Stockwatch: international growth could boost this cheap share

There’s more for this company to achieve overseas, believes analyst Edmond Jackson who also wonders if the undervalued sector might replicate the stellar recovery of bank stocks.

9th December 2025 13:21

by Edmond Jackson from interactive investor

“Very subdued” UK consumer confidence cited by the CEO of Frasers Group (LSE:FRAS) in its latest interims is notable following the Budget. Similarly, as in my last article, I considered demand for credit as reflected by results from Paragon Banking Group (LSE:PAG).

Subsequently, Frasers’ shares are down nearly 10% to 655p, where if consensus is fair then they are on 6.6x normalised earnings per share (EPS) to end-April 2026 and 6.2x to April 2027, for a remarkably attractive PEG (the price/earnings (PE) ratio divided by expected EPS growth rate) of 0.4x.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

So, is an implied recovery to earnings power that was achieved in the April 2023 year too good to be true, or is international growth driving this at Frasers and currently being overlooked?

I would consider how Frasers’ earnings can vary according to financial derivatives and property trading included “above the line”. This relates to a wheeler-dealer aspect of management by founder Mike Ashley who holds 73.3% of Frasers’ equity, and his son-in-law CEO with a background in property. There can be something of a discount in the shares for the maverick Ashley factor, but I would respect his retailing nous, especially in challenged times.

An interesting long-term precedent for the shares

Recalling the aftermath of the 2008 crisis and around the 2011 eurozone debt crisis, the group previously named Sports Direct did very well. From 35p in late 2008, its shares were a parabolic bull market over 800p by mid-2014, significantly because the group’s marketing mix was right for the times.

