AIM IPOs: These four top stocks have doubled

UK IPOs are rare now, but our AIM market analyst has found one that's up 325%! Find out who it is here.

3rd May 2019 16:25

by Andrew Hore from interactive investor

UK IPOs are a rare beast indeed, so our AIM market analyst assesses performance of last year's crop.

It has been a slow start to the year when it comes to IPOs. This is true of both AIM and the other tiers of the London Stock Exchange.

Brokers appear to have a pipeline of potential AIM entrants but the uncertainty surrounding Brexit and the economy appears to be putting off some of these flotations.

There have been some shell companies joining the Stock Exchange's standard list, and there were two premium listings: lawyer DWF (LSE:DWF) and UAE-based payments processor Networks International.

Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

Completely new companies joining AIM have been just as rare this year. This excludes companies which have been readmitted because of a reverse takeover or change in country of incorporation, or ones that have moved from the Main Market. Even if they are included, the number is still small.

Up until the end of March, there were just five new admissions to AIM. That included Circassia Pharmaceuticals (LSE:CIR) and United Oil & Gas (LSE:UOG), which were transfers from a full listing.

Coming up in the next couple of months there are another two companies set to move from the full list to AIM: engineer Renold and construction products supplier Alumasc.

Chaarat Gold Holdings (LSE:CGH) acquired Kapan Mining and Processing, which owns the Kapan gold mine in Armenia, and this was classed as a reverse takeover. The other reversal was online entertainment media group Digitalbox (LSE:DBOX), which reversed into the shell that had previously been known as Fitbug. The share price slumped after the reversal, probably because old shareholders were taking the chance to exit, but it has recovered recently.

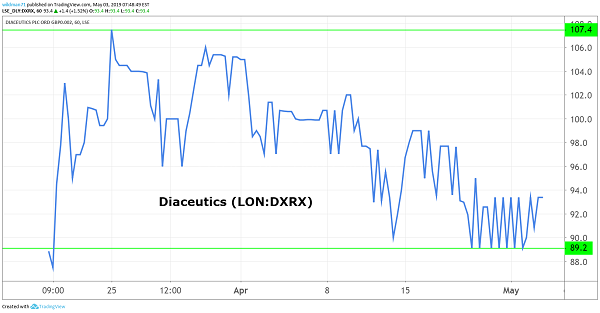

Diaceutics is all on its own

Northern Ireland-based Diaceutics (LSE:DXRX), which provides data analysis and advisory services that help pharma companies developing diagnostic tests, was the only completely new company to join AIM in the first quarter.

Diaceutics is an example of what can happen when liquidity is limited because shares are tightly held.

The placing price of 76p appeared a full valuation for the business, which has significant growth potential. The institutions who bought shares in the placing were holding on to their shares, and other shareholders were not keen to sell, so the share price moved above 100p within a few days. The share price has drifted back to 92p.

Source: TradingView Past performance is not a guide to future performance

Café bars operator Loungers (LSE:LGRS) joined AIM on 29 April. The share price initially went to an 8% premium to the 200p placing price, but it has fallen back to 208p.

Loungers operates 146 sites in England and Wales under two brands: Lounge and Cosy Club. The strategy is to open 25 sites each year. Lounge is a neighbourhood café/bar that combines elements of coffee shop, pub and restaurant. Cosy Club are more formal bars than Lounge and they are typically located in city centres.

Loungers was previously debt financed, which meant that the operating profit was wiped out by interest charges. Net debt was more than £160 million at 7 October 2018 and there were net liabilities. The placing raised £56.4 million after expenses of £5.2 million. That means that debt levels will still be relatively high.

The future

Potential new entrants continue to be thin on the ground for AIM. Trufin (LSE:TRU), which itself joined AIM in February 2018, is spinning off Distribution Finance Capital as a separate AIM company on 9 May. TruFin currently owns 94% of DFC and it will distribute shares to its own shareholders.

DFC has been trading for around three years and it offers finance to manufacturers to help with their working capital requirements. The focus is currently on five sectors: motor vehicles, marine, recreational vehicles, industrial equipment and agricultural equipment.

There will be no new cash raised by DFC. Existing shareholders are selling shares worth £19.8 million and the company's market capitalisation is expected to be £96 million.

Momentum is building up at DFC, but it is still early days. Total operating income was £1.68 million in 2018 and the loss was £7.27 million. The net asset value (NAV) was £54.6 million at the end of 2018 and the full benefits of the cash put into the business have not shown through in the past income statements.

