Three hot stocks in a booming sector

Having already tipped two of these successful companies at lower prices, analyst Rodney Hobson reviews prospects and reveals which of these shares he’d keep buying.

28th May 2025 08:06

by Rodney Hobson from interactive investor

Energy companies are supposed to be dull, solid investments for those who seek certainty rather than excitement. In the somewhat weird world of President Donald Trump, American gas and electricity suppliers have suddenly become star performers, replacing the much bigger and brassier technology companies in the eyes of investors looking for quick profits.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

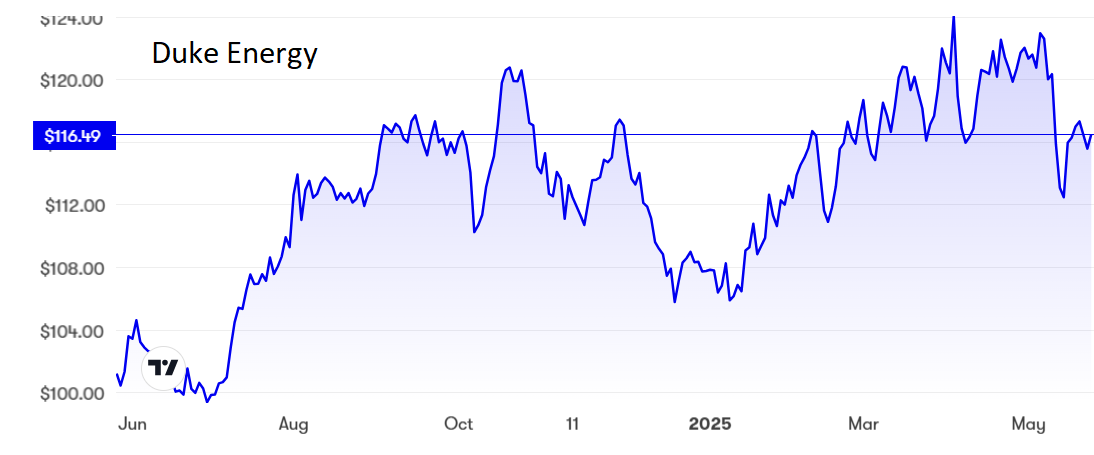

Duke Energy Corp (NYSE:DUK) shares stood at $105 in early January but shot up to $124 by mid-April, an 18% gain in just over three months, as Trump’s crusade to bring manufacturing back to the United States promised a surge in demand for energy.

Source: interactive investor. Past performance is not a guide to future performance.

Latest quarterly results were well received, showing revenue of $8.2billion, in line with expectations, while profits were up 22% to US$1.76 per share, slightly ahead of analysts’ forecasts.

The figures, the first under new chief executive Harry Sideris, were good enough for analysts to stick with their belief that revenue will edge up 3.1% for this year as a whole while earnings per share (EPS) will rise about 5.6%. This is a solid performance that well befits a solid company, which is itself confident of 5-7% annual growth in earnings through to the end of 2029, with a step up in performance in 2027. These are pretty reliable figures as there is good visibility of revenue from gas and electricity operations thanks to rates agreed with regulators.

Duke is planning well for the future, diversifying its energy sources and upgrading aging infrastructure before it is too late. Approval has just been received from the Nuclear Regulatory Commission to extend the operating licence for the Oconee nuclear station for an additional 20 years. It has the capacity to power North and South Carolina for another 30 years. Other nuclear plants plus natural gas and hydro power units will have their capacities increased and operating lives expended.

- This is why investors blow up – even when knowing the future

- Future Minerals: why utility and scarcity make a winning union

- Future Minerals: from underground to building blocks of tomorrow

US energy companies will be reasonably insulated from the effect of tariffs, which is just as well given the constant chopping and changing of threats against various countries, which suggests that there is no coherent plan. Duke reckons the impact could add 1-3% to the cost of its capital spending but the main chunk, on American labour, is unaffected by tariffs. Duke also believes that its size as America’s biggest energy supplier will enable it to smooth out any problems in its supply chain.

Duke shares have been back down to $112 this month but are perking up again at $116, where the price/earnings (PE) ratio is not too demanding at 19 and the yield is quite attractive at 3.6%.

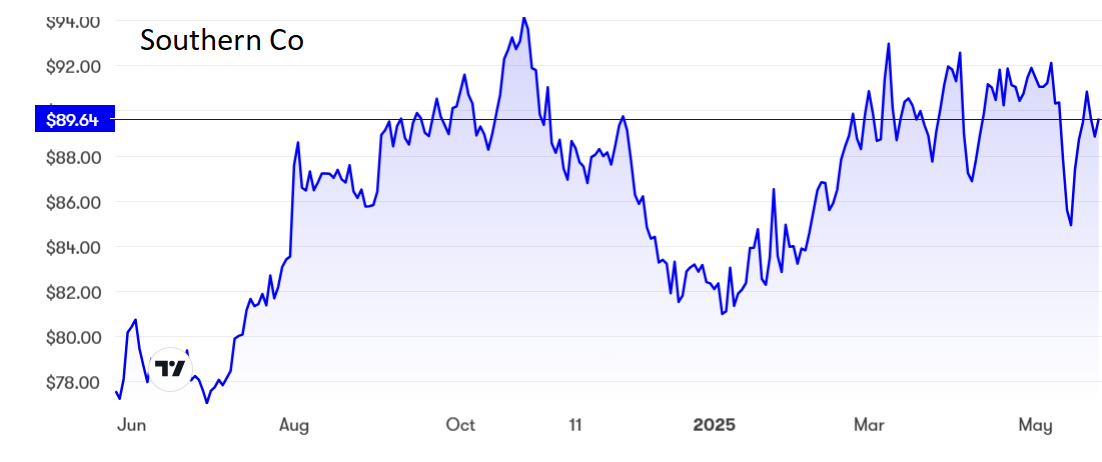

Southern Co (NYSE:SO), a smaller but ambitious power supplier,had a great run over most of last year to peak at $94, before coming off the boil to settle back to $81 in January. However, it has greeted the new president with a recovery to $90, where the ratios are only slightly less favourable than at Duke with a PE of 21.5 and a yield of 3.25%.

Source: interactive investor. Past performance is not a guide to future performance.

NRG Energy Inc (NYSE:NRG)has gained most from the Trump effect, shooting up from below $90 to nearly $160 and taking the PE to a more demanding 25. The yield at just over 1% is not so appealing.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I have long been a fan of Duke Energy, having first recommended the shares below $90 as long ago as 2019. Since then there has been a modest capital gain to accompany a solid dividend. My last buy tip was in November at $113 after a small dip. Duke shares are only a couple of dollars higher than they were three years ago when the world was still getting over Covid, yet the prospects look much brighter now. Buy.

I also rated Southern a buy six years ago at $54. It is still a great alternative buy in the energy sector. NRG, though, looks to have risen quite far enough for now and rates only a hold.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.