Bargain Hunter: the investment trust sector tipped as a buy

20th April 2022 10:38

by Kyle Caldwell from interactive investor

Twelve of the 16 investment trusts in this sector are trading on discounts above 20%.

Investment trusts backing unquoted businesses have been among the losers of the market rotation that’s taken place since the start of 2022.

Winterflood, the investment trust analyst, points out that the average discount among private equity investment trusts widened from 15% to 21% at the end of March. The average share price fall in the first quarter was 9%.

Many private equity trusts have a big focus on higher-growth companies in areas such as technology. Given that listed growth companies fell out of favour in the first three months of the year, it is no surprise that investors turned cold on unlisted growth companies, amid fears that the valuations of private companies will be marked down due to the lag effect between public and private market valuations.

Growth companies fell out of favour in the first three months of 2022, with investors concerned over the high valuations attached to such shares at a time of high inflation and interest rate hikes. Investors have been switching their attention to value shares, which, as well as carrying cheaper valuations, are expected to perform better during a period of tightening monetary policy.

- Funds and trusts four professionals are buying and selling: Q2 2022

- Funds Fan: Scottish Mortgage, popular funds, and trust bargains

- Fundamentals: growth fund versus income fund, which is best for me?

Winterflood, however, argue that both the share price falls and the increase in discounts have been overdone. It says the market has underestimated the strong performance of the sector in 2021, with many trusts recently reporting results for that time period. The highest net asset value (NAV) returns last year came from HarbourVest Global Priv Equity (LSE:HVPE), HgCapital Trust (LSE:HGT) and NB Private Equity Partners (LSE:NBPE), with respective returns of 50%, 44% and 42%.

The analyst said: “We believe that the share price falls seen across the sub-sector have been overdone. Historically, the market has de-rated private equity funds at times of increased volatility and uncertainty.

“While we can understand this, equally we believe it represents an opportunity and note that, in general, most listed private equity funds currently possess strong balance sheets, buoyed with the cash generated from realisations, while outstanding commitments are relatively modest.”

Wise Funds’ Vincent Ropers, who is a multi-asset investor, agrees that private equity trusts are looking attractively cheap. He told our Funds Fan podcast in early April: “We still find a lot of value in that space. Although a discount in itself is justified because those managers invest in illiquid assets, we think the broad market does not recognise the value those strategies can add to a portfolio.”

Private equity investment trusts, with their specialist managers and closed-ended structure, offer investors a way to access an illiquid part of the market. It is an area where there’s scope for dramatic uplifts when trusts sell successful holdings. For example, when a company decides to list on the main market through an initial public offering (IPO).

On the whole, private equity trusts back relatively mature businesses. In contrast, growth capital trusts, which are a sector in their own right that includes trusts such as Chrysalis Investments (LSE:CHRY) and Schiehallion(LSE:MNTN), have a greater focus to less mature names. This includes some exposure to potential unicorns – companies that could come to be worth $1 billion. For example, Chrysalis Investments owns fintech unicorn firms Starling and Klarna.

Both sectors have plenty of big discounts. Of the six growth capital trusts, two are trading on discounts over 20%. The sector is trading on a discount of 10.1%.

Among private equity trusts 12 of the 16 in the sector are on discounts above 20%.

Winterflood’s preferred private equity trusts are: ICG Enterprise (LSE:ICGT), abrdn Private Equity Opportunities (LSE:APEO) and NB Private Equity Partners. The respective discounts are 29%, 24.8% and 26.7%.

Ropers, meanwhile, favours Pantheon International (LSE:PIN), Oakley Capital Investments (LSE:OCI), and BMO Private Equity Trust (LSE:BPET). He says: “All are trading between 20% and 30% discounts, and we think this is too wide.”

Earlier this year, investment trust analysts at Peel Hunt, picked out four private equity trusts they favour, namely HgCapital Trust, NB Private Equity Partners, HarbourVest Global Private Equity and Augmentum Fintech (LSE:AUGM).

- 11 alternative investment trusts to capture growth

- Don't be shy, ask ii...why is this investment trust on a huge premium?

- Fundamentals: five reasons why investment trusts are different from funds

Bear in mind that private equity trusts typically trade on high discounts. Winterflood points out that over the past eight years the average trust in the sector has largely traded in a discount range of 10% to 20%.

One factor behind this is the reluctance of some wealth managers to invest because some trusts were highly gearing during the global financial crisis. In addition, both the professionals and DIY investors may be put off gaining exposure to unlisted shares following the Woodford Equity Income debacle. The fund’s suspension and subsequent closure shows that illiquid holdings, such as the unlisted companies in the Woodford fund, can prove very problematic when investors rush to the exit.

