Games Workshop: Verdict on this stunning performer

24th August 2018 13:52

by Richard Beddard from interactive investor

From being a good business going nowhere, it's now a better business releasing its full potential, argues analyst Richard Beddard. The impact on performance has been remarkable.

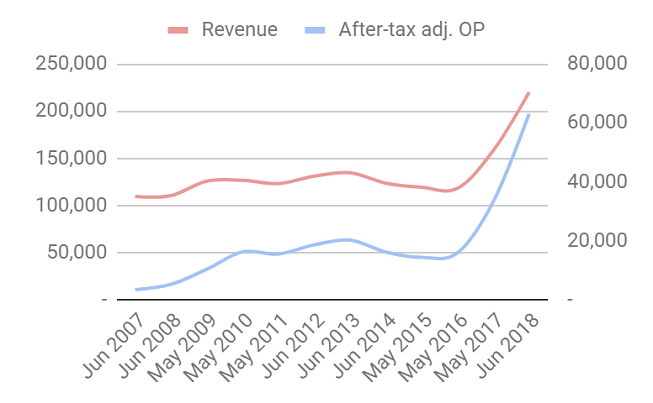

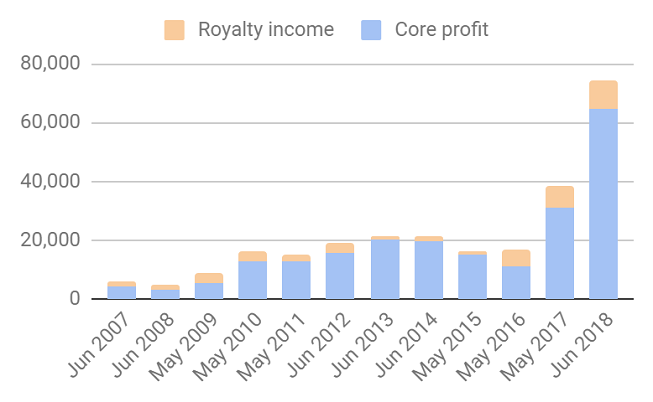

Like many shareholders, I'm still coming to terms with what's happened at Games Workshop over the last two years. If you're not familiar with the story, the charts show just how remarkable the turnaround is.

Games Workshop wasn't a bad business before it doubled revenue and quadrupled profit in two years, though...

Source: interactive investor

The company makes models, mostly soldiers, for collectors and for gamers who fight battles in fictional worlds. Warhammer 40,000 is set in the future, and Warhammer Age of Sigmar has a historical fantasy setting.

The company had expanded rapidly in the 2000s because of the popularity of a third game launched to coincide with the blockbuster Lord of The Rings films. The popularity of the game quickly subsided though, once the film trilogy had run its course, and the company's costs were too high compared to flagging sales.

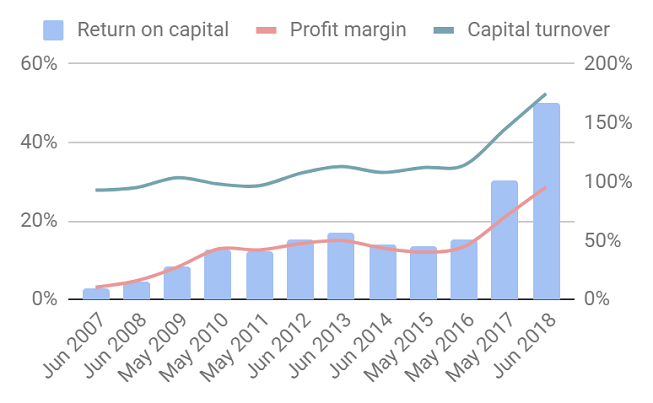

A period of rationalisation followed and from 2010 Games Workshop was a very profitable business again, earning returns on capital and operating margins in the mid-teens. It wasn't growing much though, until the years ending May 2017 and 2018.

Source: interactive investor

Then, I think Games Workshop started releasing its full potential. Before I do my best to explain why, a few more charts to demonstrate it is performing in every way:

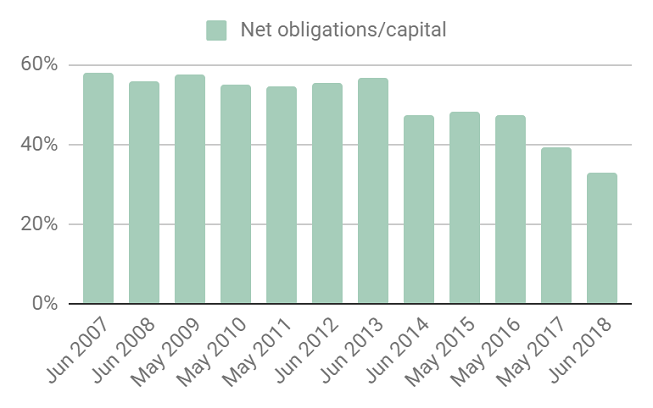

Source: interactive investor

The company has experienced extraordinary growth, while reducing its dependence on external finance. It has no debt.

