Seeking yield? Consider these areas of the bond market

A Kepler analyst assesses the state of the fixed-income sphere from cash and high yield, to investment trust options.

22nd August 2025 14:02

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

At first glance, bonds might seem to be an attractive place to be allocating at this point in time. Rates are high, so yields are high, while they are expected to fall, which should boost prices. However, there are a number of factors which need to be considered and which make the picture more complex.

Here, we assess the state of fixed-income markets from cash through to high yield, and look at the options in the investment trust sector.

Cash or gilts?

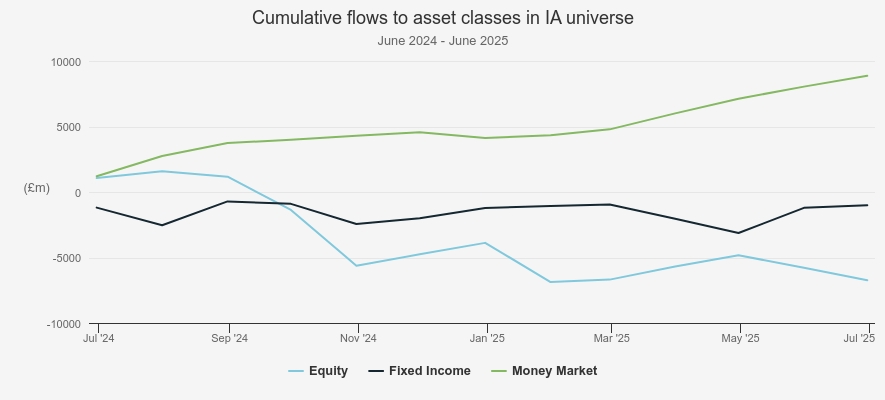

UK retail investors still seem wedded to cash judging by fund flow data. Perhaps there are some tentative signs that a rotation into bonds might be starting, if you squint at the chart below really hard.

Inflows into money market funds have slowed in recent months, although they remain positive, while the last two reported data points show fixed income funds seeing inflows. Investors continue to sell equities hand over fist.

UK retail fund flows

Source: Investment Association.

We find it surprising that demand for cash remains so strong in the light of falling rates – the base rate has fallen from 5.25% last July to 4%. It has to be due to risk aversion in our view, with the UK struggling under a weight of negativity about the outlook for its own economy and stock market, and perhaps global markets too in the light of the recent round of polite and civilised tariff renegotiations.

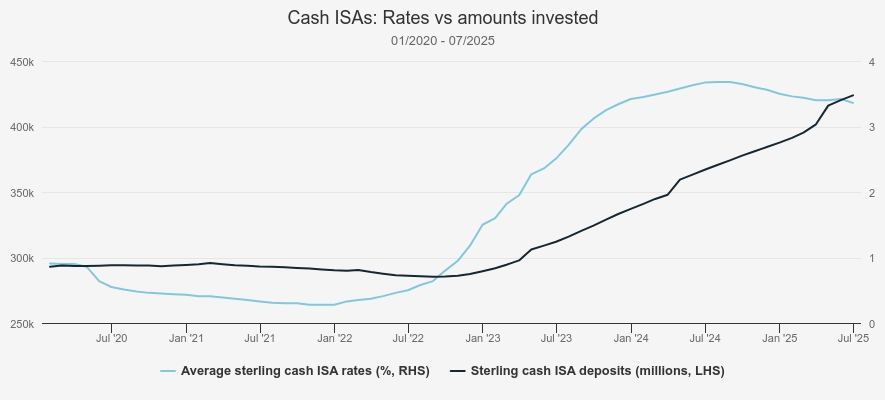

Another data point is the amount held in cash ISAs, which has continued to show strong growth as the chart below indicates, even after the rates available have started to fall.

UK Cash ISAs

Source: Bank of England

Investors have really missed out as a result. Over the past year, rate cuts have helped the FTSE All-Share Index deliver 14.6% (to 12 August 2025).