However, at their current ratings, and particularly in the event of improved sentiment for growth shares, Winterflood said “it would expect to see discounts on listed private equity funds narrow as the year progresses”.

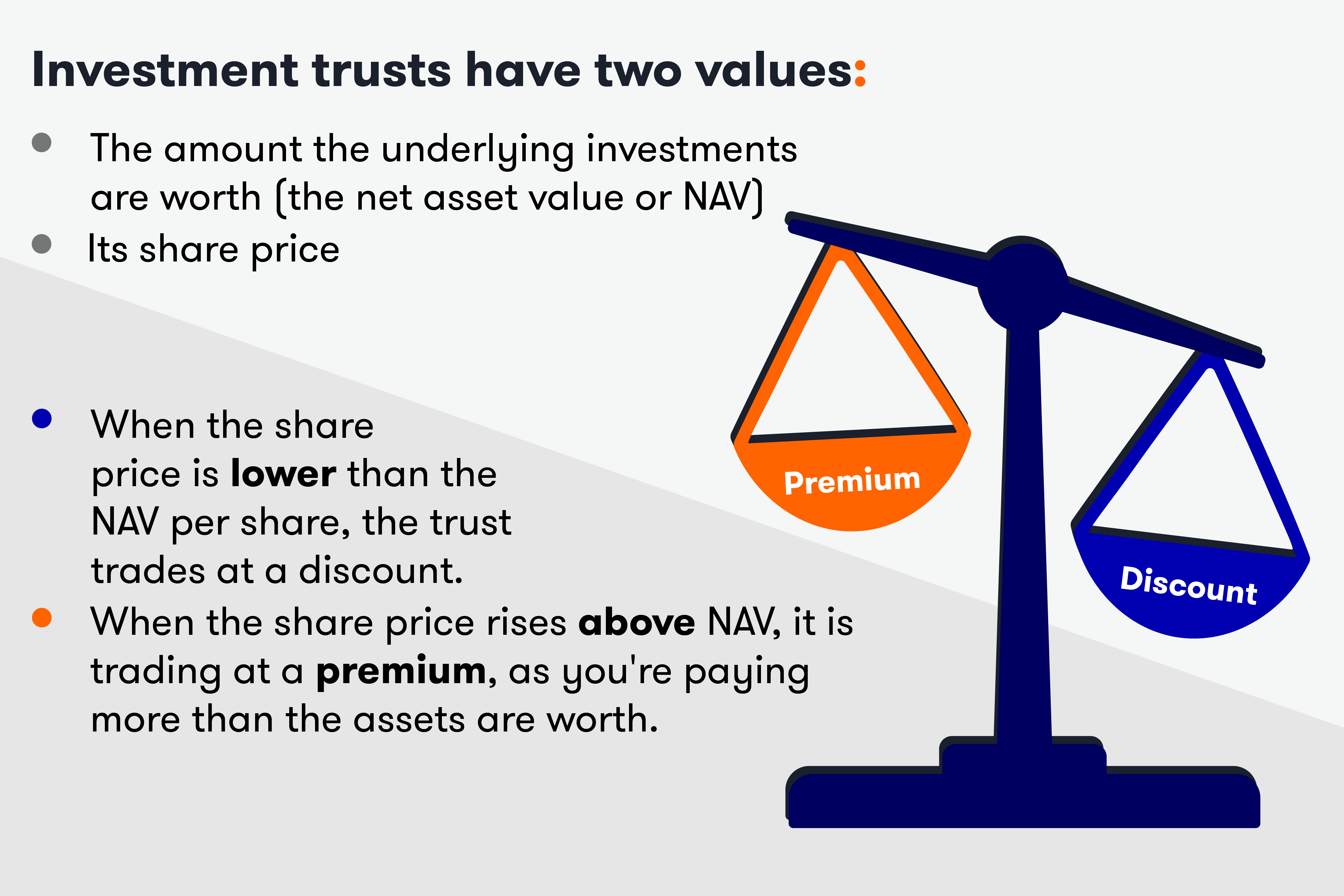

Moreover, investment trusts do not have the liquidity problem that funds face when there are large redemptions. Under the trust structure, a fixed number of shares are issued, raising a fixed amount of money for the manager to invest in a portfolio of assets. Those shares are traded on a stock exchange and their price fluctuates according to demand and supply.

Crucially, the fund manager does not have to sell or buy shares depending on whether they are attracting or losing investors. This makes trusts a more suitable vehicle to hold illiquid assets and also arguably allows the fund manager to take more of a long-term view while running the portfolio.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.