The funds leading the recovery in November

A handful of stocks lifted a range of funds, explains Saltydog Investor.

4th December 2023 14:41

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Nearly all the major stock markets around the world went down in August, September and October, so it was a welcome relief to see a rally in November.

The Hong Kong Hang Seng ended the month down 0.4%, but all the other indices we track went up.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

The American markets did particularly well. In the US, the Dow Jones Industrial Average went up by 8.8%, the S&P 500 made 8.9%, and the Nasdaq gained 10.7%. The Brazilian Ibovespa beat them all, rising by 12.5%.

| Stock Market Indices | |||||||

| Index | 1 Jan to 31 March | 1 April to 30 June | July 2023 | Aug 2023 | Sept 2023 | Oct 2023 | Nov 2023 |

| FTSE 100 | 2.4% | -1.3% | 2.2% | -3.4% | 2.3% | -3.8% | 1.8% |

| FTSE 250 | 0.4% | -2.7% | 3.9% | -2.8% | -1.8% | -6.5% | 6.7% |

| Dow Jones Ind Ave | 0.4% | 3.4% | 3.3% | -2.4% | -3.5% | -1.4% | 8.8% |

| S&P 500 | 7.0% | 8.3% | 3.1% | -1.8% | -4.9% | -2.2% | 8.9% |

| NASDAQ | 16.8% | 12.8% | 4.0% | -2.2% | -5.8% | -2.8% | 10.7% |

| DAX | 12.2% | 3.3% | 1.9% | -3.0% | -3.5% | -3.7% | 9.5% |

| CAC40 | 13.1% | 1.1% | 1.3% | -2.4% | -2.5% | -3.5% | 6.2% |

| Nikkei 225 | 7.5% | 18.4% | -0.1% | -1.7% | -2.3% | -3.1% | 8.5% |

| Hang Seng | 3.1% | -7.3% | 6.1% | -8.5% | -3.1% | -3.9% | -0.4% |

| Shanghai Composite | 5.9% | -2.2% | 2.8% | -5.2% | -0.3% | -2.9% | 0.4% |

| Sensex | -3.0% | 9.7% | 2.8% | -2.5% | 1.5% | -3.0% | 4.9% |

| Ibovespa | -7.2% | 15.9% | 3.3% | -5.1% | 0.7% | -2.9% | 12.5% |

Data source: Morningstar. Past performance is not a guide to future performance.

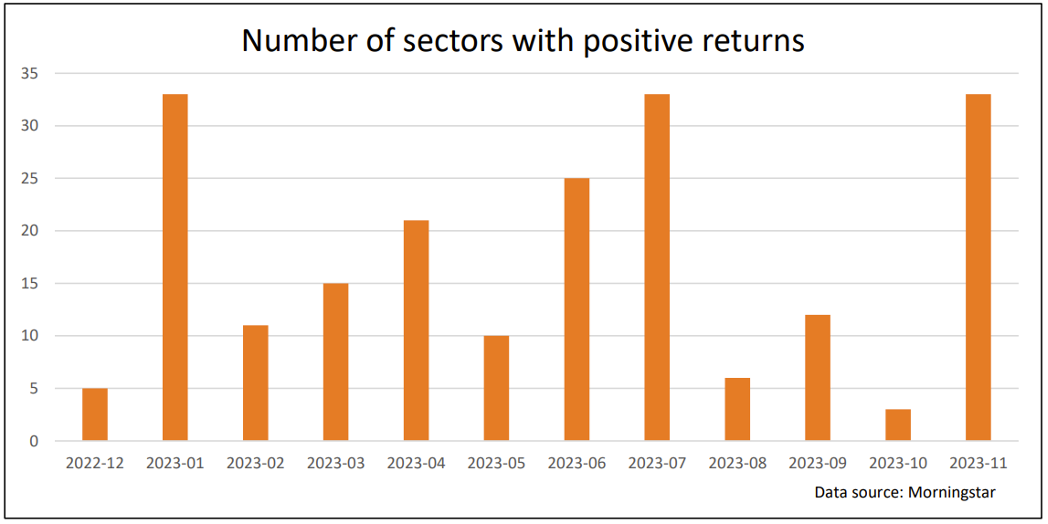

This change in fortune is also reflected in our latest sector analysis.

