Why this could be the start of a ‘quality’ rally, and three trusts to play it

21st July 2023 14:02

Kepler Trust Intelligence explains why it thinks interest rates won’t be higher for longer, which would benefit this style of investing.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

In my first job in the industry, I remember coming back from an interview and scoffing at Nick Train referring to his companies as ‘high quality’ – it seemed like a pretty arrogant boast. It was (patiently) explained to me that ‘quality’ had a particular meaning when it comes to equity investing.

- Invest with ii: Buy Investment Trusts | Top UK Shares | Open a Trading Account

It can still seem a pretty nebulous term though, so for the sake of readers who aren’t clear what it refers to, let’s consider the MSCI definition. MSCI Quality Indices look at Return on Equity, Debt to Equity, and Earnings Variability. These are calculated for index constituents, and then Z-scores are calculated, which place each constituent in relation to the mean. The quality score is an average of these three scores. MSCI select the highest-scoring companies for their indices, subject to some tedious rules intended to ensure concentration, market capitalisation, and the number of constituents are appropriate. Like all quant systems, past data is used, and in this case, it means past 12-month data for the first two metrics and the standard deviation of five-year numbers for earnings variability. These three basic metrics definitely coincide with what active managers tell us they look for, with plenty of individual nuances.

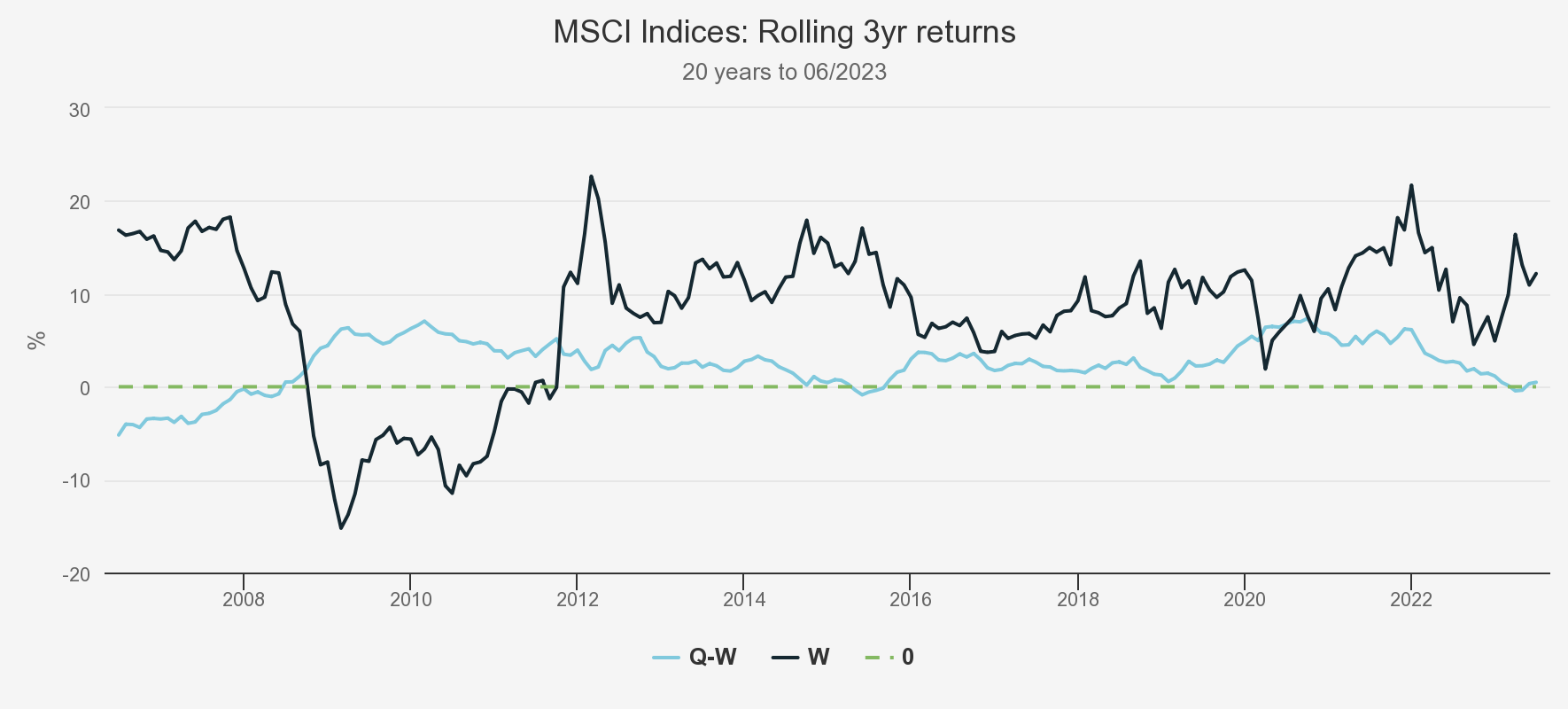

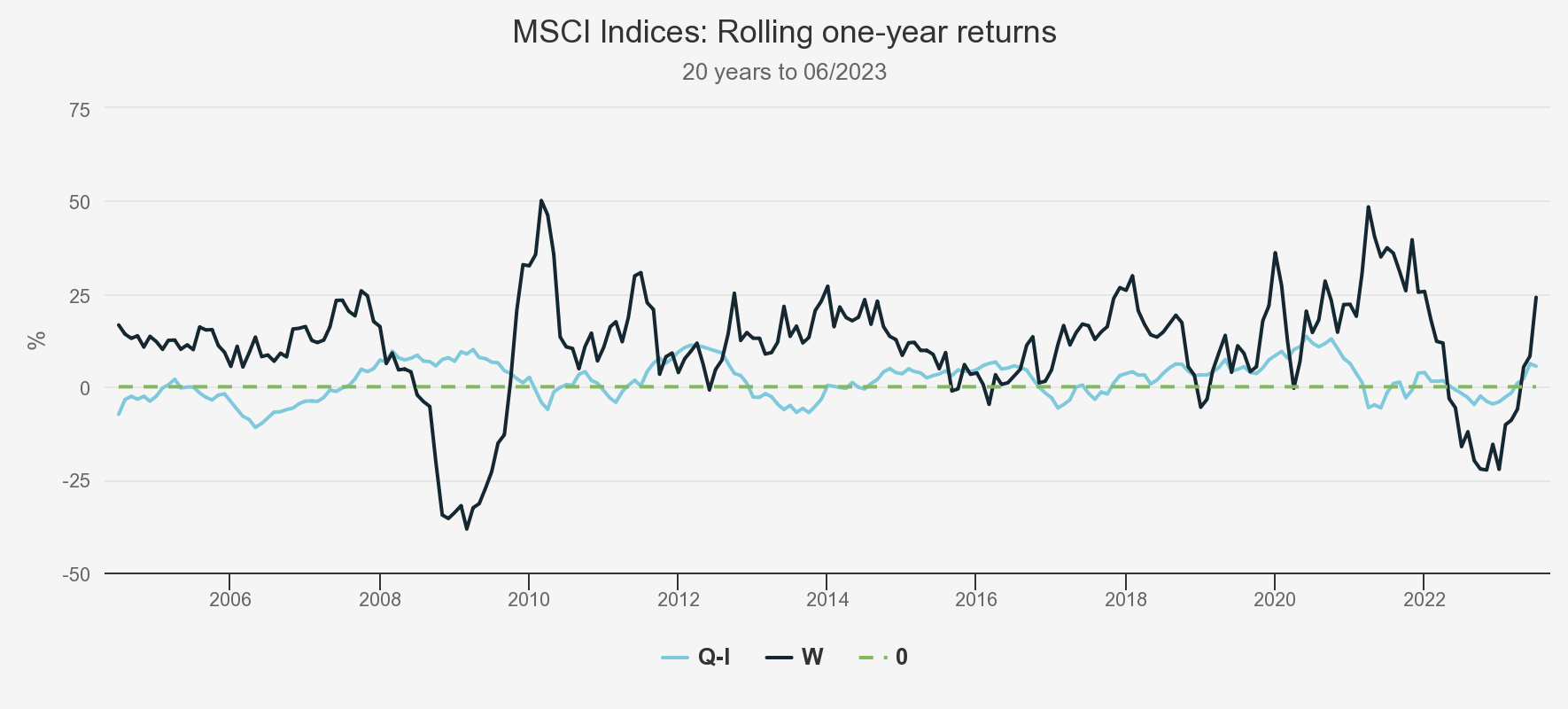

