Super 60 Morningstar makeover

25th January 2022 10:06

by Jemma Jackson from interactive investor

interactive investor publishes rated list changes and performance analysis as it outsources rated list.

- Over two-thirds of active selections on Super 60 outperformed their benchmark over 3 years, with a more mixed picture over the past year

- New in on Super 60: Ninety One UK Alpha Fund, Jupiter UK Special Situations Fund, BlackRock Continental European Income Fund, PIMCO Global Investment Grade Credit Fund, Jupiter Japan Income Fund.

- Ejected: Liontrust Special Situations Fund, CFP SDL UK Buffettology Fund, JPMorgan European Income Trust, FTF Martin Currie IF Japan Equity Trust, Marlborough Global Bond Fund

Earlier this month, interactive investor, the UK’s second-largest direct-to-consumer investment platform, announced that it has handed over the day care of its rated lists to Morningstar’s Manager Selection Services Group.

Today, ii publishes Morningstar’s changes as it takes over the day care of the list, as well as looking at how Super 60 has fared over three years on ii’s watch. With a handful of new constituents, and another handful of ejections, today’s changes are more of a makeover than a face lift. But there are some interesting surprises, too.

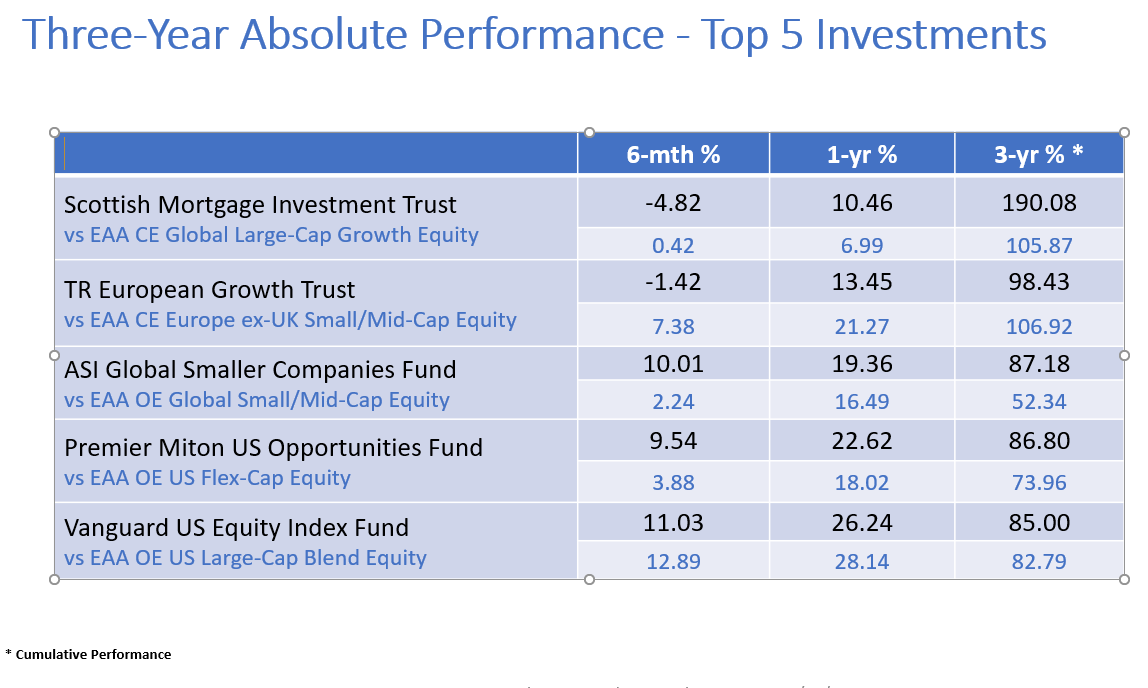

More than two-thirds (72%) of active selections on Super 60 outperformed their respective benchmark index over the past three years since Super 60 was launched.

Scottish Mortgage (LSE:SMT) was the overall best performing constituent, returning 190% and almost double the return of the second-best performing constituent, TR European Growth (recently renamed to European Smaller Companies Trust (LSE:ESCT). In either scenario, it is difficult to imagine such extraordinary returns being repeated any time soon over a three-year period.

