A global star fund with less tech and US exposure

Saltydog Investor identifies a global fund that has topped the return charts even with just 25% invested in the US.

19th May 2025 13:28

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

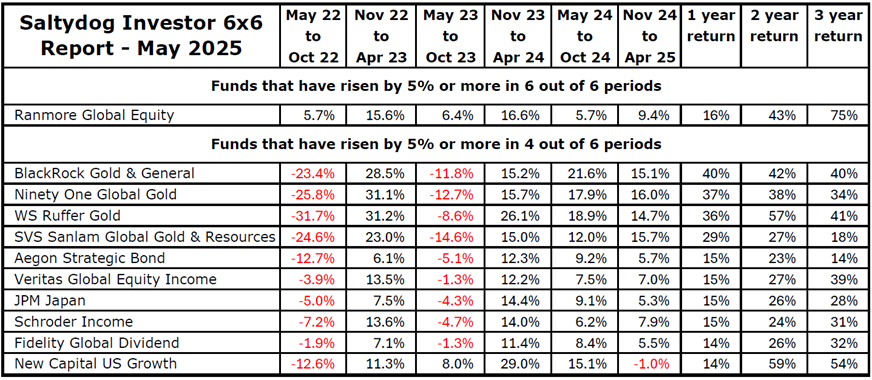

Every three months we trawl through our data in search of funds that have returned 5% or more in each six-month period over the last three years. We have recently crunched the numbers for the three years ending 30 April.

One fund, Ranmore Global Equity, has achieved the elusive six out of six. It is an offshore fund, domiciled in Ireland, but available in the UK, and has UK reporting fund status.

Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

No funds managed to beat the target five times out of six, but 35 achieved it four times. The table below shows the top ten, ranked by their one-year returns.

I am not surprised to see the gold funds featuring. They have benefited from the global uncertainty caused by the troubles in Ukraine and the Middle East, as well as President Trump’s on-again off-again tariff policies. I have written about them several times in recent months.

The top funds are also very different from the ones that we would have seen a year or so ago, when the Technology and North American funds were dominant.

When highlighting the best-performing funds over varying timeframes, it is not unusual for us to come across funds from the Global sector. The Investment Association classification gives the fund managers a fair degree of leeway, and so they can align with the latest trends. The sector definition requires funds to “invest at least 80% of their assets globally in equities. Funds must be diversified by geographic region.”

- Does this fund currency trick boost returns?

- Is US stock market exceptionalism over?

- Investing globally: where bargain hunters can find ‘sweet spot’

The Technology & Technology Innovation sector was the best-performing sector in 2020 and again in 2023. Last year it came in a very close second. The Financial & Financial Innovation sector rose by 23.8%, while Technology & Technology Innovation made 23.5%.

When all the technology funds were doing well, we got used to seeing certain Global funds in the mix. There were several from Baillie Gifford – Baillie Gifford Global Discovery, Baillie Gifford Long-Term Growth, Baillie Gifford Positive Change – along with funds like GAM Star Disruptive Growth, abrdn Global Innovation Equity, and Liontrust Global Innovation.

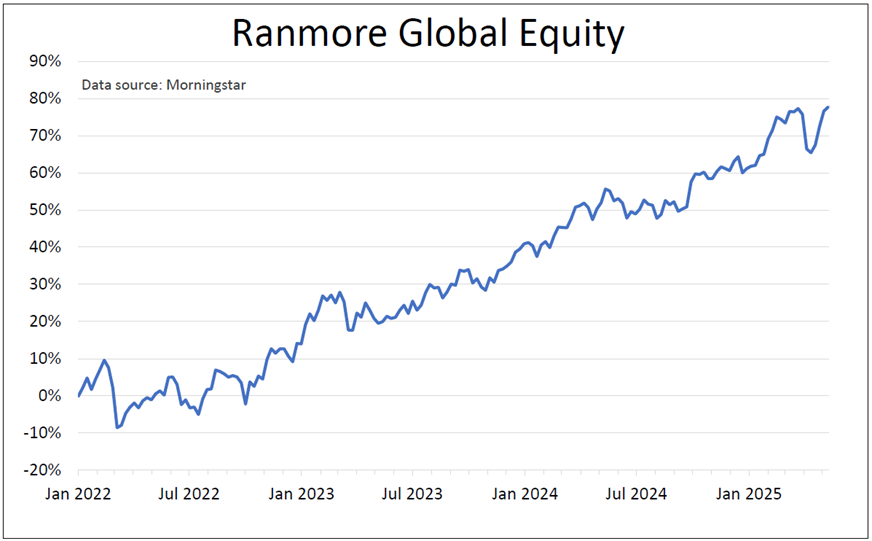

The Ranmore Global Equity fund is very different.

It maintains a concentrated, actively managed portfolio that invests in undervalued companies from around the world. Managed by Sean Peche since its launch in 2008, the fund follows a disciplined, value-based approach, focusing on companies with strong fundamentals trading below their intrinsic worth. Rather than chasing trends or hugging benchmarks, the manager conducts detailed bottom-up analysis to identify opportunities others may overlook.

- The most-popular dividend shares among global fund managers

- Trump’s first 100 days: always opportunities for investors

It has relatively little exposure to the technology sector, preferring to focus on consumer discretionary, financials, and consumer staples:

- Consumer Discretionary – 27%

- Financials – 22%

- Consumer Staples – 14%

- Technology – 6%

That has definitely given it an edge over the last six months.

It still has a reasonably large exposure to the US, 24%, but significantly less than many other funds in its sector. The GAM Star Disruptive Growth fund has nearly 85% invested in the US, and the three Baillie Gifford funds that I mentioned earlier have over 60%. The Ranmore fund takes a much more balanced approach. Along with its 24% in the US, it has over 30% invested in Europe (including 5% in the UK), 15% in Asia, 9% in Japan and 8% in South & Central America.

The portfolio typically holds 30 to 40 mid- and large-cap stocks, diversified across regions and sectors.

While the fund can be volatile at times, it has delivered strong long-term returns and tends to stand out when sentiment turns in favour of value investing.

For investors looking for global exposure, without too much emphasis on the US technology sector, this could be a good option.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.