Stockwatch: is this tech stock now an even better buy?

There are three companies competing in this sector, and one of them has just been upgraded by a City expert. Analyst Edmond Jackson gives his opinion on prospects.

29th August 2025 11:59

by Edmond Jackson from interactive investor

Softcat (LSE:SCT) is an IT group selling software services and infrastructure products. It’s the UK’s third-largest IT re-seller after mid-cap peers Computacenter (LSE:CCC) and Bytes Technology Group Ordinary Shares (LSE:BYIT).

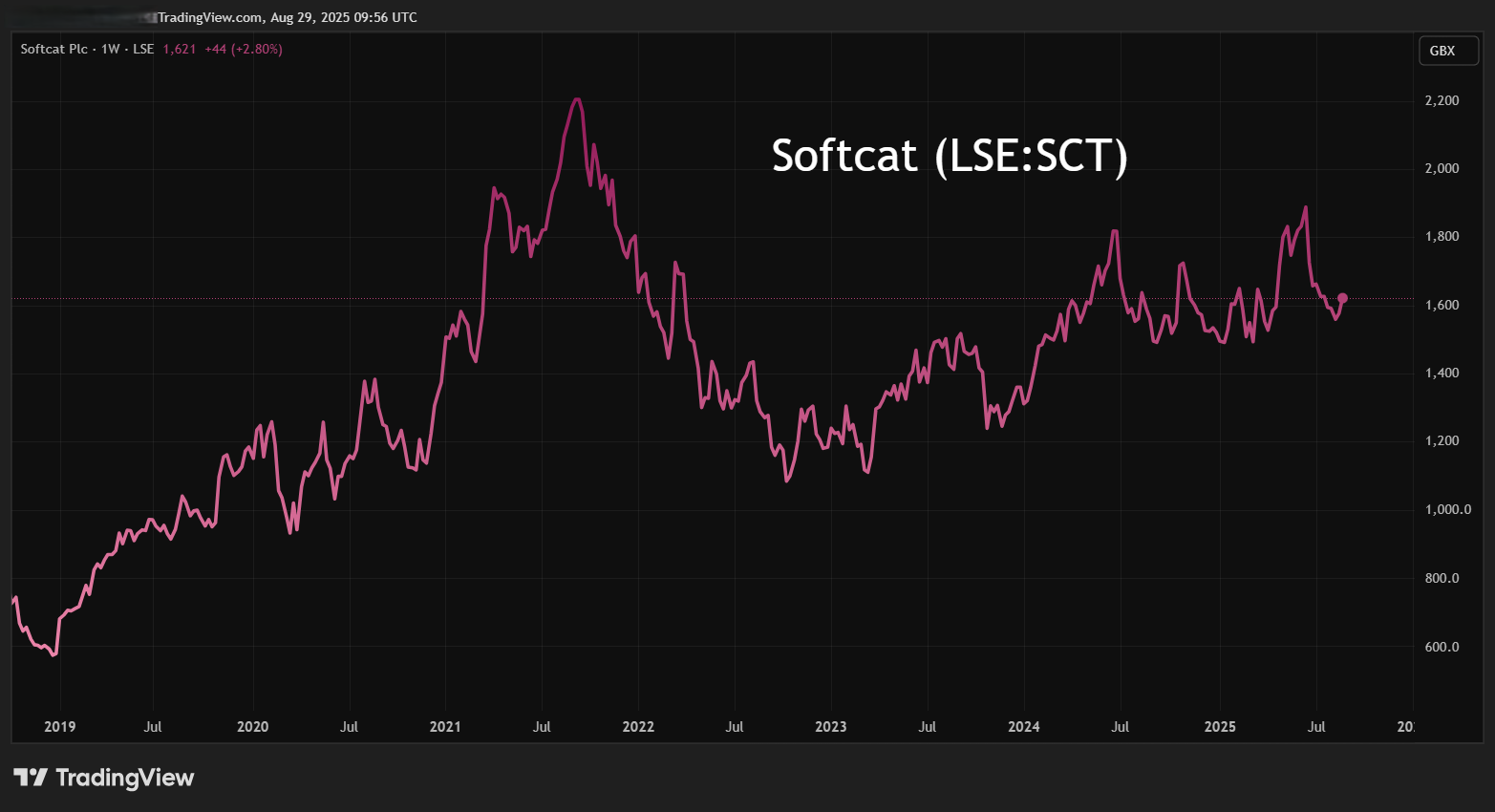

When they all last reported in March, numbers and guidance were well received, promoting rallies in subsequent weeks with Softcat jumping over 20% to near 1,900p by mid-June, Bytes 34% to 535p in mid-May; and Computacenter, less vigorously given less strong numbers, up 14% to 2,630p.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Given that their commercial pitch is helping organisations design, procure, implement and manage their digital infrastructure, they are quite sensitive both to economic cycles and sea changes in IT requiring upgrades.