The list turnover has been relatively low (under 15% every year), emphasising interactive investor’s long-term view when selecting funds and reflecting the team’s high conviction in chosen managers.

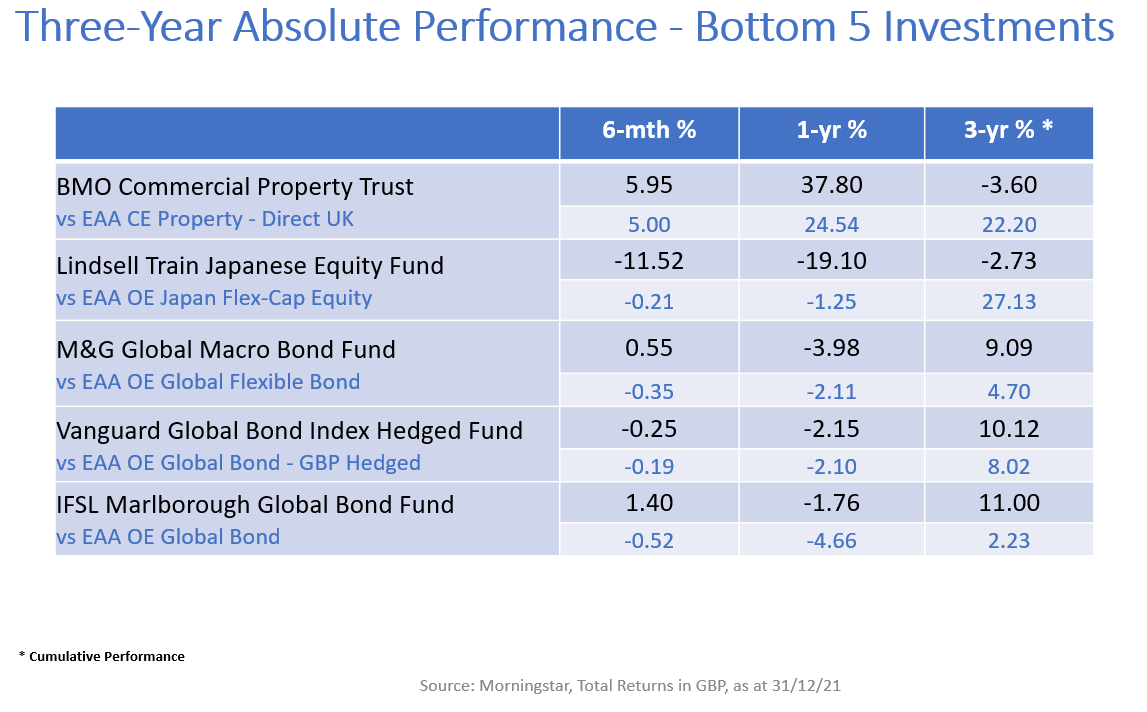

BMO Commercial Property (LSE:BCPT) was the worst performing Super 60 rated fund over 3 years, down 3.6%, followed by Lindsell Train Japanese Equity, down 2.73%. Morningstar has spared the Lindsell Train fund from ejection (ii put it under formal review in November), instead removing FTF Martin Currie Japan Equity (and reclassifying the Lindsell Train fund as ‘Adventurous). Interactive investor did not have the Martin Currie fund under formal review.

Over one year, the Super 60 performance analysis is more mixed, as would be expected over shorter time frames: 51% of active selections outperformed their benchmarks.

Dzmitry Lipski, Head of Funds Research, interactive investor, says: “It’s great to see the majority of active selections performing in-line with our expectations over three years. The shorter-term data is often more mixed, and while we take this with a pinch of salt, it’s always a little sobering when the data is less clear cut – we’re only human!

“We all have to be realistic: investing is a long-term process and we can’t be overly influenced by short term data, good or bad. As we hand over to Morningstar for the day-to-day management, we can take a calm and objective view as our lists evolve. I look forward to monitoring Morningstar’s performance and process as they follow our methodology.”

