Share Sleuth: why valuation alone is not enough to trigger a ‘sale’

Richard Beddard shares his thought process before hitting the sell button and calls time on an investment

3rd September 2020 14:35

by Richard Beddard from interactive investor

Richard Beddard explains his thought process ahead of hitting the sell button and calls time on one of his worst investments.

It takes considerable effort to gain enough confidence in a business to commit to it, and once I am confident, my intention is to buy and hold the shares forever. Only two things can really change that.

Too much of a bad thing

I may decide I was wrong about the business when I last evaluated it. Since I score shares before adding them to the model Share Sleuth portfolio and then re-score them once a year as soon as possible after the annual report is published, it is easy to see if I have lost confidence.

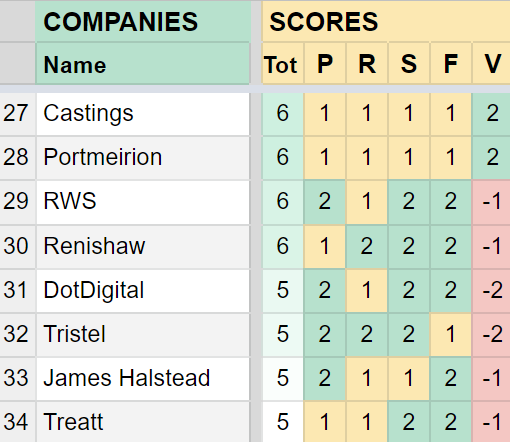

The four criteria that relate to the business, as opposed to its valuation, are profitability, risks, strategy and fairness. A company receives a score of zero, one, or two for each criterion. Zero means that I have very little confidence, and two means that I am confident. One is somewhere in between.

If a company scores one across the board, such as 27th-ranked Castings (LSE:CGS) and 28th-ranked Portmeirion (LSE:PMP), it betrays ambivalence.

Castings and Portmeirion are ranked 27th and 28th out of the 34 shares in my Decision Engine, all the shares I follow closely. The table shows how I score each share in terms of P (Profitability), R (Risks), S (Strategy), F (Fairness) and V (Value). For more on the Decision Engine see last week’s update.

Castings, a manufacturer of components for large commercial vehicles in the main, and Portmeirion, a designer and manufacturer of tableware and home fragrances, are troubling me.

For many years, I have characterised Castings (reviewed in July) as a stalwart because its return on capital is more than adequate. Castings should be able to reinvest profitably, yet profit today is roughly the same as it was before the Great Financial Crisis in 2008.

Portmeirion (reviewed in June) has also stumbled in pursuit of growth. The company owns popular tableware brands in the UK and the US, but it has struggled to achieve reliable growth in overseas markets where it relies more heavily on distributors. This raises questions about Portmeirion’s strategy because it has been, to an extent, predicated on international expansion.

Castings and Portmeirion are not the lowest-scoring shares in the table because the shares are cheap, but the Share Sleuth portfolio is supposed to be a club of companies that I rely on through thick and thin, and I am not sure they make the grade.

In contrast, I am confident in some aspects of all the other bottom-of-the table businesses. The Share Sleuth portfolio holds three of them: Renishaw (LSE:RSW) (ranked 30), Tristel (LSE:TSTL) (32) and Treatt (LSE:TET) (34).

The scores of these businesses penalise their relatively high valuations, but if I were to dispose of every share in a good business when it traded at a high valuation I would not be a long-term investor.

I have, though, reduced all three holdings in the past and I would again, but valuation alone is not enough to trigger a “sale”.

Too much of a good thing

To trigger a sale, the portfolio’s holding in a share must also have grown too big. Then I reduce the holding to a more reasonable size.

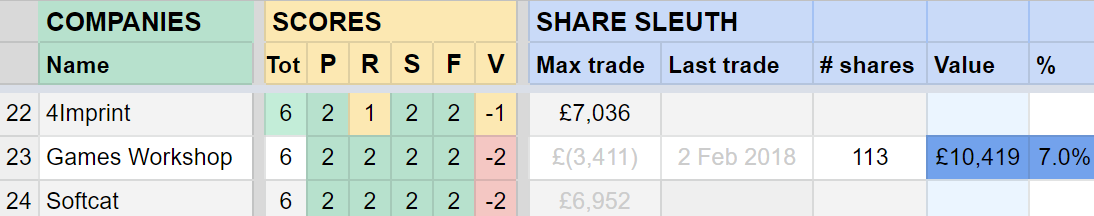

The company closest to breaking through this threshold at the moment has done so twice before. It is Games Workshop (LSE:GAW), ranked 23:

The arithmetic is in the blue columns in my spreadsheet.

The “ideal” size of a holding as a percentage of the total value of the portfolio is 75% of its score, so a share with a score of 6 would ideally constitute 4.5% of the portfolio.

But share prices change every day and it would be impractical and expensive to keep a holding at its ideal size. I trade a share only if it exceeds its ideal size by my minimum trade size, which is 2.5% of the total value of the portfolio.

Then I can reduce it down to its ideal size.

The scores are rounded in the table so the numbers do not quite work out as per my illustration, but you can see Games Workshop is close to the limit.

The ideal size (4.5%), plus the minimum trade size (2.5%), is 7%, which is the size of Share Sleuth’s Games Workshop holding in the right column.

Part of the portfolio’s holding in Games Workshop is also, therefore, in jeopardy.

