Bond Boss: what bond markets are and aren’t telling us about inflation

In his latest monthly bond column Aberdeen’s Jonathan Mondillo outlines where inflation is heading in 2026, and explains how he turns inflation risks into an opportunity.

12th December 2025 09:04

by Jonathan Mondillo from Aberdeen

Inflation has been one of the defining economic stories of recent years. Living standards stalled as households navigated a post-Covid world marked by supply and demand imbalances. From steaks and vegetables to gas bills and car insurance, everyday essentials became more expensive, while wages struggled to keep pace.

But that’s the past. What about the future? How will our ability to afford life’s basics change in 2026 – and will there still be room for those little luxuries?

- Invest with ii: Buy Bonds | Tax Rules for Bonds & Gilts| General Investing with ii

The market’s view on inflation

One way to gauge expectations is through the inflation-linked bond market. These bonds offer a window into what investors believe inflation will look like over the coming years. But how reliable is that view? And could central banks reignite inflation by cutting interest rates too aggressively to appease political pressures?

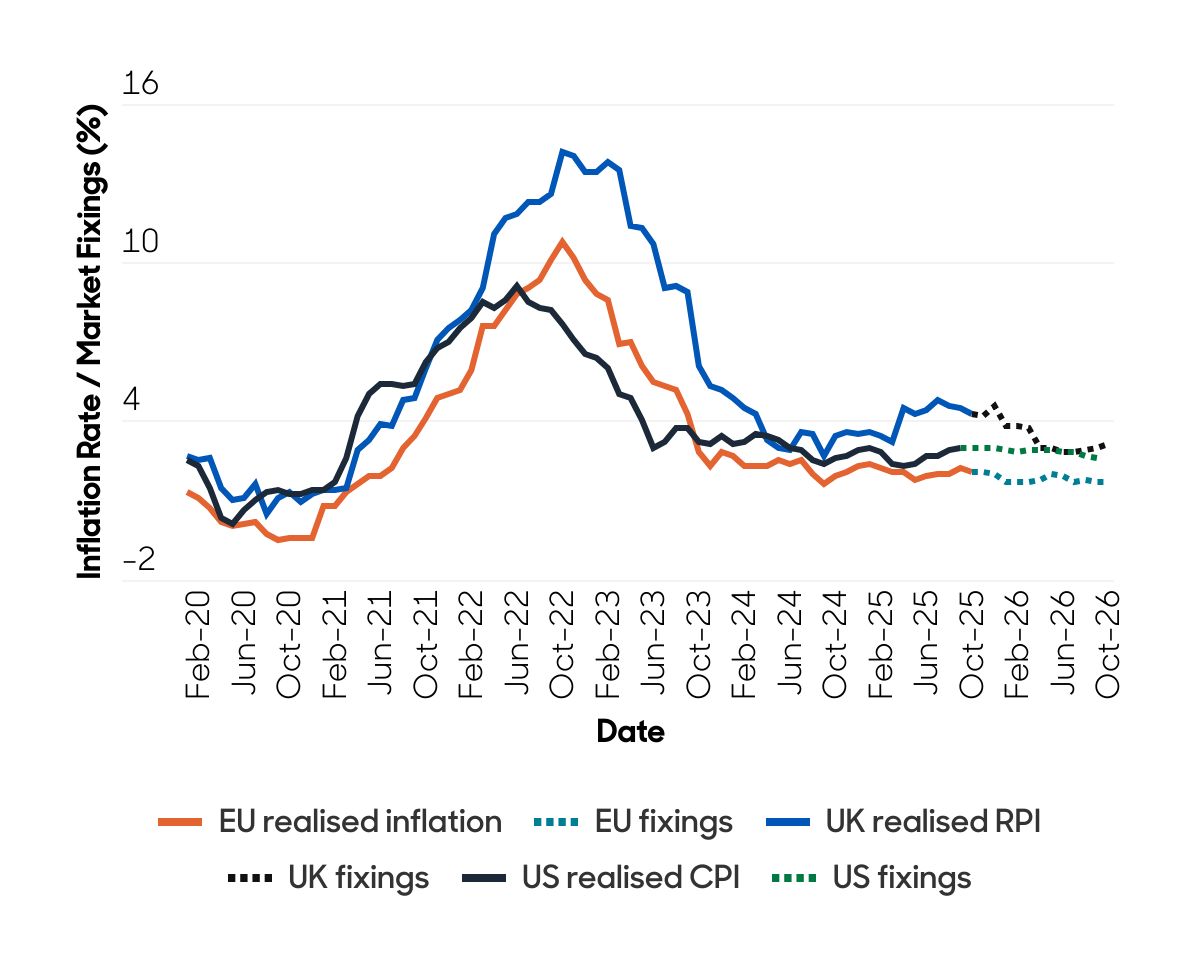

Let’s set the scene. The chart below shows where we’ve come from – and where markets expect us to go. It captures the pandemic-driven inflation shock, followed by the more nuanced regional paths that have emerged since.