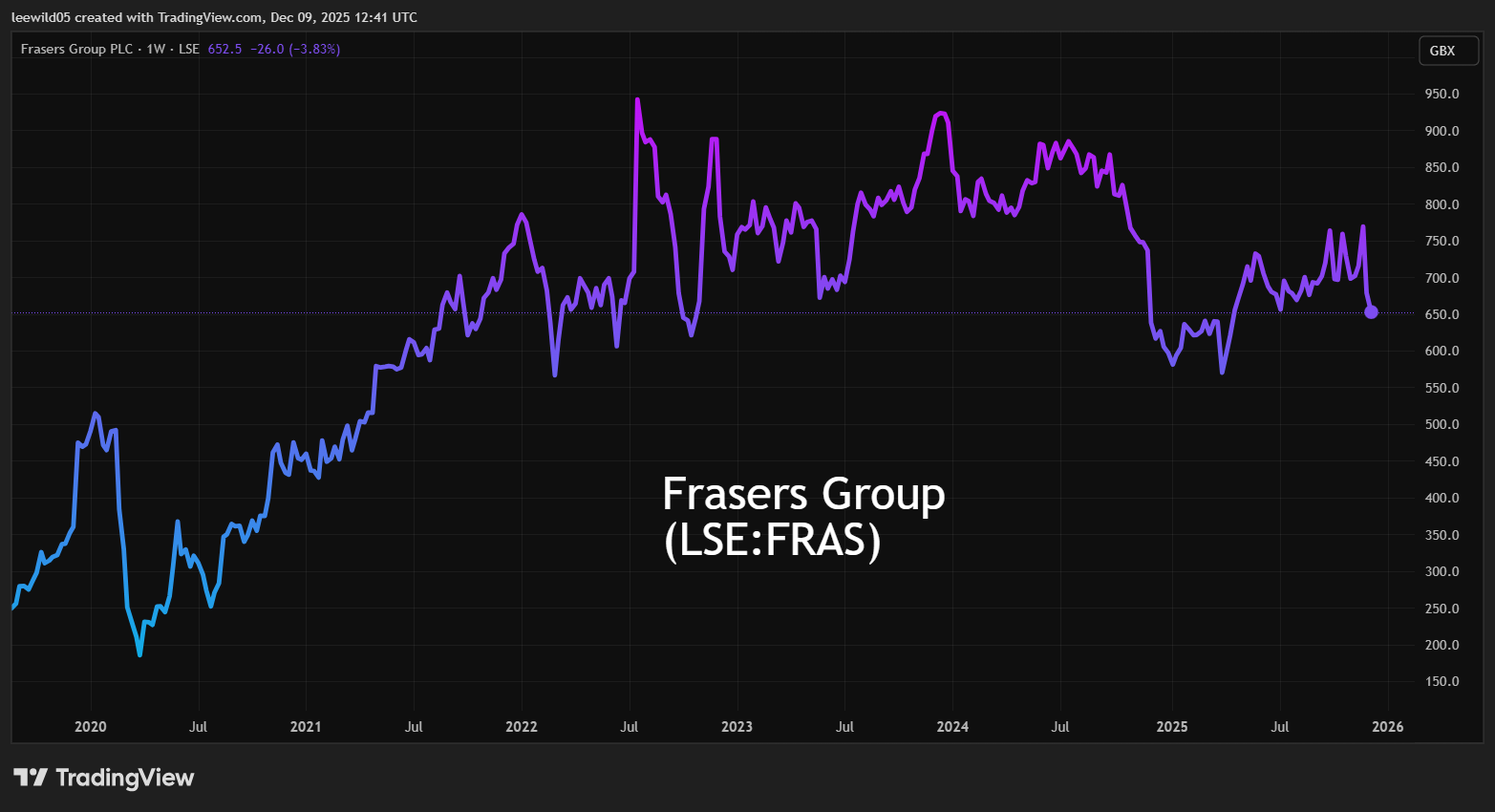

Come 2016, however, the price was down to around 300p as Ashley went out of investor favour and the group’s auditors were subsequently fined for failure to detect related party transactions. Then, after the Covid plunge to 150p, came another bull run to a 700-900p range from late 2021, after which the trend has been volatile sideways:

Source: TradingView. Past performance is not a guide to future performance.

Fitness/activity businesses can do well in straitened times when people supposedly take up self-improvement and hone their appearance. Sport/outdoors kit can cost less than gym membership, which is more tied to discretionary spending power. Yet nowadays there seem to be many more sports clothing suppliers online, and Frasers has diversified from Sports Direct with more strands of the group to interpret. The 2018 acquisition of House of Fraser out of administration for £90 million, which a year later Ashley appeared to regret, seemed to characterise a maverick style.

Frasers’ current message on the consumer environment squares with advisory firm BDO, citing Black Friday as having failed to drive any meaningful retail sales growth due to discounting. It was a similar picture throughout November: minimal growth in shop sales and online achieving volume growth by price cuts to shift excess inventory.

The hope had been that consumers were holding back until the Budget, yet Black Friday failed to unleash much demand. Frasers is cautious about the second half of its financial year to end-April, but continues to expect full-year adjusted pre-tax profit of £550-600 million, roughly in line with consensus for £440 million net.

Frasers Group - financial summary

year-end 28 April

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Turnover (£ million) | 2,904 | 3,245 | 3,360 | 3,702 | 3,957 | 3,507 | 4,691 | 5,586 | 5,317 | 4,926 |

| Operating margin (%) | 7.7 | 4.6 | 6.0 | 4.3 | 4.9 | -2.1 | 6.4 | 9.9 | 10.1 | 11.4 |

| Operating profit (£m) | 223 | 148 | 201 | 161 | 192 | -73.3 | 301 | 553 | 540 | 561 |

| Net profit (£m) | 277 | 230 | 20.1 | 112 | 93.8 | -83.0 | 250 | 492 | 381 | 292 |

| EPS - reported (p) | 45.5 | 38.3 | 3.8 | 21.5 | 18.5 | -18.2 | 47.5 | 101 | 88.3 | 66.0 |

| EPS - normalised (p) | 51.9 | 31.4 | 2.4 | 25.6 | 27.9 | 18.2 | 78.4 | 102 | 88.2 | 62 |

| Operating cashflow/share (p) | 10.8 | 42.9 | 61.4 | 52.5 | 74.3 | 103 | 108 | 118 | 156 | 218 |

| Capital expenditure/share (p) | 33.9 | 68.9 | 39.2 | 30.6 | 63.8 | 43.9 | 68.5 | 102 | 60.9 | 95.1 |

| Free cashflow/share (p) | -23.1 | -26.0 | 22.2 | 21.9 | 10.5 | 59.1 | 39.5 | 16.0 | 95.1 | 123 |

| Return on total capital (%) | 12.3 | 8.5 | 9.2 | 6.3 | 6.4 | -2.6 | 9.7 | 16.8 | 15.5 | 14 |

| Cash (£m) | 234 | 205 | 360 | 448 | 534 | 457 | 337 | 333 | 359 | 252 |

| Net debt (£m) | 99.7 | 182 | 397 | 379 | 990 | 972 | 1,112 | 1,097 | 1,094 | 1,609 |

| Net assets (£m) | 1,386 | 1,223 | 1,194 | 1,247 | 1,267 | 1,193 | 1,293 | 1,628 | 1,845 | 1,960 |

| Net assets per share (p) | 232 | 218 | 222 | 232 | 224 | 230 | 264 | 348 | 410 | 435 |

Source: historic company REFS and company accounts.

