Stockwatch: is there life left in this share down 96%?

This former AIM darling has fallen far from its top perch, but there’s something about it that’s piqued the interest of analyst Edmond Jackson. Here’s why he thinks it’s one to watch.

28th November 2023 10:24

by Edmond Jackson from interactive investor

It has shadows of Eidos some 20 years ago, but I see a possible parallel in how Frontier Developments (LSE:FDEV) may end up similarly a takeover target for the gaming industry.

Usually, if you are contemplating stocks in the “down 90% club”, it is wise to heed the adage that “they do not generally come back”. True, as a generality, but if a business exists, then even modest recovery can multiply money. There is always the example of WPP (LSE:WPP), which fell as low as 2p in the 1990s recession but was no write-off, and its price entertained 1,900p in early 2017, hence even a small investment becomes worth a lot.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

In relation to Naked Wines (LSE:WINE) recently, I have also flagged takeover potential, and am similarly interested in video games group Frontier Developments which, at 147p, is down 96% from its early 2021 high. Both stocks show how a huge drop is not necessarily related to underlying viability; in recent years, trading hysteria during Covid lockdowns conflated with a few companies doing very well.

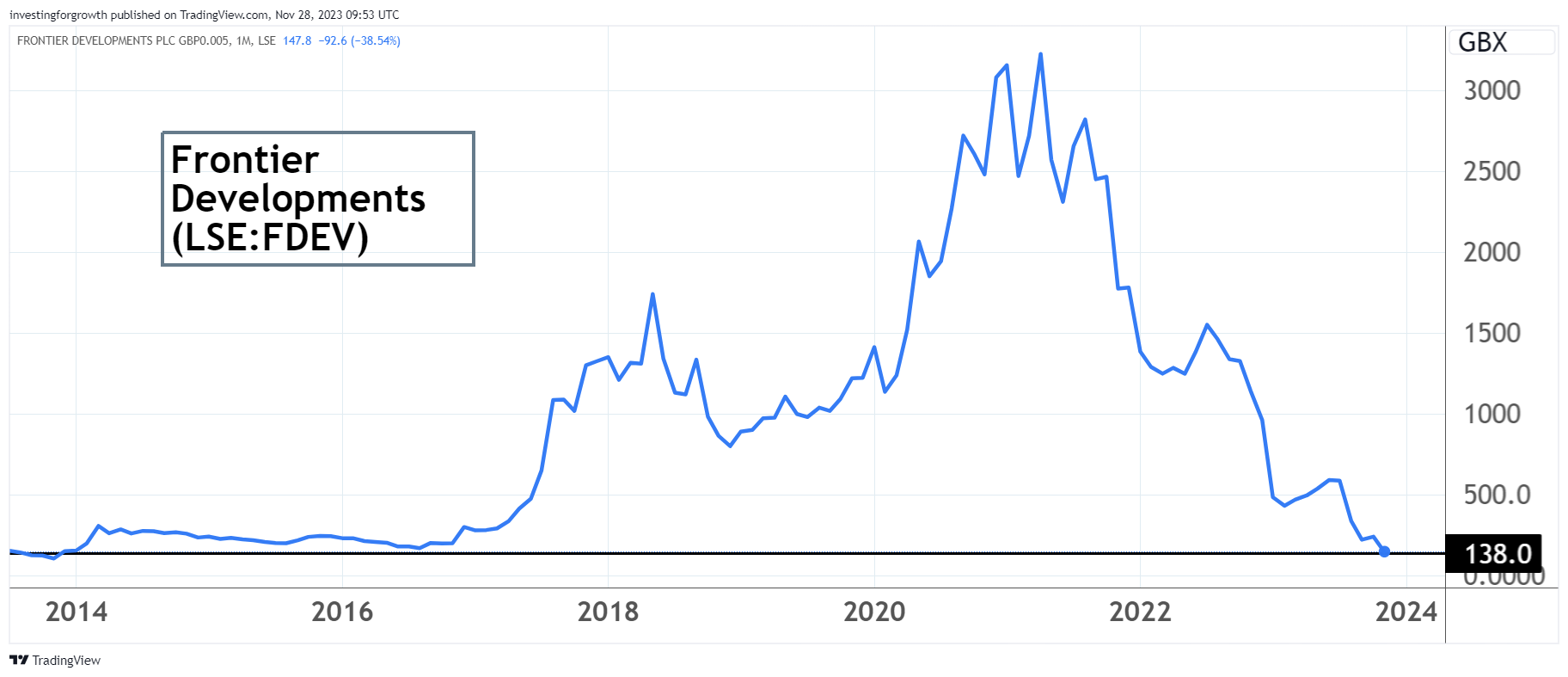

Frontier exhibits a massive near “Return to Go” after it floated at 127p in mid-2013, having re-rated to over 1,500p in 2018, then enjoyed a Covid-based run from around 1,200p to over 3,300p. Since then, it has been in a relentless jagged descent.

Source: TradingView. Past performance is not a guide to future performance.

Progression of revenue warnings in last two years

I have been wary given high valuations attached to such stocks, where a fan club element plus momentum buying leaves no room for upsets. Exactly two years ago, I reviewed Frontier after a revenue warning saw the stock plunge 30% to around 1,700p, after Jurassic World Evolution 2 had failed to become the company’s biggest revenue contributor as hoped, that financial year. Another key game, Elite Dangerous: Odyssey, saw muted sales.

Low forward price/earnings (PE) multiples can be as dangerously enticing as high yields, with revenue guidance at the time implying a forward PE of only around 8.5 times, but I concluded: “best sit back because if the story worsens then short-sellers may start playing their own games”.

