Shares for the future: this company’s days in my list might be numbered

31st March 2023 15:03

by Richard Beddard from interactive investor

Plenty of people love this business, but its place in our columnist’s Decision Engine is at risk. Richard explains why and also publishes an update to his 40-strong list of shares.

Before we publish this month’s shares for the future, we need to tackle some unfinished business, relating to a share I am not at all sure is for the future.

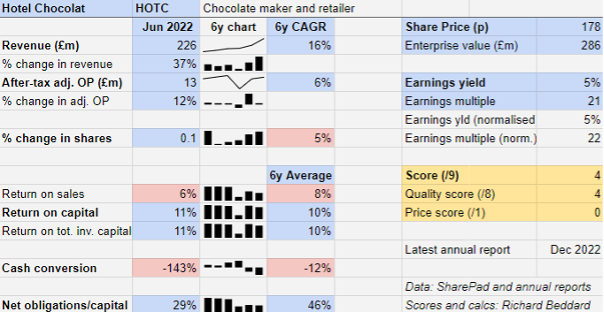

Hotel Chocolat (LSE:HOTC) published its full-year results in December, but I did not re-score the business because it had thrown its international growth strategy into reverse.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

The scoring system used by my Decision Engine (described in detail in the articles linked at the end of this article) evaluates risks and strategies, but this is much more speculative if the strategy changes radically.

Instead of re-scoring Hotel Chocolat, I set every score relating to the quality of the business to one out of two, reflecting my uncertainty. The sum of these scores and the price score would not be sufficiently high to warrant buying the shares, however low the share price fell.

Hotel Chocolat languishes near the bottom of the Decision Engine table, indicating my continuing interest, and intention to score the share properly after a year of the new strategy, when it publishes its annual report in December 2023.

However, maybe Hotel Chocolat will not be in the Decision Engine by then.

Should it stay or should it go?

Taking the numbers at face value, the last full financial year to June 2022, was not a particularly bad one:

Hotel Chocolat was as profitable as usual, but that was only after adding back huge costs deemed exceptional. The biggest by far was the £22 million impairment of a joint venture in Japan stemming from the decision to rein in overseas expansion.

Cash too had flooded out of the business as Hotel Chocolat increased the capacity of its factory in Huntingdon and manufactured more stock, investments originally put in place to fulfil the growth strategy it binned just before the end of the financial year.

Although debt levels at the year-end were lower than usual, the company owed that to shareholders who had stumped up £40 million through a share placing in 2021.

In July 2022, Hotel Chocolat revealed that it had decided to invest no more money in its loss-making operation in the US or its joint venture in Japan. Subsequently it closed the last remaining US store and its US website. It formed a new partnership in Japan after the old one went into administration.

- Four AIM shares up over 1,000% since Covid crash

- 10 UK shares Warren Buffett might put in his ISA in 2023

- These 8 FTSE 100 shares will generate £8bn dividend windfall in April

The company has a 20% stake in the partnership and will receive royalties. It may also find a wholesaler in the US but for the time being the focus is on the UK. Here, Hotel Chocolat will seek to increase profitability through efficiencies and support growth by adding more stores and capacity.

In summary, Hotel Chocolat could no longer afford rapid international expansion, so it has chosen slower but profitable UK growth instead.

2023 is a transitional year in which the company expects revenue and profit to decline, but from 2024 Hotel Chocolat expects growth in revenue and EBITDA, a measure of profit that conveniently excludes the cost of depreciating the heavy investments the company has made, to continue.

Focus is a good thing, but the hand-break turn is also unnerving. Though the pandemic will have delayed progress overseas, the prospect of turning the overseas businesses into profitable ones must have been remote for the company to fold just as the pandemic was easing.

The company dangles the prospect of 50 new UK stores (it has 125) over the next three to five years and a more profitable estate, but its international appeal may be critical for the very long-term.

What is special about Hotel Chocolat?

I am a chocoholic and in theory everything that appealed about Hotel Chocolat when I added it to the Decision Engine in 2021 is still evident, bar rapid international expansion.

A more cacao, less sugar ethos promises a healthier, and once you have got used to it, luxuriant experience.

The company’s Gentle Farming Charter promises a living income and training to its suppliers in Ghana, in return for the adoption of sustainable farming practices that eschew illegal child labour.

It is a vertically integrated business that grows some of its own cacao, manufactures almost all of the chocolate, and sells most of it directly through stores and online.

These qualities make Hotel Chocolat a distinctive brand. No doubt they are a result of the drive and passion of the founders: chief executive Angus Thirwell and development director Peter Harris.

Their combined holdings mean they own more than 50% of the company.