Taking a little less risk in sterling high yield would have made 11.3% just tracking the index. The more defensive options in fixed income haven’t paid off as well; the even less risky investment grade corporate bond index has delivered just 3.75%, which is only marginally higher than the average cash ISA rate one year ago.

Investors in a gilt index tracker would have lost 1.26%. This hasn’t stopped retail investors piling in though: Hargreaves Lansdown reported demand for UK gilts was at a four-year high in January and then beat it by 63% in February. Investors were sucked in by higher yields on offer on new issuance, as gilt yields jumped.

While it’s true that nominal yields have risen on gilts, it’s worth considering the impact of inflation on this return, as higher expected inflation is a key driver of higher yields on government bonds.

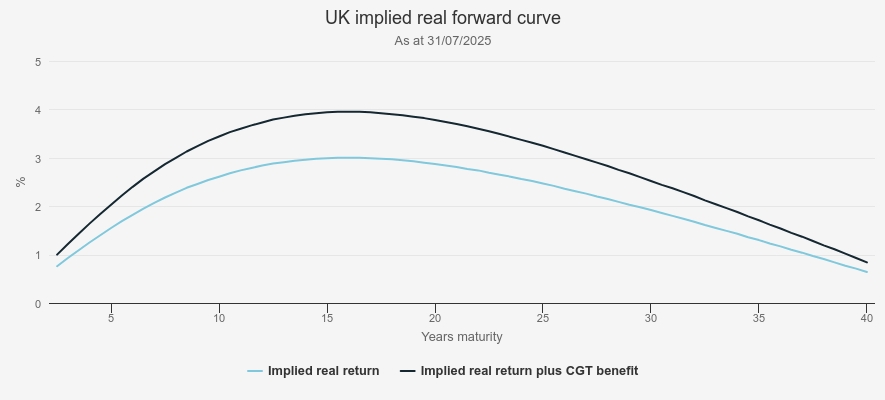

The blue line in the chart below shows the expected real return on UK government bonds over different holding periods, as of 31 July 2025. It shows that investing in a five-year government bond would be expected to deliver 1.55% per year after inflation. A bond with a seven-year maturity is expected to deliver 2.1% a year after inflation, while locking up your cash for 10 years should deliver 2.6% per annum after the impact of inflation.

We know a lot of retail investors like gilts because CGT isn’t payable on gains. It seems to us this should only really be relevant to a tiny number of investors who are likely to max out their own ISAs as well as any spouse’s ISAs, and indeed Junior ISAs for their children in some circumstances, and who couldn’t usefully use their own £60,000 pension allowance or top up their partner’s.

Apparently, plenty of people either fall into this category or prefer gilts for some other reason, and so we show the implied return assuming CGT is ‘saved’, which is of course around 31% higher in each case.

At the key rates given above, implied real returns rise to 2%, 2.7% and 3.4% respectively. Even these returns are nothing to write home about really. Perhaps cash and gilts have a role to play as emergency funds, but from an investment point of view they don’t look very attractive. On the other hand, there is the defensiveness and security of lending to the UK state to consider.

Prospective real return from gilts

Source: BoE

In fact, we suggest investors should be considering that security especially carefully at the current moment, and especially sceptically. UK government finances are on an alarming path, with the government seemingly unable to correct course. Despite a large majority, it was unable to pass some relatively modest welfare reforms, which would have slowed the pace of the growth in government spending on welfare (not even reducing it).

We are all braced for tax rises as a result, but this is going to further throttle economic growth; we may be able to definitively answer the question where the Laffer curve bends in the near future. The current party most likely to win the next election has made some big spending promises too, and how they expect to fund those remains to be seen. Some well-regarded economic commentators, and some fund managers we talk to, are murmuring about the possibility of an IMF bailout in the years to come.

That is an extreme scenario, but we shouldn’t discount it. In that eventuality, there would be huge volatility in all sterling assets, although the risk has to be highest for holders of government debt. Perhaps more likely is that the public finances remain stretched and solvency remains a lurking danger.

In that case, we would expect UK rates to stay high and of course there is the possibility they have to be hiked to encourage capital to stay in the country, even if inflation falls. This would imply that investors shouldn’t expect duration to work in their favour in the coming years, and capital gains from bonds are less likely.

