The top-performing funds we’ve been buying

This sector has been the best performer among sectors that Saltydog classes as being relatively cautious, which has led to increased exposure to two funds.

5th February 2024 14:28

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After a strong finish to 2023, with nearly all the sectors that we monitor making gains in November and December, this year has got off to a more sluggish start.

Past performance is not a guide to future performance.

In November, 33 of the 34 sectors went up, with only China/Greater China making a loss. In December, the UK Direct Property and the China/Greater China sectors both went down, but the remaining 32 sectors all went up. Last month, only 12 sectors made gains and one of them, Flexible Investment, only went up by 0.004%.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Past performance is not a guide to future performance.

The two money market sectors in our “Safe Haven” group continue to make steady progress. In our demonstration portfolios, we still hold the Royal London Short Term Money Mkt, L&G Cash Trust, and abrdn Sterling Money Market funds.

In our “Slow Ahead”group, which contains funds from sectors that are slightly more volatile, only one sector, £ High Yield, went up in January, making 0.7%. It was also the best-performing sector in this group last year, with an annual return of 10.9%.

We currently hold two funds from the £ High Yield sector in our portfolios, Schroder High Yield Opportunities and Invesco High Yield UK. They have performed well for us and last week they were still appearing in our tables. Three weeks ago, our Ocean Liner portfolio added to its holding in the Invesco High Yield UK fund, and last week the Tugboat portfolio increased its holding in the Schroder High Yield Opportunities fund.

Past performance is not a guide to future performance.

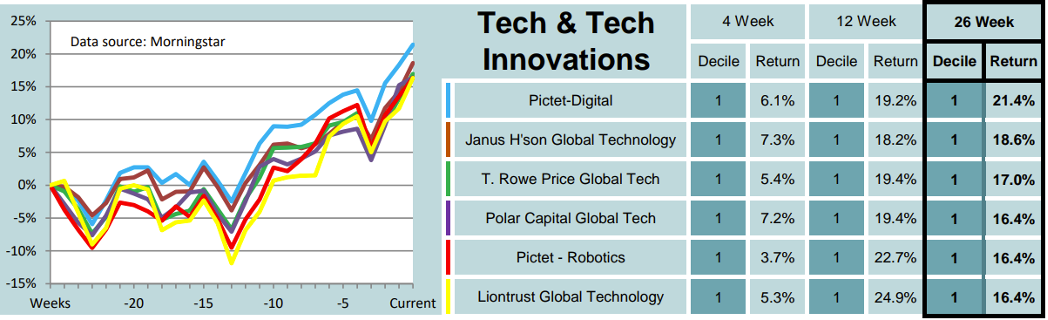

Overall, the best-performing sector last month was Technology & Technology Innovations, from our Full Steam Ahead Emerging group, with a one-month gain of 3.4%. When we looked last week, it was also the leading sector from any group over 12 and 26 weeks. We were already invested in the Pictet-Digital fund and last week we added to our holding.

Past performance is not a guide to future performance.

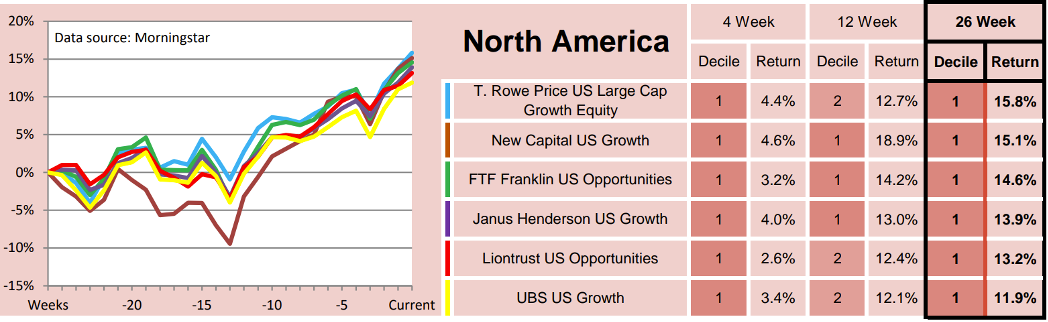

When funds from the Technology & Technology Innovations sector are on a roll, it is not unusual to see certain funds from the Global and North American sectors doing well. They can all invest in the same large US technology stocks. We have held the UBS US Growth fund since last June and have now added to our investment. It is in the top decile for its group over four and 26 weeks, and although a few funds in the sector have done slightly better, it is still up there with the best-performing funds.

Past performance is not a guide to future performance.

Since the beginning of the year our most cautious portfolio, the Tugboat, has gone up by 1.2%. Our slightly more adventurous Ocean Liner has made 1.9%.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.