Looking back over the past 20 years, if you could have invested passively in this index (you couldn’t have, iShares launched its ETF in 2014) you would have done pretty well. On a one-year basis, if you had invested in the MSCI World Quality Index rather than the MSCI World Index, you would have been ahead 62% of the time (calculated monthly). Over a three-year basis, returns have been even better: the quality index outperformed in 85% of three-year periods. The chart below shows rolling three-year returns to the world index alongside the three-year outperformance of the quality index versus the world index.

THREE-YEAR RETURNS

Source: Morningstar. Past performance is not a reliable indicator of future results

The declining three-year outperformance since 2020 (the falling blue line) reflects weak performance for quality strategies since then. In the one-year rolling chart below, it is evident that quality has lost money versus the index for most periods since the start of 2021. What immediately jumps out though, is the sharp outperformance seen in recent months. We will park that thought and return to it later.

ONE-YEAR RETURNS

Source: Morningstar. Past performance is not a reliable indicator of future results

Historically we would note a few things from the above charts. Quality did very well on a relative basis in the aftermath of the 2007-08 crash, which might interest investors who think we are currently in the next big crisis. Quality outperformed when the market was falling, and then underperformed in the recovery. The same pattern can be seen in 2020, and indeed in 2011 when the Eurozone crisis saw global markets fall and quality outperform, only to underperform in the better markets of 2012 and 2013.