One of the threats to the UK’s solvency and to returns in bonds is inflation. If inflation persists in being higher than desired, then rates will have to stay high or be hiked, and then gilt holders will make losses. It would further erode the real returns from the low numbers given above too. Additionally, higher borrowing costs will bring down economic activity and reduce the tax base, sub-optimal when the fiscal position is getting dicey.

The Bank of England’s monetary policy committee expects inflation to jump again later this year as a result of the government’s taxation on jobs. It expects inflation to then fall back to 2% – but, of course it does. It is the job of the monetary policy committee to keep inflation at around 2%, and they have the power to change interest rates in order to affect this. How could they not forecast inflation falling towards the target?

We think that market pricing being more or less in line with this forecast over the longer run just reflects the market’s belief that the authorities will remain in control. We suggest this belief and trust in the UK’s solvency is very much a ‘gradually, then suddenly’ issue, and investors should treat gilts with extra caution, particularly in light of the fact that long-term gilt yields have risen since the last rate cut.

Higher-yielding debt

A low real return lending to a country which seems to be on a path to fiscal ruin doesn’t seem very attractive to us, but what about the higher-yielding debt markets? The sterling high yield market certainly seems to have an attractive yield at the moment, the FTSE Sterling High Yield Bond Index yielding 8.9% at the end of July.

However, it isn’t as appealing as it first might seem. Whereas in the equity markets the largest weights are in the companies that have delivered the best share price returns, in the debt markets they are in those companies that are the most indebted. This means that at present, the debt of Thames Water makes up as much as 9% of the sterling high yield index. Thames Water has defaulted on debt payments already and remains in serious trouble, with the prospect of nationalisation, which could mean anything for its lenders. As a result, the yield-to-maturity (YTM) on its debt is currently 11.8%.

The other largest borrowers are Morrisons, the debt of which yields 11.1% on average, and Asda, paying 9.4%. Meanwhile, Stonegate Pubs, which owns Slug and Lettuce among other chains, is also drowning in debt, the average YTM of which is 10.2%. Together these four troubled borrowers with their exorbitant yields are responsible for 24% of the debt in the market – hardly Nvidia, Apple, Microsoft and Meta.

Avoiding this sort of borrower explains why the yields on offer in the sterling high-yield funds are so much lower. In the IA Sterling High Yield sector, the average yield is 6.2%, while only five of the 31 funds yield over 7%. If we take this 7% and assume a maturity of four years as a reasonable estimate of the average for a high yield portfolio, this would imply a real return of 5% a year, based on current market expectations for four-year average inflation implied by the gilt market. This looks much more interesting.

It’s worth bearing in mind that the outlook for rates will affect the outlook for the prices of high-yield bonds, but the typical duration is much lower, usually around three rather than the nine of the gilts index. (As a reminder, this means that a 1% parallel shift down in the yield curve would see a 3% rise in the price of the portfolio, and vice versa.) However, it is true that with gilt rates relatively high, the extra compensation for taking corporate credit risk (the spread) isn’t that high at the moment by historical standards.

This means that should the UK economy worsen, there is the chance that companies might have to pay more to borrow which would lead to price declines on bond portfolios. Of course, these price declines would only lead to realised losses if the bonds were bought above par, otherwise the par value would be returned on maturity. For income-seeking investors this shouldn’t be too much of a concern. Meanwhile, good active management should be able to avoid defaults, which alone bring the permanent loss of capital, albeit at the expense of some yield.

For investors looking to take advantage of the high yields on offer in the market, Invesco Bond Income Plus Ord (LSE:BIPS)offers this along with the advantages of the closed-ended structure. While open-ended bond funds will see their income rise and fall over time, the board of BIPS is able to build up revenue reserves and generate a consistent income profile, while setting an income policy for the year ahead which tells investors what they can expect.

The dividends have risen steadily in recent years, and the current year payout equates to a yield of 7.1%, even as the shares trade on a 2% premium. A modest amount of gearing helps boost the yield, with net gearing 5.6% as of the end of July.

