Important information: The ii SIPP is for people who want to make their own decisions when investing for retirement. As investment values can go down as well as up, you may end up with a retirement fund that’s worth less than what you invested. Usually, you won’t be able to withdraw your money until age 55 (57 from 2028). Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. Tax treatment depends on your individual circumstances and may be subject to change in the future. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

Every year, thousands of people are transferring their pensions to ii looking for lower charges, greater flexibility and better support.

Many pension providers charge a percentage of your retirement pot, meaning the more you save, the more they take.

Many savers may be paying overly complex, often excessive pension fees. At ii, we’re different. We charge a low, flat monthly fee - meaning your pension pot at retirement could be worth tens of thousands more.

You don’t have to settle on limited investment options. The ii Personal Pension offers a wide range of investment options to help you reach your retirement goals.

But more choice doesn't have to mean more complexity. Our Managed Portfolios, expert picks, and SIPP investment ideas can do the hard work for you.

There’s nothing more frustrating than not getting the help you need.

ii’s award-winning Customer Support team is here when you need it.

Keeping track of your pension is also easy thanks to our straightforward website and secure mobile app.

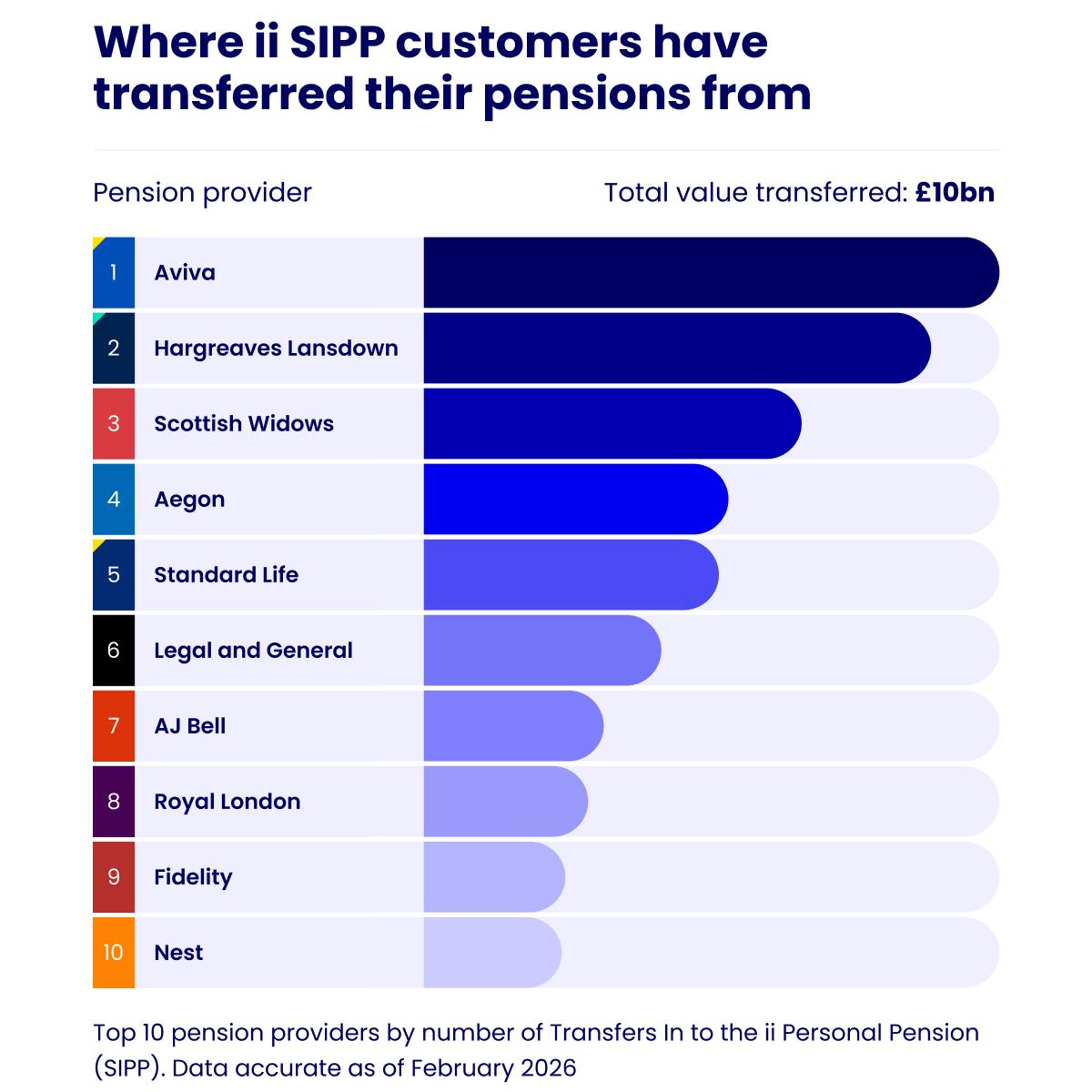

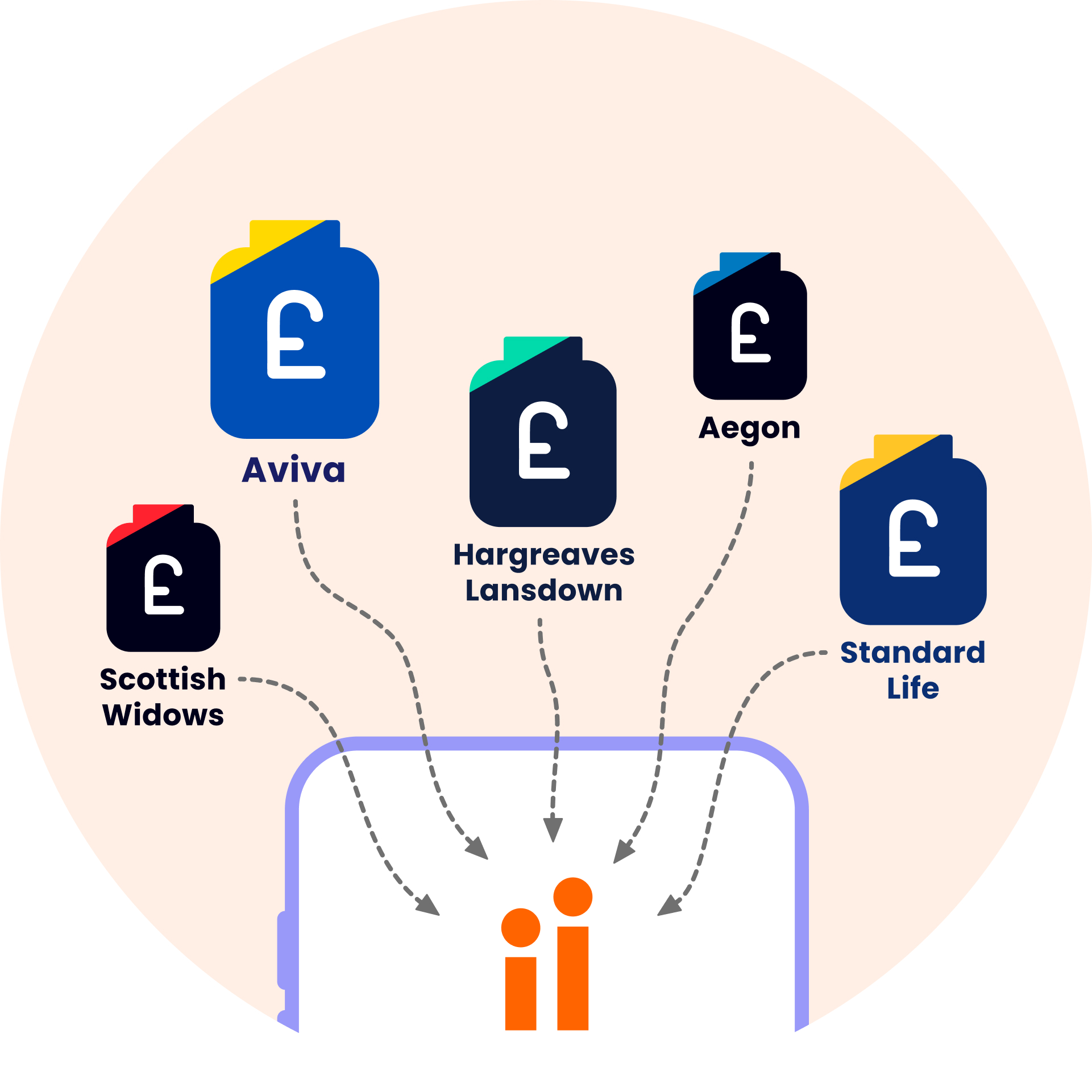

Join tens of thousands of people moving their pensions to ii for better pricing and more control. Here’s a snapshot showing where they’ve transferred from.

