Why a poor August points to a September rally for funds

Saltydog Investor recaps a difficult month for fund investors, but finds reasons to be cheerful as Autumn begins.

4th September 2023 14:27

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Nearly all UK domiciled funds are assigned to one of the Investment Association sectors.

There are now more than 50 sectors, but the Investment Association do not provide average return data for a few of them because the fund objectives and strategies can vary so widely, such as Targeted Absolute Returns. A couple of years ago they also split the Global Bond sector into 14 new sectors, mainly to incorporate exchange-traded funds (ETFs). Most of these sectors only contain a handful of funds (unit trusts and OEICs) so at Saltydog we still combine all of the non-UK bond sectors to create our ‘Global and Global Emerging Market Bond’ sector.

- Invest with ii: Top ISA Funds | Top Junior ISA Funds | Open a Stocks & Shares ISA

This means that we end up reporting on 35 sectors.

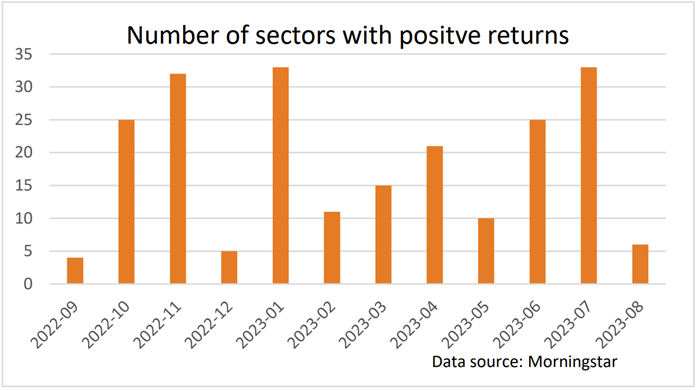

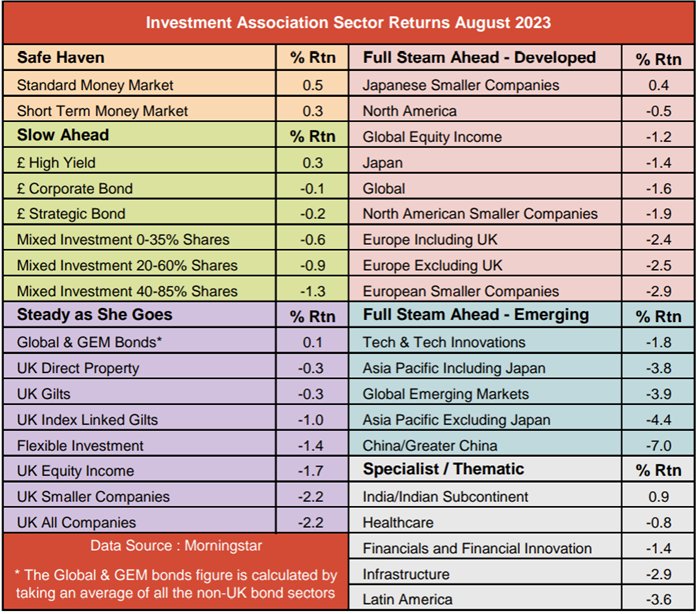

In July 33 sectors made gains, up from 25 the month before. Unfortunately, only six sectors rose in August, making it the worst month so far this year.

The top performing sector last month was “India/Indian Subcontinent” with a one-month return of 0.9%. It is also one of the few sectors that has gone up in each of the last four months.

Last week I wrote about the Jupiter India fund which is now one of the holdings in our Ocean Liner portfolio.

The next best sector in August was ‘Standard Money Market’, up 0.5%, followed by ‘Japanese Smaller Companies’, up 0.4%, and then ‘Short Term Money Market’ and ‘£ High Yield’, which both rose by 0.3%.

- Terry Smith sells share he flagged as “concerning”

- The fund that’s caught our eye in this rising market

We currently hold three funds from the money market sectors. They are the Royal London Short Term Money Market Fund, abrdn Sterling Money Market, and the L&G Cash Trust fund. The returns from these funds have been increasing as interest rates have been rising. For example, last September the Royal London Short Term Money Market Fund went up by just 0.15%, but last month it went rose by 0.52%. If it keeps on going at its current rate, then that works out at an annual return of over 6%.

The only other sector that went up in August was our combined ‘Global and Global Emerging Market Bonds’ sector.

The worst performing sector was China/Greater China with a one-month loss of 7%.

The last couple of times that the number of sectors making one-month gains has dropped into single figures, there has been a strong recovery the following month. Fingers crossed for a good September.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.