Wild’s Winter Portfolios 2020: we beat the market

Left behind by a broad rally in November, this year’s portfolios narrowed the gap last month.

8th January 2021 15:32

by Lee Wild from interactive investor

Left behind by a broad rally in November, this year’s portfolios narrowed the gap last month.

Investors remain stuck on a stock market rollercoaster with more stomach-churning twists and turns than any amusement park ride. A pandemic crash, rapid recovery, then a pause followed by a sharp dip, and now another steep ascent. What could possibly happen next?

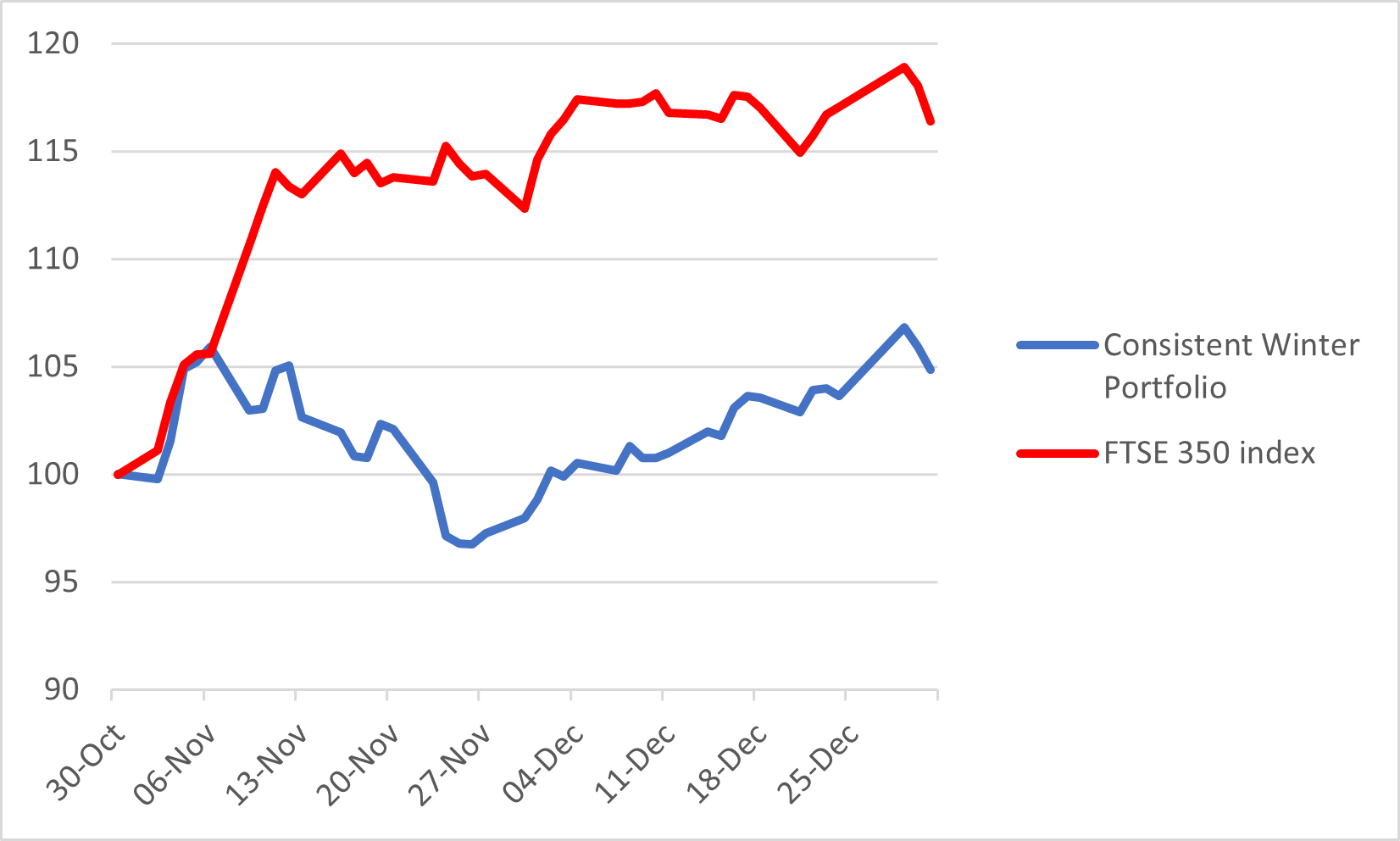

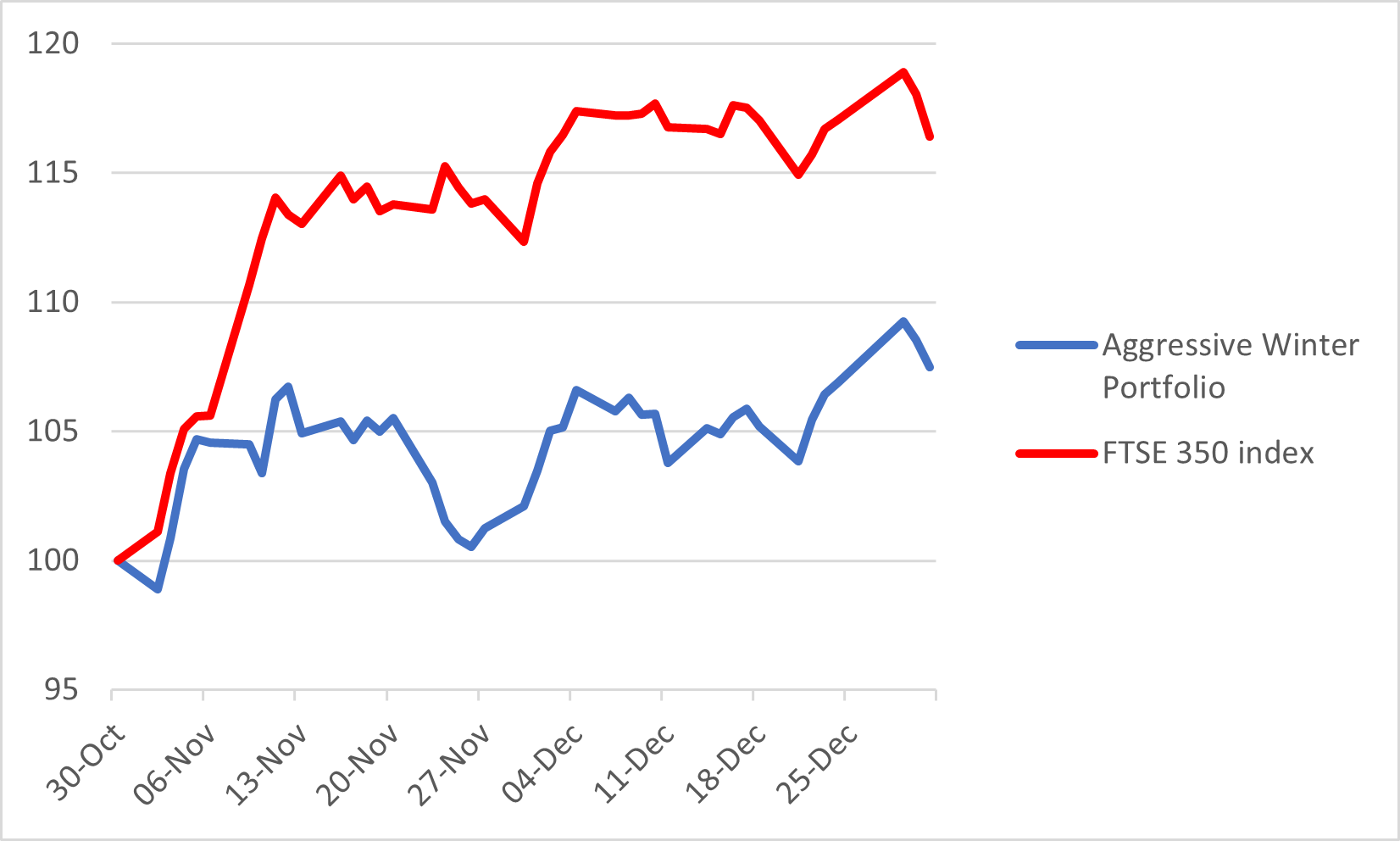

For Wild’s Winter Portfolios, the final month of a truly horrible 2020 was blessed with success. Both the consistent and aggressive baskets of shares rose sharply, outperforming the FTSE 350 benchmark index.

That was welcome relief, having lagged the wider market from 9 November when Pfizer announced its Covid vaccine. That sparked a rush into cheap stocks hit hard by the pandemic, leaving quality stocks that make up Wild’s portfolios behind.

December was a catch-up month, with the consistent portfolio up 7% and the higher-risk aggressive portfolio up 5.3%. That leaves the pair up 4.9% and 7.5% respectively this winter. However, they’ve got some way to go to match the FTSE 350. While the benchmark index was up just 3.6% in December, a 12.3% gain in November has it up 16.4% for the first two months of this year’s seasonal strategy.

As always with these portfolios, the primary aim is to return profit. Beating the benchmark comes second, but there are still four months for it to happen.

Wild’s Consistent Winter Portfolio 2020-21

Source: interactive investor. Past performance is not a guide to future performance

Only one of this year’s consistent portfolio stocks posted gains in November, and insurer Admiral (LSE:ADM) rose for a second month in December, adding 1.7% for a combined increase of 5.7%.

