazil, where it has four.

This year it is recruiting more sales people and introducing a Customer Relationship Management system. This, it expects, will enable it to foster closer relationships with the large integrators that dominate production.

Acquiring businesses that will give Anpario more products to put through this distribution network is also an ambition, but it is tough going.

Many complementary businesses are family-owned and not for sale. Those that come to market often end up in the hands of private equity buyers with fat wallets. I think Anpario is quite picky too, which is a good thing.

Scoring Anpario

Anpario is managed prudently and, until the chaotic markets of 2022, it had a track record of steady and profitable growth.

But it is a small business which is both diversifying and simultaneously vertically integrating. It is stretching itself deep and wide, which feels like a tall order for a small company.

Does the business make good money? [2]

+ High return on capital

+ Decent profit margin

? Cash conversion

What could stop it growing profitably? [1]

? Capricious markets have halted growth, at least temporarily

? Complex competitive landscape

? Acquisitions hard to come by

How does its strategy address the risks? [1]

+ Taking more control of distribution

? Diversification into ruminants

? Global diversification?

Will we all benefit? [2]

+ Experienced management

+ Focus on health and sustainability

+ Communicates well with shareholders

Is the share price low relative to profit? [1]

+ Yes. A share price of 203p values the enterprise at about £36 million, about 6 times normalised profit. They haven’t been this low since September 2013.

My confidence in Anpario has been rattled a bit, but helped by a very weak share price, a score of 7 out of 9 indicates it probably is a good but somewhat speculative long-term investment.

It is ranked 16 out of 40 stocks in my Decision Engine.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Anpario.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.