Saintly stocks turning the tables on the Sinners

13th June 2014 09:00

by Heather Connon from interactive investor

Socially responsible investing (SRI) - once seen as the province of sandal-wearing eco-warriors - has reached the mainstream.

Many large institutional investors now at the very least avoid those companies with poor governance or social records, while a growing number also actively seek businesses whose products and services are aimed at addressing key issues like climate change or dwindling natural resources.

SRI screening is now used by seven of the world's 10 largest pension funds, according to the London Stock Exchange. That makes financial sense, given the impact that environmental, social and governance disasters can have on company performance.

Those who want to seek out either sinful or saintly stocks can find collective investment options by reading: Six funds with (or without) an ethical bent.

Poor SRI policies

Poor SRI policies

BP's share price has still not fully recovered from the impact of the Deepwater Horizon oil spill in the Gulf of Mexico four years ago; provisions for mis-selling payment protection insurance policies have already cost British banks £10 billion; accusations of corruption in China are likely to have a significant impact on the prospects for business there.

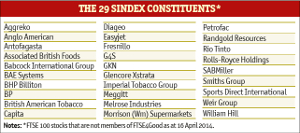

There are now signs that growing investor awareness of the real economic costs of poor SRI policies is being reflected in stock market performance. Money Observer has been calculating its own Sindex of the biggest 30 companies spurned by SRI investors (in most cases because they are involved in arms, tobacco, oil or mining) for almost a decade, and for much of that time the corporate Sinners have trounced the Saints.

For the second year running, however, the Saints have gained ground, and they remain well ahead of the Sinners over one, three and five years, although the Sinners retain the upper hand over the past decade.

But that long-term advantage may not last much longer. The Saints' long-term performance is handicapped by the dismal performance of the banks since the financial crash in 2007: the banking sector as a whole has lost almost two-thirds of its value since the crisis erupted and stands at around half of where it was a decade ago, while the wider FTSE 100 (UKX) index is up by a third over that period.

As bank shares gradually recover - and, more importantly, as we get closer to the 10th anniversary of the crash - the Saints could finally overtake the Sinners over the long term too.

Of course, many of us would consider banks to be among the worst corporate sinners: not only did their reckless behaviour precipitate the financial crisis and thus cause the global financial turmoil that followed in its wake, but they show little sign of cleaning up their act. And there is the traditional complaint of ethical investors that banks are bank-rolling gambling, weapons, alcohol production and other such vices.

A Second sindex

This year, therefore, we have constructed a second Sindex that includes the banks - which has a significant impact on the performance of the two indices. When the banks are included, the Sindex lags the Saints over all four time periods, albeit that the long-term lead is narrow.

The impact of the banks on the performance of the indices underlines one of the key issues with ethical investment: one man's virtue is another man's vice. We have historically based our Saints and Sinners indices on the FTSE4Good ethical series, which has been run by the FTSE Group since 2001.

This is a fairly inclusive index - indeed, FTSE itself is reacting to institutional investors' increasing interest in ethical issues with plans to fine tune the indices to cover 14 major themes, instead of the current six.

David Harris, director of ESG (environmental, social and governance) at FTSE Group, says the aim is both to encourage more fund managers to consider ESG criteria as part of their investment policies, and to help the large number that already do so to select holdings according to those companies' individual policies.

It does, however, make FTSE4Good less useful in the context of the Sindex. We therefore decided to apply one further test of the merits of Sinful investing by constructing an index made up of the sectors traditionally excluded by ethical investors - tobacco, defence, gambling and mining.

Mixed performance

Here, the performance was much more mixed, with the traditional Sinners lagging the FTSE 100 index over one and three years but beating it over five and 10 - indeed, the index performed almost twice as well as the FTSE 100 as a whole over the past decade.

That owes much to the stellar performance of tobacco giants and : the tobacco sector has almost quadrupled over the decade, while the FTSE 100 as a whole has made little progress.

Miners and defence companies have also made substantial gains over the past 10 years, although miners, in particular, have had a more difficult time recently, which helps explain why the FTSE 100 did better than the Sinners over one and three years.

Variations in Sinful performance are reflected in the contrasting performances of ethical funds. Over the past decade the top performer - , which avoids any company whose products or services harm people, animals, society or the environment - made a total return of almost 180%.

The worst performer, by contrast - Scottish Widows Ethical, which seeks out companies with good ethical practices - returned less than 40% over the decade. Over one, three and five years, the Kames fund has remained towards the top of the performance charts and, while the Scottish Widows fund has improved, it has remained in the middle of the table.

Diversification is a major problem for ethical investors"Patrick Connolly

The type of companies favoured by ethical funds also varies widely. The top holding in Scottish Widows Ethical is , while blue chips , , and are in the top 10; Vodafone is in Kames' top 10 as well, but its largest holding is , with builders merchant and stockbroker also among the top 10 holdings.

That reflects the fact that its policies mean it is likely to find more opportunities among small and mid caps than the FTSE 100. - an indexed fund - has among its top 10, which could raise environmental eyebrows on the grounds of the impact of mining, not to mention social and governance issues.

But the ethical sector also includes a growing number of funds that invest in companies for their positive environmental, social or governance attributes. These include - one of the oldest funds - where the top four holdings are , , and : none of them household names. Jupiter Ecology's performance has been rather erratic; while it is first quartile over the past year, over three years it is third quartile.

Disparity in performance

The great disparity in both the performance and the objectives of ethical funds may be one of the reasons that, for retail investors, SRI investment has never really taken off. The latest statistics from the IMA show that ethical funds were worth £9.2 billion, or just 1.2% of total funds under management. To put that into context, - which has just been passed from Neil Woodford to Mark Barnett - is worth £13.5 billion alone.

Patrick Connolly, head of financial planning at Chase de Vere, says that, while ethical investment may have periods of popularity, he does not expect it to ever become a mainstream strategy. Apart from the lack of consistency about what constitutes ethical or SRI investments, he adds: "Diversification is a major problem for ethical investors, which is why ethical portfolios can be volatile."

Clare Brook, head of business development at WHEB, says that the ethical badge is now redundant as it "implies you can separate moral issues from sound financial analysis" - something she firmly believes is impossible. She prefers to talk about the ESG issues informing the firm's investment strategy.

She believes there is concrete proof that such an approach works: WHEB has an investable universe of more than 1,000 companies across the world that pass its screening tests for having a positive contribution to our key challenges such as climate change, a growing and ageing population and the scarcity of resources.

Over the past five years, these companies have grown their sales by almost 10%, compared with around 7% for the MSCI World index, and their earnings by more than 12%, compared with just over 10% for the index.

She also points to studies from organisations such as the Harvard Business School and Deutsche Bank, which indicate that companies with good ESG strategies perform better.

"We believe that ESG analysis should be built into the investment processes of every serious investor and into the corporate strategy of every company that cares about shareholder value. ESG best-in-class focused funds should be able to capture superior risk-adjusted returns if well executed."

Brook says it is not clear whether good ESG policies are a cause of outperformance in themselves, or whether it is simply that good managers are better at dealing with them. 'A company on top of all its potential liabilities, whether environmental, social or political, is likely to do better than one that failed to spot them.'

The more this becomes accepted, the more ESG screening will be built into the day-to-day analysis of fund management. That may eventually mean that investors will no longer have to buy a separate ethical fund but instead choose a fund manager whose ESG screening fits with their own. That is still, however, some way off.