Where next for energy and mining funds?

Saltydog Investor charts the rise of the commodities sector since the pandemic – but can the excellent run continue?

14th August 2023 14:00

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

At Saltydog Investor we usually focus on relatively short-term performance, ranging from a couple of weeks to a few months, however, we do sometimes take a longer-term view. Every three months we run our 6 x 6 report, where we see how the funds that we monitor have performed over the last six six-month periods.

- Invest with ii: Top ISA Funds | Top Junior ISA Funds | Open a Stocks & Shares ISA

We are trying to find funds which have risen by 5% in each period. They are few and far between, but we do come across a few from time to time. Our latest report covers the three years starting in August 2020 and ending at the end of last month.

No funds rose in all of the six-month periods, but 13 managed to achieve it five out of six times. There were two funds from the Japan sector, three funds from the Global Equity Income sector, two from the Global sector, one from the North America sector, and one from the Global Emerging Markets sector.

The remaining four were all from the Commodities and Natural Resources sector. I have shown them in the table below along with Schroder ISF Global Energy, which is actually in the Global sector but also invests in companies involved with energy production.

Saltydog Investor 6x6 Report - August 2023

| Aug 20 | Feb 21 | Aug 21 | Feb 22 | Aug 22 | Feb 23 | 1 year | 2 year | 3 year | ISIN | |

| to | to | to | to | to | to | return | return | return | ||

| Jan 21 | July 21 | Jan 22 | July 22 | Jan 23 | July 23 | |||||

| Funds that have risen by 5% or more in 5 out of 6 periods | ||||||||||

| Schroder ISF Global Energy | 22.7% | 23.2% | 33.3% | 18.1% | 14.1% | 4.3% | 19% | 87% | 184% | LU0969110765 |

| BGF World Energy | 9.9% | 15.9% | 38.1% | 26.1% | 9.6% | -3.0% | 6% | 85% | 136% | LU0630472362 |

| TB Guinness Global Energy | 14.3% | 17.0% | 36.7% | 13.6% | 15.9% | -4.1% | 11% | 73% | 131% | GB00B56FW078 |

| BlackRock Natural Resources | 15.5% | 15.1% | 19.0% | 9.6% | 16.5% | -7.6% | 8% | 40% | 87% | GB00B6865B79 |

| JPM Natural Resources | 13.6% | 14.1% | 12.9% | 11.1% | 17.2% | -10.1% | 5% | 32% | 71% | GB00B88MP089 |

Past performance is not a guide to future performance.

