Alert: Boris’s lockdown speech and US jobs shock

These events over the long VE day weekend could have a significant impact on shares come Monday morning.

7th May 2020 15:04

by Graeme Evans from interactive investor

These events over the long VE day weekend could have a significant impact on shares come Monday morning.

It has only been 18 days since the Easter break. But after income-sapping dividend cuts from BT Group (LSE:BT.A) and Royal Dutch Shell (LSE:RDSB) and a rollercoaster ride for markets, the VE Day bank holiday weekend probably cannot come soon enough for many investors.

This looks be a good time to take stock, particularly for those needing a closer look at how the recent wave of dividend cuts will impact their flow of income over the coming months. On a brighter note, it will be a chance to assess the recovery for many stocks following a spectacular April in which stock market indices rebounded by as much as 18%.

Investors will do so knowing that the outlook for many of these stocks may look very different again by next week, given that UK prime minister Boris Johnson is due to address the nation on Sunday with his roadmap for easing the restrictions introduced on 23 March.

It is likely that the lockdown will remain in place for another three weeks. However, a timeline for beyond this point should at least provide consumer-facing sectors, such as retail, transport, and pubs and restaurants, with the most visibility they have had in almost three months.

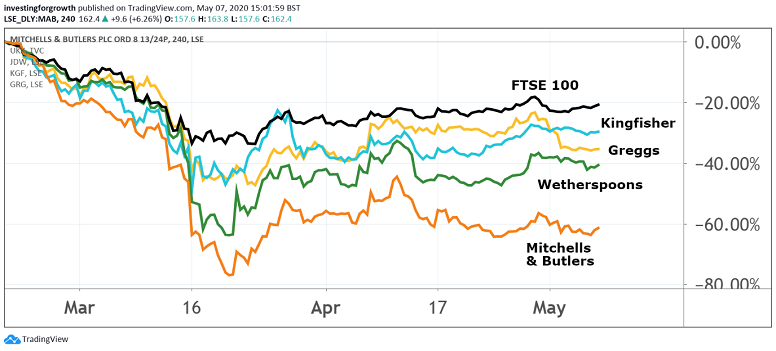

Unfortunately, for the likes of pub chains Mitchells & Butlers (LSE:MAB) or JD Wetherspoon (LSE:JDW), they will be at the back of the queue in terms of re-openings. Pubs are expected to be in the last wave in August or September, with strict social distancing rules also in place.

What is less clear is when shops will reopen, given that B&Q owner Kingfisher (LSE:KGF) has already opened its doors to customers and others such as Greggs (LSE:GRG) have been talking about doing the same. Garden centres could be allowed to reopen from Monday, according to reports.

Source: TradingView. Past performance is not a guide to future performance.

Large eurozone countries are already embarking on a gradual re-opening of their economies. In Germany, most retail shops and car dealers were allowed to open a couple of weeks ago, while markets and other non-essential retailers in France should resume from Monday.

The UK's plan includes the re-opening of schools from next month, with people also being encouraged to return to work if they are able to. That should be a small positive for transport companies, although Go-Ahead (LSE:GOG), FirstGroup (LSE:FGP) will still face significant capacity restrictions.

National Express (LSE:NEX), which operates services in eight countries, yesterday detailed a “pessimistic downside scenario” where further lockdowns are imposed to contain any future peaks in infection.

It said its forecasts involved revenues recovering slowly from the start of the third quarter, and remaining at lower levels throughout 2021 with a monthly run-rate of approximately 25% down versus pre Covid-19 levels.

Alternatives to mass transit systems have become increasingly popular, with Halfords (LSE:HFD) highlighting this yesterday when it upgraded profit expectations on the back of strong online and click-and-collect sales in the cycling category.

- How Halfords shares took post-crash rally past 170%

- ii Winter Portfolios 2019-20: beating the market in a crash

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

It is one small example of resilience in the UK economy, although this will be little consolation by next Wednesday when the first print of Q1 GDP is published by statisticians.

The Bank of England thinks the UK may contract by 14% this year, with today's monetary policy report pointing to an unprecedented 25% decline in the current quarter and 3% fall in Q1.

The closely-watched US non-farm payrolls are also due for release tomorrow, meaning that UK investors will only be able to react to these figures after the bank holiday weekend.

According to a Reuters survey of economists, the figure is forecast to have plunged by a historic 22 million in April. The level dropped by 701,000 jobs in March, which was the first negative result since September 2010.

The unemployment rate is set for a post-war record of 16%, although a $3 trillion stimulus package and partial re-opening of some US states may mean this is the low point.

This optimism is shared on Wall Street, with the tech-driven Nasdaq up by 15% in April on expectations that the US Federal Reserve will continue to underpin the financial system.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.