Moira O’Neill, Head of Personal Finance, interactive investor, says: “Investors need options they can trust. The Super 60 can help you pick investments that match your investment style and interests, with the list including a wide range of active and passive funds, investment trusts, and exchange-traded funds (ETFs), rigorously selected by impartial experts across core, adventurous, low cost and smaller company categories.

“The latest changes show Morningstar making a clear mark as they take over our list. But they are more of a makeover than a face lift, with most of our selections staying, and a few interesting surprises.”

Super 60 changes

Prior to handing over to Morningstar, interactive investor had already put CFP SDL UK Buffettology under formal review. Morningstar have today removed this fund from Super 60, and replaced it with Jupiter UK Special Situations.

Likewise, JPMorgan European Income (LSE:JETI), which ii has also had under formal review since October 2021, is to be replaced by Morningstar with BlackRock Continental European Income(an open-ended fund). This follows shareholder approval of the JP Morgan trust’s merger with JPMorgan European Growth investment trust. The formal review was initiated by ii because of what would be an increased focus on capital growth for those investors who had been in the income shares

Morningstar have decided to keep TM Crux European Special Situations on the list, which had been under formal review by ii since November 2021.

Key changes:

- Remove: Liontrust Special Situations. Replace with Ninety One UK Alpha. Morningstar says: “We are recommending the removal of the Liontrust Special Situations from interactive investor Super 60 list due to concerns over the strategy size. The fund is one of the largest UK Equity funds in the market but maintains a dedicated allocation to small and mid-cap companies. This means that the fund has to choose between having high ownership of a company or owning smaller portions of more companies. We feel that this means the managers cannot fully express the fund's investment process and that they may end up owning companies in which they have lower conviction just to spread the money.

- “Our recommendation for a replacement fund is the Ninety One UK Alpha fund. The investment process blends fundamental, bottom-up stock research with top-down analysis, and the manager believes that a clear understanding of the macroeconomic and thematic background is a vital starting point. The fund benefits from a strong and experienced team, a clearly defined approach and strong execution thereof. While we are disappointed with the fund’s recent returns, we continue to believe that it represents a strong option for broad exposure to UK equities.”

- Remove: CFP SDL UK Buffettology. Replace with Jupiter UK Special Situations. Morningstar says: “This strategy [UK Buffettology] was previously Under Review due to concerns about the size of assets that were being accumulated and we have taken the decision to remove it from the Super 60 list. The fund has grown in size over the last 3 years based on strong inflows, and our analysis of the liquidity profile (how quickly the fund could be sold if everyone requested their money back) and ownership (how much of each company they own) suggests that if inflows continue then the strategy could either run into problems or have to change how the fund is run, for example investing in large companies when historically their success has come from smaller companies. We recognise that the strategy has delivered very strong performance but due to the possible risks or uncertainties we have lost confidence that this return profile can be replicated in the future.

- “Our recommendation for a replacement fund is the Jupiter UK Special Situations fund which as has been managed by Ben Whitmore since November 2006, when he joined Jupiter from Schroder Investment Management. Despite strong long-term performance, the fund’s value bias and contrarian approach do mean that returns can deviate significantly from those of the index from time-to-time. The investment approach reflects the fund manager’s contrarian and value-orientated investment philosophy. They aim to identify longer-term valuation anomalies by looking for stocks that have an attractive P/E ratio when calculated using 10- year average earnings but are nevertheless well-run companies with sound balance sheets.”

- Remove: JPMorgan European Income (LSE:JETI). Replace with BlackRock Continental European Income. Morningstar says: “This strategy [JPMorgan European Income Trust] was previously Under Review due to the planned merger with the JPM European Growth Trust and is now being removed as it sat in the income bucket which will no longer be the Trust's primary aim. Whilst the merged vehicle will maintain a 4% dividend policy to appeal to income investors the primary objective of the Trust will no longer be the delivery of income and as such, we are removing the Trust from the Super 60 list in order to replace it with a purer income seeking strategy.

