This fund region is in a rich vein of form

Saltydog Investor’s latest review of performance data shows there’s a fund region topping the charts over the past four, 12 and 26 weeks.

25th September 2023 14:02

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Last week, when we reviewed our fund performance data up to 16 September, we noticed how some of the funds from the Japanese sector had taken off in recent weeks.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

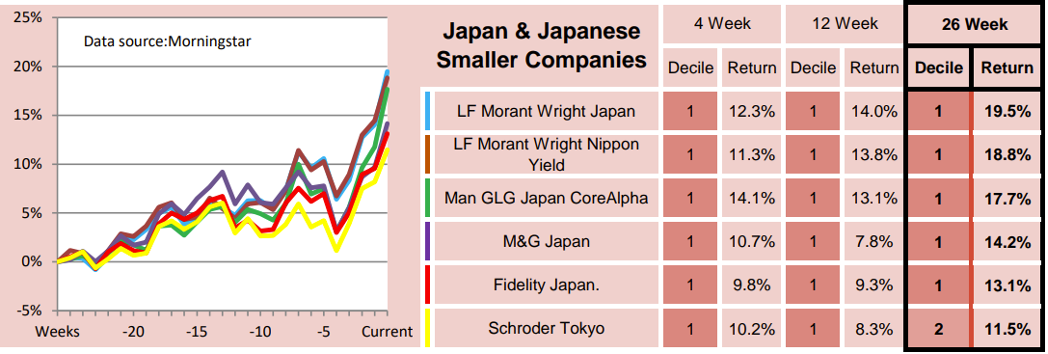

Here is an excerpt from last week’s reports showing the leading funds from the Japan and Japanese Smaller Companies sectors, based on their performance over the previous 26 weeks.

Past performance is not a guide to future performance.

I have checked again this morning, and the top three funds so far this month are all from the Japan sector.

LF Morant Wright Japan is at the top, followed by Man GLG Japan CoreAlpha, and then LF Morant Wright Nippon Yield. Out of the top 20 funds, ranked by their month-to-date returns, 13 are from either the Japan or the Japanese Smaller Companies sector.

Although Japan is the world’s third-largest economy, behind the US and China, it is unusual to see the funds that invest in it making their way to the top of our tables.

Japan’s stock market rose sharply in the 1980s powered by a strong export-driven economy. The Nikkei 225 went from around 6,500 at the beginning of the decade to an all-time high of nearly 39,000 at the end of 1989.

During that period there was also a real estate boom that eventually collapsed in the early 1990s.The bursting of the asset price bubble led to a prolonged period of economic stagnation, known as the "Lost Decade”. Japan's stock market experienced a sharp decline, with the Nikkei 225 losing over half its value from its peak in 1989.

Japan's economy gradually recovered during the early 2000s, driven by exports and increased business efficiency. However, like many other countries, it was caught up in the global financial crisis in 2008, which led to a brief economic downturn.

- Should you copy Britain’s best fund managers, or buy their funds?

- What the delayed recession means for investors

In 2012, Shinzo Abe became prime minister and implemented a set of economic policies known as Abenomics. These policies aimed to combat deflation, stimulate economic growth, and weaken the yen to boost exports.

The stock market initially responded positively to Abenomics, and the economy showed signs of improvement. From the start of 2012 to the end of 2019, the Nikkei 225 went up from around 8,500 to over 23,000, a rise of more than 175%.

Then the Covid-19 pandemic had a significant impact on Japan's economy, leading to a recession in 2020. From then on it started to recover. The Nikkei 225 briefly went above 30,000 at the end of 2021, before dropping back down to around 26,000 at the end of last year.

- Should you follow Warren Buffett into Japan?

- Fund Spotlight: buying India over China pays off for this fund

Abe was replaced by Yoshihide Suga in 2020, who resigned a year later following criticism of his handling of the Covid-19 pandemic. Fumio Kishida took over in October 2021. All three are from the Liberal Democratic party, but Prime Minister Kishida is looking to move away from the Abenomics policies, which he said were not enough to create a sustainable and inclusive economy.

So far this year, the Nikkei has gone up by 25% and in June went back above 33,000 for the first time since 1990. It dropped below 31,500 in August, but subsequently recovered. The largest gains were in May, when it went up by 7%, and June, when it rose by 7.5%.

At the moment I am not sure exactly what has driven the funds investing in Japan up so steeply in the past few weeks, but they are certainly worth keeping an eye on.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.