The two fund types dominating August’s top-performing funds

Saltydog Investor crunches the numbers and highlights key trends among the best-performing funds and sectors in August.

9th September 2025 09:20

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Global stock markets have enjoyed one of the strongest summers in recent memory. After the April sell-off triggered by US tariff announcements, indices have rebounded sharply.

During the summer, many of the world’s major indices not only recovered their earlier losses but have gone on to reach new all-time highs.

- Invest with ii: Top ISA Funds | FTSE Tracker Funds | Open a Stocks & Shares ISA

In the UK, the FTSE 100 passed 9,000 for the first time ever, and the FTSE 250 hit its highest level in more than three years. In the US, the S&P 500 and Nasdaq have repeatedly closed at record levels, and the Dow Jones Industrial Average has recently joined the party. Germany’s DAX and Japan’s Nikkei 225 have also set fresh records. Throughout Asia, South America, and parts of Africa, major indices have also been climbing.

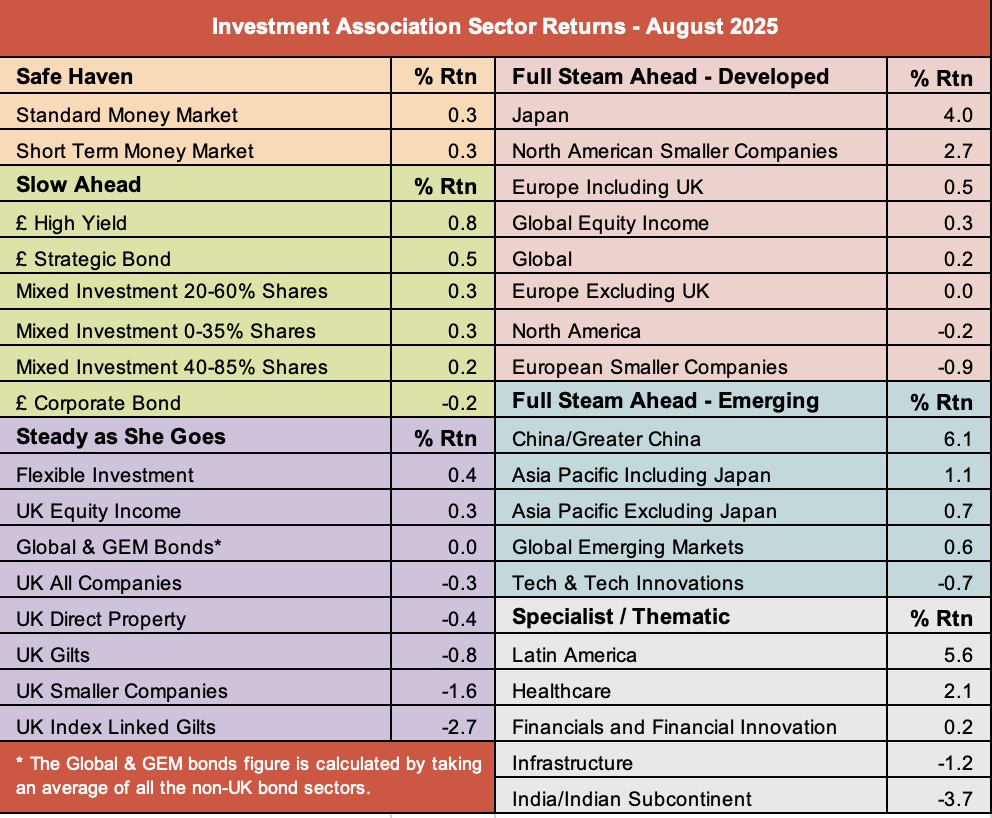

This has been reflected in the performance of the Investment Association (IA) sectors. Over the last three months, nearly all have made gains. The only exceptions are UK Index Linked Gilts, UK Direct Property, and India/Indian Subcontinent.

- Top 10 most-bought investment funds: August 2025

- 10 tactics when researching funds, investment trusts and ETFs

The summer started with the Technology & Technology Innovations sector leading the way. In June, it posted a one-month return of 6.5%, adding to the chart-topping 8.8% that it recorded in May. All the other sectors also went up.