- Bond Boss: are money market funds still a good deal?

- Bond Boss: where next after 30-year gilt yields hit headlines?

The dotted lines section highlights where markets think UK, US, and European inflation will head throughout 2026. The message? They expect inflation to fall across these regions. That makes sense as Covid-era drivers such as trade disruption and supply bottlenecks continue to fade.

UK, US and EU realised inflation and market fixings

Source: Bloomberg, Barclays Live, November 2025.

What could derail this story?

In my view, there are a few “knowns” – foreseeable risks – that could push inflation off course.

Trade tensions

The tariff story is well known. So far, their impact on everyday prices has been less severe than feared. There’s only been a limited effect on the goods component of the US Consumer Price Index (a measure of the average price changes shoppers face). The question I keep asking is: when – if at all – will price rises feed through to inflation, and by how much? This matters because, at this point, markets seem to have given up on the idea that goods price inflation is coming. If it does materialise, inflation expectations would rise.

Fiscal policy

US government spending and Europe’s planned infrastructure and defence investments could boost economic growth. They could also increase demand for goods and services, making them more expensive. Hello, inflation.

Geopolitical risks

A resolution in Ukraine would likely cause energy and grain prices to fall – taking inflation with it.

These risks to the inflation outlook largely lie beyond the central banks’ control. Their job is to steer inflation back to its target in a sustainable way over the medium term. They do this by adjusting interest rates – either speeding up or slowing down the economy. That, in turn, creates or quashes price pressures and therefore inflation. At least, that’s the theory.

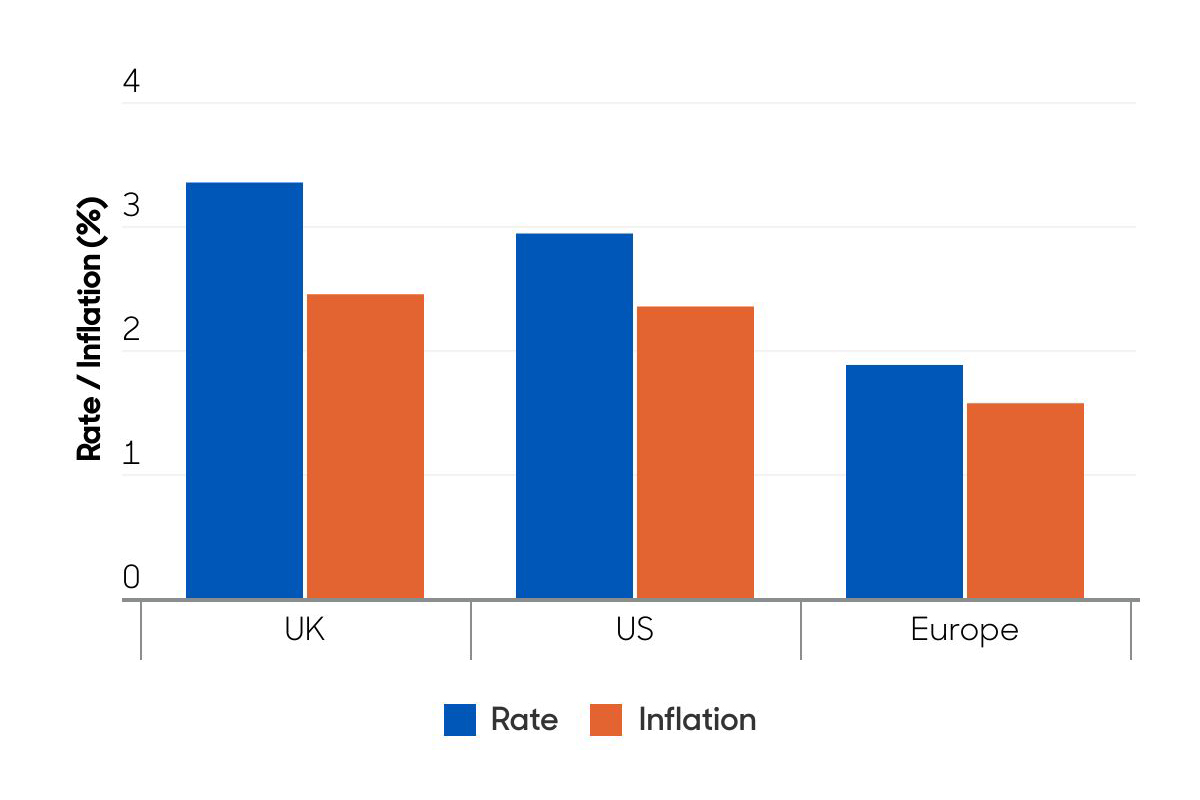

Rates and inflation outlook 2026

Source: Bloomberg, November 2025.