Even so, DFC may find it difficult to maintain its expected valuation in the medium-term.

Performance stats for Class of 2018

The majority of 2018 new entrants were in the first half of the year. June was the main month for new admissions with 14 of the full-year total of 65 coming from that single month. There will need to be a lot of catching up if that number is going to be reached this year.

There were 44 companies which can be described as completely new entrants. This does include some companies on non-UK markets that obtained a dual listing plus Block Energy and Crossword Cybersecurity which switched from NEX Exchange.

There was a mixed performance by the 2018 new entrants but that is no different to other years.

There are 24 companies that have a higher share price than when they joined AIM, 18 that have fallen in price and two that are no longer on AIM. Cradle Arc went into administration earlier this year and Crusader Resources left AIM after its nominated adviser resigned leading the oil and gas company to focus on its ASX listing.

Four companies have at least doubled their share prices. Two of those are litigation finance companies Manolete Partners (LSE:MANO) and Litigation Capital Management (LSE:LIT), both of which have been quoted for less than six months.

The best performer is Georgia-focused oil and gas company Block Energy (LSE:BLOE), which transferred from NEX Exchange last June. The Block share price has more than trebled, but less than two months ago it was still trading around the 4p level. News about production from well 16aZ in West Rustavi field and an agreement to sell gas to a Georgian gas supplier sparked investor interest.

Source: TradingView Past performance is not a guide to future performance

Another former NEX-quoted company, Crossword Cybersecurity (LSE:CCS), is the sixth best performer with a 75.9% rise in the share price in less than six months.

A strong start for a newly quoted company is not necessarily a good indication of longer-term share price success.

By the end of June, GRC International (LSE:GRC), which floated on the back of interest in GDPR and cyber security, was by far the best performing new issue of the year with a 357% increase. Since then, the share price has drifted lower and is currently 0.5p lower than the original 70p placing price.

This was a case where a high-profile sector at the time meant that the share price got pushed up to ridiculous levels as investors tried to buy. The one-off boost of GDPR has gone and boosting the cost base meant that the interims to September 2018 showed a loss.

Virtual reality firms VR Education (LSE:VRE) and Immotion are further examples of how a fashionable industry can attract investor interest and push the share price to much higher levels after which the share price drifts lower. Both companies are trading at a discount to their issue price and they have made good progress.

The reverse is also true. Manolete (LSE:MANO) initially fell to a small discount. The significant rise in the share price started in February and it is the second-best performing AIM new entrant last year with a more than trebled share price.

IPOs with staying power

Some share prices maintain momentum. Aquis Exchange (LSE:AQX) floated at 269p in June and at the end of the month the share price was already 68% higher.

There was a dip later in the summer, but it returned to a positive trajectory and the share price has more than doubled. This is partly because the flotation not only raised cash, it also made traders and investors aware of the transparent, subscription-based equities trading platform and helped to accelerate growth in revenues.

Aquis also indicates that even when a share price is consistently successful, it can pay to hold off for a few weeks while the share price settles down. That can provide a more attractive buying opportunity.

Rosenblatt (LSE:RBGP) is trading at a modest premium to its placing price. Before it published 2018 results this week, the share price was below the placing price.

Underlying earnings per share were 5.5p, but this did not benefit from the investment in a new litigation funding vehicle, which will boost earnings in the coming years. Earnings per share are forecast to increase to 7.4p this year and the forecast yield is 4.5%.

Rosenblatt has conservative revenue recognition policies relating to its litigation business, which means that cash flow is strong. There are good long-term prospects for the business and it is one of the more attractive investments from last year's intake – based on current share prices.

| AIM new entrants in 2018 | ||||||

|---|---|---|---|---|---|---|

| Float date | Company | Business | Code | Float price (p) | Current price (p) | % change |

| 11/06/2018 | Block Energy | Oil and gas | BLOE | 4 | 17 | 325 |

| 14/12/2018 | Manolete Partners | Litigation finance | MANO | 175 | 590 | 237.1 |

| 14/06/2018 | Aquis Exchange | Securities trading platform | AQX | 269 | 587.5 | 118.4 |

| 19/12/2018 | Litigation Capital Management | Litigation finance | LIT | 52 | 111 | 113.5 |

| 29/06/2018 | Knights Group | Solicitors | KGH | 145 | 283 | 95.2 |

| 14/12/2018 | Crossword Cybersecurity | Security technology | CCS | 290 | 510 | 75.9 |