Why all the talk about selling?

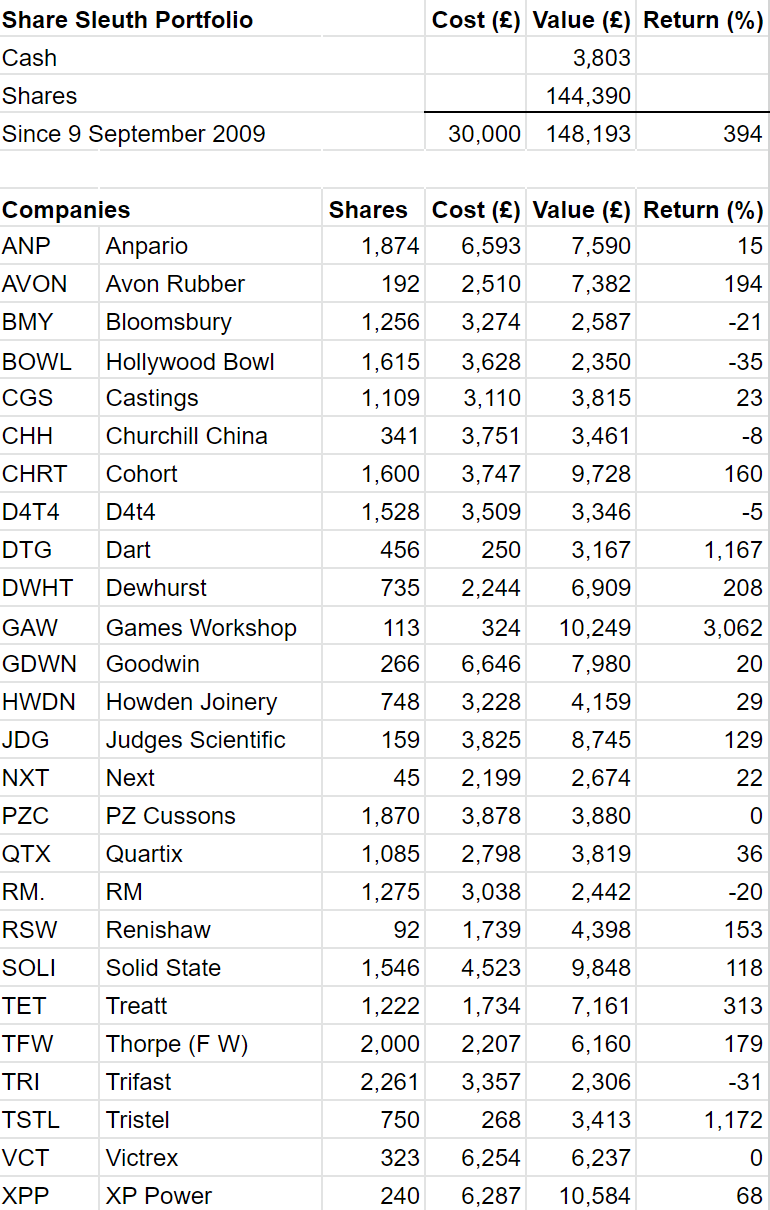

This month’s Share Sleuth column is all about selling because I like to keep enough cash on hand to fund a purchase, and prior to this month’s transaction the portfolio did not have enough cash to put into shares.

The minimum trade size means a new holding, or a top-up to an existing one, would have cost £3,727, 2.5% of the total value of the portfolio. Even after dividends in August from Dewhurst (LSE:DWHT), Castings (LSE:CGS) and Treatt (LSE:TET), the portfolio had only £2,500 in cash.

Reluctantly, because it feels like I am giving up one of my babies, I have decided to remove Portmeirion.

On 2 September, I liquidated the portfolio’s entire holding of 349 shares at a share price of £3.76. The transaction netted the portfolio £1,302 after charging £10 in lieu of broker fees.

Portmeirion is one of my worst investments. I added the shares little more than three years ago in May 2017 and the holding declined 50% in value despite the beneficial effect of dividends.

Table notes:

There were no new additions and one disposal (Portmeirion) in the month

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

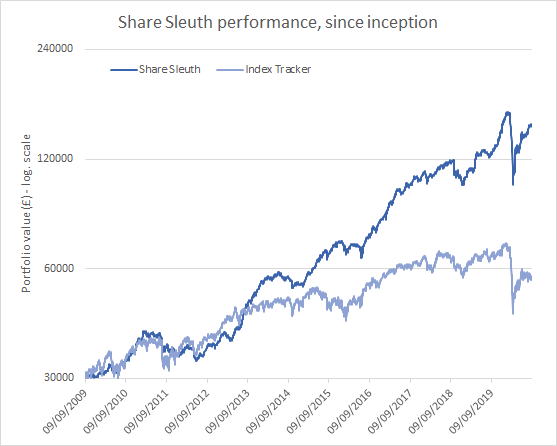

£30,000 invested on 9 September 2009 would be worth £148,193 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £55,901 today

Objective: To beat the index tracker handsomely over five-year period

Source: SharePad, 2 Sep 2019

Share Sleuth’s cash balance is now £3,802, just sufficient to fund a purchase should I wish to make one.

For very different reasons, Castings and Games Workshop remain on the naughty step.

Richard owns shares in all of the companies in the Share Sleuth portfolio, and Portmeirion.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.