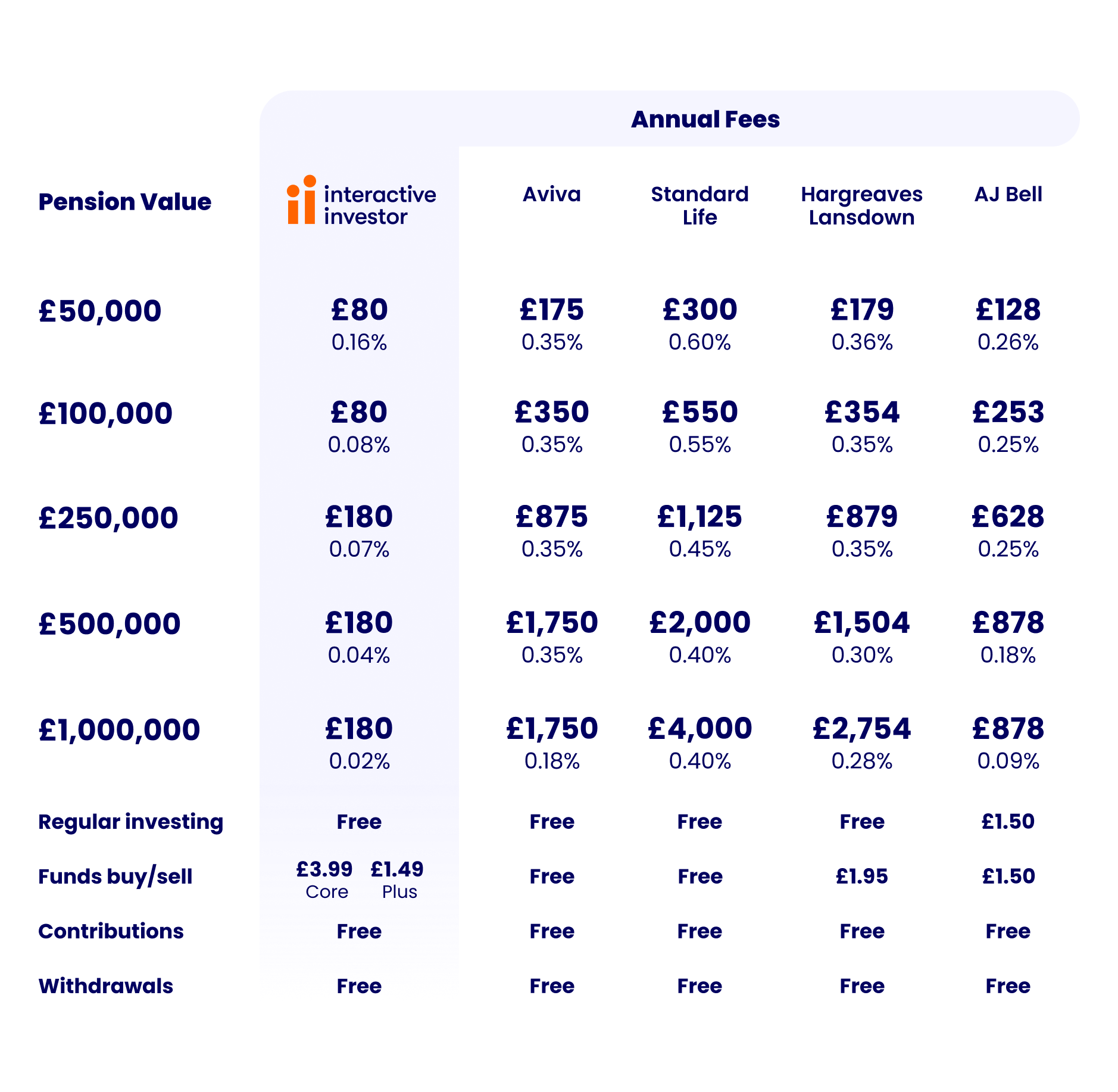

See how much you could save with our low, flat monthly fee Personal Pension compared to other SIPP providers that charge percentage-based fees.

Here's a look at our flat monthly fees:

With ii, you will always pay a low flat fee - helping you keep more of your money invested for the future.

Important information - Annual charge comparisons based on published SIPP charges on 01/02/2026 for Aviva SIPP, Standard Life SIPP (Level 2 Investment Options) & AJ Bell SIPP. Hargreaves Lansdown SIPP charges based on new pricing plan effective 01/03/2026. Assumptions: 100% holding in funds - choosing other assets such as shares and ETFs, may result in lower charges. Two fund purchases/sales. Pension charges only, excludes fund manager charges. Read more about our analysis. Verified as accurate by The Lang Cat.

