Gearing proves costly in first half of 2022 for Witan

16th August 2022 11:58

by Kyle Caldwell from interactive investor

The use of gearing has hit short-term returns, but over the long run it has provided a boost to returns for Witan’s shareholders.

Witan (LSE:WTAN), one of a small number of investment trusts operating under a multi-manager structure, underperformed its benchmark by -4.7% in the first half of the year.

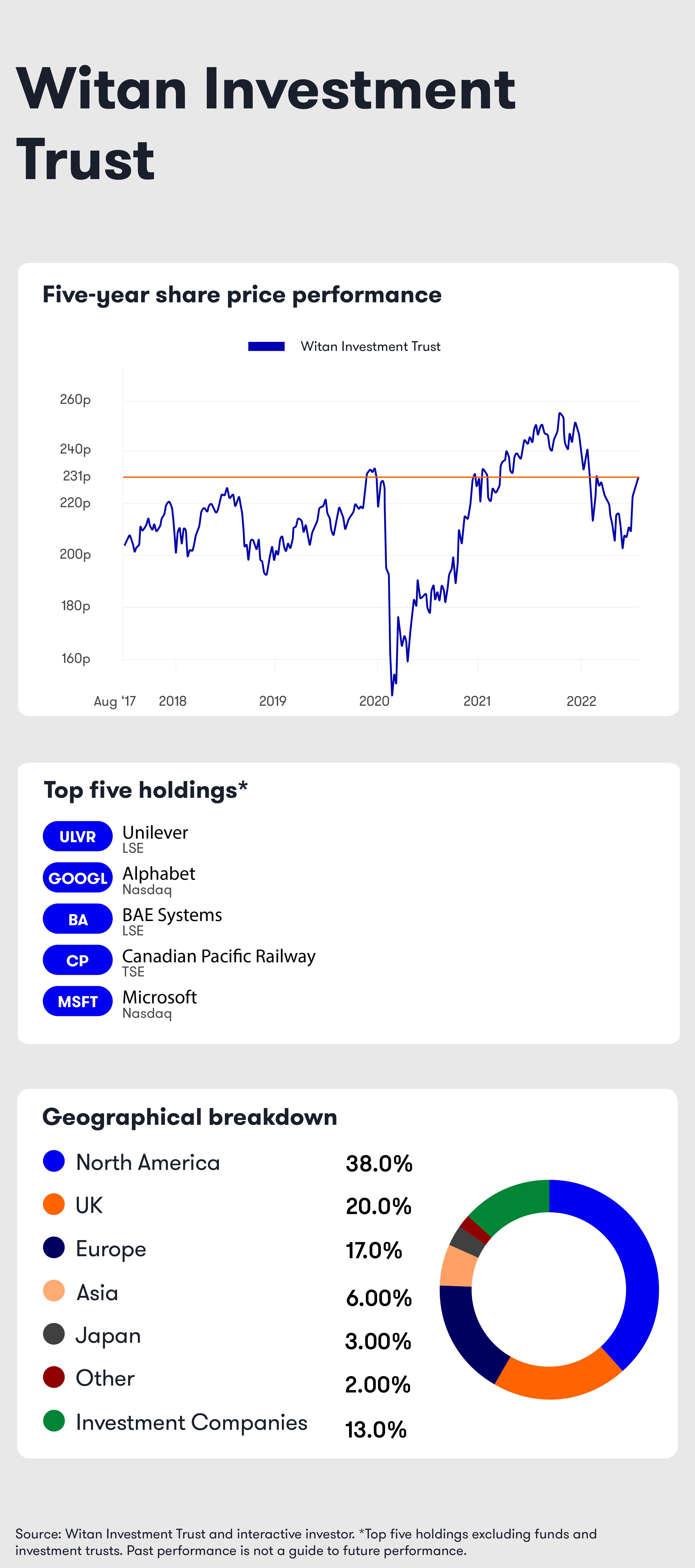

Its results for the six-month period, released this morning, show a net asset value (NAV) decline of 14.3% versus 9.6% for its composite benchmark (15% FTSE All-Share, 85% FTSE All World Index). Its share price total return was a loss of 17.1%, due to its discount widening from 5.8% to 8.9%.