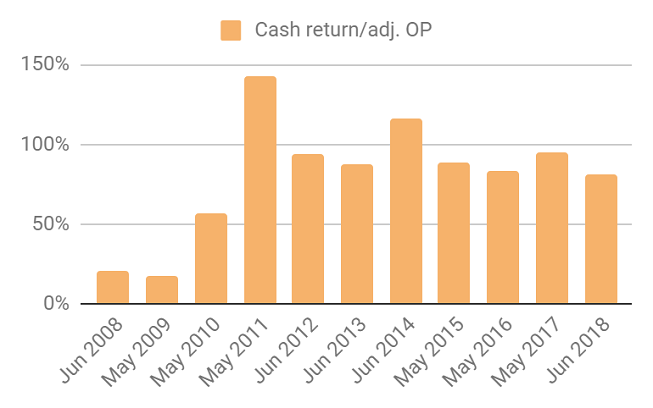

The obligations in the chart above are, in the main, a rough estimation of the value of the leases on stores. Games Workshop's finances are strong because it earns most of its profit in cash:

Source: interactive investor

Three years ago a vocal subset of customers were petitioning the company to refocus on the game. Shareholders, me included, were afraid too. By focusing on big spending collectors of intricate and expensive models, often former gamers, the company seemed to be neglecting the game that introduced them to the modelling hobby in the first place.

Scoring Games Workshop

As usual I’m scoring Games Workshop to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 2

The resurgence of Games Workshop coincides with the tenure of Kevin Rountree, a Games Workshop lifer who was elevated from chief financial officer to chief executive in 2015. It also coincides with the gradual retirement of Tom Kirby the man who oversaw the company’s dramatic growth in the 1990s and early 2000s, and the stagnation that followed. Kirby owns about 6% of the shares.

Nick Donaldson, who replaced Kirby as chairman a year ago, says the spectacular growth of the last two years was “driven by the strategy devised and implemented by our CEO,” Kevin Rountree. The “core” of the strategy, according to the chairman is “to design, manufacture and sell wonderful models and games for our existing hobbyists/customers and to recruit and retain new customers excited by our Warhammer worlds.”

This strategy differs from Kirby’s in two ways. It acknowledges the role of the game and it emphases recruiting new customers.

Rountree says there have been no silver bullets, but it seems likely initiatives started under the old regime laid some of the foundations for change. The company's controversial switch from metal to resin has allowed it to design far more intricate models, while reducing the manufacturing cost. The adoption of a mainly one-man store format has helped it keep the business profitable as sales have moved online.

The company makes money selling miniatures collected by modellers and gamers. Warhammer comes in two versions. The fantasy rulebook has been torn up and simplified taking some of the best elements of the more popular science fiction version, Warhammer 40,000. The re-launched Warhammer Age of Sigmar proved a hit like its stablemate. Games Workshop has subsequently launched new editions of Warhammer 40,000 (June 2017) and Warhammer Age of Sigmar (June 2018),

In 2013, the company seemed to withdraw from the internet when it closed a corporate Facebook page down in the face of a customer backlash. Now it is colonising YouTube and Facebook with daily videos that it says reach 100,000 people a day. The Warhammer Community site, still less than two years old received 70m page views from 5m users in the year to May 2018.

The charts show that except for the Lord of the Rings years, Games Workshop has always made good money. Fans of the film series didn’t have gaming and modelling in their DNA. They were attracted to Games Workshop’s stores by their love of the films, and Games Workshop failed to convert enough of them into life long modellers. That experience probably induced Games Workshop’s subsequent focus on its own intellectual property, a good thing, and neglect of gamers, which wasn’t so good.

Adaptable: How will it make more money?

Score: 2

The attraction of Games Workshop has always been the intellectual property, fictional worlds that capture the imaginations of large numbers of young people. Importantly, the hobby, particularly the modelling aspect, often stays with them into middle age and beyond.

The only firms that can profit legally from Warhammer characters and stories are Games Workshop, retailers who buy from Games Workshop, and its licensees, principally computer game designers.

A vertically integrated business model means Games Workshop captures most of the value. The company designs and manufactures the models in Nottingham. It sells them in its own stores, and markets them through its own publications in print and online. The company relies on independent stores in parts of the World it has yet to reach or that won't support a dedicated store, as I discovered in Kirkwall, Orkney, this summer, while gazing in the window of the local bike shop:

With Warhammer resurgent, Games Workshop is striving to meet demand, adding new capacity to its factory in Nottingham and warehousing in Nottingham, Memphis and Sydney. It is upgrading IT systems and plans to open 25 new stores, mostly in North America and Germany.

