Wild’s Winter Portfolios 2021: a month to forget

9th March 2022 14:33

by Lee Wild from interactive investor

Just as the world emerges from a pandemic, an horrific conflict in Ukraine is causing further human suffering. As well as extreme health and social consequences, there is of course an economic cost.

War has colossal humanitarian consequences, but as well as extreme health and social consequences, the scale of conflict in Ukraine will also have severe economic repercussions.

We’re told of a likely impact on access to fertilisers and essential foods such as wheat, and the price of oil has rocketed amid a ban on Russian oil.

Already there are shortages as the emergence from a pandemic triggered a boom in demand which supply has been unable to keep up with. Inflation has hit multi-decade highs but could go even higher and possibly for longer, turbo-charged by new disruption, triggering more rapid rises in interest rates.

Higher rates had already caused panic among investors in growth stocks, and events of the past few weeks have only heightened concerns. This has direct consequences for both the consistent and aggressive winter portfolios.

These are not defensive portfolios. They rely heavily on growth. When the market does well, these two baskets of shares typically do better. When markets fall, the winter portfolios do too. Risk is exaggerated because these are concentrated portfolios, each one made up of just five different stocks and limited cross-sector diversification.

Performance data for both portfolios includes only three days of trading in February following the Russian invasion. The full impact will be evident in numbers for March. But stocks on historically generous ratings – and there were many – had already been sold off. The conflict extended the rout.

- Wild’s Winter Portfolios 2021: winners revealed

- 10 shares to give you a £10,000 annual income in 2022

- Six speculative UK share ideas for 2022

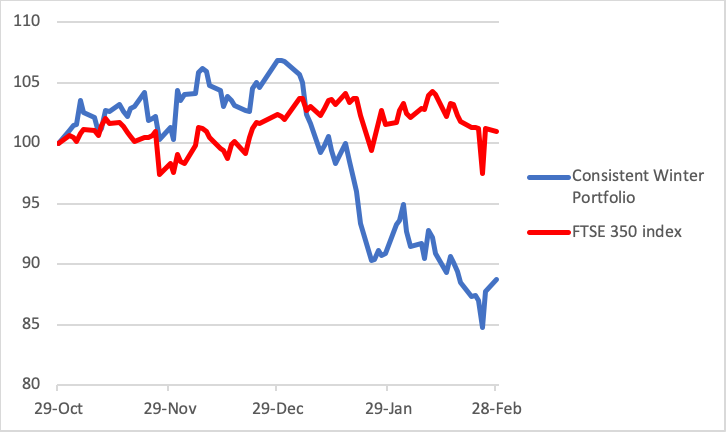

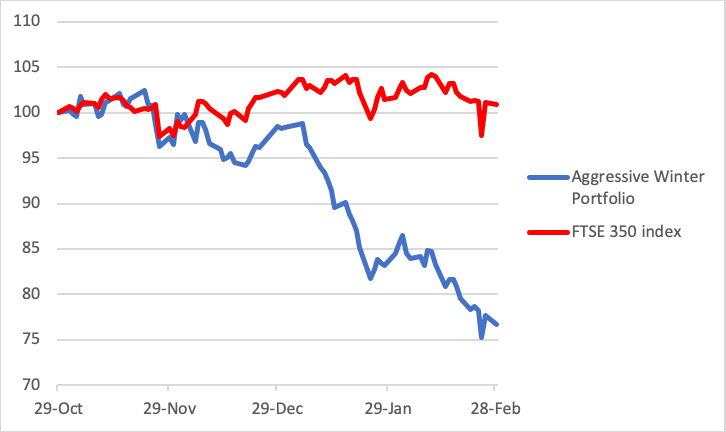

The Consistent Winter Portfolio fell 4.9% in February, taking losses for the first four months of the seasonal strategy to 11.3%. The Aggressive Winter Portfolio was down 9.3% last month and is now 23.3% lower so far this winter.

The FTSE 350 benchmark index was helped by the presence of commodities companies like oil and mining stocks where share prices, which had already risen significantly in 2022, have surged again since Russia invaded Ukraine. It fell just 0.7% in February and was actually 1% better between the end of October and end of February.

To put into some kind of context, the AIM All-Share was down 15% over the same period, the Nasdaq tech index more than 11% and the FTSE 250 almost 9%. The FTSE 100 was up 3%.

Consistent Winter Portfolio 2021-22

Source: interactive investor. Past performance is not a guide to future performance.

A 6.7% decline at Liontrust Asset Management (LSE:LIO) wasn’t the worst performance in February, but the asset manager’s 30% drop this winter is as bad as it gets for these portfolios. Rising inflation and the prospect of much higher interest rates has made risk assets like equities less attractive. That decline in value is reflected in the asset manager’s share price.

Power adapters maker XP Power (LSE:XPP) was February’s worst performer, losing 10.7% in the month. The shares have failed to impress this winter and are now down 17%. There was obvious weakness in the run up to annual results published on 1 March. Despite highlights in the numbers, investors focused on supply chain, component shortages and inflationary pressures, weaker profit and the planned departure of long-serving chairman James Peters.

- Shares, funds and trusts for your ISA in 2022

- Subscribe for free to the ii YouTube channel for our latest share tips and fund manager interviews

Technology conglomerate Halma (LSE:HLMA) has plenty of defensive qualities, but high demand over the past few years has swelled the valuation, making it vulnerable to profit-taking and any broader sell-off.

Insurer Admiral (LSE:ADM) had fully justified ousting former winter portfolio star Croda International (LSE:CRDA) and, despite a 5.3% decline last month, was still way ahead of the wider market.

Finishing off on a positive note, self-storage firm Safestore (LSE:SAFE) actually rose 0.6% in Feb, taking gains for this winter to 5.9%. Shares retreated following first-quarter results published mid month but rebounded later.

Aggressive Winter Portfolio 2021-22

Source: interactive investor. Past performance is not a guide to future performance.

The aggressive portfolio, which also includes Liontrust and Safestore, has proved why it is the higher risk option. There are some big fallers here, and not necessarily because of the Ukraine conflict.

Synthomer (LSE:SYNT) announced the $1 billion acquisition of the adhesive resins business of Eastman Chemical Company before the winter portfolios began, but its historic performance meant it had to go in. This acquisition has risks, and sentiment was already weak. Now, there are concerns about the market for Nitrile Butadiene Rubber (NBR), a key driver of Synthomer’s profit. A trading update ahead of this month’s annual results implies downgrades to forecasts for 2022. A 21% drop last month means the shares have lost 43% this winter.

Precision instrumentation company Spectris (LSE:SXS) fell 16.6% in one month, not helped by news it had made a £1.8 billion takeover offer for Oxford Instruments. Uncertainty caused by Russia’s invasion of Ukraine has now convinced the £3 billion firm to abandon the idea.

It’s been a hard 2022 for Hill & Smith (LSE:HILS) so far. The company, which makes motorway barriers among other things, lost down 5.6% in February. Annual results are scheduled for Thursday 10 March.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.