However, the trust pointed out that the Association of Investment Companies’ (AIC) global equity sector saw an average NAV fall of 19%.

Witan, managed by Andrew Bell and James Hart, said that its underperformance was owing to two factors; a weak showing in the first quarter (a 6.3% decline versus 1.9% for the its composite benchmark), and its gearing levels over the six-month period. Witan pointed out that its returns were closer to the benchmark in the second quarter (-8.6% versus -7.6%), with the fund managers’ performance in line at the portfolio level. However, this performance was offset by the impact of gearing, which ranged between 10% and 14%.

- Battle of the big three multi-manager trusts: who comes out on top?

- Four investment trust turnaround stories the pros are backing

Andrew Ross, chair of Witan, said:“Due to the falls in markets, the use of gearing has detracted from returns so far in 2022, although it has historically benefited performance.”

Ross noted that in July performance picked up as Witan benefited from the “summer rally”.

He said: “The mid-year period end coincided with a low point in market sentiment and performance. Between then and 12 August(the latest practicable date before the publication of this report), the NAV rose 11.4% to 252p and the share price by 14.1% to 235p, ahead of the composite benchmark's return of 9.9%.

“While noting that there remains ground to make up, there is reassurance for shareholders that absolute performance significantly recovered and the company outperformed during the summer rally.”

- Bargain Hunter: 13 eye-catching investment trust discounts

- Discount Delver: the 10 cheapest trusts on 5 August 2022

For Witan’s portfolio, which comprises nine external fund managers and its own portfolio of direct investment company holdings (accounting for 11.2%), the trust reported that all the stock pickers suffered falls over the six-month period, with those who invest in growth shares the biggest laggards.

Witan noted that the GMO Climate Change portfolio and Veritas’ quality-focused portfolio both outperformed. Another bright spot was Lindsell Train, which Witan said “showed signs of greater resilience after an uncharacteristically poor 2021”.

The direct holdings portfolio lagged overall, mainly down to discount widening in the private equity sector. In terms of portfolio activity, Witan reported that BlackRock World Mining Trust (LSE:BRWM) was reduced significantly when its share price surged following the Russian invasion, while Schroder Real Estate Investment Trust (LSE:SREI) was “also trimmed into strength”. Meanwhile, Victory Hill Sustainable Energy Opportunities was added to.

How rivals have fared

Two of Witan’s multi-manager trust rivals, F&C Investment Trust (LSE:FCIT) and Alliance Trust (LSE:ATST), have also recently reported their six-month numbers to the end of June.

F&C Investment Trust posted a NAV loss of 9.6% versus a loss of 10.7% for its benchmark, the FTSE All-World index. The share price return was –11.8%, due to a widening of its discount from 7.3% to 9.6%. The trust is a member of interactive investor’s Super 60 list of fund ideas.

Alliance Trust just pipped its benchmark in the first half of the year, delivering a NAV decline of 10.5% compared with a 11% drop for the MSCI All-Country World index. Its share price return was -11.3% return, as the discount widened to an average of 6.3%, above the 5.9% average in the first half of 2021.

- F&C IT switches to defensive mode amid volatile markets

- Alliance Trust churns portfolio by one-third as it narrowly beats benchmark

All three offer a one-shop stop for investing – picking funds on behalf of their investors. The trio aim to provide long-term growth, as well as being AIC “dividend heroes”, having raised their dividends every year for more than 20 years.

What is gearing?

Investment trusts are allowed to gear, or borrow to invest. This can improve their performance, but it means they tend to be more volatile than their open-ended peers. Gearing in a rising market magnifies gains for each shareholder; but if the market falls, investors in a geared trust will suffer greater losses per share.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.