The company is broadening the appeal of Warhammer with easier to assemble push-fit models and Warhammer 40,000 Conquest, a partwork comprising magazine, paints and miniatures, so customers can build a collection over time. It is also letting its licensing team off the leash, encouraging them to be more experimental, courting not just computer game and app designers but filmmakers.

Source: interactive investor

The Warhammer rules are free to download. Royalties from licensees are lucrative, but the company still makes most of its money from models. What has changed in the last few years is the approach to marketing. Games Workshop has gone on the offensive again.

Resilient: What could go wrong?

Score: 2

The company largely controls its destiny. It has prospered alongside the growth of video gaming, and although rivals exist, they are small. A challenge to Games Workshop’s dominance seems unlikely because so many gamers and modellers have bought into Warhammer, a captive audience that has enabled the company to build economies of scale in terms of manufacture and distribution. Counterfeiters are an irritant, but Games Workshop works hard to shut them down.

Any company going through rapid expansion risks operational hiccups and misjudging capacity. Games Workshop has experienced overcapacity before, but 15 years ago it opened large multi-man stores to meet ephemeral demand.

Now it mainly operates cheaper one-man stores, and it may find it easier to sustain demand.Unlike the Lord of the Rings period, the enthusiasm for Warhammer is home-grown, so it seems likely loyal customers are spending more, and new customers will be more likely to stick with the hobby.

However, customers have splurged on new models over the last few years, and they may be satiated. The challenge for Games Workshop is to find new ways to stimulate them, and new customers to stimulate.

Equitable: Will we all benefit?

Score: 2

Games Workshop’s two executive directors are receiving substantial pay rises, and chief executive Kevin Rountree joins the half a million pound club. He will be earning a base salary of about twenty times the UK median salary.

The remuneration committee is also introducing an additional and exceptional bonus capped at 100% of salary for executive directors, to be paid in full for the year just gone, subject to shareholder approval at the AGM in September.

Though current norms for executive pay seem outrageously high to me, the exceptional bonus scheme for directors is transparent and puts the onus on the non-executive directors to justify paying it, unlike most boards who invent convoluted Long-Term Incentive Plans that obscure the true extent of pay.

Thankfully, the board’s largesse extends to staff, who in previous years have experienced pay freezes. The company has increased the limits of the profit share scheme, available to all employees, paid the new maximum, and raised salaries by 5%.

In a barbarous age of pay disparities, Games Workshop’s remuneration policy is refreshingly straightforward, even ifit is not equitable enough. I believe the board’s incentives demonstrate it’s main concern is the strength of the business.

This is perhaps exemplified in its attitude to the share price, which “must look after itself”. Thanks for all the investment awards, Games Workshop says in the annual report. No disrespect intended, but we're focused on running a business so we haven't picked them up.

Cheap: Is the firm’s valuation modest?

Score: 0

Although the share price has risen six-fold,the shares only trade on a multiple of about 18 times adjusted profit in 2018, a reasonable price if Games Workshop grows modestly over the years. The easy money has been made as the company has used up spare capacity and released the potential in the business, but if it wasn’t apparent before, the quality of the business is now there for all to see.

Rountree says “... It would be unrealistic, if not daft, of me to promise that we can continue to grow at the rates we have reported over the last two years. I am not, however, planning to scale down our ambitions, I am just informing you of the backdrop.”

As a nuanced statement on Games Workshop’s prospects, I can’t really improve on that.

Verdict: Buy and hold

Games Workshop is a unique business, and probably worth investing in, even if large numbers of traders now realise that. In the short-term it may have difficulty growing or even sustaining profit, but a score of 8/10 means Games Workshop should make a good long-term investment.

Here are some of Richard's recent articles:

- System1: Testing its powers of recovery

- MS International: Can the rebound last?

- Castings: Between a rock and a hard place

- Trifast: Continuous improvement adds up

- Vp: An acquisition too far

- Air Partner: Talks a good business

- Sprue Aegis: Do this and they'll be 'dirt cheap'

- 16 conviction shares to consider

- Walker Greenbank: Cheap but fearful

- Hollywood Bowl close to joining exclusive club

- Anpario: Gearing up for growth

- Are Next shares a buy for the long term?

- 16 shares for the future

- Is Portmeirion in the 'buy' zone?

- XP Power shares: They're electrifying!

Contact Richard Beddard by email: richard@beddard.net or on Twitter:

@RichardBeddard

Richard owns shares in Games Workshop

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.