Even so, analysts at Berenberg, for example, upgraded Softcat in July from “hold” to “buy” and its fair value target from 1,600p to 1,900p, given a continued strong operating performance and a consistent ability to beat market expectations. This broker also respects Sofcat’s broad-based performance despite lumpy deals having given it a boost lately. It implies resilience, Softcat being the best example in the sector of prospects to upgrade expectations over the medium term, as it continues to navigate the challenging macroeconomic environment.

Yet macro worries hit the sub-sector, which I find interesting to note generally, given the way we have seen advertising, recruitment and selective industrial cyclical companies warn of a downturn in the second half of 2025.

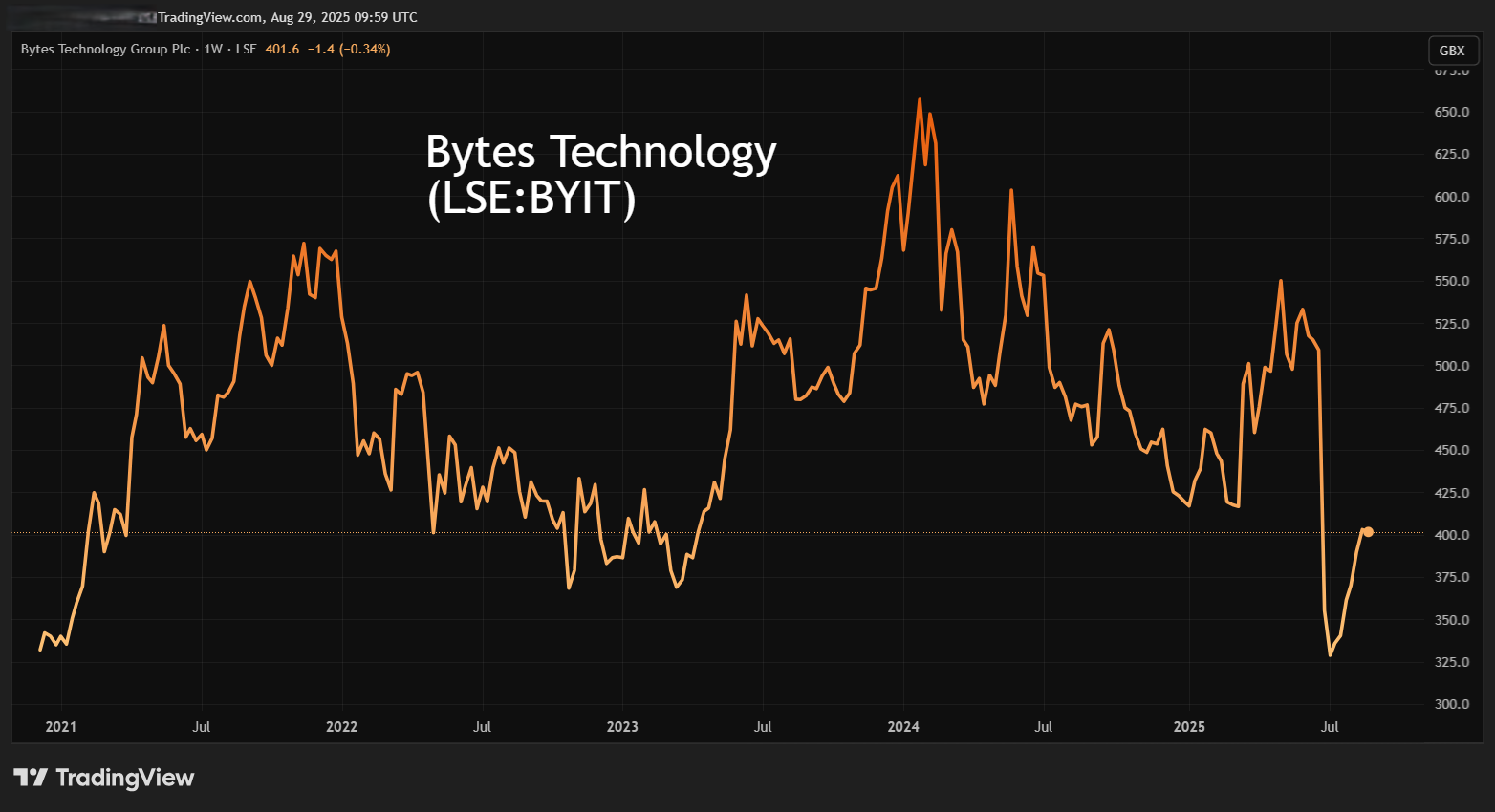

In particular, Bytes Technology said at its 2 July AGM that trading since March had been hit by “a challenging macroeconomic environment, leading to some deferral of customer buying decisions, particularly in the corporate sector”. Consequently, it expected flat profit for its first-half year from 1 March, with operating profit marginally lower.

- Trading Strategies: does Rolls-Royce still offer growth potential?

- Huge month for dividends as Lloyds Bank, BP, Shell, L&G pay out

Bytes shares plunged from around 500p, finding support at 320p a fortnight later, but that helped set up a fresh uptrend as investors probe for where median fair value could lie.

To my mind, Bytes’ volatile-sideways chart confers an industrial cyclical rather than growth company. Indeed, around 403p currently, it’s priced for a circa 5% yield as partial compensation for uncertainty:

Source: TradingView. Past performance is not a guide to future performance.

Softcat, meanwhile, retreated 16% from its 20 June high to around 1,560p as of 22 August, finding support on what looks like an uptrend since a chart double-bottom in 2023:

Source: TradingView. Past performance is not a guide to future performance.