In practice, I am not a big customer of Hotel Chocolat though. It is pricey and I find the shops somewhat intimidating. They are not somewhere I would go to buy chocolate for myself, and the online marketing only tempts me to buy the occasional gift.

The company puts much emphasis on the Velvetiser, a hot chocolate maker that promises “barista-grade drinking chocolate” and earns a barista grade annuity in hot chocolate shaving sales (the company says “unregulated” chocolate pieces can break the machine).

In four years, Hotel Chocolat has sold 888,000 Velvetisers, but it could just be a fad. At home, we shave bars of ethically sourced plain chocolate from supermarkets and froth it up with a milk frother. It is unregulated chocolate, but our frother does not seem bothered.

Last week I removed RM (LSE:RM.) from the Decision Engine and replaced it with YouGov (LSE:YOU). If I find another new share to score, Hotel Chocolat may well be the one that makes way for it.

Decision Engine

I re-score each share in the Decision Engine once a year, after the publication of the annual report.

Since the last update a month ago, Anpario (LSE:ANP), Quartix Technologies (LSE:QTX), RWS Holdings (LSE:RWS) and YouGov have gone through the process. To see how I scored Quartix, RWS and YouGov, please click on the share’s name in the table below. My re-evaluation of Anpario will be published next week.

Porvair (LSE:PRV), XP Power Ltd (LSE:XPP), Bunzl (LSE:BNZL), Judges Scientific (LSE:JDG), Garmin (NYSE:GRMN) and Howden Joinery (LSE:HWDN) have all published annual reports, so I have a busy couple of months re-scoring companies coming up.

Experience tells me shares that score 7 or more out of 9 are probably good value, this month there are 25 (last month there were 24), and shares that score 5 or 6 out of nine are probably fairly priced.

Shares marked with an asterisk score less than 5 out of 6 for Risks, Strategy and Fairness, the three forward looking categories of the five I score. These shares are more speculative.

0 | Company | Description | Score |

1 | Designs recording equipment, loudspeakers, and instruments for musicians | 9 | |

2 | Supplies kitchens to small builders | 9 | |

3 | Manufactures tableware for restaurants and eateries | 8 | |

4 | Manufactures pushbuttons and other components for lifts and ATMs | 8 | |

5 | Translates documents and localises software and content for businesses | 8 | |

6 | Imports and distributes timber and timber products | 8 | |

7 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 8 | |

8 | Online marketplace for motor vehicles | 7 | |

9 | Retails clothes and homewares | 7 | |

10 | Sources, processes and develops flavours esp. for soft drinks | 7 | |

11 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7 | |

12 | Supplies vehicle tracking systems to small fleets and insurers | 7 | |

13 | Manufactures/retails Warhammer models, licences stories/characters | 7 | |

14 | Sells hardware and software to businesses and the public sector | 7 | |

15 | Manufactures natural animal feed additives | 7 | |

16 | Manufactures power adapters for industrial and healthcare equipment | 7 | |

17 | Manufactures sports watches and instrumentation | 7 | |

18 | Manufactures filters and filtration systems for fluids and molten metals | 7 | |

19 | Manufactures military technology, does research and consultancy | 7 | |

20 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7 | |

21 | Whiz bang manufacturer of automated machine tools and robots | 7 | |

22 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7 | |

23 | Manufactures specialist paper, packaging and high-tech materials | 7 | |

24 | Distributor of protective packaging | 7 | |

25 | Manufactures personal care and beauty brands | 7 | |

26 | Distributes essential everyday items consumed by organisations | 6 | |

27 | Acquires and operates small scientific instrument manufacturers | 6 | |

28 | Manufactures power adapters for industrial and healthcare equipment | 6 | |

29 | Sells promotional materials like branded mugs and tee shirts direct | 6 | |

30 | Manufactures vinyl flooring for commercial and public spaces | 6 | |

31 | Publishes books, and digital collections for academics and professionals | 6 | |

32 | Operates tenpin bowling and indoor crazy golf centres | 6 | |

33 | Manufacturer of scientific equipment for industry and academia | 6 | |

34 | Develops and integrates Customer Data Platforms | 6 | |

35 | Online retailer of domestic appliances and TVs | 6 | |

36 | Manufactures disinfectants for simple medical instruments and surfaces | 6 | |

37 | Manuf's rugged computers, battery packs, radios. Distributes electronics | 6 | |

38 | Supplies software and services to the transport industry | 5 | |

39 | Flies holidaymakers to Europe, sells package holidays | 4 | |

40 | Hotel Chocolat* | Chocolate maker and retailer | 4 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in most of the shares in the Decision Engine.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.