All this seems to be out of kilter with what we have seen in 2023. This year, quality has outperformed as the global index has rallied. To explain this, we need to look at how the index has changed in recent years. Remember, the quality index is sector- and country-agnostic: MSCI picks the highest scoring companies for quality, wherever they are and in whatever sector. Over the last ten years, there has been a dramatic increase in the weighting to the US, with 72.2% of the quality index in that country compared to 61.6% 10 years ago. This makes it even more geographically concentrated than the MSCI World Index, where the US makes up 69.4%.

Even more significantly, the quality index is now heavily tilted towards technology. NVIDIA Corp (NASDAQ:NVDA) is in the largest position in the MSCI World Quality Index, just ahead of Apple Inc (NASDAQ:AAPL). Together they make up 10.5% of the index. Microsoft Corp (NASDAQ:MSFT), Meta (NASDAQ:META), Alphabet (NASDAQ:GOOGL) and ASML (EURONEXT:ASML) are also top 10 holdings, and these six companies together make up 19% of the index. All but Apple have a greater weighting in the quality index than the market cap-weighted index, and the basket is responsible for over 500bps of active weight (see table below). Nvidia in particular has rocketed away this year on the rage for AI, and other tech stocks have been dragged up with it. The information technology allocation in the quality index has more than doubled to 24% over the past decade, and that doesn’t even include many of the large tech-related stocks which are often correlated to the same trades. Ultimately, this is the main reason for the dramatic uptick in performance for the quality index this year.