Moreover, yesterday the shares picked up 4% to 1,624p after Softcat issued an update in respect of its financial year to 31 July that was interpreted as a third upgrade after March and May. It did not comment specifically on market expectations but cited high teens percentage growth in gross profit and mid-teens growth in operating profit “supported by further conversion of larger solutions projects”. Early guidance for its July 2026 year is low double-digit growth in gross profit and high single-digit growth in operating profit.

This is, frankly, quite abstract but possibly begs the question of whether management might again be guiding cautiously enough for outperformance to follow, or whether the UK macro context might simply prove too compromising.

At least one upgrade has followed, given the way consensus on July 2025 earnings per share (EPS) growth has just risen from 11% to near 13% based on net profit of £135 million and EPS of 67p. So far it appears that 2026 expectations remain quite similar, implying 7% EPS growth.

Refreshingly, in comparison with so many companies where you are in a quandary as to true earning power, Softcat’s record shows identical reported versus normalised EPS numbers:

Softcat - financial summary

Year end 31 July

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 992 | 1,077 | 784 | 1,078 | 985 | 963 |

| Operating profit (£m) | 84.5 | 93.7 | 119 | 136 | 141 | 154 |

| Net profit (£m) | 68.5 | 75.7 | 96.2 | 110 | 112 | 119 |

| Operating margin (%) | 8.5 | 8.7 | 15.2 | 12.6 | 14.3 | 16.0 |

| Reported earnings/share (p) | 34.4 | 38.0 | 48.2 | 55.3 | 56.0 | 59.4 |

| Normalised earnings/share (p) | 34.4 | 38.0 | 48.2 | 55.3 | 56.0 | 59.4 |

| Operational cashflow/share (p) | 32.5 | 32.2 | 45.8 | 41.9 | 52.4 | 57.7 |

| Capital expenditure/share (p) | 1.2 | 4.5 | 3.2 | 2.6 | 1.6 | 3.6 |

| Free cashflow/share (p) | 31.3 | 27.7 | 42.5 | 39.3 | 50.7 | 54.1 |

| Dividend per share (p) | 14.9 | 16.6 | 20.8 | 23.9 | 25.0 | 26.6 |

| Covered by earnings (x) | 2.3 | 2.3 | 2.3 | 2.3 | 2.2 | 2.2 |

| Return on total capital (%) | 73.2 | 62.0 | 63.4 | 62.3 | 53.9 | 48.9 |

| Cash (£m) | 79.3 | 80.1 | 102 | 97.3 | 123 | 158 |

| Net debt (£m) | -79.3 | -70.3 | -93.4 | -90.6 | -113 | -148 |

| Net assets (£m) | 115 | 141 | 179 | 211 | 251 | 298 |

| Net assets per share (p) | 58.2 | 70.8 | 90.0 | 106 | 126 | 149 |

Source: company accounts.

