10 stocks from one of 2019’s top strategies

It was the strategy to follow last year, but can a Warren Buffett-inspired approach do it again in 2020?

8th January 2020 13:57

by Ben Hobson from Stockopedia

It was the strategy to follow last year, but can a Warren Buffett-inspired approach do it again in 2020?

2019 was a solid year for the UK stock market despite the political and economic uncertainty that swirled for much of the time. Indeed, the FTSE All Share wrapped up the year with a respectable 14% gain.

In terms of winning and losing investment styles, last year saw a very noticeable pull back in the power of momentum. Strategies that pursue shares already in an uptrend have outperformed nearly everything else over the past decade, but they faded in 2019.

Instead, styles like ‘growth’, ‘value’ and ‘quality’ set the pace. And of all the guru-inspired approaches tracked by Stockopedia, it was a ‘quality’ strategy that ultimately netted the biggest gain in 2019.

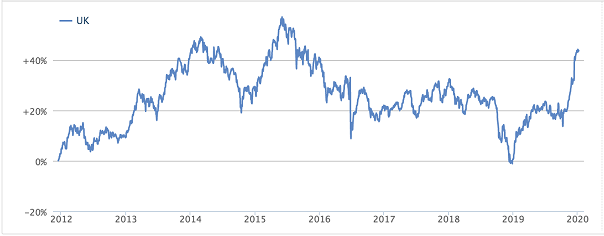

Despite his fame for being one of the wealthiest and most successful investors on the planet, screens that aim to mimic the approach of Warren Buffett have been lacklustre in recent years. But that changed dramatically last year. We saw a 40% gain from a Buffett-inspired approach that aims to find high-quality companies with the best chances of achieving high returns over the long term.

Source: Stockopedia - Buffettology-esque Historical Growth Screen (since inception)

Buffettology-esque Historical Growth is a strategy with quality and value at its core. This idea was explained in a book called The New Buffettology, written by David Clark and Mary Buffett (a divorced former daughter in law of Warren Buffett). To start with, it looks for all the classic features that Buffett likes in a ‘consumer monopoly’ type of business:

- Earnings should be strong and growing

- It should be conservatively financed

- It should earn a high rate of return on shareholders’ equity

- It should generate a consistently high return on total capital

- It should not need to constantly reinvest capital

- The stock should be good value

A key part of assessing whether the stock is good value is to consider its expected sustainable rate of return. Buffett’s view, apparently, is that if a company earns a high Return on Equity because of some kind of durable competitive advantage, it’s possible to make fairly long-term projections about its earnings. This strategy does this by using the historical earnings growth rate over the previous ten years to calculate what the earnings per share (EPS) should be 10 years ahead.

In their book, Mary Buffett and David Clark explain: "Historical ‘per share’ earnings that are both strong and show an upward trend indicate a durable competitive advantage."

Currently, there are around 20 companies passing these rules in the UK stock market, and here is a selection of them. The names here range from the small-cap data management software business Arcontech and digital marketing software firm dotDigital to much larger groups like the fantasy wargaming retailer Games Workshop and the insulated construction materials group Kingspan:

| Name | Mkt Cap £m | EPS Growth Streak (years) | Return on Equity % 5y Avg | Earnings Yield % Last Yr | Exp. Return (Historical Growth) |

|---|---|---|---|---|---|

| Robert Walters (LSE:RWA) | 438 | 6 | 21.1 | 10.6 | 55.1 |

| Arcontech (LSE:ARC) | 27.2 | 5 | 22.4 | 4.45 | 54.5 |

| SThree (LSE:STEM) | 478.6 | 5 | 38.5 | 9.77 | 43.5 |

| Persimmon (LSE:PSN) | 8,696 | 8 | 23.7 | 13.8 | 31.6 |

| dotDigital (LSE:DOTD) | 294.9 | 5 | 26.8 | 4 | 26.5 |

| MJ Gleeson (LSE:GLE) | 542.3 | 7 | 15.2 | 8.01 | 26.2 |

| PageGroup (LSE:PAGE) | 1,612 | 6 | 31.3 | 8.54 | 23.4 |

| Moneysupermarket (LSE:MONY) | 1,810 | 9 | 42 | 5.92 | 20.4 |

| Kingspan (LSE:KGP) | 8,405 | 8 | 17.2 | 3.91 | 20.3 |

| Games Workshop (LSE:GAW) | 2,049 | 5 | 49.6 | 4.02 | 17.2 |

Source: Stockopedia

Of course, past performance is no guarantee of future returns. Just because this strategy did well last year, there is no way of predicting how it will do in 2020.

It is worth noting that investment approaches that focus on business quality, like this Warren Buffett screen, have often underperformed during the bull run of recent years because momentum was such a powerful force. But few would argue that a strategy like this, which targets solid, profitable, growing firms at appealing prices is a bad idea.

For disciples of Warren Buffett, the combination of high quality at reasonable prices is an investing philosophy that will endure regardless of market conditions.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

About Stockopedia

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

- Interactive Investor readers can enjoy a two-week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.