Wild’s Winter Portfolios 2022-23: outperforming stock markets by 200%

10th March 2023 09:56

by Lee Wild from interactive investor

One of our winter portfolios has returned three times more than the UK stock market over just four months. The other is also streets head. Lee Wild runs through the winning stocks.

Stock markets in the UK and Europe continued their strong start to 2023 with further gains in February, although the pace of growth was more modest. However, our pair of winter portfolios continued to significantly outperform, stretching their lead over the wider market and their benchmark index.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

Inflation remains an issue globally, and investors remain nervous about just how far central banks will be forced to raise interest rates before costs are back under control. It’s why professionals in the Square Mile and on Wall Street are watching every piece of economic data like hawks, which makes for some volatile trading.

Although talk of recession has subsided recently, it remains a possibility, and while there are signs conditions are improving, there are also indicators which point to future weakness for stocks.

However, for now the rally which began mid-October remains intact, certainly in the UK where the FTSE 100 set a record high in February and broke above 8,000 for the first time. Only the French and German markets did better. All the major US indices lost ground last month.

Outperformance by UK stocks is reflected in Wild’s Winter Portfolio, which this year include some of the market’s star performers.

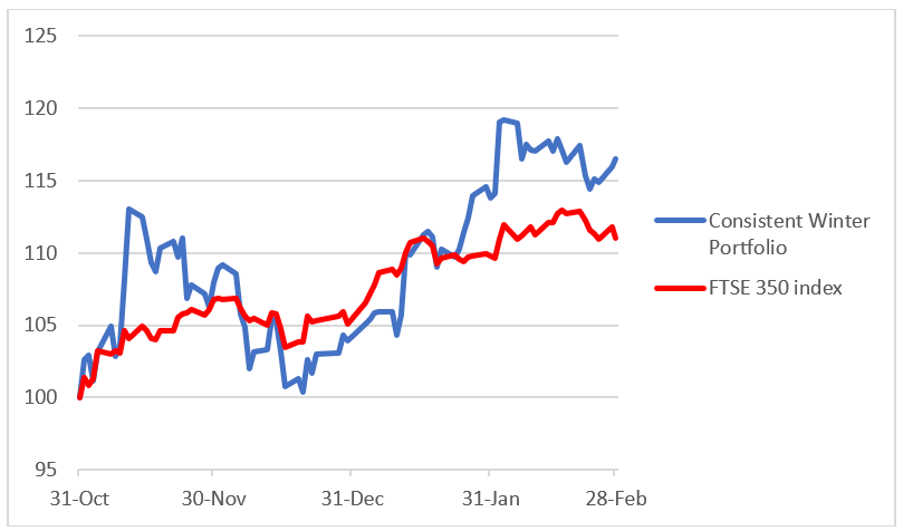

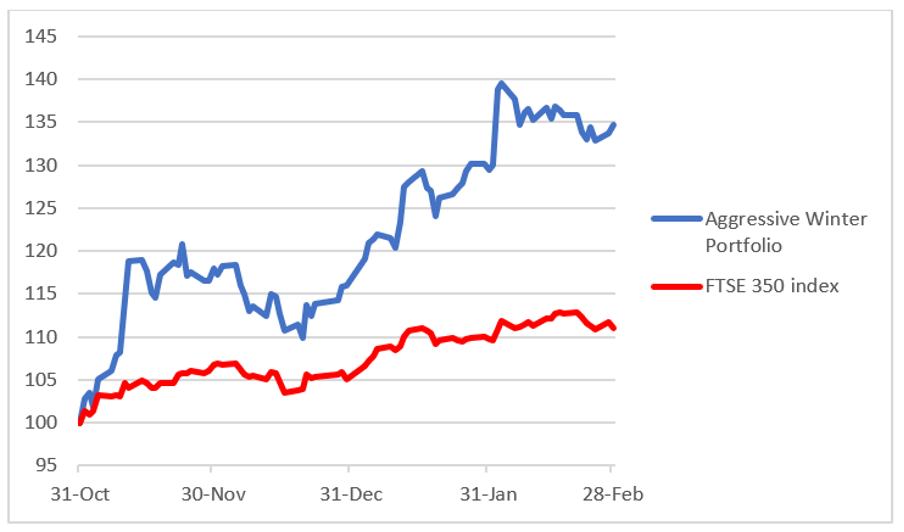

In February, the consistent basket of five shares rose by 2.4%, extending its price return over the four months of this six-month strategy to 16.5%. The aggressive portfolio, which carries greater risk due to a slight relaxation of entry rules, jumped another 4% and is now up 34.7% since launch at the end of October. It had been even higher, up almost 40% at the beginning of Feb. The FTSE 350 benchmark index added 1.2% last month, giving it a winter profit so far of 11.1%.

Wild’s Consistent Winter Portfolio 2022-2023

Past performance is not a guide to future performance.

If you’d told me at the start of this winter season that Hilton Food Group (LSE:HFG) would be one of the best performing stocks, I’d have raised an eyebrow. It was included in Wild’s Winter Portfolios this year because they are data driven, based on performance over the past 10 winters, and Hilton has risen in nine of them, returning an average of 14.6%. But it issued a profits warning in September and another again in November. However, an 18.9% surge in the share price in January after a trading update has been followed by an 8.3% advance in February. The food packaging firm is now up 17.5% so far this winter.