International sales offset weakness in UK

This is interesting as is validating the company’s diversification, and also how the luxury Flannels stores are showing “green shoots” of recovery with a return to sales growth.

Total half-year group sales to 26 October rose 5% to £2.6 billion driven by international revenue growth of 43% – acquisitive and organic – to represent 28.5% of the group total and nearly 27% of gross profit.

Holdsport has been acquired in South Africa and XXL in the Nordics, and Sports Direct stores have recently been opened in Malta, Australia and the Middle East “as we continue to build a platform for global growth”. International store numbers are up from 372 to 537 chiefly due to the two acquisitions.

Obviously, international growth rates can look very attractive from a low base, and bear in mind that these acquisitions have also contributed to a 20% hike in the depreciation charge, widening disparity between reported and normalised EPS. But overseas seems to be going well as part of the “elevation strategy”, with £10.3 million of net cost savings and synergy benefits also said to have been delivered from acquisition integration.

- JD Sports Fashion wrong-footed in Q3

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

JD Sports Fashion (LSE:JD.) is plenty more advanced abroad – the US and Europe driving sales and the UK nowadays representing around 25% – and its shares trade on a very similar forward PE to Frasers. Yet with Frasers group revenue around 40% of JD’s, might it have more overseas potential, especially if Sports Direct has relatively better appeal?

UK sports retail revenue is down 5.8% to £1.3 billion, or 51% of the group total, although it is blamed on “planned decline” at the GAME video games shops (included in this segment) and also the online arm of Studio Retail, whereas sales at the core Sports Direct retail business actually grew. Hence, core business revenues have been diluted by aspects of the acquisition strategy.

While Flannels grew, sales in the premium lifestyle side slipped 4% as they were more than offset by rationalising the House of Fraser store portfolio plus businesses purchased from JD Sports Fashion, reducing divisional stores from 58 to 34 over a year. Yet gross profit rose 7% to £190 million as Flannels increased its contribution and a more relevant product offering generally.

What of costs imposed by the government?

Costs are a bugbear of the retail industry. Frasers, so far, appears to have absorbed them – unless blurred by acquisition integration – given “£10.3 million underlying net cost savings and synergy benefits despite significant increases in staff costs driven by increases to National Minimum Wage and Employers’ National Insurance from April 2025”.

Yet there is no mention of the latest increases in the UK minimum wage where Sports Direct has generally aligned or paid slightly over. The Unite Union has branded Sports Direct “the UK’s meanest employer” over failure to award a “fair and decent pay rise”. It appears to be the latest episode of union conflict after Unite said the Shirebrook workforce should be sent home on full pay during Covid.

- Insider: heavy director share buying at these four companies

- 10 hottest ISA shares, funds and trusts: week ended 5 December 2025

It is also hard to discern the significance of pay: Frasers’ interim cost of sales as a percentage of revenue has reduced from 54.8% to 52.9% but selling/distribution/admin costs have risen from 36.4% to 38.9% of revenue.

An adverse shift in property-related impairments/reversals was more influential to impact reported interim operating profit by 18% to £219.8 million. Then an even larger £101 million boost from equity derivatives, plus a £128 million revaluation of the group’s 19% holding in Hugo Boss, helped continuing operations report net profit up 93% to £301.3 million.

Does CEO’s pay package inflame industrial relations?

The CEO missed targets for an initial £100 million share-based award after Frasers’ share price failed to reach £15 for 30 days by October. This is now downgraded to £12 by September 2030, but Frasers must still achieve an underlying pre-tax profit of at least £500 million. In this respect, the way property valuations/deals are treated as part of Frasers’ normal business concerns me. While the CEO has waived his salary for three years and continues to do so, he is not financially wanting as a property professional and billionaire Ashley’s son-in-law.

I am sceptical about schemes like this – heavily focused on the top individual – which depend very much on collective effort within a company and what industry conditions prevail.

That aside, both Frasers and JD are on PE multiples below 7x, which look cheap in a long-term context unless there simply is too much competition nowadays. It seems quite like how banks looked cheap two years ago, with no obvious trigger for upwards mean-reversion – but which eventually happened in spades.

Last month I cautiously drew attention to JD as a potential “buy” at 77p ahead of a 20 November third-quarter update, which saw a drop to 73p after annual profit was guided to the lower end of the expected range. Yet JD has since risen to 80p.

Possibly this shows lowly rated retailers trading around an inflection point valuation-wise. There are no disclosed short positions above 0.5% in either share. Macro factors will remain influential, but I tilt towards a “buy” stance on both shares. Fate or flourish in terms of the US consumer will be influential for JD in 2026.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.