Time to revisit recovery stocks and faded stars of yesteryear

As the GameStop saga nears its inevitable conclusion, our overseas investing expert looks back in time.

3rd February 2021 09:32

by Rodney Hobson from interactive investor

As the GameStop saga nears its inevitable conclusion, our overseas investing expert looks back in time.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Follow the herd by all means – but remember to keep your distance. A lot of investors get crushed in the stampede. This advice is always worth following and it is particularly pertinent during the current US reporting season, especially in light of the mass hysteria surrounding the social media app Reddit and the surge of buyers into GameStop (NYSE:GME).

Hedge funds have been portrayed as the villains for shorting overvalued stocks while the leaders of the Peasant Traders’ Revolt are somehow cast as heroes. Yet the rabble rousers have made millions of dollars for themselves. while luring unsuspecting investors into grossly overpriced stocks. Hedge funds provide useful signals and create investment opportunities for ordinary mortals.

- Invest with ii: Most-traded US Stocks | Buy International Shares | Interactive investor Offers

When hedge funds short sell, consider whether they have got it right. If the target company is solvent and profitable, look for the chance to buy in at a cheap level. When short sellers close their positions they will be buying stock, thus helping to start a revival from a lower level.

- A risky investing craze: GameStop’s most volatile day

- GameStop needs a miracle

- What the GameStop saga means for markets

Shares in drug companies have naturally done well in the pandemic, while travel and hotels have understandably suffered. The case for tech stocks soaring during lockdowns is more problematic: it is true that demand for many products, both in hardware and cloud computing, has been ramped up by home working, but that phenomenon has to some extent been factored in and may not be repeated as workers drift back to the office.

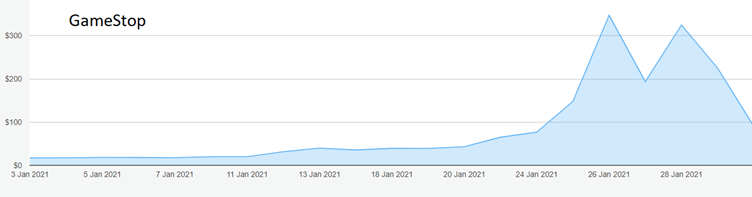

The picture is clouded by the reappearance in new guises of some faded stars of yesteryear. This was a factor in the saga of GameStop, a computer games and electronics chain. New directors are trying to take the company away from its declining bricks and mortar past and into new areas.

Even so, quite why anyone thought that shares trading below $20 at the start of this year could be worth over $400 just two weeks later is a mystery. But then the people who jumped on the bandwagon just before the wheels fell off were not thinking, just following the herd.

Source: interactive investor. Past performance is not a guide to future performance

See Lee Wild’s excellent article on GameStop on this site on 28 January. The shares have since plunged by two-thirds in two trading days. All the bubble did was provide hedge funds with an even better opportunity to make money from short selling.

That short selling opportunity continues and $5 may well beckon. Certainly, the momentum is likely to push GameStop back into single figures. A 3.1% fall in revenue over the Christmas period does not augur well for the immediate future.

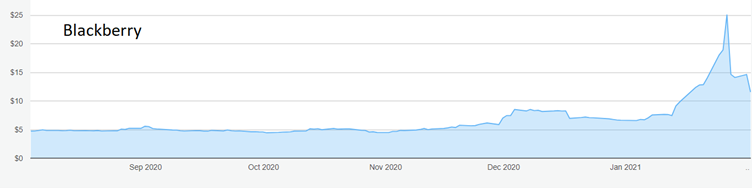

Remember when BlackBerries were all the rage? You were nobody if you didn’t send messages “from my BlackBerry”. The company stood still and was overtaken by more fleetfooted companies making better, faster, more versatile mobile phones.

BlackBerry (NYSE:BB), once the world’s largest smartphone manufacturer, is back as a software provider for communications and vehicle entertainment systems. The shares started this year at $6.63 and shot to a grossly overvalued $25 before slipping back to around $11. The downward momentum having been established, the stock could again halve in value before it stabilises.