Liontrust Asset Management (LSE:LIO) kept moving in the right direction too, building on stellar gains already this season. A 3.1% jump in February was only slightly less than the gain in January and means the asset manager is now up 39.8% this winter.

Elsewhere, self-storage company Safestore (LSE:SAFE) added another 0.7% to sit up over 12% over the past four months. That’s despite a lukewarm reaction to a first-quarter trading update which showed slower growth than some in the City had hoped for.

- 10 shares to give you a £10,000 annual income in 2023

- FTSE 100 at 8,000: the 25 stocks and 10 sectors responsible

London Stock Exchange (LSE:LSEG) has been this winter’s big disappointment and is the only one of the seven constituents across both portfolios still in negative territory since launch. It added 0.4% in February but is still down 1.8% since the end of October. The share price had been up over 4% mid-month before drifted lower to finish the month pretty much where it had started. There were clearly nerves ahead of annual results published on 2 March, which proved unfounded as the numbers were decent. There are concerns too about a stock overhang, as major shareholders locked into LSEG stock since the $27 billion acquisition of Refinitiv in 2021 are freed from the lock-in. That could cap upside until those investor’s plans for the shares are known.

Finally, one of January’s star stocks took the wooden spoon last month, following up a 17.6% gain with a 0.6% decline. The benefits of a positive Q3 trading update toward the end of January had clearly worn off, although the shares still ended February with a four-month gain of 14.8%, better than many major stock markets.

Wild’s Aggressive Winter Portfolio 2022-2023

Past performance is not a guide to future performance.

The biggest contributor to the success of this winter’s aggressive portfolio delivered again in February. Starting the month up 67% since the seasonal strategy began at the end of October, JD Sports Fashion (LSE:JD.) shares jumped 11.2%, taking returns to an incredible 85.8%. Despite this huge success, many in the City back the trainers to tracksuits chain to go higher still, arguing that its combination of growth, margins, returns and valuation remains compelling.

After a stellar start to the winter, Investec (LSE:INVP) has quietly gone about it’s business since. But while the shares have paused for breath, they still added 2.6% in February after a 1.2% advance at the beginning of 2023. They’re also up 21.1% this winter and up 24.4% over the past six months compared to a 5.4% gain for the FTSE 100 index.

Safestore, Liontrust and discoverIE Group (LSE:DSCV) appear in both the consistent and aggressive portfolios for 2022-23.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.