The case for diversifying beyond gold

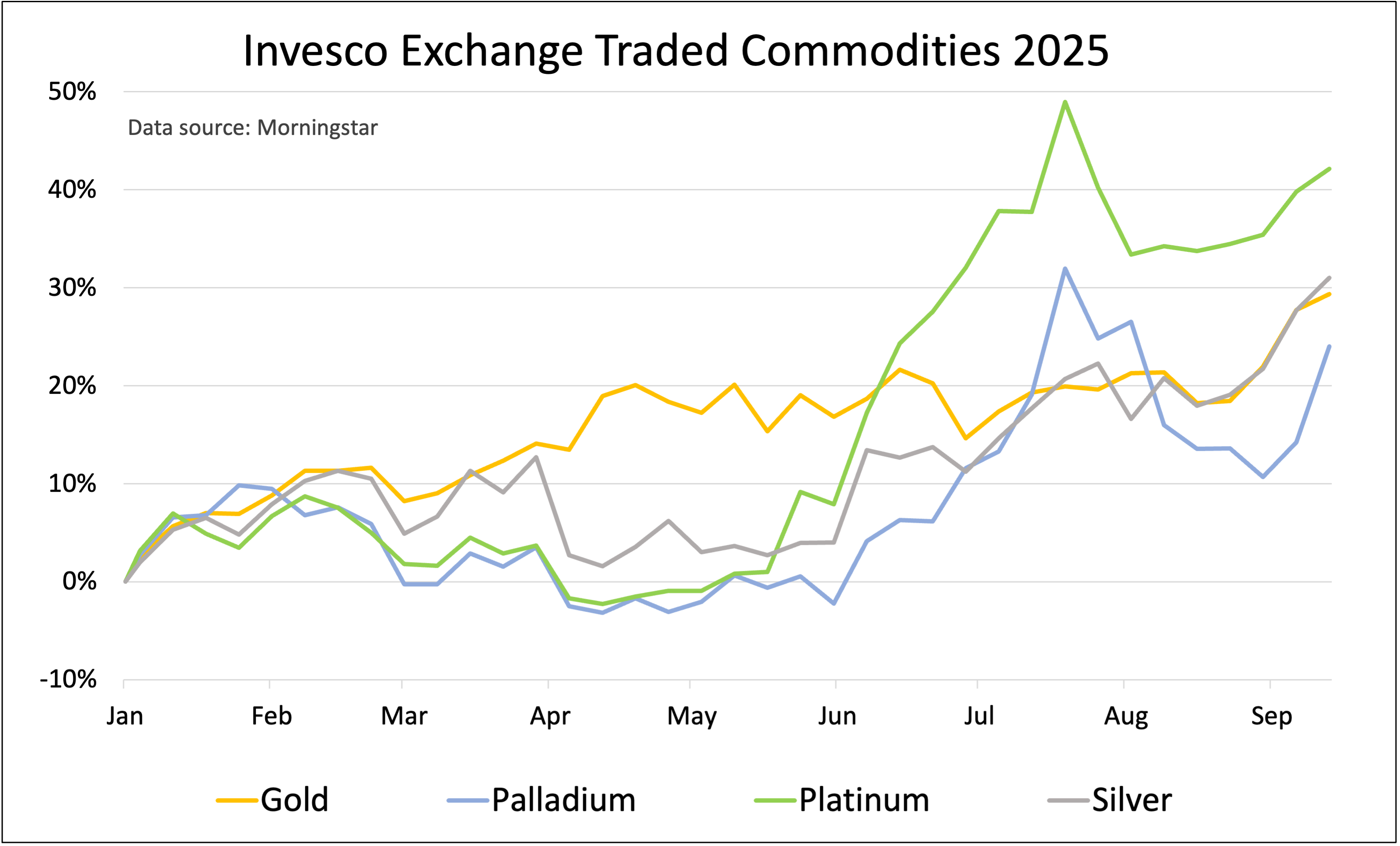

Saltydog Investor explains that gold is not the only metal that’s performing strongly in 2025, with palladium, platinum and silver all up over 20% year-to-date.

16th September 2025 09:42

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Every investor sooner or later comes back to the subject of gold. It has been trusted as a store of value for millennia, and even now, in our modern age of central banks and digital currencies, it continues to command respect.

Last week, we highlighted that the gold funds from the Specialist sector were once again topping our tables. We explained some of the reasons why gold has been rallying so strongly and looked at the case for investing in it, particularly through funds that hold shares in gold miners rather than the physical metal itself. This week we want to broaden the discussion.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

One of the advantages of the work we do at Saltydog Investor is that we don’t just follow the well-trodden paths of unit trusts and OEICs. We also keep an eye on investment trusts and exchange-traded products. One of the patterns that’s stood out this year is that gold is not the only precious metal to have done well.

