The gold funds shining as geopolitical tensions rise

In a tricky October for markets, Saltydog Investor highlights the handful of funds that delivered positive returns.

6th November 2023 15:06

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

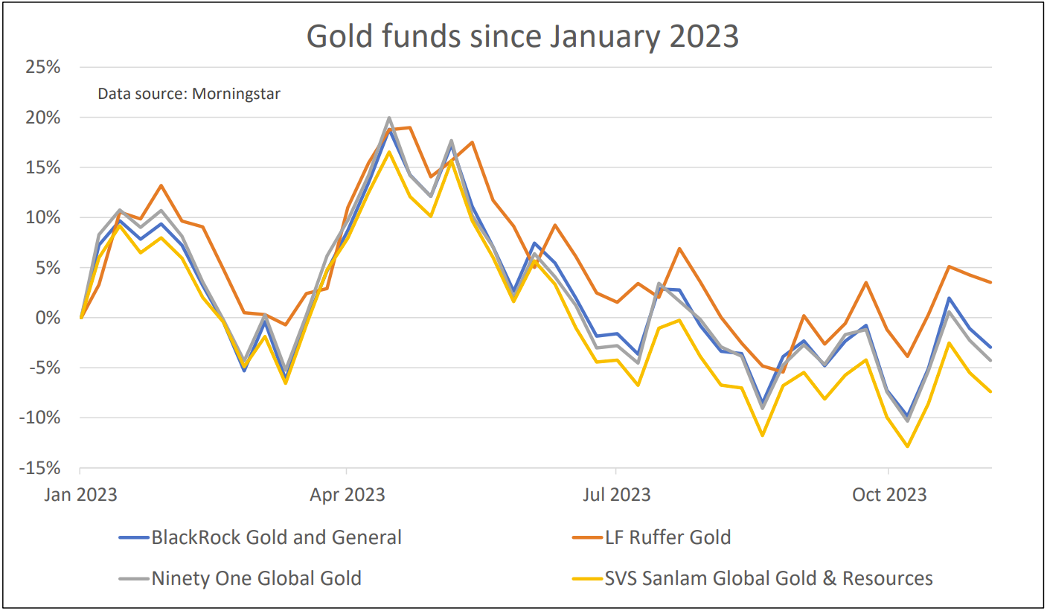

Last month, four of Saltydog’s top 10 funds were what we call the “gold” funds from the Specialist sector. They tend to invest in the shares of gold mining companies and other companies in the precious metals and resources industries. They do not directly track the price of gold, like a gold ETF, but they are closely correlated.

- Invest with ii: Invest in Unit Trusts | Top Investment Funds | Top ISA Funds

Saltydog’s top 10 funds in October 2023

| Fund name | Investment Association sector | Monthly return |

| VT Argonaut Absolute Return | Targeted Absolute Return | 7.4 |

| BlackRock Gold and General | Specialist | 6.6 |

| Ninety One Global Gold | Specialist | 5.7 |

| LF Ruffer Gold | Specialist | 5.5 |

| SVS Sanlam Global Gold & Resources | Specialist | 4.4 |

| TM Tellworth UK Select | Targeted Absolute Return | 1.5 |

| CT European Bond | EUR Mixed Bond | 1.4 |

| BlackRock European Absolute Alpha | Targeted Absolute Return | 1.3 |

| Ninety One Em Mkts Lcl Currency Debt | G.E.M. Bond - Local Currency | 1.1 |

| FTF ClearBridge Global Infrastructure | Infrastructure | 1.0 |

Data source: Morningstar. Past performance is no guide to future performance.

During times of political instability and conflict, such as the war in Gaza, it is not unusual to see increased demand for gold as a perceived safe investment. This was certainly true in October as the price went from below $1,850/oz to over $2,000/oz, before dropping back to around $1,985/oz at the end of the month.

The gold funds also tend to do well when most other sectors are struggling.

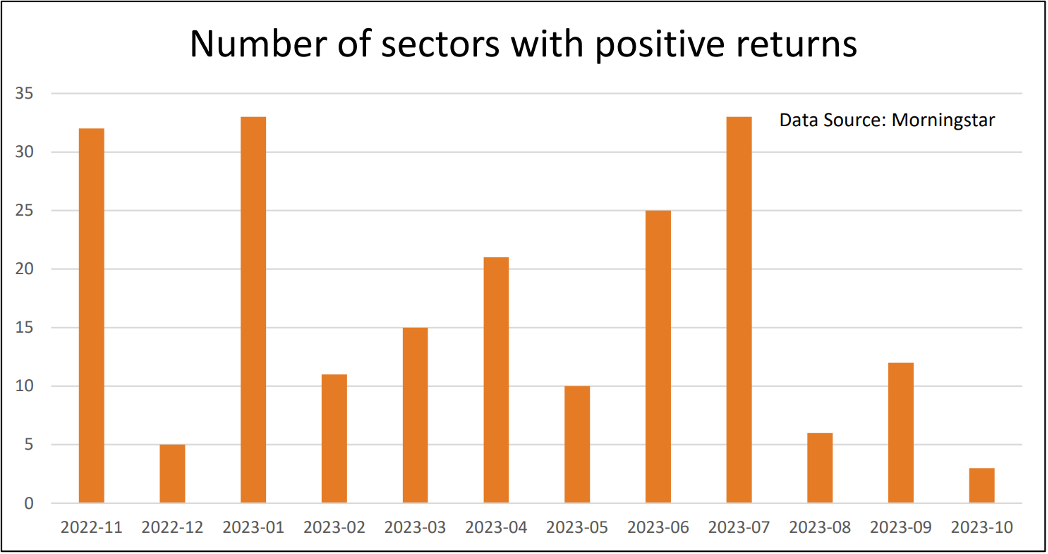

We track the performance of 35 sectors, based on the Investment Association (IA) sector data. Unfortunately, they do not provide regular performance data on a few sectors, like Specialist and Natural Resources. We have also decided to group various sectors together if we do not track sufficient funds in the individual sectors to make it meaningful. However, overall we feel that our 35 sectors give us a pretty good feel for what is happening in the markets and where to look for the best-performing funds.