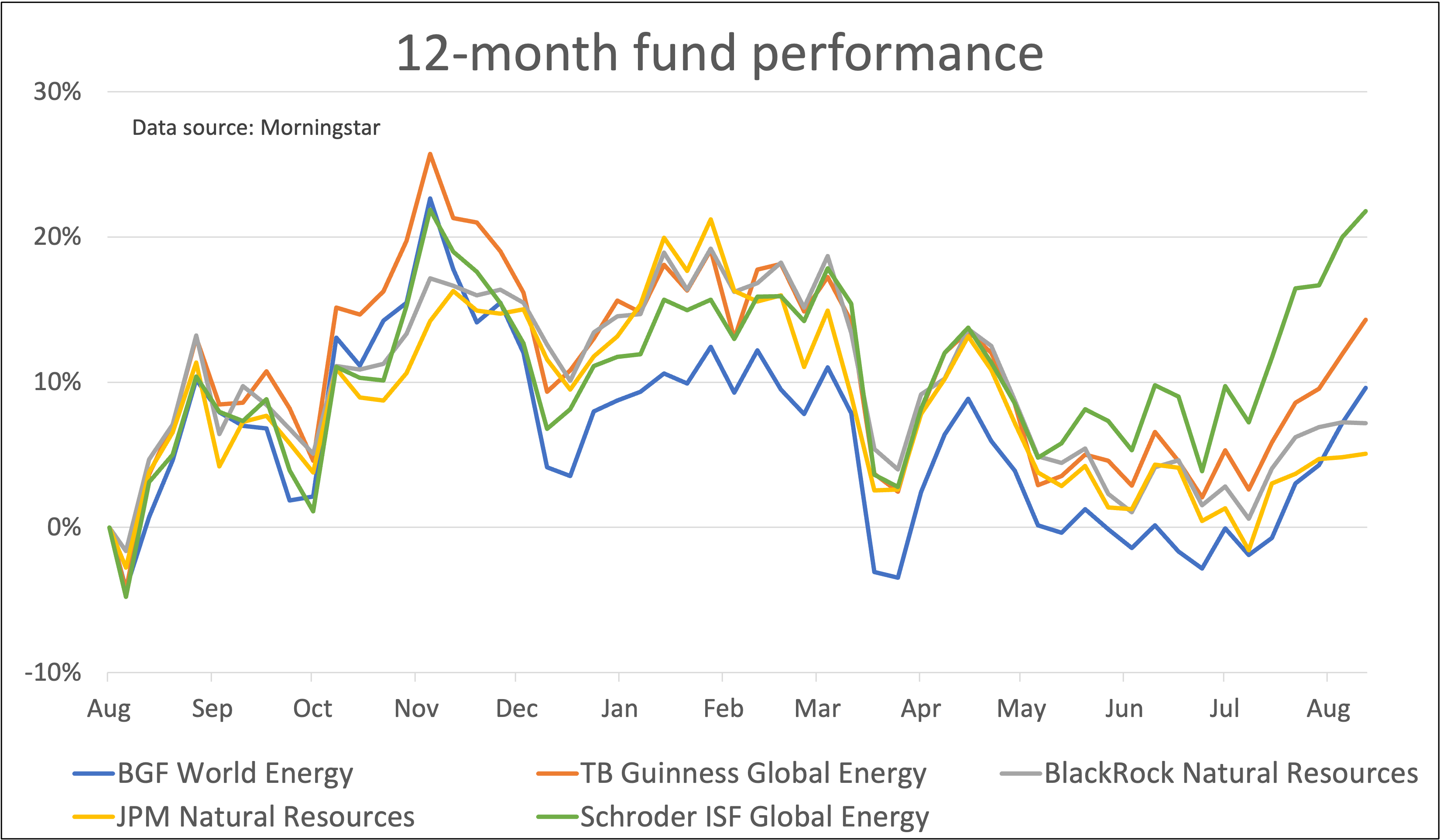

These funds had all been on a winning streak, with significant gains in the first five of the last six six-month periods. It is only in the last six months that they have failed to achieve the 5% target, but the Schroder ISF Global Energy fund got pretty close, up 4.3%. Over the three-year period it has gone up by 184%.

All these funds struggled at the beginning of 2020, as it became increasingly more apparent that the Covid-19 outbreak in China could not be contained. It was clear that it would turn into a worldwide pandemic with severe consequences for the global economy. As countries went into lockdown, factory doors closed, and international travel was banned. Demand for commodities, and oil in particular, fell. However, as the year progressed, these funds started to recover.

In 2021, they did particularly well, going up when most funds were falling. There was an increase in demand for commodities as the world came out of lockdown, and at the same time supply was being hampered by the Russian invasion of Ukraine.

- Why diversification is back – and how to do it properly

- Fund Battle: Vanguard LifeStrategy versus BlackRock MyMap

These funds then maintained their upwards trajectory until June/July 2022. That was when inflation was rising, and in the US had risen to above 9%. Central banks had started to increase interest rates and speculators were concerned that America, and other developed economies, could be heading into a recession. Demand for energy and natural resources would not be as strong as previously thought, investors decided.

In July last year, Andrew Bailey, governor of the Bank of England, said that he expected the UK to go into recession in the last quarter of 2022 and for it to continue throughout 2023. Fortunately, that was not the case. In the US, the situation is even better. Inflation has dropped to around 3%, and although interest rates are up at a 22-year high, there has not been a significant reduction in consumer spending or employment levels.

- Seven funds protecting capital and making hay when markets rise

- DIY Investor Diary: how I invest to preserve wealth

Energy funds rebounded and went on to set new highs in November 2022. In part because the general consensus was that if there was a recession it would be shorter and less severe than was once feared, but also because OPEC+ reduced its global oil output by around two million barrels per day.

Since then, the performance of these funds has been more lacklustre, which is why their latest six-month figures have been disappointing, but they have picked up again in the last few weeks.

Past performance is not a guide to future performance.

We might see another surge if the recovery in China strengthens, but that is a big “if”.

The recent upturn is probably more to do with concerns over oil supply as investors worry about production cuts from OPEC and Russia.

We benefited from holding these funds in our demonstration portfolios as they recovered after the Covid-19 pandemic, but are now waiting to see if they will reach new highs before investing again.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.