The big fund winners from the central bank rate turnaround

Some funds rose nearly 20% in the final three months of last year, reveals Saltydog Investor.

22nd January 2024 14:01

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Last year started well with more than 95% of the funds we track making gains in January.

February and March were less encouraging, but by the end of the first quarter almost 80% of the funds were still ahead of where they started the year.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

Things then took a turn for the worse with less than 50% of the funds making gains in the second and third quarters of the year. Although the global economic climate was improving, with inflation falling and interest rates starting to level off, central banks were still suggesting rates would be “higher for longer”, and stock markets remained cautious.

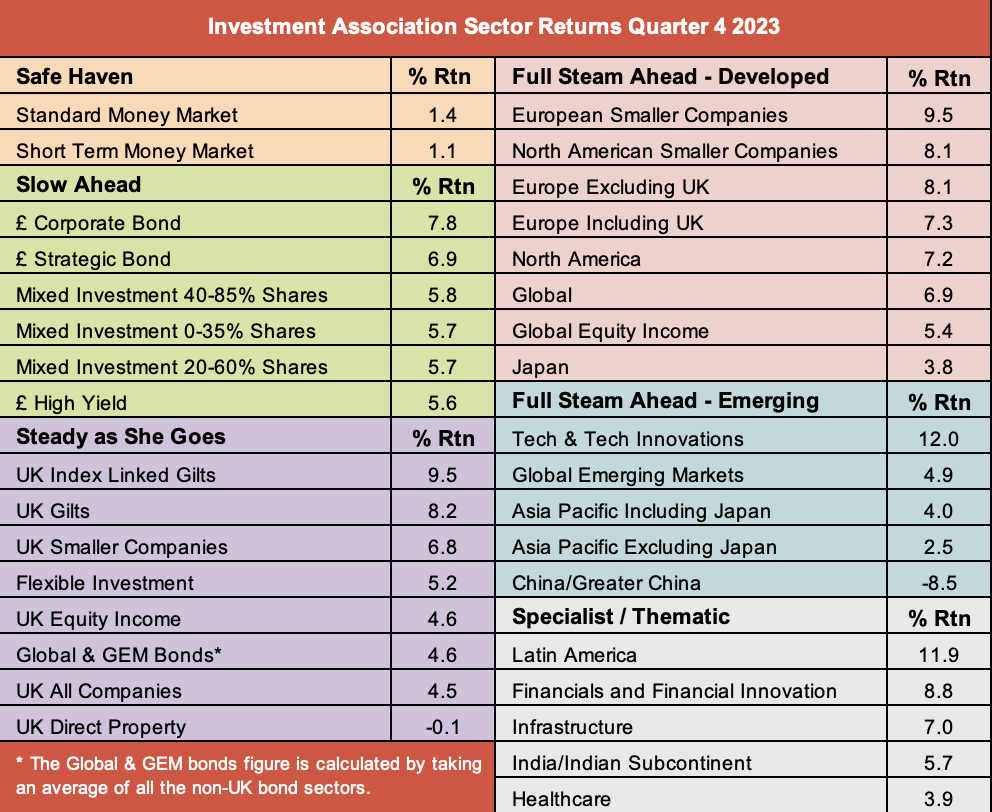

Towards the end of the year there was a shift in sentiment and a feeling that perhaps there was light at the end of the tunnel. During October, November, and December, 32 of the 34 sectors we track rose and almost 95% of the funds made gains.

The best-performing sector was Technology and Technology Innovations with a three-month gain of 12%. Close behind was the Latin America sector, up 11.9%, and then the European Smaller Companies and UK Index Linked Gilts sectors, which rose 9.5%.

Data source: Morningstar.

The best-performing fund over this period was the Premier Miton Pan European Property Share fund which is in the Property Other sector. There are a few sectors where the Investment Association (IA) do not provide performance data, because of the diverse range of funds in the sector, and Property Other is one of those sectors. There are two sectors for funds which invest in property. UK Direct Property, for funds which invest “at least 70% of their assets directly in UK property over five-year rolling periods”, and all the rest go into Property Other.

Saltydog’s top 10 funds in Q4 2023

| Fund name | Investment Association sector | Monthly return 2023-10 | Monthly return 2023-11 | Monthly return 2023-12 | Quarter Four return |

| Premier Miton Pan Eurp Prpty Share | Property Other | -2.6 | 12.7 | 8.8 | 19.3 |

| GAM Disruptive Growth | Global | -2.1 | 14.2 | 6.5 | 19.1 |

| Liontrust Global Technology | Technology and Technology Innovation | -6.2 | 15.6 | 8.1 | 17.1 |

| Baillie Gifford American | North America | -8.6 | 17.8 | 8.7 | 17.1 |

| abrdn UK Real Estate Share | Property Other | -4.2 | 11.9 | 9.1 | 16.9 |

| New Capital US Growth | North America | -2.4 | 12.2 | 6.4 | 16.4 |

| T. Rowe Price Glb Tech Equity | Technology and Technology Innovation | -1.3 | 13.0 | 4.1 | 16.1 |

| Pictet - Robotics | Technology and Technology Innovation | -5.6 | 13.4 | 8.3 | 15.9 |

| FTF Martin Currie European Uncons | Europe Excluding UK | -2.5 | 11.7 | 6.1 | 15.5 |

| Janus Henderson Instl Lg Datd Crdt | £ Corporate Bond | -0.9 | 7.1 | 8.6 | 15.3 |

Data source: Morningstar.

It was no surprise to see that three of the top 10 funds were from the Technology and Technology Innovation sector. There were also some other familiar names such as GAM Disruptive Growth, from the Global sector, and Baillie Gifford American and New Capital US Growth, from the North America sector, which tend to do well when the large US technology companies are performing well.

They did well during the Covid pandemic when interest rates were low, people were working from home, and all forms of outdoor entertainment were curtailed. In 2020, the Technology and Technology Innovation sector rose 44.8% and in 2021 it made 16.5%. It then ran out of steam in 2022. As the pandemic subsided and central banks tightened monetary policy to combat inflation, the economic climate shifted. Rising interest rates made borrowing more expensive and dampened investor appetite for high-growth, riskier assets such as tech stocks. The sector ended the year down 27%.

- Jeff Prestridge: these funds are robust long-term pillars of an ISA

- 2024 Investment outlook: share tips, forecasts, tax, pensions and savings

Last year was more mixed for the technology stocks. It started well as the hype surrounding artificial intelligence surged after the launch of OpenAI's ChatGPT in November 2022. It then slowed through the middle of the year as interest rates kept rising, but then took off again towards the end of the year as interest rates stabilised and central banks hinted rate cuts could come this year.

Over the years, our demonstration portfolios have invested in a number of different technology and US growth funds. We currently hold the UBS US Growth and the Pictet-Digital funds. They both fell in the first week of this year but have subsequently recovered. The UBS US Growth fund is currently showing a year-to-date gain of 2.6%, while the Pictet Digital fund has risen 3.4% and is one of the top funds so far this year.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.