- Nine gold mining shares that could add sparkle to your ISA

- Gold: four exciting companies to track this year

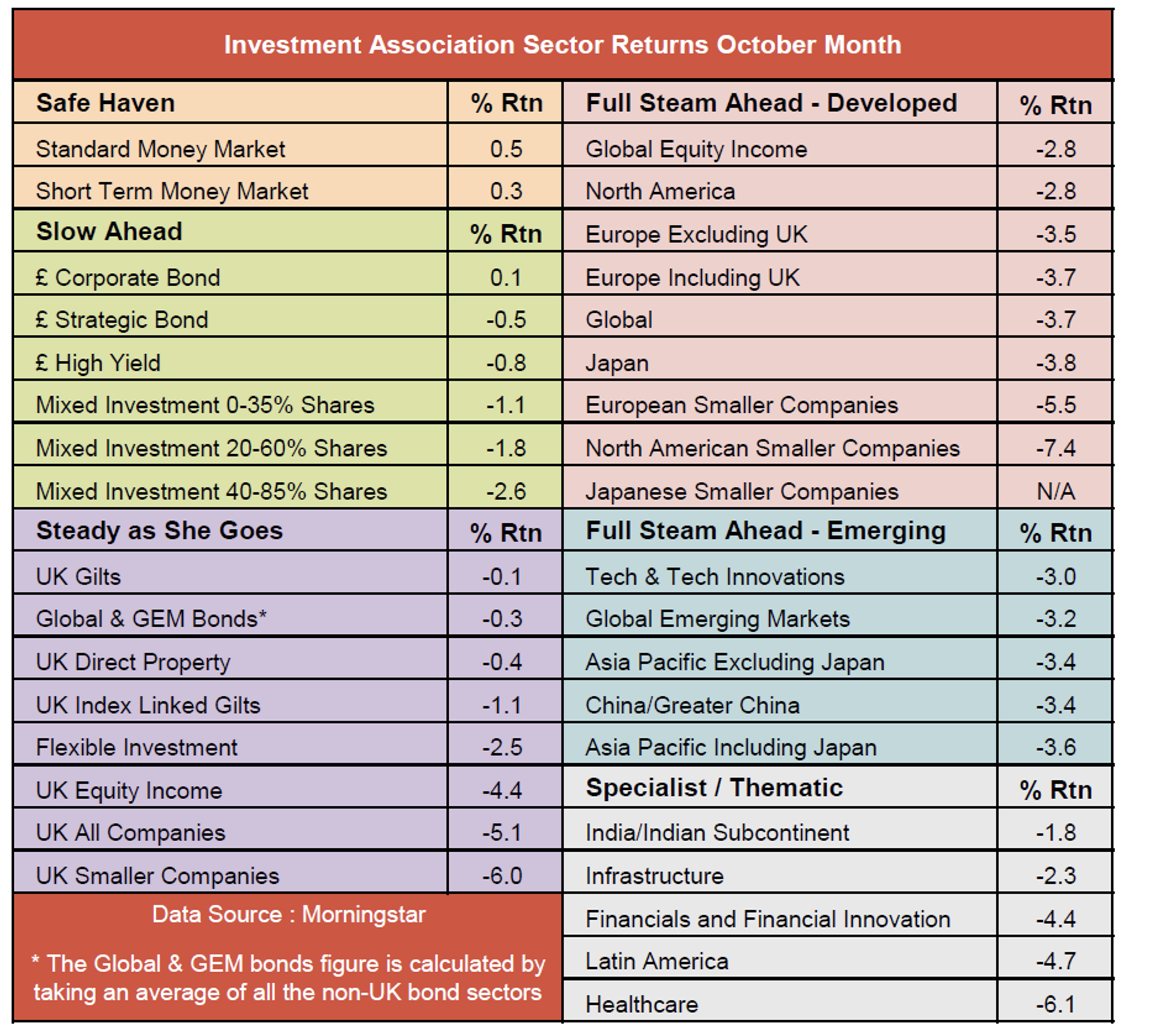

Out of the 35 sectors, only three rose last month. They were the Standard Money Market, Short Term Money Market and £ Corporate Bond Sectors. Only the Money Market sectors have risen in each of the past three months. It just goes to show what a challenging time it has been for investors.

Past performance is not a guide to future performance.

Not only did most sectors fail to make gains in October, but some have also seen significant losses.

The relatively conservative Mixed Investment 40-85% Shares sector, which used to be called the ‘Balanced Managed’ sector, ended the month down 2.6%. The UK Smaller Companies sector went down by 6%, and North American Smaller Companies lost 7.4%. We are still waiting for a finalised figure for the Japanese Smaller Companies sector, but I am anticipating another significant loss.

Past performance is not a guide to future performance.

While the gold funds looked particularly attractive last month, it is important to realise how volatile they can be, they have already started to fall.

Past performance is not a guide to future performance.

For the time being we are still keeping the most of our investments in the money market funds or cash.

For more information about Saltydog Investor, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.