TOP 10 HOLDINGS

| HOLDING | COUNTRY | INDEX WEIGHT (%) | GLOBAL INDEX WEIGHT (%) | SECTOR |

| Nvidia | US | 5.30 | 1.84 | Info tech |

| Apple | US | 5.25 | 5.40 | Info tech |

| Microsoft | US | 5.07 | 4.24 | Info tech |

| Meta Platforms | US | 3.25 | 1.12 | Comm Services |

| Visa | US | 2.75 | 0.68 | Financials |

| Lilly (Eli) & Company | US | 2.49 | 0.67 | Healthcare |

| Alphabet | US | 2.42 | 1.26 | Comm Services |

| Johnson & Johnson | US | 2.42 | 0.76 | Healthcare |

| UnitedHealth Group | US | 2.32 | 0.79 | Healthcare |

| ASML | NL | 2.23 | 0.51 | Info tech |

| TOTAL | 33.5 | 17.27 |

Source: MSCI, as at 30/06/2023

This also explains why some quality growth managers haven’t done as well as the quality index in relative terms: they haven’t all been invested in US tech. In fact, if we look at the regional indices, the difference between the recent performance of quality in the US and elsewhere is stark. Since October 2022, quality has underperformed in Japan and Europe, and is flat against the index in the UK. In the US, it has delivered almost 1000bps of outperformance.

Bear case

Is this really a quality rally then? It’s important to remember when analysing factors that there will always be an answer to which factor is outperforming even if there is no causal connection. We can build an index any way we want, and historical patterns will emerge, but it doesn’t mean that the factor is driving returns rather than simply a data artefact. Should we be interpreting this uptick as a by-product of a rally in large cap, US tech?

Back in May 2021, an esteemed former colleague foresaw the underperformance of quality we have since experienced. Briefly, one of his key arguments was that for various reasons, decadal trends towards bigger companies, increased concentration, and economies of scale were reversing, thanks largely to geopolitical shifts which were seeing a reversal of globalisation and an increasing animosity in the West towards the international arbitrage of labour. A key element in this reversal is the relationship between the US and China, which has been shifting from frenemies to outright confrontation.

Two years, on, we would argue that we can see that deglobalisation is so far something very different. The unmooring of China from the global wharf is very real, but we have seen a shift in manufacturing and FDI to Vietnam, Mexico, Indonesia, and others. We have seen the emergence of a US-led bloc, but most countries are retaining a studied neutrality between the US and China, and benefitting from investment by both. There definitely has been reshoring, with the US seeing a record number of jobs brought back in 2022 (according to numbers compiled by The Reshoring Initiative), boosted by the Inflation Reduction Act’s protectionist approach to EVs. There does seem to be more scepticism in the West towards free trade and a shift in power back from capital to labour. But de-globalisation seems to be an exaggeration. Importantly, the quality index is heavy in US companies which are largely not restricted from operating globally, and in the case of US tech companies have prime positions in industries with high margins as well as earnings growth potential in upgrades and new lines of business. It may get harder for Chinese companies to operate in the US, but is it going to get harder for US companies to operate in Europe? Will shifting manufacturing from China to Vietnam and India lead to a marked drop in profitability for Apple and its competitors, or just some extra one-off costs? We are not convinced.

Another line of argument referred to in our previous note rests on what an inflationary environment means for quality, particularly in contrast to value. We would argue the 2007/2008 crash was deflationary, as was the Eurozone crisis, and the sudden stop to economic activity caused by the 2020 lockdowns. Our current moment is clearly inflationary – could this cause quality to perform differently? Well, we can argue it theoretically. We could point out that quality companies should have greater pricing power and so should be able to protect margins better in an inflationary environment. However, we would rather focus on data. In Q4 2018, we saw an inflationary pulse flow through markets as Trump’s election led to fears of protectionism and inflation. Quality outperformed. Looking back further, in our 2021 note, our data shows value outperformed quality in the 1980s, a period of high, if declining, inflation. Therefore, we don’t think quality outperforming in an inflationary environment is an anomaly.

Rate cycles

What really needs to be explained in recent patterns is what happened in the major sell-off that started in late 2021 and continued through 2022. Why didn’t quality outperform in this crash as it did in the previous ones? It is not explained by the high representation of US tech in the quality index. Looking at the regional quality indices, they all underperformed the market cap-weighted indices during this falling market. This underperformance is a genuine feature of quality globally.

