FTSE 100 stocks jump 25% and three shares confirm corona boom

Share prices are sharply higher, and business is better than ever at some companies.

7th April 2020 12:57

by Graeme Evans from interactive investor

Share prices are sharply higher, and business is better than ever at some companies.

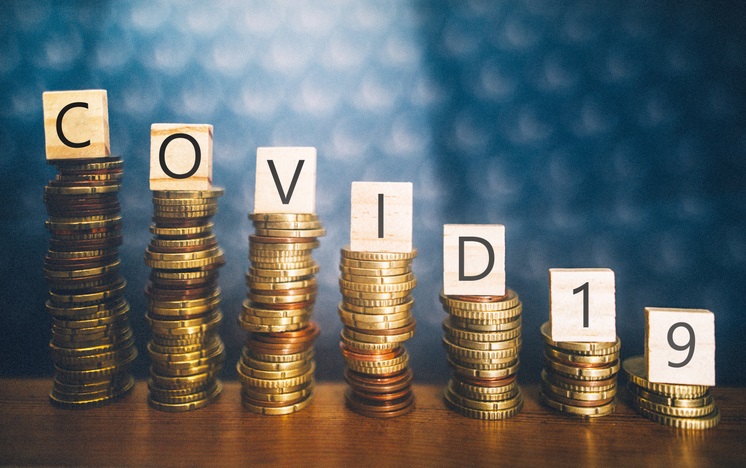

Carnival (LSE:CCL) and easyJet (LSE:EZJ) shares surged by more than a fifth today as global stock markets continued a rally that even the most optimistic investor might struggle to fully justify.

Encouraged by tentative signs that the Covid-19 death rate is slowing in Europe, the FTSE 100 index added another 2.4% and 18 top-flight stocks opened more than 10% higher. Several widely-held stocks improved, with ITV (LSE:ITV) up 13%, Barclays (LSE:BARC) ahead 12% and Next (LSE:NXT) 11% stronger.

It means the FTSE 100 has climbed more than 16% since dipping below the 5,000 barrier on 23 March, even though large parts of Europe are still in lockdown and the shutdown of several industries is certain to result in the worst economic figures in living memory.

Since the market turmoil started in mid-February, the top flight's fall has been limited to 22% as investors show faith in the efforts of governments and central banks to prop up the global system. The market resilience comes despite companies taking the unprecedented action of jettisoning dividend payments to ensure they have enough cash to fight the downturn.

Source: TradingView Past performance is not a guide to future performance

Rolls-Royce (LSE:RR.), for example, has just scrapped its dividend for the first time since it was privatised in 1987. Its shares, however, were up by another 14% today to add to the 18% gain seen on Monday after it said it had enough cash to see it through the crisis.

Other blue-chip stocks showing signs of recovery after being on the frontline of the Covid-19 sell-off, are British Airways owner International Consolidated Airlines Group (LSE:IAG) and InterContinental Hotels Group (LSE:IHG) after both rose 12% today. Lloyds Banking Group (LSE:LLOY) was back above 30p after climbing 5%.

As well as falling death numbers in Italy and Spain, where there are now hopes for an easing in lockdown restrictions, investors have been encouraged by a rebound in oil prices. This has been driven by hopes that Russia and Saudi Arabia can resolve their supply differences at an OPEC meeting on Thursday.

BP (LSE:BP.) shares were up another 1.5% today and have now risen by 46% since their pummelling in mid-March when the price of Brent crude slid below US$30 a barrel. And having recently been hit by fears that it may have to cut its dividend for the first time since the Second World War, Royal Dutch Shell B (LSE:RDSB) shares improved by another 3% to 1,483p.

- Stockwatch: a bet on recovery as crisis could transform sales

- Best and worst FTSE 100 shares in the first quarter of 2020

Today's session in London was also marked by a reduction in the number of companies reporting on the impact of Covid-19.

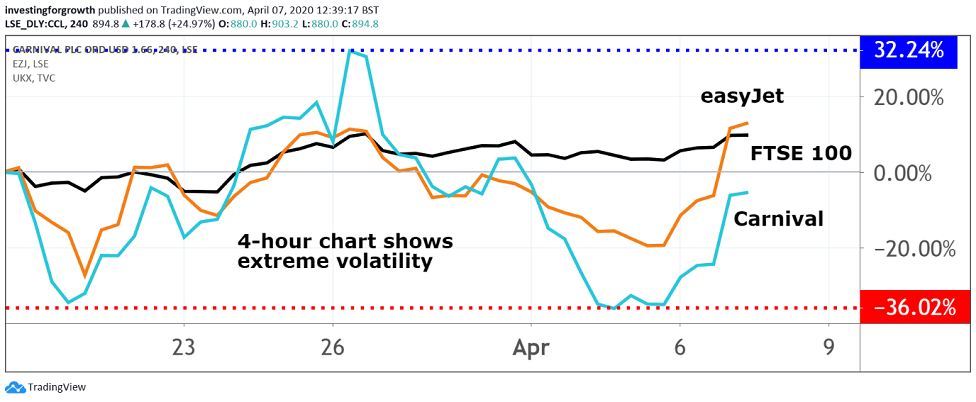

In the case of Plus500 (LSE:PLUS), the contracts-for-difference platform is actually benefiting from the current turmoil as more customers seize on volatile price movements to place leveraged bets on a wide range of markets.

It said today that revenues for the quarter to 31 March had jumped 487% to $316.6 million, with its number of active customers almost doubling on a year earlier to 194,024. Revenues and profits for 2020 are now set to be substantially ahead of City forecasts, helping shares to consolidate gains of more than 50% since the middle of March.

Source: TradingView Past performance is not a guide to future performance

Appliance repairs business Homeserve (LSE:HSV) is also showing signs of resilience after it published a robust end-of-year trading update today. Profits are set to be up by a bigger-than-expected 12% to £181 million, with the company still looking at its dividend options ahead of May's results.

It has not furloughed or made staff redundant in the current crisis, with Homeserve's 6,000 office-based staff all working from home and the company globally completing 150 emergency repair jobs every hour.

Its all-important customer policy retention rate also remains strong, leading shares to jump 11% to 1,164p following a recovery from a low of 762p less than a month ago.

- The first fund we’ve bought since the crash

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

There was a similar story at Hilton Food Group (LSE:HFG), which today announced an unchanged full-year dividend of 21.4p after reporting an 8.7% improvement in earnings per share to 46p.

All its food packing facilities remain fully operational, with no significant supply chain issues experienced so far. Chairman Robert Watson said:

“So far we have coped well with the challenges and are confident that through our local operating model and financial strength we are well placed.”

Shares rose 5% to 1,040p, which is close to where they were prior to the Covid-19 crisis.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.