An even higher yield is on offer from CQS New City High Yield Ord (LSE:NCYF), which has punchier gearing of 11%. This and more aggressive style allow the trust to offer a yield of 8.9%. There’s definitely more risk in the portfolio to achieve this, with the manager, Ian Francis, currently having both Stonegate Pubs and Asda in his top 10 positions. The fund will also own some convertible bonds and preference shares, which can yield more but also bring different risks.

Other options in the closed-ended funds sector

We think the outlook for the UK economy and the narrowness of credit spreads are risks to be borne in mind with traditional high yield. The closed-ended structure allows managers to offer some more sophisticated investment strategies, which are hard to access elsewhere and which offer a different risk profile.

A number of funds manage to offer high yields without taking on the credit risk of the traditional high yield funds, largely by taking the risk of investing in illiquid and complex private debt. It’s reasonable for some investors to be put off by the complexity of these investment strategies, which are indeed harder to understand and harder to track. But for those who feel capable of doing the research and keeping on top of the funds, dialing down the credit risk and dipping into the more institutional strategies offers a way to generate some exceptionally attractive yields with a risk profile that might be more attractive in the light of tight credit spreads.

M&G Credit Income Investment Ord (LSE:MGCI), for example, is a bond fund with a very wide remit, manager Adam English is able to invest across the public and private debt markets with a relative value approach. Adam draws on the research of the huge fixed-income teams at M&G, which serve a massive institutional pension and insurance business, covering all areas of the debt markets and doing bespoke deals for borrowers.

The portfolio is majority floating rate, and so rate cuts would see the income earned fall. But the trust targets a dividend of 4% of NAV over the base rate, calculated quarterly, and so it should continue to offer a handsome extra return. The historic yield is currently 8.1%, based on the last quarterly dividend. This yield is generated without gearing, and with 79% of the portfolio invested in debt the M&G analysts consider investment grade quality. The extra yield is compensation for the fact that a lot of the debt can’t be traded on the open market and requires a lot of work to underwrite. For full details of how this works, see our latest note on the trust.

MGCI’s private investments include asset-backed securities and other packaged investments, but Sequoia Economic Infrastructure Inc Ord (LSE:SEQI)has a portfolio made up solely of loans made on a one-to-one basis or with a small group of institutional lenders to individual businesses. At the last count there were 60 individual investments, which had a YTM of 9.9%, allowing the trust to have a historic dividend yield of 8.6%. SEQI’s discount has narrowed markedly in recent months, but is still attractively wide at 12.7%, which offers another route to investment gains.

The other three trusts we have discussed are all at premiums and issuing shares. Other features to bear in mind are the narrower remit of the trust which invests solely in economic infrastructure themes. These are reasonably diverse though, encompassing power networks, data centres, renewables and transport networks among other industries. Given the more concentrated portfolio, there is more stock-specific risk to bear in mind, although as we discuss in our notes on the trust, the team have a good record of working out any problematic loans and generating high recovery rates.

SEQI does assess its portfolio as being high yield on average, but it has a defensive sectoral tilt and a much higher yield than the active bond funds. Like MGCI, this is achieved without gearing (both have facilities for liquidity management, but don’t borrow to gear up investments).

Conclusion

In our view, the lower-risk areas of the bond market look a little riskier than normal. The real yields are likely to be very low in practice, with a decent chance that inflation resurges and reduces these returns even further. Gilts look less of a defensive asset than they have for many years thanks to the poor state of the public finances.

For those wanting to get an income, the high-yielding active funds do offer a decent pick-up over inflation, although credit spreads aren’t wide and could be vulnerable if the economy deteriorates.

We think active management is particularly important in this sector, and particularly so at the present moment given the poor economic outlook which could bring the solvency of some businesses into question.

Given the state of spreads and the gilt market, we think yield-seeking investors might consider allocating to the trusts that dip into the private debt markets. These latter take some of the credit risk out of the equation, although the liquidity and company-specific risks they bring have to be carefully considered. We think that the high yields they offer are particularly attractive given their more diversified risk profile and lack of gearing.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.