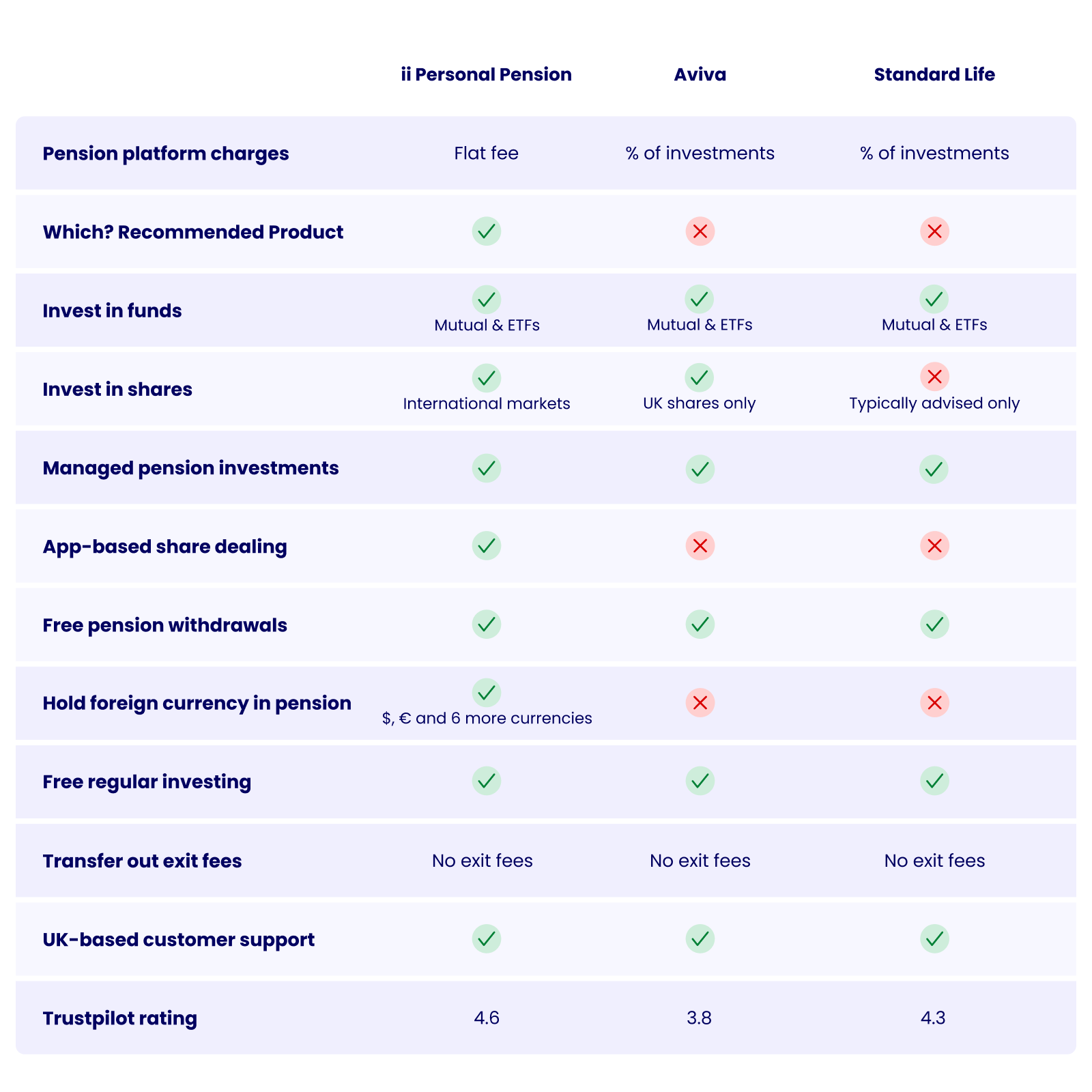

The ii Personal Pension (SIPP) is a refreshing alternative to the traditional pension providers you might be used to. Like all pensions, it offers the same generous tax benefits, but with wider investment choice and greater control - all for a low, flat fee.

Comparison information: This comparison table is provided by ii and is for information purposes only. It compares features of SIPP and Personal Pension products available on a non-advised, execution-only basis. The information reflects product features as described on provider websites as of 01/02/26, and information available publicly. Older or legacy products could be significantly different and offer different features, benefits, or charging structures that are not reflected in this table. Before transferring your pension, check if you’ll be charged any exit fees and make sure you don't lose any valuable benefits such as guaranteed annuity rates, lower protected pension age or matching employer contributions. If you’re unsure about opening a SIPP or transferring your pension(s), please speak to an authorised financial adviser.

Wherever you are, you can stay in control of your pension with the ii app.

It's easy to consolidate your pensions with ii. From old workplace pensions to SIPPs, even with traditional pension providers like Aviva and Standard Life, transferring to ii gives you more control over your money and, possibly, lower fees.

You can do this entirely online once you open an ii Personal Pension.

Once you've decided a transfer is right for you, you can apply online for your ii SIPP and get set up in less than 15 minutes. If you need any support with your application, our team is here to help.

You can start your transfer while opening your SIPP. If you want to transfer later, that works too – just log in via the website.

