The UK housebuilder stocks 'primed for recovery'

Having underperformed the wider stock market for a number of years, one group of experts believes it’s time to buy the housebuilding sector.

20th May 2025 15:26

by Graeme Evans from interactive investor

Housebuilders including Barratt Redrow (LSE:BTRW) and Persimmon (LSE:PSN) are among the near clean sweep of Buy recommendations after a City bank reviewed a sector “primed for recovery”.

The analysis of UBS in the wake of recent trading updates highlights improving affordability levels, supportive supply-side policy and unchallenging valuations.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The broker holds Buy positions on six of the seven industry’s leading players, with the others in favour being Bellway (LSE:BWY), Berkeley Group Holdings (The) (LSE:BKG), Crest Nicholson Holdings (LSE:CRST) and Taylor Wimpey (LSE:TW.). The exception is Vistry Group (LSE:VTY).

Taylor Wimpey boasts the biggest price target upside in the bank’s coverage of 33% to 155p, with the FTSE 100-listed company also trading with the biggest dividend yield of 8%.

This reflects the builder’s pledge to give investors a reliable income stream through the cycle by returning 7.5% of net assets or at least £250 million every year.

The wider sector trades with an average dividend yield of 4% and 1.02 times 2025’s forecast tangible net asset value, compared to a long-term average of around 1.24 times.

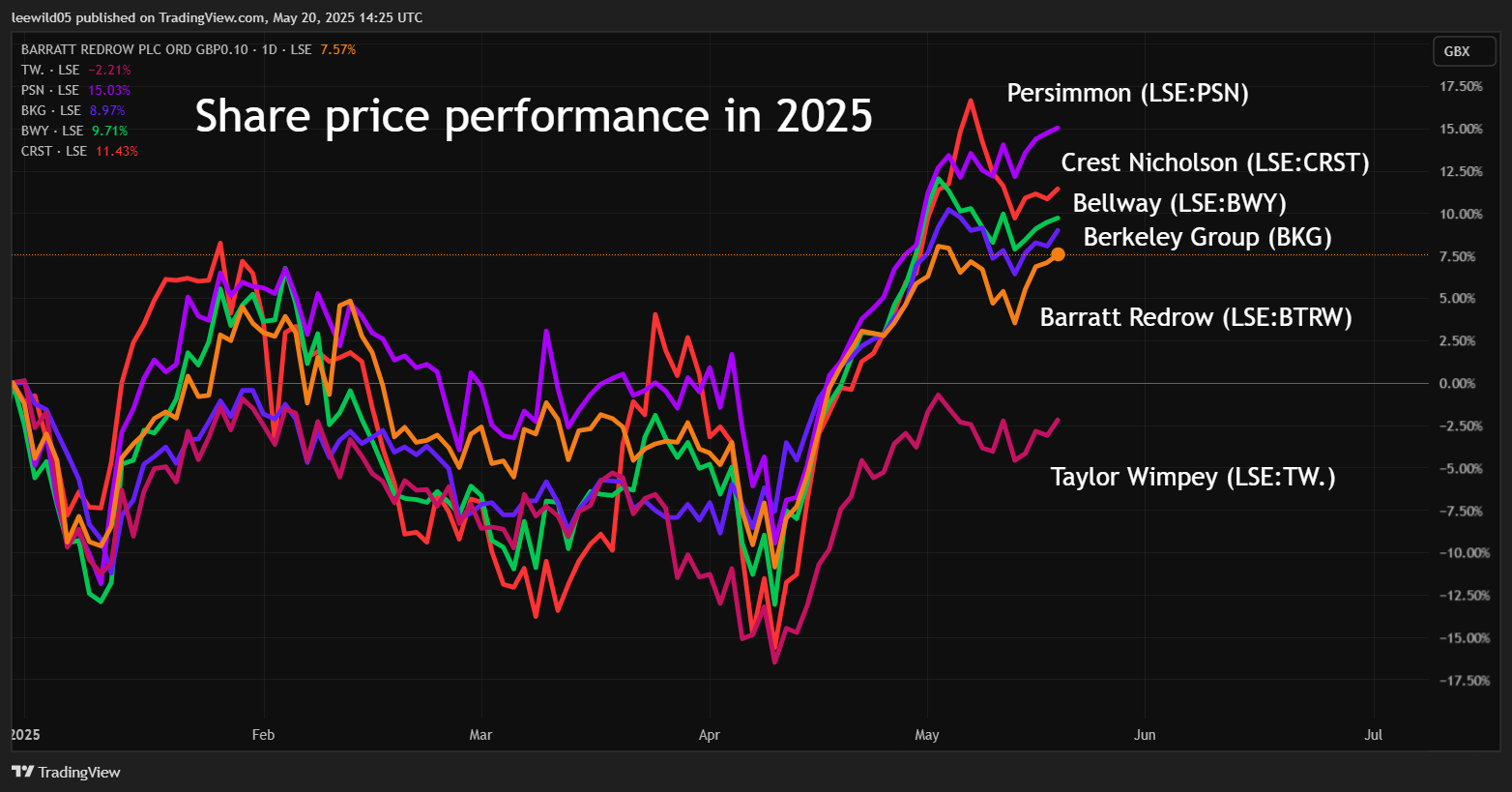

That’s despite a strong rebound for valuations since the height of tariffs uncertainty on 9 April, with Persimmon today 27% higher and Barratt Redrow up 20%.

Source: TradingView. Past performance is not a guide to future performance.

UBS wrote last week that the industry is approaching an attractive earnings recovery cycle, reflecting its view that volumes and margins are likely to have troughed in 2024.

Sales rates so far in 2025 are up 4% on average at around 0.65 per site per week, which UBS regards as a healthy level in the context of history and without Help to Buy.

The industry commentary on sales outlets has been mixed but on balance the sector expects a net improvement from this point, which should aid volume growth in 2026.

- FTSE 100 shares round-up: Lloyds Bank, Diploma, Smiths Group

- Stockwatch: is this still a growth share with legs?

Pricing and the use of incentives has remained stable, while build cost inflation is in line with expectations at around the low single-digit level.

UBS is encouraged by improving affordability metrics, driven by falling mortgage rates and increasing UK wages.

It estimates that a 75 basis point decline in swap rates would result in a return to the long-run average in terms of mortgage payments as a percentage of take-home pay.

The bank adds: “We also note the continued recovery in mortgage approvals and housing transactions. Downside risk remains the impact of macroeconomic uncertainty to consumer confidence and headwinds to discretionary pay.”

Over the longer-term, it adds that supportive planning policy reform should drive volume recovery and improve asset turn.

- Vodafone begins to ring the changes

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Among the bank’s other Buy recommendations, price targets of 575p and 3,500p for Barratt Redrow and Bellway represent upsides on last week’s level of 26% and 30% respectively.

Berkeley is seen 20% higher at 4965p, Persimmon up 15% to 1,540p and Crest Nicholson 19% higher at 220p. Vistry is Sell rated with a price target of 450p.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.