Your kids could make it a merry Christmas for this famous stock

Still benefiting from the blockbuster movie of the summer, the tills should keep ringing for this firm in the run up to Christmas. But overseas investing expert Rodney Hobson thinks it’s time to sell one of Hollywood’s biggest names.

15th November 2023 08:38

by Rodney Hobson from interactive investor

Barbie and her boyfriend Ken have reigned in an idealised realm this summer. Warner Bros. Discovery Inc Ordinary Shares - Class A (NASDAQ:WBD), the company that created the film, and Mattel Inc (NASDAQ:MAT), the toymaker that owns the franchise, have to live in the real world.

The film itself turned into the biggest blockbuster that Warner has ever produced, grossing nearly $1.5 billion in global box office takings already. That meant group core earnings of almost $3 billion in the third quarter on revenue just shy of $10 billion, up 2% on the same quarter last year. Another big plus was $2.06 billion free cash flow, which will enable a further substantial reduction in debt.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Alas, the figure that matters most is that the group produced a net loss of $417 million, way down on the $2.3 billion net loss a year ago and less than the $1.24 billion deficit in the second quarter, but a loss nevertheless. Given that Warner reduced total costs by 18% year-on-year, this is rather disappointing.

While Barbie brought home the bacon, two Hollywood strikes have caused further serious disruptions to an industry that was only just recovering from the pandemic shutdowns. Film and television writers have now agreed a three-year contract after a stoppage lasting nearly five months, but an actors’ union is continuing a strike that started in July. The impact of both disputes will run on into 2024.

Unabashed, Warner has decided on a significant expansion of its Studios Leavesden in Hertfordshire, adding 10 new sound stages and 400,000 square feet of production and support space over the next three years.

Warner’s share chart goes back only 19 months, to the merger of Warner Brothers with media and entertainment company Discovery. The peak of $25 was reached in April 2022 but the shares have since dipped below $10 on three separate occasions, including last week.

Source: interactive investor. Past performance is not a guide to future performance.

Toy maker Mattel has also benefited from the success of the Barbie movie, with sales up 7% on the previous year, partly helped by favourable currency changes. Toy vehicles are also going well, up 18% thanks to the Hot Wheels franchise.

The future is a little uncertain, even though the impact of the Barbie movie should continue throughout Christmas and into the New Year. With household budgets in major countries feeling the effects of rising interest rates, Mattel failed to raise its full-year revenue forecast that sales for 2023 will be pretty similar to last year.

However, that view looks to be erring on the side of caution. Christmas is squaring up to be a success, and hard-up parents would rather stand the squeeze themselves than cut back on presents for their demanding children.

- Barbie and Ken movie hype is just the beginning for Mattel

- ii view: cost-conscious Disney cheers profit and subscriber growth

Mattel has a ludicrously high historic price/earnings (PE) ratio of 80 and does not pay a dividend, but it does make a profit and the forward PE is far more realistic, possibly below 20. The impact of Barbie will continue into next year, when the animated series Hot Wheels, Let’s Race will be released on Netflix.

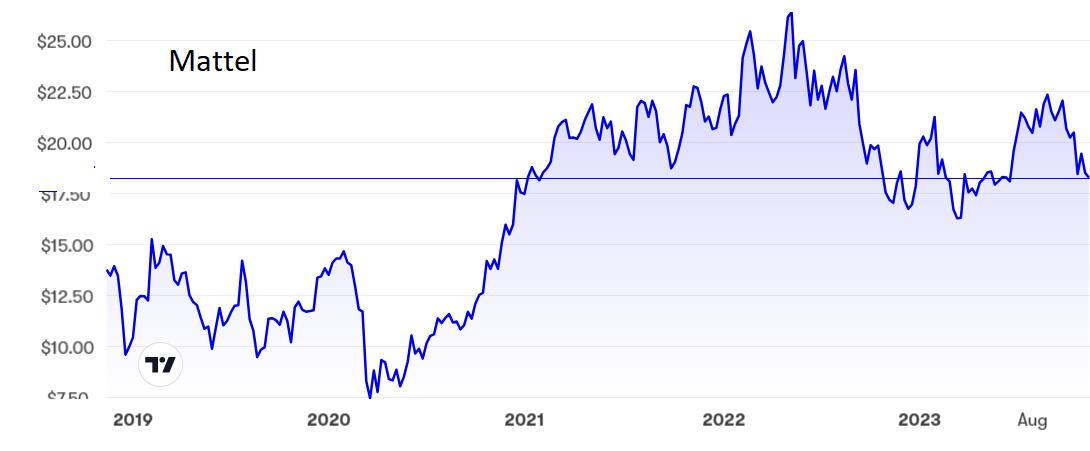

The shares made a solid recovery after the pandemic lows to peak at $26 in May last year, but they have eased back since and were dragged down to $19 by reports of declining sales at rival Hasbro Inc (NASDAQ:HAS).

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Warner is nowhere near out of the woods yet and it will take more than Barbie to work some magic on the results. I cannot in all honesty recommend buying shares in a loss-making company unless there are genuine signs of a turnaround. Bite the bullet and sell.

The downside on Mattel shares looks to be $16 but I do not think that level will be touched again, while the short-term upside is $22.50, which could well be challenged before Christmas is over. I first recommended buying at that price in August last year and again at $21 when the Barbie movie was launched this summer. Although the shares have stagnated disappointingly, I still think they are a buy.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.