When completing your transfer request, you’ll need to tell us a few important details, including:

Depending on what you’re transferring, you may need to send us forms after you’ve submitted your request. If so, the forms will be available on the confirmation page for you to print, complete, sign and return to us.

Once your transfer details are in, it’s time for you to sit back and relax. We’ll work with your current provider to move your pension to ii.

If we need any more information from you, we’ll be in touch. We’ll provide regular updates as your transfer progresses.

The right choice depends on how you want to manage your pension, your pot size, and what fees you're comfortable with.

Transferring a pension to ii can be a good choice for many reasons. It can save you money, improve your investment options and give you greater flexibility with your retirement income.

But there are some important things to check and consider before you make your move.

It’s always free to transfer with ii from our side. But be sure to check if your current provider charges any exit fees or penalties.

Some pensions have special guarantees and benefits. Before transferring, make sure you won't lose any of the following:

If you’re unsure about transferring your pension(s), please speak to an authorised financial adviser who specialises in pensions. And if you’re over 50 and thinking about retiring soon, you can also book a free and impartial guidance session with Pension Wise, part of the government’s MoneyHelper service. They can help you understand your options and decide whether a transfer is right for you.

For the fourth year in a row, independent analysts at Which? have recognised the ii Self-Invested Personal Pension for its industry-leading choice, support and value.

Join over half a million investors and feel confident in building the retirement you want.