This chart compares the relative performance of four Invesco Physical ETCs, which track the prices of gold, silver, platinum, and palladium.

Past performance is not a guide to future performance.

Metals are often divided into two categories: base and precious. A base metal is common, abundant, and relatively inexpensive. These metals are widely used in industry and manufacturing, are less valuable than precious metals, and corrode more readily. Examples include copper, aluminium, iron, zinc, lead, nickel, and tin.

Precious metals are rarer and of higher economic value. They are known for their scarcity, durability, resistance to corrosion, high lustre, and in many cases conductivity and malleability. The most widely recognised are gold, silver, platinum, and palladium, although others include rhodium, ruthenium, iridium, and osmium.

Gold has performed well over the past couple of years. At the beginning of 2024 it was trading at around $2,200. Since then, it has climbed relentlessly, passing $3,600 to set new records. As we mentioned last week, this has been driven not by one single factor but by several acting together: central banks, particularly in Asia and the Middle East, buying at record levels; stubbornly high inflation; expectations that US interest rates will soon be cut; a weakening dollar; and the ever-present backdrop of geopolitical instability. Put together, these forces have created a powerful tailwind.

- Gold investing: what, why and how to invest

- The Analyst: the benefits of owning commodities in your portfolio

Silver, like gold, has long been used as money and is seen as a store of value, but it also plays a vital role in modern industry. Its outstanding electrical conductivity makes it indispensable in solar panels, electric vehicle batteries, and other renewable energy technologies. As the world pushes further down the road towards a low-carbon economy, silver demand is only going to grow. Mining output, however, has been flat, and the imbalance between supply and demand has been a key force driving prices upward.

Silver shares gold’s qualities as a hedge against uncertainty, but at a fraction of the cost. That makes it more accessible to smaller investors, and because it is less widely traded, it tends to be more volatile. When it rises, it can soar quickly. For years, the gold-to-silver ratio (a measure that compares the price of gold to the price of silver) has suggested that silver is undervalued compared with gold. If that gap narrows, silver could have plenty of room to run.

Platinum is a rather different proposition. Scarcer even than gold, its supply comes mainly from South Africa, a country that has faced no shortage of power cuts, labour strikes, and logistical bottlenecks. As a result, global stockpiles are at low levels. On the demand side, platinum has long been used in catalytic converters for petrol and diesel cars. More importantly, it is increasingly critical in hydrogen fuel cells, which are gaining traction as the world shifts towards cleaner energy.

- 10 tactics when researching funds, investment trusts and ETFs

- The biggest risks keeping fund managers awake at night

Historically, platinum has often traded at a premium to gold, but today it trades at a discount. If market conditions normalise, there is potential for a re-rating. For investors, that suggests upside potential alongside its industrial and clean energy role.

Palladium is the most complex of the four. It, too, has been used in catalytic converters, especially for petrol engines, and for many years rising demand, coupled with tight supply, sent its price sharply higher. Lately, though, the tide has turned. Recycling has increased, and automakers have been swapping platinum in for palladium because it is cheaper. That shift has changed the balance, and palladium no longer looks quite as scarce as it once did.

Even so, it remains a rare metal, and its supply comes from just a few countries, most notably Russia and South Africa. That brings its own risks. And while the traditional automotive demand may ease, palladium is finding new uses. It has properties that make it suitable for hydrogen purification, storage, and even fuel cells. It can also be applied in sensors and renewable technologies. So, although the old demand drivers may weaken, fresh ones could yet take their place.

One advantage of investing in funds rather than physical metals is diversification. A gold fund, for example, might also hold shares in companies that mine silver, platinum, or palladium, meaning investors are indirectly exposed to a broader set of precious metals. Because these funds invest in equities, they can sometimes outperform the underlying metal price. Miners’ profits are leveraged to the price of the commodity they produce, and if costs are contained, profits can rise faster than revenues. That has been the case this year, with many gold and precious metals funds outperforming the metals themselves.

- Stock secrets of where value fund managers are hunting

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

For those wanting more specific exposure, exchange-traded products provide direct access to a single metal, whether it is gold, silver, platinum, or palladium. They are often backed by physical holdings and aim to track the spot price.

What’s clear is that gold is not the only story in precious metals this year. Silver, platinum, and palladium each have distinct roles, risks, and opportunities. For investors, the question is not just whether to hold precious metals, but how to navigate them, and which mix suits their objectives.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.