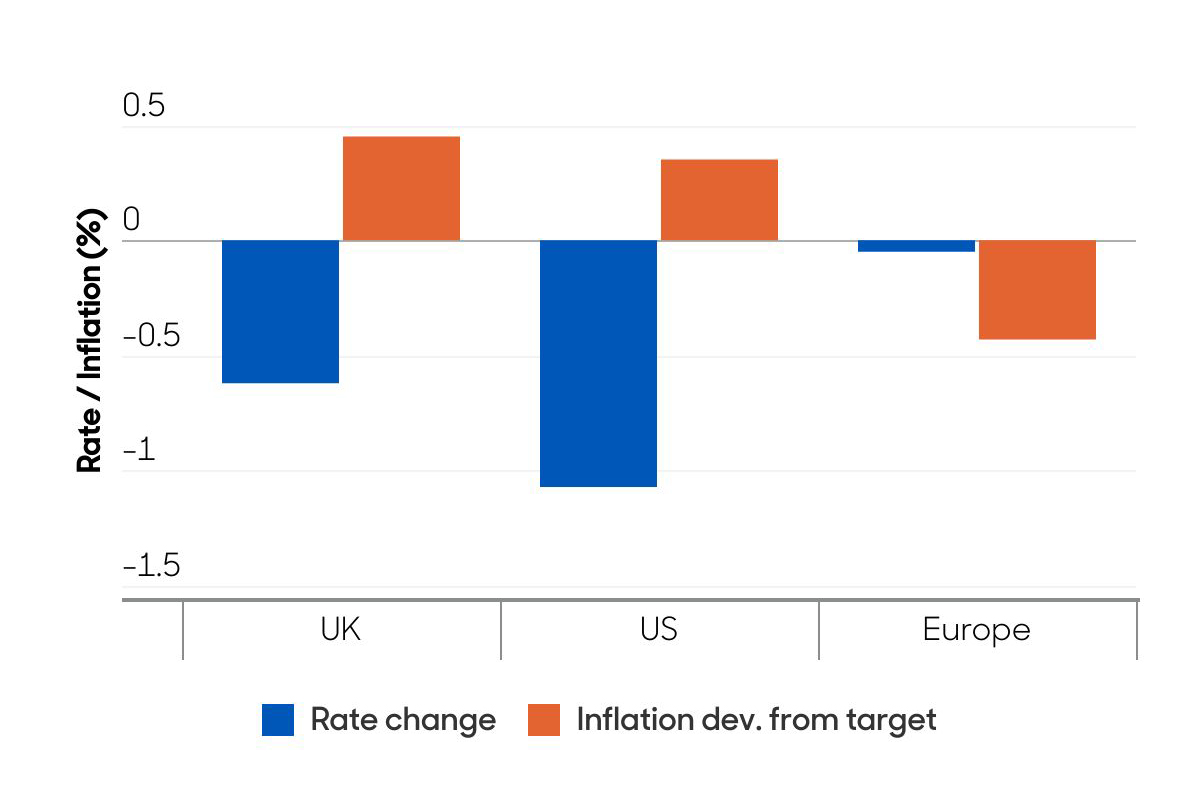

Forecasted rate changes and inflation gap vs 2% target

Source: Bloomberg, November 2025.

So, given markets expect lower inflation, what’s their forecast for interest rates?

What bond markets are telling investors

Markets expect rates to fall – but not everywhere. Inflation is forecast to ease, yet central banks aren’t all moving in the same direction.

The eurozone is the only region where inflation is projected to be at or below target at the end of next year. Yet markets don’t think the European Central Bank will cut rates to boost growth.

In the UK, inflation is still forecast to be above target – even after the Bank of England trims rates by 0.6 percentage points. The US tells a similar story: the Federal Reserve is expected to reduce rates even though inflation is higher than its goal.

For investors, inflation eats into returns like a silent tax. So, how do you protect your portfolio – or even turn this risk into an opportunity?

- Where can bond investors find yield as interest rates fall?

- AI fever hits bond markets – tactical play or a bigger bubble?

Enter inflation-linked bonds

These bonds adjust with inflation, so they deliver a “real return” that keeps pace with rising prices. Higher inflation? Higher returns. Lower inflation? You still earn a return that moves with prices.

In our inflation-linked strategies, we expect US inflation to stay higher than markets predict. We look at something called the “inflation breakeven” – the difference between the yield on a regular bond and an inflation-linked bond. It’s a quick way to see what markets expect inflation to be.

Our goal is simple: find inflation-linked bonds that look attractively priced compared to our view on inflation. In other words, we take a view on inflation without taking on extra interest rate risk.

The bottom line

Bond markets offer valuable signals on inflation, but they’re not infallible. Inflation is shaped as much by geopolitics, government spending and supply chains as by central bank rates.

For investors, understanding these nuances is critical. Inflation-linked bonds provide not just protection against inflation surprises but also a useful lens on market expectations. In today’s climate, they’re more than a hedge – they’re a savvy way to stay ahead.

A big thank you to Tom Walker, Nicholas Chatters and Milana Muratova for sharing expertise and thoughtful perspectives on this topic.

Jonathan Mondillo is global head of fixed income at Aberdeen.

ii is an Aberdeen business.

Aberdeen is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.