Most sectors maintained their upward momentum in July, and the Technology sector grew by a further 5.5%. However, China/Greater China rose to the top of the table with a 7.6% gain.

Last month, overall sector returns were less impressive. China/Greater China stood out, with a 6.1% gain, followed by Latin America, up 5.6% and then Japan, up 4.0%. A significant number of sectors were either flat over the month or were showing losses, including the Technology sector which fell by -0.7%.

Data source: Morningstar. Past performance is not a guide to future performance.

Our list of top-performing funds has shifted noticeably from month to month. In June, Technology & Technology Innovation dominated, with five of the top 10 funds coming from that sector. July brought a more eclectic mix, led by biotech, with strong contributions from renewable energy, financials, and China.

In August, the focus narrowed again. Not surprisingly, five funds from the month’s best-performing sector, China/Greater China, made it into the top 10, but the top four funds were from the Specialist sector. Specifically, funds investing in companies involved in the mining of gold and other precious metals.

Our 10 top-performing funds in August

Saltydog’s top 10 funds in August 2025

| Name | Investment Association sector | Monthly return |

| WS Ruffer Gold | Specialist | 20.3 |

| Ninety One Global Gold | Specialist | 17.7 |

| SVS Sanlam Global Gold & Resources | Specialist | 16.1 |

| BlackRock Gold and General | Specialist | 15.7 |

| Allianz China A-Shares Equity | China/Greater China | 15.1 |

| New Capital China Equity | China/Greater China | 8.4 |

| BGF Systematic China A-Shares Opps | China/Greater China | 8.1 |

| Baillie Gifford Japanese | Japan | 7.6 |

| Matthews China Discovery | China/Greater China | 7.2 |

| Baillie Gifford China B Acc | China/Greater China | 7.2 |

Data source: Morningstar. Past performance is not a guide to future performance.

China’s recovery has been supported by policy easing, a trade truce with the US, and renewed investor interest. For many investors, Chinese equities still look attractive after years of underperformance, although they remain volatile and highly sensitive to political and economic news.

The price of gold has risen sharply over the past couple of years, with the pace quickening in recent months. At the start of 2024 it was trading around $2,200 per ounce. It has since powered through successive milestones, recently topping $3,500 and setting new all-time highs.

Gold has always been seen as a safe-haven asset, but this latest rally has been unusually powerful. It reflects both long-term structural demand and short-term catalysts. A key driver has been record central-bank buying. Since 2022, central banks, particularly in Asia and emerging markets, have been adding to their reserves to diversify away from fiat currencies and US Treasuries. China has been the most prominent buyer, with India, Turkey, and several Middle Eastern countries also stepping up their purchases.

Gold is also viewed as a hedge against inflation. With rates still above central bank targets, investors have turned to gold to preserve purchasing power. Expectations of US Federal Reserve rate cuts have provided an additional boost. Gold does not yield income, so it looks less attractive when interest rates are high, but when rates fall the opportunity cost of holding gold decreases.

Another important factor has been the decline in the US dollar. Gold is priced in dollars, so a weaker dollar makes it cheaper for non-US investors to buy. The dollar has dropped sharply against a basket of currencies, amplifying demand from overseas buyers and signalling broader concerns about the US economy.

Geopolitical instability has also driven investors towards gold. The wars in Ukraine and Gaza, unrest in the Middle East, and tensions in the South China Sea have all increased demand for safe-haven assets. Trade disputes, uncertainty over US policy, and political attempts to influence central banks have added to the appeal.

Technical factors have reinforced the rally. Gold has broken through key resistance levels, attracting further buying from speculators and institutions, and exchange-traded products have seen renewed inflows. The result has been strong upward momentum, with investors buying dips rather than selling into strength.

It is worth remembering that gold funds do not invest in bullion. They hold shares in gold mining companies whose profits tend to be leveraged to the gold price. When the gold price rises, miners’ earnings can increase faster, but when it falls the reverse is true.

Although gold is considered a safe asset, its price is far from stable. History shows that rallies can overshoot before sharp corrections, and the shares of mining companies are even more volatile.

Nevertheless, the combination of strong central bank demand, inflationary pressures, a weaker dollar, geopolitical risk, and the prospect of lower interest rates should support demand. For investors seeking diversification and protection against shocks, gold funds remain a compelling, if high-risk, option.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.