Does pattern of upgrades reinforce ‘buy’ case?

When Berenberg published its report in early July, Softcat was trading around 1,650p having fallen around 13%. The price continued down to 1,565p as of 27 August, but the update has put it at 1,624p – barely down on early July, if possibly with better underlying value. Mind you, this is taking a relatively short-term view on what 2025 annual results could deliver on 22 October versus the uncertainties of 2026 onwards. Yet industry visibility is probably never going to be very far.

Consensus forecasts presently imply a forward price/earnings (PE) ratio over 24x easing below 23x in respect of July 2026, a definitively “growth” rating. Due to the EPS growth rate looking more like 7% on a one-year forward basis, it puts the PEG ratio (PE to EPS growth) at around 3.4x when ideally you are looking for below 1.0, at most below 1.5x. Admittedly, it’s a snapshot view, and what really counts are the years ahead, but strictly on earnings it is expensive.

While the cash flow profile is plenty strong, the table shows free cash flow per share has traded slightly shy of EPS. That’s inherently commendable although it’s not as if radically better cash flow implies earnings undervalue the business.

- eyeQ: a leading US tech stock forming a near-term top?

- New analyst price targets for JD Sports and Prudential

Also, the prospective yield is a quite modest 3%, with around 1.4x earnings cover, probably not enough to tempt income investors, while those disciplined over total shareholder return might baulk at the earnings valuation. It is an essential view but strictly on its numbers, Softcat does rather fall between two stools.

Its mid-teen operating margins are respectable, and return on capital employed or equity is typically well over 50%. Yet Bytes finally achieved an operating margin over 30% last year - a hare versus Computacenter’s tortoise, which is trending at just over 3% albeit with respectable returns on equity and capital around 20%.

In terms of PEG ratios, Bytes at 403p is similarly on around 3.0 versus Computacenter “down” at 1.7 with the share price at 2,310p - if still inherently pricey according to PEG methodology. It may be crude but broadly suggests that we are looking at largely cyclical shares still accorded growth ratings, despite risks of global stagflation from US tariffs.

Take a company specific or global macro view?

Such a comparison of three IT services groups and Berenberg’s “buy” case usefully illustrates a perennial theme. Do you prioritise company-specific qualities from the track record, or the wider economy? Berenberg’s view has merit in the sense that Softcat yesterday defied what Bytes had to declare two months ago. From company updates you would prioritise holding Softcat.

I cannot divorce, however, from the big picture unfolding. Yesterday also heralded an interesting Substack post from economics professor Paul Krugman entitled “Why Aren’t Markets Freaking Out?” over Trump’s tariffs and ongoing threats to US central bank independence. Krugman said: “My reading of economic and financial history is that market pricing almost never takes into account the possibility of huge, disruptive events, even when the strong possibility of such events should be obvious. The usual pattern, instead, is one of market complacency until the last possible moment.”

He backs this with two examples. The first is the sub-prime crisis when, by 2005, very good reasons existed to suspect a major housing bubble, as shown by the ratio of home prices to average rents. Yet default risk indices on mortgages involved didn’t show any serious decline until 2007, a year after the housing bubble had been deflating.

The second is the euro crisis that began in 2009 when the pricing of Spanish and German bonds failed to reflect the possibility of a sudden stop of capital to places such as Spain, financing highly speculative property investment, much like the US sub-prime bubble.

- Stock pickers strike back as value investing returns

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Personally, I would adjust for liberal-left economists such as Krugman having a visceral hatred of Trump and his actions. Is Trump really going to succeed with attempted manipulations of the Federal Reserve?

However, I think Krugman is justified when cautioning on how markets took off in April after Trump declared temporary concessions on his reciprocal tariffs. We are starting to see the effects, for example, of up to 550 jobs to go at carmaker Lotus, with tariffs specifically blamed.

The backdrop is thus challenging for organisations committing to IT upgrades, and the UK public sector may also be affected by spending constraints. I cannot, therefore, presently rate these three shares better than “hold” despite charts for Bytes and Softcat looking as if they are in an overall uptrend.

Interestingly, at Computacenter, the Hadley Trust appears to have just taken a 7.1% stake on a contrarian view that it’s cheap at around 2,300p.

It will be interesting to see how a positive company-specific view, as argued by Berenberg, works out versus wariness of the economy.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.