Source: interactive investor. Past performance is not a guide to future performance

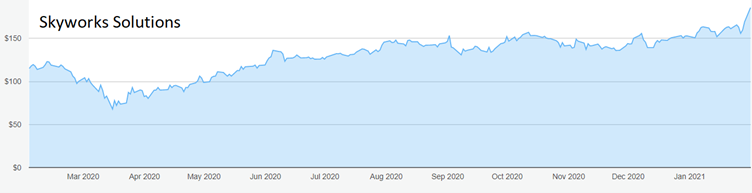

It is still possible to spot tech stocks that have stayed within reason. Skyworks Solutions (NASDAQ:SWKS), which produces semiconductors for wireless devices, bounced around $140 for several months before techmania pushed the stock up to $185. It should be underpinned at $150 and at least there is a dividend, although the yield is not much above 1%.

Source: interactive investor. Past performance is not a guide to future performance

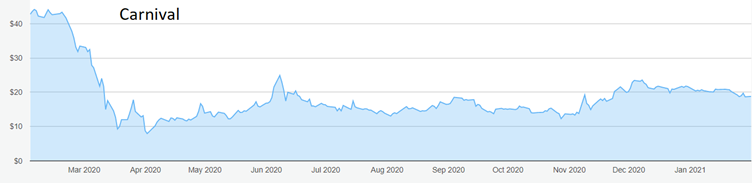

At the other end of the scale is cruise line Carnival Corp (NYSE:CCL), confined to port like its rivals, as the ships would not be allowed to make port calls even if regulations allowed it to set sail. Although sailors and shore staff can be laid off, there are very heavy fixed costs that cannot be reduced, the ships themselves being an obvious example. Some deposits on pre-booked sailings that had to be cancelled have had to be returned.

Source: interactive investor. Past performance is not a guide to future performance

The shares tumbled from $44 last February to a low of $8, and hopes that cruise enthusiasts will rush to get away as soon as they can have taken the stock only as high as around $20. Shareholders will have to be patient but, assuming that life on the ocean waves is back to normal by this time next year, a slow further recovery is likely.

Rivals Royal Caribbean Cruises (NYSE:RCL) and Norwegian Cruise Lines (NYSE:NCLH) tell a similar story. Royal Caribbean dropped from $118 to $22 and has made up only about half the deficit at $68 while Norwegian slipped from $55 to $8 and is still only at $23.

Source: interactive investor. Past performance is not a guide to future performance

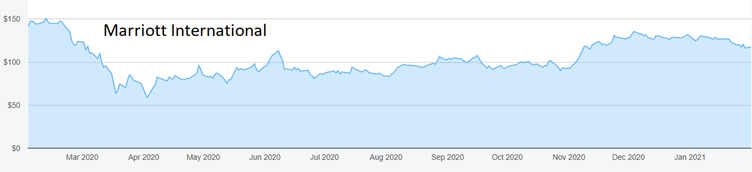

The case for buying into hotels is not so clear cut as their share prices have generally recovered most of the lost ground, while the problems of getting those hefty fixed costs working are just as considerable. Hotels rely heavily on international business travel which could be slow to get moving again even after restrictions are lifted.

For example, Marriott International (NASDAQ:MAR) shares slipped from $150 to $59 and are already back above $120. It is a strong company that will benefit from weaker rivals going to the wall but that is already reflected in the share price.

Source: interactive investor. Past performance is not a guide to future performance

Wynn Resorts (NASDAQ:WYNN) operates luxury casinos and resorts so it should benefit from being at the top end of the holiday market. The rich will be back in their playgrounds first. The drop a year ago was from $137 to $43 and the recovery has topped $100. That looks far enough for now.

Hobson’s choice: There is no dividend at the moment but BlackBerry could be a stock to watch – provided you can buy at a reasonable price. Worth considering under $8. Buy Skyworks around $150 if the chance arises.

If you are interested in GameStop, then wait until the shares stabilise. You may not have to wait long before the short sellers cash in and move on to other overvalued stocks, by which time the price will be much lower.

Seekers of recovery stocks could consider Carnival below the recent peak of $23, Royal Caribbean up to $73 and Norwegian at $25 or less.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.