| 20/06/2018 | Anexo Group | Credit hire and legal services | ANX | 100 | 162.5 | 62.5 |

| 27/06/2018 | Cake Box Holdings | Egg-free cakes maker | CBOX | 108 | 174 | 61.1 |

| 23/05/2018 | Team 17 | Video games developer | TM17 | 165 | 262.5 | 59.1 |

| 08/08/2018 | Jadestone Energy Inc | Oil and gas | JSE | 35 | 50.75 | 45 |

| 24/12/2018 | PetroTal Corporation | Oil and gas | PTAL | 11.5 | 16 | 39.1 |

| 06/11/2018 | Renalytix AI | Healthcare | RENX | 121 | 152.5 | 26 |

| 04/04/2018 | The Simplybiz Group | IFA services provider | SBIZ | 170 | 214 | 25.9 |

| 04/12/2018 | The Panoply Holdings | Digital technology services | TPX | 74 | 92.5 | 25 |

| 31/07/2018 | Trackwise Designs | Printed circuit boards maker | TWD | 105 | 118.5 | 12.9 |

| 01/06/2018 | Codemasters Group | Video games developer | CDM | 200 | 224 | 12 |

| 26/07/2018 | Nucleus Financial Group | Wrap platform for financial advisers | NUC | 183 | 203 | 10.9 |

| 15/03/2018 | Safe Harbour Holdings | Shell | SHH | 120 | 132.5 | 10.4 |

| 29/03/2018 | Polarean Imaging | Medical imaging technology | POLX | 15 | 16.5 | 10 |

| 05/07/2018 | Yellow Cake | Uranium investor | YCA | 200 | 213.5 | 6.8 |

| 21/02/2018 | Trufin | Financials | TRU | 190 | 195 | 2.6 |

| 08/05/2018 | Rosenblatt | Solicitors | RBGP | 95 | 97.5 | 2.6 |

| 17/08/2018 | Sensyne Health | Healthcare | SENS | 175 | 178 | 1.7 |

| 08/06/2018 | Yew Grove REIT | REIT | YEW | € 1.00 | € 1.01 | 0.5 |

| 05/03/2018 | GRC International | Cyber security consultancy | GRC | 70 | 69.5 | -0.7 |

| 19/10/2018 | Summerway Capital | Shell | SWC | 100 | 99 | -1 |

| 05/12/2018 | finnCap Group | Broker | FCAP | 28 | 27.5 | -1.8 |

| 20/06/2018 | Tekmar Group | Subsea protection | TGP | 130 | 122.5 | -5.8 |

| 12/03/2018 | VR Education | Virtual reality content | VRE | 10 | 9 | -10 |

| 28/06/2018 | Mind Gym | Behavioural science services | MIND | 146 | 128.5 | -12 |

| 30/04/2018 | KRM22 | Technology shell | KRM | 100 | 82 | -18 |

| 29/06/2018 | RA International | Services to remote locations | RAI | 56 | 45 | -19.6 |

| 18/05/2018 | Serinus Energy | Oil and gas | SENX | 15 | 11.5 | -23.3 |

| 29/06/2018 | TransGlobe Energy Corporation | Oil and gas | TGL | 208 | 150 | -27.9 |

| 09/05/2018 | Urban Exposure | Property finance | UEX | 100 | 70 | -30 |

| 30/11/2018 | Kropz | Phosphate | KRPZ | 40 | 26 | -35 |

| 12/07/2018 | Immotion | Virtual reality | IMMO | 10 | 6.35 | -36.5 |

| 09/02/2018 | OnTheMarket | Estate agency website | OTMP | 165 | 100 | -39.4 |

| 06/03/2018 | Stirling Industries | Shell | STRL | 100 | 56 | -44 |

| 21/06/2018 | i-nexus Global | Cloud-based services | INX | 79 | 37 | -53.2 |

| 29/03/2018 | Kore Potash | Potash | KP2 | 10.9 | 2.45 | -77.5 |

| 30/05/2018 | Maestrano Group | Software | MNO | 15 | 2 | -86.7 |

| 24/01/2018 | Cradle Arc | Mining | CRA | 10 | 0 | -100 |

| 16/04/2018 | Crusader Resources Ltd | Mining | CAS | 2.99 | * | * |

| * Still listed on ASX. # All shares prices as at close of play on 2 May 2019 |

Andrew Hore is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.