Stock market challenge: which share do you prefer?

The share price gap between these arch rivals has narrowed following a recent dramatic rise at the laggard, but which one does analyst Rodney Hobson prefer. Find out here.

15th October 2025 07:38

by Rodney Hobson from interactive investor

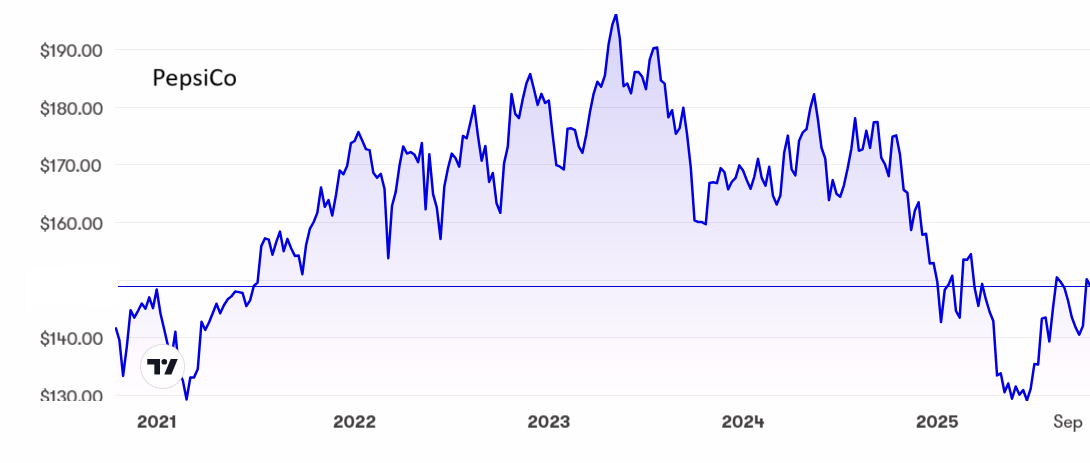

Another quarter, another disappointment from snack and soft drinks group PepsiCo Inc (NASDAQ:PEP), yet the shares promptly rose. However, they could well be bumping up against a ceiling and at the moment larger rival Coca-Cola Co (NYSE:KO) looks to be the real thing for investors as well as cola drinkers.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

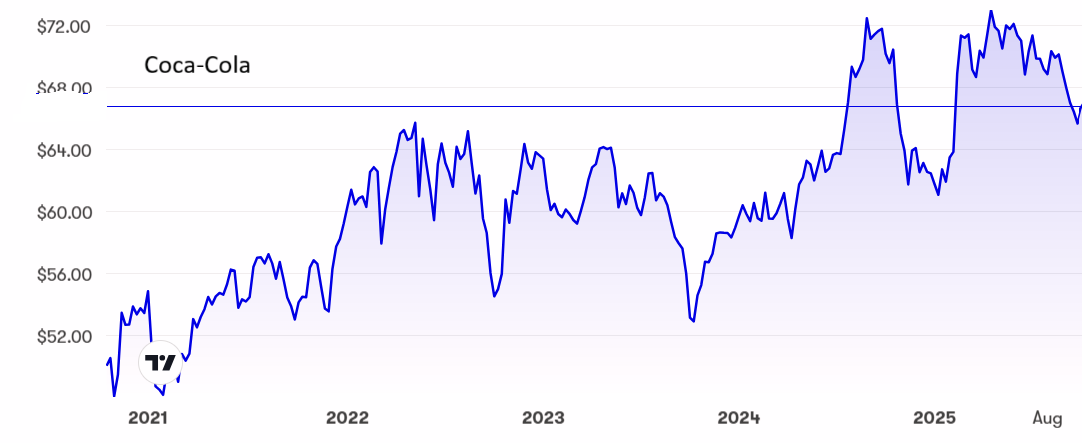

Coca-Cola has admittedly struggled to keep volumes growing as US President Donald Trump’s on-off tariff diplomacy has upset supply chains and stoked anti-American sentiment. However, as ii’s Keith Bowman reported in his expert analysis, it has managed to keep revenue and profits moving upwards and actually pushed its forecast for profits growth higher at the halfway stage.

Source: interactive investor. Past performance is not a guide to future performance.

Revenue has also risen at Pepsi but there has been a repeat of the fall in profits seen earlier in the year. Net income for the three months to 6 September fell from $2.93 billion to $2.0 billion. While this was partly because of a one-off £133 million impairment charge, mainly at its Rockstar energy drink brand which it acquired five years ago, there would still have been a decline in profits even without the one-off charge. Earnings per shares (EPS) slipped from $2.13 to $1.90.

Despite what the company described as resilient international operations, a stronger momentum for beverages in North America and the benefits of restructuring the portfolio, growth in revenue was comparatively modest at 2.6% to $23.9 billion. The fact that this was better than analysts expected reflects the lowly hopes for Pepsi at the moment.

Clearly new chief financial officer Steve Schmitt has his work cut out as chair and chief executive Ramon Laguarta talks of accelerating growth, getting a better grip on controlling costs and adjusting the pricing structure. Financial guidance for revenue growth of less than 5% – and probably quite a bit lower – for the full year has been confirmed.

- Stockwatch: is recent bolt of panic a warning sign?

- Rethinking exposure to US? The domestic shares the pros are buying

Downbeat hopes that EPS will be flat now look optimistic if anything, despite forecasts that the headwinds from foreign currency changes will be only 0.5% this year rather than 1.5% as feared earlier when the US dollar was stronger.

Schmitt moves next month from a similar role at retailer Walmart Inc, where he has gathered much needed experience, and will be helped by Pepsi’s current finance chief Jamie Caulfield in a smooth handover. He does so after figures for the nine months to early September showed how much there is to do, with net revenue rising less than 1% and net income slumping nearly 30% to $5.7 billion.

Clearly there must be a big improvement in the final quarter to early December if the guidance is to be fulfilled.

Source: interactive investor. Past performance is not a guide to future performance.

Pepsi shares have been as low as $130 in June, the same level they were more than four years ago, and there seems to be a solid ceiling just over $150, making capital gains look unlikely. At the current level just over $150 the price/earnings (PE) ratio is still quite hefty at 28.5, although there is the consolation of a 3.7% yield, which is higher than for most American stocks, and the dividend does look secure.

Coca-Cola shares have slipped back from a peak of $74 in April but are building a floor around $66, where the PE is cheaper than Pepsi’s at 23.8 but the yield is a little lower at 3%.

- ii view: JP Morgan benefits from new tech boom

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Hobson’s choice: I have long preferred Coca-Cola to Pepsi and that stance remains. The more lowly PE rating at Coca-Cola is entirely unjustified and the shares remain a buy as the downside looks strictly limited. In light of the past two quarters’ results Pepsi is only a hold.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.