Four household names: buy, hold or sell?

Analyst Rodney Hobson revisits two old favourites, highlights a stock where his faith in it as an investment has been justified, and examines an American megabrand that’s just published results.

13th August 2025 09:16

by Rodney Hobson from interactive investor

More bad news from two old favourites of this column, neither of which pay a dividend or look likely to do so for years to come.

- Invest with ii: Most-traded US Stocks | Buying US Shares in UK ISA | Cashback Offers

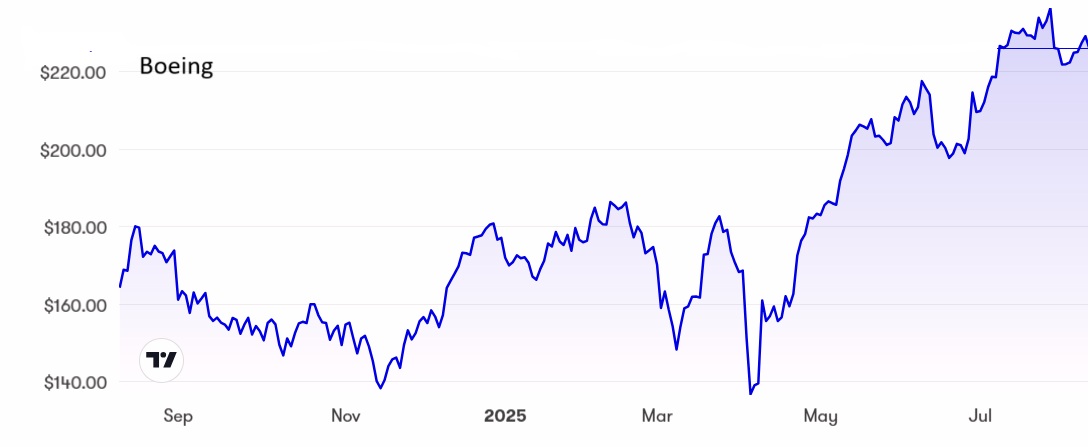

Just when life seemed to be getting better for airplane manufacturer Boeing Co (NYSE:BA) after so much bad news on the civil aviation side, up pops strike action by more than 3,000 defence workers over pay and conditions.

Boeing claims that it was already offering a 40% pay rise over four years. Boeing is already loss-making and can hardly afford the current offer, let alone one that will buy off the striking workers. Boeing shares have jumped from below $140 in May to around $230 in a triumph of hope over reality. All the more reason to sell.

Source: interactive investor. Past performance is not a guide to future performance.

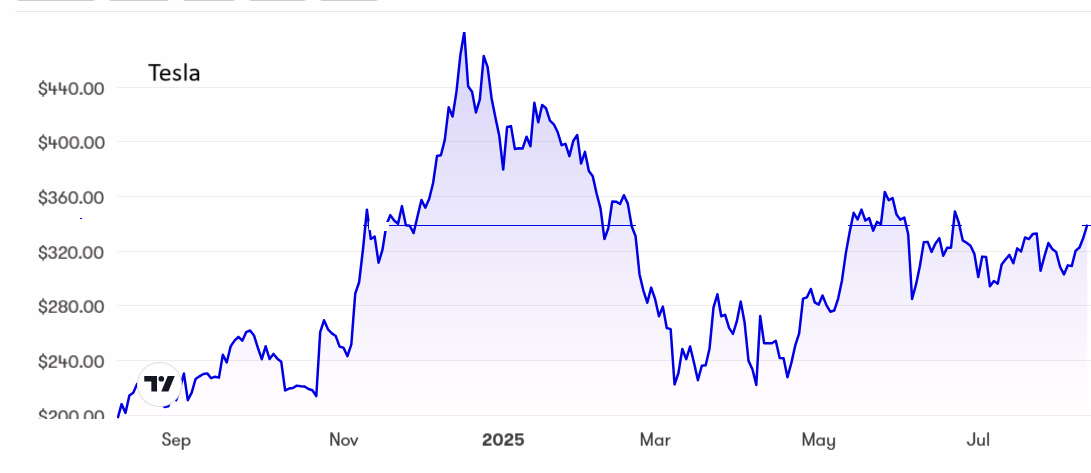

Carmaker Tesla Inc (NASDAQ:TSLA) continues to suffer falling sales in Europe, most noticeably in the UK, where sales slumped by 60% to fewer than 1,000, but also in France and Denmark. Yet Elon Musk is continuing to try to railroad through a hefty package of new shares for himself as part of a $29 billion (£21.4 billion) pay package, despite a court throwing out the scheme as unfair to other shareholders.