- Five outperforming AIM shares that could keep rising

- Insider: heavy buying at two FTSE 100 companies and this small-cap

The last annual results to 31 May raised doubt about whether the business model is valid. A dilemma with this type of creative company is high levels of investment to generate fresh content – potentially having to “run fast to stand still”. So, while revenue and gross profit falls were not too bad – respectively, down 8% below £105 million and 9% to £67 million – a 47% uplift in R&D expenses to £68 million alongside sales, marketing and administration costs being quite stable, meant a £26.5 million pre-tax loss.

More positively, once a £41 million depreciation charge plus £18 million for intangible asset impairment were added back, net cash from operations rose 16% to near £48 million. But investment needs still saw year-end cash down 27% to £28 million, which has since fallen to around £21 million as of end-October. That constitutes 33% of market value, however sales must pick up.

Frontier Developments - financial summary

Year end 31 May

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 21.4 | 37.4 | 34.2 | 89.7 | 76.1 | 90.7 | 114 | 105.0 |

| Operating margin (%) | 5.8 | 20.9 | 8.2 | 21.6 | 21.8 | 22.0 | 1.4 | -25.4 |

| Operating profit (£m) | 1.2 | 7.8 | 2.8 | 19.4 | 16.6 | 19.9 | 1.5 | -26.6 |

| Net profit (£m) | 1.4 | 7.7 | 3.6 | 18.0 | 15.9 | 21.6 | 9.6 | -20.9 |

| Reported EPS (p) | 4.1 | 22.4 | 9.1 | 44.7 | 39.4 | 53.3 | 23.7 | -53.6 |

| Normalised EPS (p) | 4.1 | 22.4 | 9.1 | 44.7 | 39.4 | 53.3 | 35.6 | -23.4 |

| Return on total capital (%) | 5.1 | 23.5 | 5.0 | 25.6 | 13.0 | 13.9 | 1.1 | -22.4 |

| Operating cashflow/share (p) | -3.6 | 13.5 | 25.9 | 81.5 | 80.4 | 96.3 | 101 | 123 |

| Capex/share (p) | 1.0 | 2.3 | 46.0 | 42.9 | 53.8 | 81.2 | 95.4 | 111 |

| Free cashflow/share (p) | -4.6 | 11.2 | -20.1 | 38.6 | 26.6 | 15.1 | 5.6 | 12.0 |

| Cash (£m) | 8.6 | 12.6 | 24.1 | 35.3 | 45.8 | 42.4 | 38.7 | 28.3 |

| Net debt (£m) | -8.6 | -12.6 | -24.1 | -35.3 | -22.2 | -20.3 | -18.0 | -9.0 |

| Net assets (£m) | 22.8 | 31.3 | 55.3 | 74.2 | 96.7 | 113 | 118 | 96.0 |

| Net assets/share (p) | 66.8 | 91.4 | 143 | 192 | 249 | 288 | 300 | 243 |

Source: historic company REFS and company accounts.