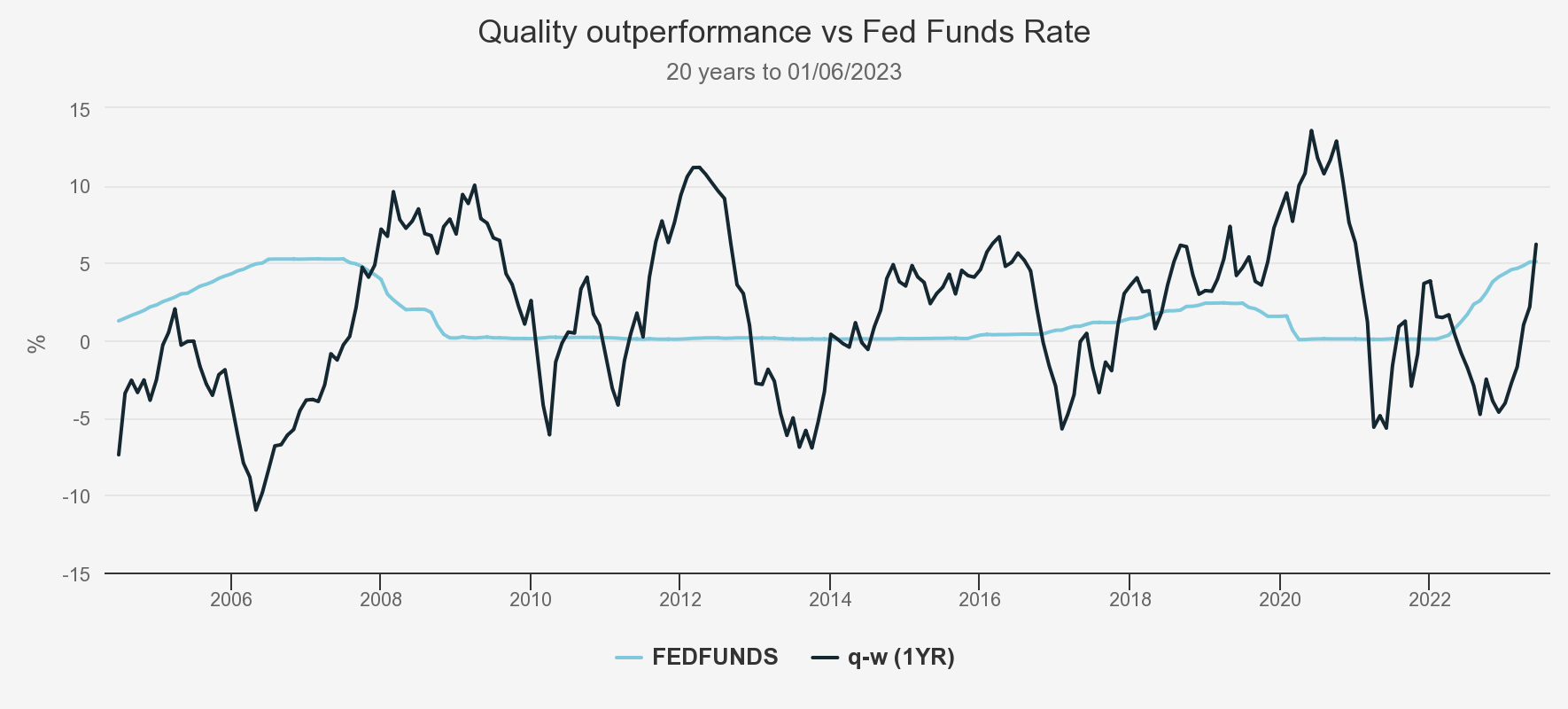

In our view, it is clearly due to the dramatic repricing of assets we have seen following the fastest rate hiking cycle in modern history. The below chart shows the outperformance of quality once more (on a rolling one-year basis) and compares it to US interest rates. Previous rate hiking cycles have been associated with a sell-off in quality versus the market, while rate cuts have led to outperformance. In this light, the outperformance of quality in recent months makes a lot of sense: equity investors are anticipating an end to the rate hiking cycle in the US and indeed rate cuts. According to the Atlanta Fed, the market expects US rates to rise into September and then fall. The dot plot made from the forecasts of the US Federal Reserve board of governors (the people who make the decision) has rates falling in early 2024. So equity markets are merely expressing received wisdom in our view – buying the rumour, you could say. In this light, quality’s underperformance last year makes sense. What we actually saw was a repricing in markets while the economy (in the US, UK, and Europe) remained strong. Despite all the negative headlines, economies grew and unemployment was low.