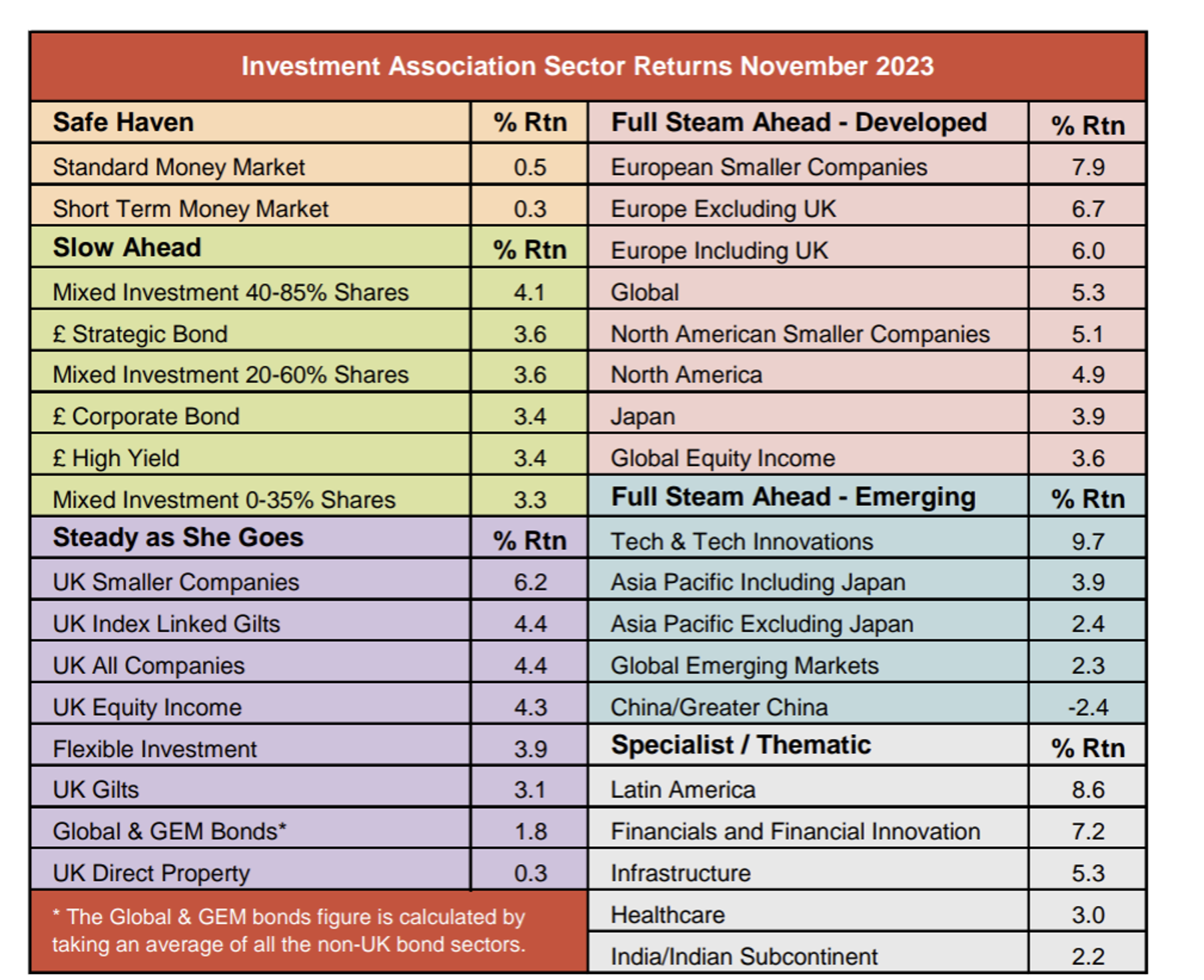

Last month, 33 out of the 34 Investment Association (IA) sectors that we monitor went up, compared with six in August, 12 in September, and three in October. The only one that went down was China/Greater China, which fell by 2.4%.

The best-performing sector was Technology & Technology Innovations, up 9.7%, but lots of other sectors did well. The three European sectors, UK Smaller Companies, Latin America, and the Financials and Financial Innovation sector all went up by 6% or more.

Data source: Morningstar. Past performance is not a guide to future performance.

When the Nasdaq performs well, you know that the US technology stocks are having a good run and that it is probably being led by the Magnificent Seven - NVIDIA (NASDAQ:NVDA), Tesla (NASDAQ:TSLA), Meta Platforms (NASDAQ:META), Apple Inc (NASDAQ:AAPL), Amazon.com Inc (NASDAQ:AMZN), Microsoft Corp (NASDAQ:MSFT), and Alphabet (NASDAQ:GOOGL). That was certainly the case in November.

This in turn will help the funds in the Technology and Technology Innovations sector and so it is no surprise that it was the leading sector last month. However, it is not only the technology funds that invest in these high-flying US technology stocks. They can also form a significant part of the holdings in the growth and innovation funds from the North America and Global sectors.

- Why 2023’s biggest stock market story has staying power

- Terry Smith adds tech stock owned by Smithson to flagship portfolio

Looking at the top 10 funds from our analysis in November, three are from the Technology and Technology Innovation sector, but the leading fund, Baillie Gifford American, is actually from the North America sector. Five of the funds are from the Global sector.

The Baillie Gifford American fund has around 40% invested in technology companies and Amazon, Nvidia, and Tesla all feature in its top five largest holdings. This would explain why it always tends to do well when the funds from the Technology and Technology Innovations sector are also doing well.

Saltydog’s top 10 funds in November 2023

| Fund name | Investment Association sector | Monthly return (%) |

| Baillie Gifford American | North America | 17.8 |

| Liontrust Global Technology | Technology and Technology Innovation | 15.6 |

| GAM Disruptive Growth | Global | 14.2 |

| Liontrust Global Innovation | Global | 13.5 |

| Pictet - RoboticsI | Technology and Technology Innovation | 13.4 |

| T. Rowe Price Global Technology Equity | Technology and Technology Innovation | 13.0 |

| Premier Miton Pan European Property Share | Property | 12.7 |

| GAM Star Disruptive Groeth | Global | 12.4 |

| Baillie Gifford L/T Global Growth | Global | 12.4 |

| abrdn Global Innovation Equity | Global | 12.3 |

Data source: Morningstar. Past performance is not a guide to future performance.

Although their performance has been impressive over the last month, these funds did fall heavily during the previous three months, and have still not got back to where they were when they peaked towards the end of 2021.

For more information about Saltydog Investor, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.