Why FTSE 250 index is the place to be now

Over the past three weeks, only one global stock market has done better than the UK mid-cap index. Graeme Evans reveals which stocks are driving the rally.

15th November 2023 16:08

by Graeme Evans from interactive investor

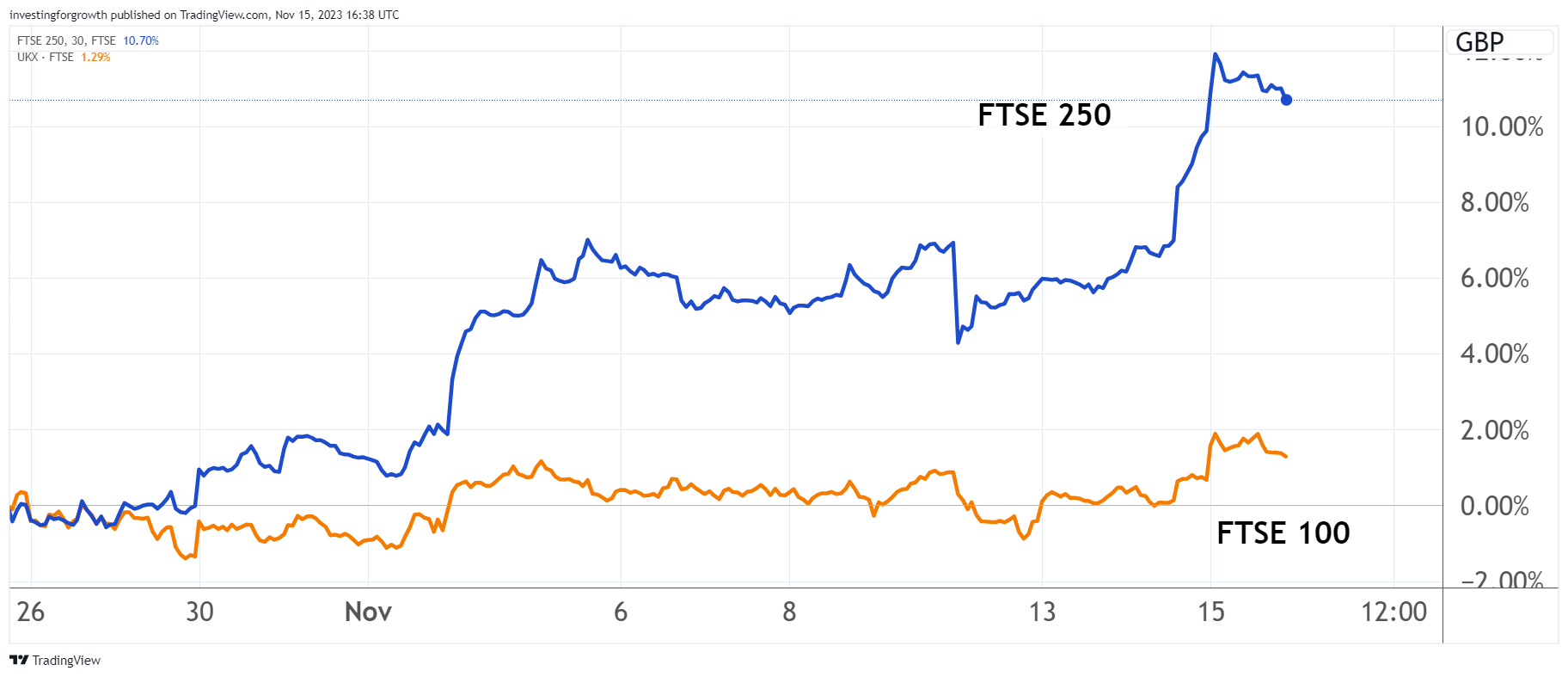

Fresh gains for mid-cap stocks today ensured the FTSE 250 index kept pace with New York’s Nasdaq as the best-performing global benchmark in the current upturn.

Optimism over a potential peak in interest rates has helped the UK-focused index to rebound 12% since 26 October, similar to the record of the technology-focused Nasdaq 100.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

In contrast, the more defensively positioned FTSE 100 index is up by just 2% as the worst major performer bar the two leading benchmarks in Shanghai.

The recovery for the FTSE 250, which follows a period of heavy selling earlier in the autumn, has seen 41 companies jump by a fifth or more in the three weeks up to last night.

They include a large number of rate-sensitive stocks from the heavily sold property and house-building sectors, with shopping centre owner Hammerson (LSE:HMSO) up 33%, British Land (LSE:BLND) 24% higher and Crest Nicholson (LSE:CRST) up 27%.

Persimmon (LSE:PSN) has jumped by 30% and is now worth close to £4 billion as the York-based builder bids to win back its place in the FTSE 100 index in next month’s reshuffle.

- World’s biggest dividend stocks in Q3 2023

- Jeff Prestridge: cash is king but equities will prevail

- ii view: income play British Land optimistic on outlook

The shares, which traded at 3,000p in 2021, went below the 1,000p threshold for the first time in a decade earlier this summer but today stood at 1,245p as hopes grow that the squeeze on mortgage affordability will not get any worse.

The best performer in the period has been OSB Group (LSE:OSB) as the buy-to-let and retail savings business continues its recovery from a profit warning in July. The shares are up 41% since 26 October and by 15% since Friday after recent results included upgraded loan book guidance.

Other popular stocks up by a fifth or more over the three weeks include Trainline (LSE:TRN), Safestore Holdings (LSE:SAFE) and Watches of Switzerland Group (LSE:WOSG).

Today’s performance saw the FTSE 250 add another 180.38 points to its highest level since mid-September at 18,716.51. It follows yesterday’s best session since mid-July as the mid-cap benchmark jumped by 3.5% in contrast to just 0.2% for the FTSE 100 index.

Source: TradingView. Past performance is not a guide to future performance.

Inflation figures on both sides of the Atlantic have fuelled speculation that further rate rises are no longer on the cards, with Deutsche Bank today reporting that Wall Street is now pricing an 86% chance of a cut by US policymakers by May.

- Four ways to beat the market

- Inflation eases to 4.6% - what this means for your savings and borrowings

- ii view: Watches of Switzerland details ambitious growth plan

Such bets meant America’s small-cap focused Russell 2000 jumped 5.4% last night in its best session in over a year. It remains down 10.2% since July, however, as investors worry about a shorter debt maturity schedule than larger companies.

In today’s London session, the improvement in risk appetite helped Aston Martin Lagonda (LSE:AML) to jump 10p to 225.2p and heavily sold National Express owner Mobico Group (LSE:MCG) to lift 3p to 68.15p. The coach operator recently shocked shareholders by suspending dividend payments and warning its profits recovery is taking longer than expected.

Genuit Group (LSE:GEN) shares posted the biggest rise in the FTSE 250, up 24p to 316p as the former Polypipe business reported robust demand in its drainage, storm water and ventilation markets. This means annual operating profits will be marginally ahead of City expectations.

Broker Peel Hunt said Genuit was delivering well against a tough backdrop: “Markets are challenging but the diversified nature of the business is limiting the scale of volume declines.

“At the same time, the price/cost dynamic is improving and cost continues to be taken out of the business, allowing the group to make progress against its strategic objectives.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.