FED FUNDS RATE VS QUALITY PERFORMANCE

Source: Morningstar, St Louis FRED. Past performance is not a reliable indicator of future results

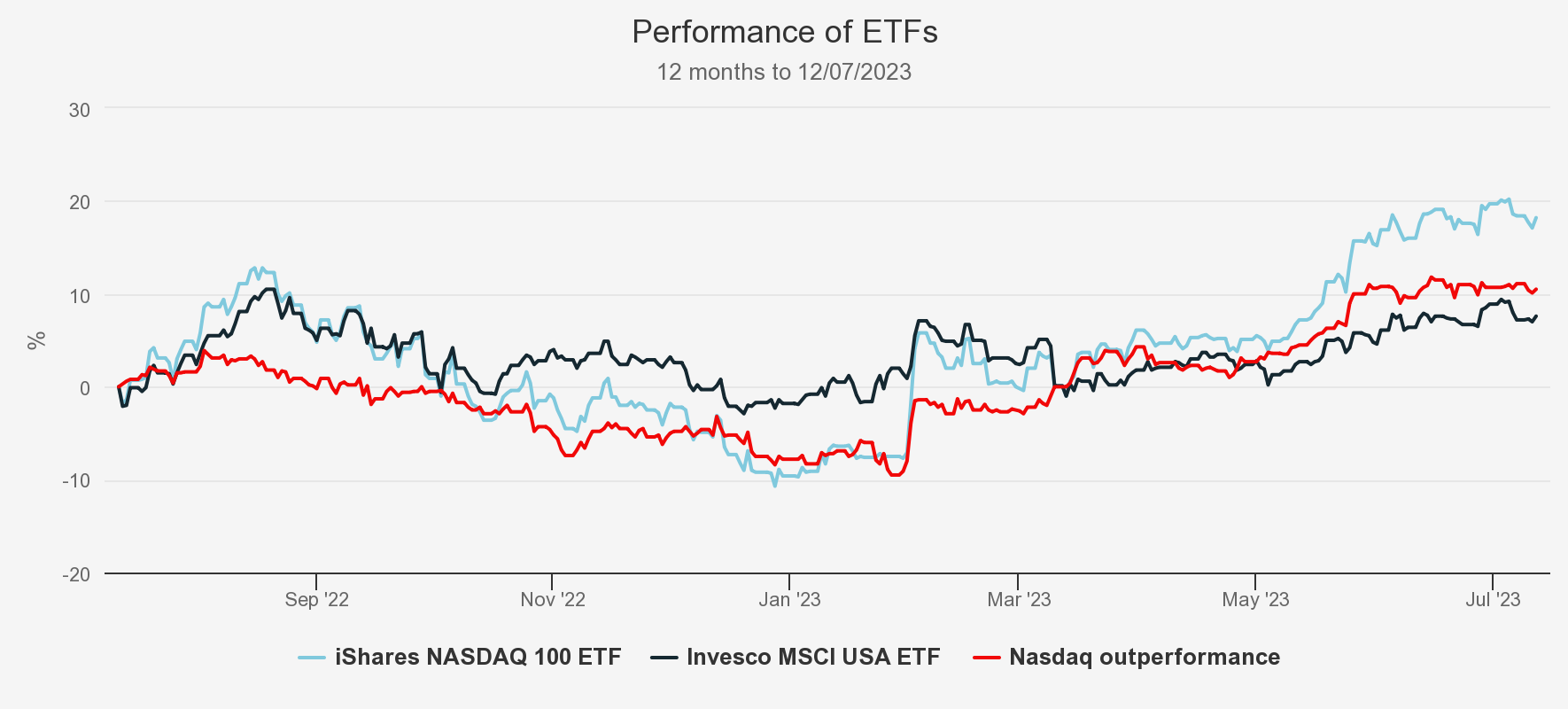

We could view the rally in Nvidia and related names as the market returning to the exuberant excesses that saw penny stocks, bitcoin, NFTs, and other speculative assets surge in 2020 and 2021. It may indeed be the case that Nvidia and some other companies are over-valued – Nvidia’s price-to-sales ratio has gone from 12 to 42.5 since October 2022. However, given the rates dynamic, we are tempted to be optimistic and argue that the current market rally is not an aftershock of recent excesses. Indeed, we would highlight that the outperformance of US large-cap tech began before the emergence of ChatGPT. In fact, it was Q4 2022 when the move began – see the slope of the red line below.

NASDAQ VS S&P 500

Source: Morningstar

For this reason, we are inclined to see it as the market making a move on rate cuts and rewarding steady large-cap companies with strong competitive positions, strong balance sheets, and high earnings growth baked in – many of which can now be found in the tech ecosystem. Nvidia is a side-show in our view.

The history discussed above would suggest if we do get rate cuts, quality will indeed do well once more versus the market, even in a weak overall economic environment. In our view, if this happens the quality rally is likely to last and broaden. This seems most likely to us right now and would be our base case. However, we note the possibility the market has got this wrong. If we see inflation rebound in the US, the American economy weaken, and rate cut expectations pushed out, this may prove to be a false dawn.

How to play a quality rally?

If we are right, then Allianz Technology Trust Ord (LSE:ATT) looks like great value on a 12.7% discount. The NAV has performed well year-to-date, to put it mildly, up over 28% at the time of writing. The shares haven’t kept pace though, perhaps as most investors are sceptical about this rally. If or when that changes, we would expect the discount to close, perhaps rapidly. ATT has large positions in Apple, Nvidia, and Alphabet, but otherwise, a mid-cap bias which could see it do well if the rally broadens.