The stock is down 25% since an update yesterday cited lower-than-expected sales of a latest Warhammer game despite “mostly positive” reviews from critics and players.

Is this mainly due to such games being highly exposed to lower consumer discretionary spending, or do they lack competitive appeal? Games Workshop Group (LSE:GAW) is a £2.6 billion mid-cap that also markets Warhammer – for miniatures gaming – and its June to July trading was ahead of expectations, with a 14% rise in core revenue and licensing revenue doubled. While they are not exactly comparable, I think it’s fair to say Frontier has marketing issues.

Revenue guidance for the current financial year is downgraded from £108 million to an £80-95 million range, according to the various games’ performance.

Management adds a positive edge, saying: “we expect sales to build over time” – albeit this is perhaps a soft warning, given the important December trading period is imminent.

‘At least break-even’ is projected for May 2025

The extent of stock price fall also relates to a guided £9 million adjusted EBITDA loss “remaining achievable” in respect of the May 2024 year as a result of cost savings, but implicitly it could now be higher.

At least break-even is projected for the May 2025 year (albeit presumably also in terms of adjusted EBITDA) based on revenue expectations from current games and future releases. Yet their guidance barely six weeks ago has been overtaken.

Unless the company shows more adept marketing in a “higher for longer” UK interest rates scenario, cash will get tight on a two-year view. They need to beat profitability estimates, not slip further. At least in terms of financial risk, the last balance sheet had no debt beyond £19 million lease liabilities.

- Five hard-hit AIM stocks with recovery potential

- Stockwatch: takeover bids imply stock market in recovery mode

That makes the stock highly speculative, although a stream of smaller buy orders helped lift the price from 150p yesterday afternoon. If Frontier can sustain at least £100 million revenue, that puts it on 0.6 times sales. A potential buyer could offer 1.0 to 1.5 times – up to 380p a share – and by taking out costs, integrating with its operations, make a deal value-accretive.

It is going back some 20 years, but I recall the video games publisher Eidos becoming an erratic performer – going from wunderkindto bête noire status – although it was taken over in 2005 at a decent premium to market price by SCi Entertainment Group, itself taken over by Square Enix in 2009. This industry is cannibalistic.

Mind, however, Superscape was taken over at 10p a share in 2008, after this once-feted mobile games publisher was bought by Glu Mobile of the US for less than £30 million equivalent. Superscape achieved a top five position in mobile games in the US, a lot of its titles had critical acclaim, but it exited the market at well over a 95% drop from euphoric highs in the 2000 tech-stock boom.

Chair steps down after only 12 months

It comes across as if the chair finds the challenge too hard (unless there were personality clashes) despite the often said “focusing on other interests” reason for leaving. I incline to regard this as underlining how a turnaround is not going to be easy.

The table above shows that capital expenditure as a proportion of operational cash flow rose from 53% in the May 2019 to 90% in 2023, yet the follow-through by way of recent revenues is disappointing.

An inherent dilemma with games publishers is the need to generate new successes, which are hard to predict and mean a lumpy financial profile. Frontier only made £1 million or so profit back in 2016 but by leveraging revenue, and improving margins to over 20%, net profit soared by more than £20 million. It is hard to see that being repeated, but what if costs were taken out by a new owner?

Over the last five years, Frontier has tried to diversify its games portfolio, but did not meet hopes, hence it is re-focusing on creative management simulation (CMS) games where four of them – Planet Coaster, Planet Zoo, Jurassic World Evolution also Jurassic World Evolution 2 – have grossed over $100 million (£79 million).

There looks to be core skills to integrate elsewhere – though mind in a “people” business, assets can migrate. I do not find takeover speculation alone enough constitute “buy”, though it is worth noting. One to watch. Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.