The energy funds boosted by conflict in the Middle East

Saltydog Investor highlights three funds that are benefitting from a rising oil price.

16th October 2023 13:58

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Each week at Saltydog Investor we look at the performance of the Investment Association sectors and highlight any trends.

We tend to focus on a relatively short period of time ranging from a week to six months. For each sector we show the cumulative four, 12 and 26-week returns, as well as the individual weekly returns for the last eight weeks.

- Invest with ii: Top ISA Funds | Top Junior ISA Funds | Open a Stocks & Shares ISA

Stock markets around the world performed well in June and July, and this was reflected in our sector performance. In the last week of July nearly all sectors were up over four weeks, and most were also showing gains over 12 and 26 weeks.

Since then, general market conditions have deteriorated and when we looked last week only three of the sectors were showing gains over the previous four weeks: the two Money Market sectors and India/Indian Subcontinent. The majority of the sectors were also down over 12 and 26 weeks.

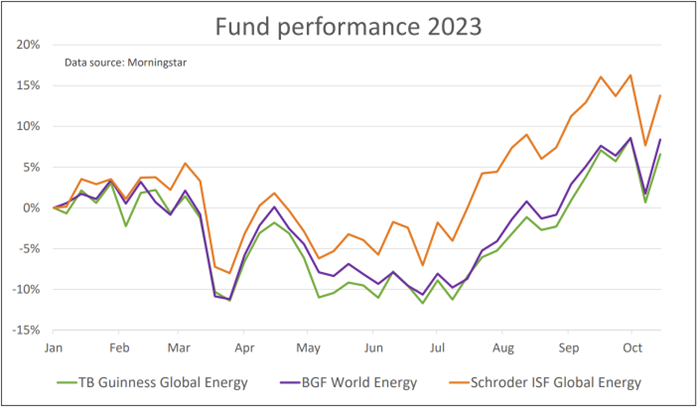

Last week I highlighted the best performing funds in the third quarter of this year. At the top of the list was the TB Guinness Global Energy fund with a three month return of 19.2%. Next was the Schroder ISF Global Energy fund, followed by BGF World Energy. They did not have a very good start to October, but picked up last week.

In the first six months of this year all of these funds dropped in value, but since July they have risen sharply.

This was mainly due to an expectation that demand in China would increase, as their post-Covid economic recovery gathers pace, while Saudi Arabia and Russia limited supply (they are maintaining voluntary oil production cuts, totalling 1.3 million barrels per day, on top of the limits already agreed by OPEC).

In the last week there have been a couple of further developments.

The Hamas assault on Israel and the subsequent retaliation by Israel forces could have knock-on effects across the Middle East. This would have a significant impact on oil supply, especially if Iran gets involved. About a third of the world’s oil is produced in the Middle East and a lot of it is shipped through the Strait of Hormuz, located between Oman and Iran.

The US has also imposed sanctions on two companies for shipping Russian oil sold above the current price cap. Following the Russian invasion of Ukraine, the European Union and G7 countries put sanctions in place to reduce Russia's revenue from oil exports, while keeping global energy markets stable. They agreed that companies in participating countries would not provide shipping, insurance, and other services related to the transport of Russian oil, unless it was sold at or below a certain price.

- Once-hot clean energy is in the doldrums – is it time to buy?

- China underweight pays off for this Super 60 fund

- Should you copy Britain’s best fund managers, or buy their funds?

This price is set at a level that is below the current market price, but still high enough to allow Russia to sell some oil. It is currently $60 per barrel.Initially, Russian crude traded below the price cap anyway, which made it easily enforceable. However, as other oil prices have gone up in recent months so has the price for Russian crude. Last week was the first time that the American government actually enforced its right to impose sanctions on two shipping companies who have carried Russian crude above the price cap.

It is also worth noting that as UK investors, we would have seen a significant currency gain in energy funds over the last few months. The majority of their holdings are based in the US, in companies like Exxon Mobil, Chevron, and ConocoPhillips. On 14 July one dollar was worth just over 76p, it is now worth over 82p, a gain of around 8%. That means that any dollar denominated assets would have gained 8% in pound note terms even if their dollar value had not changed.

The energy funds have been some of the most volatile in the past, and with all the current uncertainty I do not envisage that changing any time soon.

One of our demonstration portfolios recently invested in the Schroder ISF Global Energy fund and it is currently showing a gain of 5.7%.

For more information about Saltydog Investor, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.