- “Our recommendation for a replacement fund is the BlackRock Continental European Income fund. The managers seek to invest in quality companies with sustainable and growing dividends. The fund’s quality bias and style-agnostic approach means that returns differ from most equity income peers, which tend to have a value bias. The managers’ approach however has led the fund to have a steadier return profile and to outperform during periods of market weakness, with strong risk-adjusted returns when compared to both peers and the benchmark.”

- Add: Jupiter Japan Income. Morningstar says: “We recommend the inclusion of Jupiter Japan Income as a fund that offers a ‘Core’ return profile. The managers believe that there is an inverse relationship between Growth and Income in the market enabling them to manage the fund as a core option. Stocks selected for the portfolio typically trade on a premium yield and generate strong dividend growth. The emphasis is on well-managed companies that demonstrate strong cash flows above cost of capital, good growth prospects and management aligned with shareholders’ interests. Long-term compounders form the core of the portfolio, and the identification of long-term investment themes or economic trends comprise the rest of the fund, the portfolio is concentrated to around 40 stocks. Fund performance under Carter’s tenure has been strong with the fund ahead of the benchmark, the Topix Index.”

- Remove: Remove FTF Martin Currie Japan Equity. Recategorise Lindsell Train Japanese Equity as Adventurous. Morningstar says: “While the FTF Martin Currie Japan fund is correctly classified as an Adventurous fund and has over the long-term delivered strong performance the volatile nature of this fund’s return profile leads us to conclude that investors would be better served with a fund that has a more stable return profile. While the Martin Currie fund does a great job of capturing the market upside, it underperforms significantly during periods of market weakness too.

- “The Lindsell Train Japanese Equity fund has to date been classified as a ‘Core’ fund however we believe the fund’s growth style bias and the concentrated nature of the portfolio lead to a return profile that is more volatile than one would expect from a fund with a Core profile. While the fund’s long-term returns have been strong, the duration and magnitude of out- and under performance is not in keeping with that of a Core mandate. To this end we believe that the fund is better suited to the Adventurous Investment Category.”

- Remove: IFSL Marlborough Global Bond. Replace with PIMCO GIS Global lnvestment Grade Credit. Morningstar says: “Given the announcement of the pending retirement of the fund’s long-standing manager Geoff Hitchin, we recommend removing this fund and replacing it with the PIMCO Global Investment Grade Credit fund. Having a stable team and process is a key criteria for us when assessing funds qualitatively as it gives funds the best chance of consistently delivering good returns. As a result of the recent team change we feel that the fund is no longer a best in class option and are recommending the fund be removed from the interactive investor Super 60 fund list and replaced with the PIMCO Global Investment Grade Credit fund.

- “The PIMCO fund has been managed by Mark Kiesel since launch, although his track record managing the strategy dates back to 2002. Macroeconomic analysis is at the heart of PIMCO’s investment process and is supplemented by detailed regional and issuer analysis conducted by the large credit analyst team. The final portfolio is well diversified across a wide range of issues and the manager makes significant use of credit default swaps in building this portfolio. In performance terms the fund aims to outperform the Barclays Global Aggregate Corporate Index. The flexible nature of the mandate has historically resulted in significant off-benchmark positions and in a performance profile that can deviate from that of the index from time-to-time. The fund’s advantages include the tenacity of its veteran lead manager, the support of a large group of corporate managers and analysts, and a versatile process that draws on the firm's robust macroeconomic and fundamental research.”

- Remove from Under Review: TM CRUX European Special Situations. Morningstar says: “Recent performance has underwhelmed, which manager Richard Pease is not accustomed to. In 2020, poor relative performance resulted from a number of stock-specific disappointments, in addition to broader market dynamics related to COVID. In addition, the strategy is not as exposed to hyper-growth and some deeper value segments of the market, which have driven index returns in 2021.

- “We think short to medium-term performance can be overlooked and believe that over the long run the market will likely reward companies with high ROCE, strong free cash flow generation, and low cyclicality. Pease and Milne have an extensive and strong track record in identifying such companies, and we are reassured by Pease's long-term track record, which remains above the benchmark. Therefore, we are removing the fund from Under Review.”

Past performance is no guide to the future

Past performance is no guide to the future

Further details of the Super 60 list are here: https://www.ii.co.uk/ii-super-60

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.