The funds protecting investors from inflation and conflict in Ukraine

11th March 2022 09:40

by Sam Benstead from interactive investor

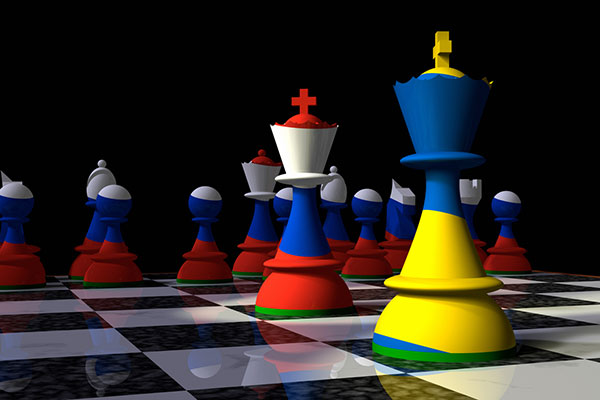

Stock markets are giving investors a bumpy ride, but some funds and investment trusts offer refuge.

Stock markets around the world have fallen in tandem this year as inflation – spurred higher by the conflict in Ukraine and the boycott of Russian oil – threatens to trigger a steep rise in interest rates from central banks.

Checking investment accounts should come with a warning: this year the FTSE 100 index has fallen 5%, the S&P 500 is down 11% and European stocks have fallen 13%. Fast-growing stocks in the Nasdaq 100 index, which have rewarded investors the most for the past decade, are down more than 17% in 2022.

But amid the market turmoil, some investments have managed to protect investors and even make them money: commodity funds and “wealth preservation” investment trusts.

Cutting Russia – and its metal, grain, oil and gas – off from the global trade is causing commodity prices to spike. Oil now trades at $120 a barrel, wheat prices set new records and gold is around $2,000 an ounce.

This has fuelled returns for funds investing in mining and oil firms, as well as commodities directly. Top performers this year include Vontobel Commodity, up 42%, Sanlam Global Gold & Resources, up 20%, and GS North America Energy & Energy Infrastructure Equity, up 32%, and BlackRock World Mining Trust (LSE:BRWM), up 26%.

- When markets fall heavily, here's what to avoid doing

- Energy independence: shares to benefit from green energy boom

Seema Shah, global investment strategist at fund manager Principal Global Investors, said: “Commodity prices rise with each terrifying headline. They have surged as fears of Russian retaliation trigger a spike in prices and, therefore, perform as both a geopolitical and inflation hedge.”

The other standout area so far this year has been investment trusts that seek to protect investors’ money. These include Ruffer Investment Company (LSE:RICA), which has returned 5% this year, and Capital Gearing (LSE:CGT) and Personal Assets (LSE:PNL), which have fallen around 2%. In contrast, RIT Capital Partners (LSE:RCP), the trust that manages the Rothschild’s family wealth, has fallen 11% .

Each wealth preservation trust has a low weighting to equities and plenty of defensive armoury, such as low-risk inflation-linked bonds and small weightings to gold.

Natural resource fund returns may cool

But Ben Yearsley, investment director at Shore Financial Planning, reckons the sharp rise in commodity prices will probably subside, meaning that buying natural resources funds now to make a quick profit is not a good idea.

“Buying these funds has been the ‘war trade’ but share prices will eventually come down. If the conflict had been in another part of the world, such as Asia, then there would not have been the same reaction from markets.”

- Commodities shock: wild times as scarcity looms

- How to play the market rotation: fund, trust and ETF ideas

- Ian Cowie: battery trust play for shift away from Russian energy

Longer term, he thinks mining firms are a good investment.

“There is still a structural demand story for clean energy, which is good for the companies that mine nickel, copper and lithium. The short-term spike in prices will probably be temporary, but over the long term, metal prices should keep rising.”

Yearsley personally owns BlackRock World Mining Trust (LSE:BRWM), Amati Strategic Metals (BMD8NV6), and Jupiter Gold & Silver as part of a balanced portfolio.

Investing in oil stocks and funds is more complicated, according to Yearsley. He said: “Oil rose before the war but has been supercharged now. Investment in new oil has dried up, meaning that supply is tight, and prices will keep rising. The medium-term outlook for oil is good but longer term it is more challenging as clean energy investment increases.”

Will wealth preservation trusts continue to deliver?

Capital preservation trusts are a strong hedge against volatile markets and can keep delivering for investors, according to Paul Chilver, financial planning manager at Birkett Long.

He said: “Based on performance figures year to date, Personal Assets and Ruffer Investment Company have so far protected investors' money better, which would be expected when looking at the top 10 holdings. Personal Assets’ largest holding is gold and Ruffer has a lot of money in inflation-protected UK government bonds.

“They, along with Capital Gearing, appear to have achieved what they aim to do, while RIT has struggled more.”

He also notes that another way of protecting a portfolio is to buy trusts that own renewable energy assets, such as Greencoat UK Wind (LSE:UKW), which invests in UK wind farms and returns the generated income to investors.

- Renewable energy stocks: Atome Energy, Ceres Power & ITM Power

- Bet on this stock in race for green energy

“It aims to preserve capital in real terms against inflation and also produces an attractive dividend, currently 4.7%,” he said.

Yearsley adds: “Personal Assets has lots of gold and inflation-linked bonds, which are doing very well this year.”

He notes that another strong performer has been VT Argonaut Absolute Return, which has made short bets on technology stocks and invested in commodities.

For Shah, an area of hope for investors is American shares, which have performed better than European peers.

She said: “Not only is this a reflection of the underlying strength of the US economy, but also America’s status as a net energy exporter. By contrast, as a net energy importer dependent on Russian oil and gas, the European economy faces considerably greater economic risk.”

The best-performing US funds this year have been those that buy dividend-paying stocks and cheap ‘value’ shares. These types of companies make a lot of money and return it to shareholders, rather than promise a lot of future growth.

Top performers include BNY Mellon US Equity Income, M&G North American Value and BlackRockGF US Basic Value.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.