Tesla shares stand $100 higher than they did in May but are now bumping against a ceiling at $340, where the price/earnings (PE) is ludicrously near 200. Sell.

Source: interactive investor. Past performance is not a guide to future performance.

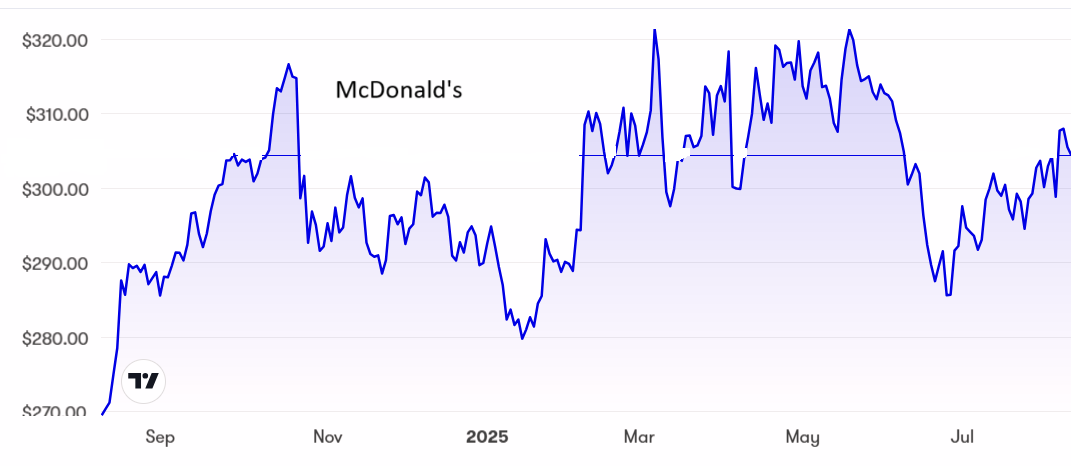

On a much happier note, my faith in McDonald's Corp (NYSE:MCD)’s as an investment (I hate the food and haven’t been in one of its restaurants this side of the millennium) has once again proved justified with its best quarterly results for more than a year.

While some rivals have struggled with a slowdown in consumer spending, McDonald’s has cleverly gone even further downmarket with its McValue range, targeting low-income groups that form its main customer base. Even so, chair Chris Kempczinski is worried about a continuing decline in visits by households with incomes of less than $45,000, which are reportedly put off by meals costing over $10.

Another shrewd move was tying in a meal with the film A Minecraft Movie across 100 countries, the biggest global campaign by McDonald’s so far. Launched in April, it sold out of collectible figures within two weeks.

- The tech funds that have actually beaten the Nasdaq

- Stockwatch: can UK shares remain strong given US tariff impact?

Revenue up 5% year-on-year at $6.8 billion and like-for-like sales up 3.8% both beat analysts’ forecasts and led to an 11% rise in net income to $2.25 billion. Growth had been subdued for four quarters thanks to food price inflation and a backlash against American brands generally.

I last tipped the shares at $290 in June, having recommended them earlier at $244 and again at $280. At the current $301, the p/e remains around 26 and there is a useful yield of 2.3%. The shares just about remain a buy although investors should note that $320 will be a tough nut to crack.

Source: interactive investor. Past performance is not a guide to future performance.

At least these excellent figures were better received by the stock market than equally good results from entertainment group The Walt Disney Co (NYSE:DIS). Disney is quite rightly reducing its reliance on the TV division, which is in a crowded and highly competitive marketplace.

- ii view: Disney details mixed results

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Instead it is building up the steady income that comes from subscribers to its Disney+ and Hulu services, adding 2.6 million in the latest quarter to take the total to 183 million. The direct-to-consumer business turned an operating loss of $19 million a year ago into a $346 million profit this time, quite a turnaround.

Source: interactive investor. Past performance is not a guide to future performance.

The improved performance was also seen in its theme parks, despite Walt Disney World in Orlando, Florida, coming up against competition from Universal’s Epic Universe, which opened nearby two months ago.

Net profit for the quarter more than doubled to $5.9 billion on revenue 2% higher at $23.7 billion.

The shares have inexplicably slipped back from $124 to around $113, where the p/e is less than 18, although the yield is pretty meagre at 0.9%. I recommended the shares at $110 in December and at $120 before that. The buy stance remains in force.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.