But that consistency was put in the shade by double-digit percentage gains for three FTSE 100 stars - London Stock Exchange (LSE:LSE), speciality chemicals firm Croda International (LSE:CRDA) and technology conglomerate Halma (LSE:HLMA). That was enough to recoup first-month losses and leave the trio up 8.8%, 9.3% and 3.4% since the end of October.

Portfolio debutant Safestore (LSE:SAFE) remains the only laggard. The self-storage provider appears in both this year’s portfolio, given it has risen in each of the past 10 winters and returned an average of 20.5% each time. But it is currently lacking a catalyst to trigger upside. Might full-year results, pencilled in for 14 January, reignite interest in the shares? CEO was Frederic Vecchioli was optimistic when he last reported in November.

Wild’s Aggressive Winter Portfolio 2020-21

Source: interactive investor. Past performance is not a guide to future performance

Every constituent in the aggressive portfolio had a positive month, but it was London Stock Exchange that stood out. Up 11.1% in November, it enjoyed a resurgence in buying in the run up to Christmas. Among those splashing out on shares in the stock exchange and financial information provider was chairman Dominic Blakemore. He spent £80,000 on LSE stock at 8,620p.

After a strong first month, latex gloves firm Synthomer (LSE:SYNT) and precision instrumentation company Spectris (LSE:SXS) continued to surge. Caroline Johnstone, chair at the former, splashed out £49,000 on shares, while Spectris sold two businesses for almost £300 million. Since this year’s winter portfolios launched, the pair are up 19% and 14% respectively.

Technical products and services company Diploma (LSE:DPLM) has disappointed with its contribution so far this season. However, the shares have a great track record of positive winter returns, but never move up in a straight line. A 3.4% gain in December is encouraging.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.