One way this might happen is if US inflation declines rapidly, bringing hopes of rate cuts in. In fact, last week US Core PCE came in at a shockingly low 2.4%. If this is confirmed to be a real move by future prints, then it massively increases the chance the US will escape without a recession – real wage growth will soon be positive. This could lead to mid and small-caps doing well, and we would highlight Brown Advisory US Smaller Companies Ord (LSE:BASC) in particular. BASC is managed by Chris Berrier with a quality growth strategy. The trust trades on a 16.2% discount at the time of writing, despite a track record of doing very well over the long run.

Quality can be found all over the world and it is not only in strategies focusing on high-growth sectors like tech or small-caps. AVI Japan Opportunity Ord (LSE:AJOT) takes an activist approach to investing in Japanese small-caps. The managers look for companies that are deeply undervalued, and where there is a clear path to unlock that value through corporate action, be that governance changes, dividends, buybacks, or operational changes. Companies that are chosen for the concentrated portfolio need to have high-quality underlying businesses, which the team think can generate attractive earnings growth. The activist approach has generated good returns in recent years in weak markets, but we think the strategy could get an extra impetus if the economic news improves and quality companies are rewarded. The trust trades on a small discount of 1.8% at the time of writing, having traded on a premium for long periods of time in recent years.

Finally, we must acknowledge that we will not have persuaded everyone. Duncan MacInnes and Jasmine Yeo, managers of Ruffer Investment Company (LSE:RICA), argue that inflation is likely to remain higher for longer, and certainly more volatile. They think rates are likely to remain higher for longer as a result, and think growth equities will most likely underperform. RICA performed very well in 2022, but performance has been weaker in 2023. Perhaps for this reason, or perhaps because defensive investors are hiding in cash, the trust is now available on a discount of 3%.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.